16+ Zakat declaration format for bank info

Home » money laundering idea » 16+ Zakat declaration format for bank infoYour Zakat declaration format for bank images are available. Zakat declaration format for bank are a topic that is being searched for and liked by netizens today. You can Download the Zakat declaration format for bank files here. Find and Download all free images.

If you’re searching for zakat declaration format for bank images information related to the zakat declaration format for bank keyword, you have pay a visit to the ideal blog. Our site always gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

Zakat Declaration Format For Bank. 1 This Ordinance may be called the Zakat and Ushr Ordinance 1980. If you have any Saving Bank Account or other bank account and dont what your Zakat to be deducted by the Bank or any other financial institution and want t. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord. The Bank operates strictly under the principles of Islamic Shariah and is well-recognized for its product development capability Islamic banking research and advisory services.

Investor Account U2013 Zakat Declaration Form To Be Made On Stamp Paper Of Rs 50 Form Cz 50 Declaration Under The Provisions To Sub Section 3 Of Course Hero From coursehero.com

Investor Account U2013 Zakat Declaration Form To Be Made On Stamp Paper Of Rs 50 Form Cz 50 Declaration Under The Provisions To Sub Section 3 Of Course Hero From coursehero.com

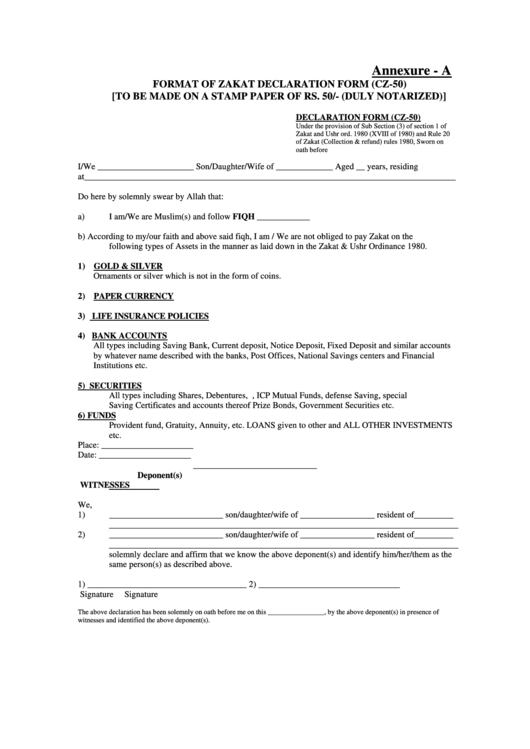

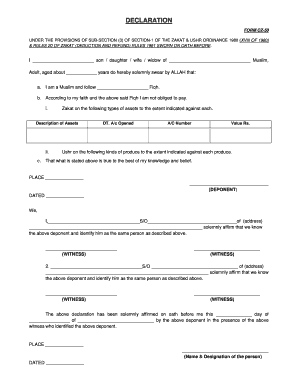

B According to my faith and the above said fiqh I am not obliged to pay zakat on the following types of assets in the manner laid down in zakat usher ordinance 1980 XVIII of 1980 and in accordance with the decision dated 9th March 1999 of Supreme Court of Pakistan. SUBMISSION OF ZAKAT DECLARATION FORM CZ50 State Bank of Pakistan has been receiving complaints from financial consumers that banks DFIs generally do not provide them acknowledgement receipts while depositing a copy of Zakat Declaration Form CZ50 at branch counters in terms of Zakat and Ushr Ordinance 1980 amended from time to time. 2 PAPER CURRENCY 3 LIFE INSURANCE POLICIES 4 BANK ACCOUNTS All types including Saving Bank Current Deposit Notice Deposit Fixed Deposit and similar accounts by. Growth and increase In the terminology of the Quran and Sunnah Zakah is the portion of asset that is made mandatory to be spent in the ways specified by Allah Taala. 1980 XVIII of 1980 and Rule 20 of. Start completing the fillable fields and carefully type in required information.

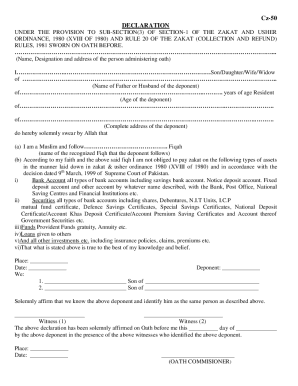

UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE ________________________________.

The Premier Islamic Bank Meezan Bank Pakistans first and largest Islamic bank that offers a range of Shariah-compliant products and services to cater your financial needs. On the other hand learned counsel for the respondent-Corporation has invited our attention to the provisions of Section 11 2 of the Ordinance. I Zakat on the following types of assets to the extent indicated against each. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. Benefits of Zakah Zakah has two straightforward benefits.

Source: zakat-declaration-form.pdffiller.com

Source: zakat-declaration-form.pdffiller.com

1 This Ordinance may be called the Zakat and Ushr Ordinance 1980. Understanding Calculation 4 What is Zakah. The Premier Islamic Bank Meezan Bank Pakistans first and largest Islamic bank that offers a range of Shariah-compliant products and services to cater your financial needs. These declare as follows. Name designated of the person administering oath I Name.

I Zakat on the following types of assets to the extent indicated against each. Request for Zakat Dear SirName With utmost respect the reason of my writing to you is that our Foundation Name has arranged a program to collect Zakat from all the reputable and good families of the area to help the poor women and girls Describe in your own words to achieve their goals in business education and other methods of making them independent. I Zakat on the following types of assets to the extent indicated against each. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. Once correct CZ-50 Solemn Affirmation has been uploaded and verified by the respective RTA there will be no need to upload provide such Forms Letters again.

Singly Jointly Either or Survivor Other specify Third party mandate. Yes enclose affidavitdeclaration on bond paper No Non Muslim enclose declaration on plain paper Signing Authority. B a declaration or an attested copy thereof filed as aforesaid in one Zakat Year whether before or after commencement of Zakat and Ushr Third Amendment Ordinance 1983 shall continue to be valid for so long as i the declaration or copy and the asset liable to Zakat to which it relates remain in the custody of the Deducting Agency. I Bank Account all types of bank accounts including savings bank account. These declare as follows.

Source: formsbank.com

Source: formsbank.com

FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. Quick steps to complete and e-sign Zakat Declaration Form online. If you have any Saving Bank Account or other bank account and dont what your Zakat to be deducted by the Bank or any other financial institution and want t. Zakat Deduction from Bank Accounts Banks only deduct Zakat from savings and profit and loss accounts. The Bank operates strictly under the principles of Islamic Shariah and is well-recognized for its product development capability Islamic banking research and advisory services.

Source:

CNIC SNIC Number. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. 2 PAPER CURRENCY 3 LIFE INSURANCE POLICIES 4 BANK ACCOUNTS All types including Saving Bank Current Deposit Notice Deposit Fixed Deposit and similar accounts by. 1980 XVIII of 1980 and Rule 20 of. Growth and increase In the terminology of the Quran and Sunnah Zakah is the portion of asset that is made mandatory to be spent in the ways specified by Allah Taala.

Source: pdffiller.com

Source: pdffiller.com

1 GOLD SILVER Ornaments or silver which is not in the form of coins. Benefits of Zakah Zakah has two straightforward benefits. The Premier Islamic Bank Meezan Bank Pakistans first and largest Islamic bank that offers a range of Shariah-compliant products and services to cater your financial needs. On the other hand learned counsel for the respondent-Corporation has invited our attention to the provisions of Section 11 2 of the Ordinance. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE ________________________________.

Source: coursehero.com

Source: coursehero.com

Yes enclose Third party mandate No ACCOUNT INTRODUCTION Telephone Number. Understanding Calculation 4 What is Zakah. B According to my faith and the above said fiqh I am not obliged to pay zakat on the following types of assets in the manner laid down in zakat usher ordinance 1980 XVIII of 1980 and in accordance with the decision dated 9th March 1999 of Supreme Court of Pakistan. Start completing the fillable fields and carefully type in required information. 1980 XVIII of 1980 and Rule 20 of.

On the other hand learned counsel for the respondent-Corporation has invited our attention to the provisions of Section 11 2 of the Ordinance. Zakat Deduction from Bank Accounts Banks only deduct Zakat from savings and profit and loss accounts. 2 PAPER CURRENCY 3 LIFE INSURANCE POLICIES 4 BANK ACCOUNTS All types including Saving Bank Current Deposit Notice Deposit Fixed Deposit and similar accounts by. Reach someone helpful 247 111-225-111. Banks then collect 25 Zakat from all the accounts that exceed this particular balance.

FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE ________________________________. Once correct CZ-50 Solemn Affirmation has been uploaded and verified by the respective RTA there will be no need to upload provide such Forms Letters again. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. Singly Jointly Either or Survivor Other specify Third party mandate.

The benchmark or Nisab is set against the value. Singly Jointly Either or Survivor Other specify Third party mandate. Yes enclose affidavitdeclaration on bond paper No Non Muslim enclose declaration on plain paper Signing Authority. On the other hand learned counsel for the respondent-Corporation has invited our attention to the provisions of Section 11 2 of the Ordinance. Name designated of the person administering oath I Name.

Source: pdffiller.com

Source: pdffiller.com

Yes enclose Third party mandate No ACCOUNT INTRODUCTION Telephone Number. 1 GOLD SILVER Ornaments or silver which is not in the form of coins. Name designated of the person administering oath I Name. Banks then collect 25 Zakat from all the accounts that exceed this particular balance. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Source: pdf4pro.com

Source: pdf4pro.com

These declare as follows. Growth and increase In the terminology of the Quran and Sunnah Zakah is the portion of asset that is made mandatory to be spent in the ways specified by Allah Taala. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord. Zakat Deduction from Bank Accounts Banks only deduct Zakat from savings and profit and loss accounts. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS.

Source: dokumen.tips

Source: dokumen.tips

These declare as follows. The Premier Islamic Bank Meezan Bank Pakistans first and largest Islamic bank that offers a range of Shariah-compliant products and services to cater your financial needs. Request for Zakat Dear SirName With utmost respect the reason of my writing to you is that our Foundation Name has arranged a program to collect Zakat from all the reputable and good families of the area to help the poor women and girls Describe in your own words to achieve their goals in business education and other methods of making them independent. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. B According to my faith and the above said fiqh I am not obliged to pay zakat on the following types of assets in the manner laid down in zakat usher ordinance 1980 XVIII of 1980 and in accordance with the decision dated 9th March 1999 of Supreme Court of Pakistan.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title zakat declaration format for bank by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.