17++ Zakat declaration form for bank account info

Home » money laundering idea » 17++ Zakat declaration form for bank account infoYour Zakat declaration form for bank account images are ready. Zakat declaration form for bank account are a topic that is being searched for and liked by netizens today. You can Find and Download the Zakat declaration form for bank account files here. Get all free photos.

If you’re searching for zakat declaration form for bank account pictures information linked to the zakat declaration form for bank account topic, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

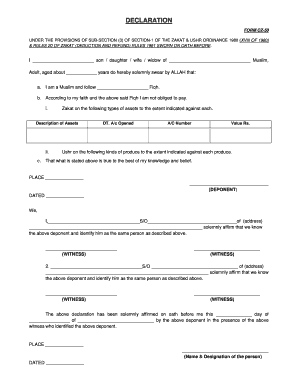

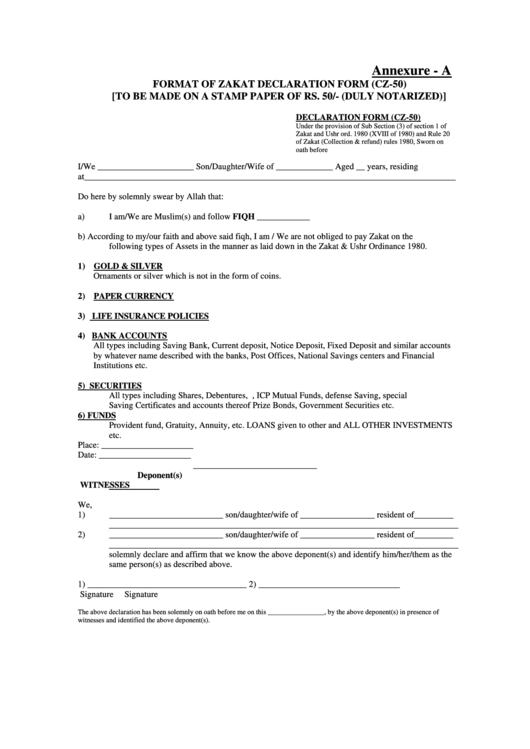

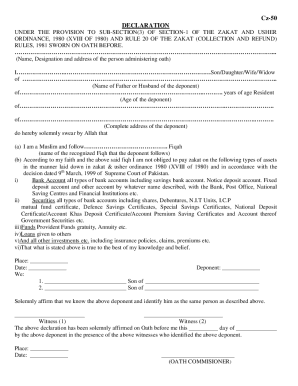

Zakat Declaration Form For Bank Account. I Bank Account all types of bank accounts including savings bank account. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. To be liable for Zakat which is one of the five pillars of Islam ones wealth must amount to more than a threshold figure which is called Nisab. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath.

Declaration Form Cz 50 Cdc Central Declaration Form Cz 50 Cdc Central Pdf Pdf4pro From pdf4pro.com

Declaration Form Cz 50 Cdc Central Declaration Form Cz 50 Cdc Central Pdf Pdf4pro From pdf4pro.com

FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of zakat declaration form meezan bank This tendency on the part of branch officials of such banksDFIs has been viewed seriously as the acknowledgement receipt is considered prime evidence. Annexure - A FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. This letter tells all the information regarding hisher. The Bank operates strictly under the principles of Islamic Shariah and is well-recognized for its product development capability Islamic banking research and advisory services. In this video you can see the process that how to submit Zakat Declaration Form to Commercial Banks National Savings Government Institutions Insurance Po.

This letter tells all the information regarding hisher.

To be liable for Zakat which is one of the five pillars of Islam ones wealth must amount to more than a threshold figure which is called Nisab. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord. There is no minimum balance requirement. DECLARATION UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath I Name MUHAMMAD WASIM SO MAHMOOD ALI Age 32 YEARS. Those who do not want Zakat deduction from their accounts had until 15th of Shaaban to submit a Zakat exemption form in their respective banks.

DECLARATION UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath I Name MUHAMMAD WASIM SO MAHMOOD ALI Age 32 YEARS. 1 For recording the deductions of Zakat in respect of the Savings Bank Accounts including those based on profit and loss sharing and similar accounts a ZCO shall prepare on the Deduction Date the Scroll from CZ-01 in respect of only those accounts which carry in the Valuation Date a balance. MCB Salary Gold Account is a profit bearing rupee Account with profit payment as per rates declared by the Bank in the PLS rate sheet. Rules of Account duly signed 14. Zakat Affidavit of all Applicants zakat Examption Operation of account clearly from MBA 059 at IoBM.

Source: dokumen.tips

Source: dokumen.tips

DECLARATION UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath I Name MUHAMMAD WASIM SO MAHMOOD ALI Age 32 YEARS. 1980 XVIII of 1980 and Rule 20 of Zakat. 1980 XVIII of 1980 and Rule 20 of. The Premier Islamic Bank Meezan Bank Pakistans first and largest Islamic bank that offers a range of Shariah-compliant products and services to cater your financial needs. 1 For recording the deductions of Zakat in respect of the Savings Bank Accounts including those based on profit and loss sharing and similar accounts a ZCO shall prepare on the Deduction Date the Scroll from CZ-01 in respect of only those accounts which carry in the Valuation Date a balance.

Source: coursehero.com

Source: coursehero.com

After opening the account A Letter Of Thanks is send to the customer in order to thank the customer for opening an account in the Bank. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord. Those who do not want Zakat deduction from their accounts had until 15th of Shaaban to submit a Zakat exemption form in their respective banks. Zakat Affidavit of all Applicants zakat Examption Operation of account clearly from MBA 059 at IoBM. Banks then collect 25 Zakat from all the accounts that exceed this particular balance.

In fact banks can only deduct Zakat from the savings and profit and loss sharing accounts. Banks then collect 25 Zakat from all the accounts that exceed this particular balance. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath. TO BE MADE ON STAMP PAPER OF RS.

Source: pdffiller.com

Source: pdffiller.com

The government sets the Nisab for Zakat deduction on bank accounts shortly before Ramadan. I Bank Account all types of bank accounts including savings bank account. Banks then collect 25 Zakat from all the accounts that exceed this particular balance. The Premier Islamic Bank Meezan Bank Pakistans first and largest Islamic bank that offers a range of Shariah-compliant products and services to cater your financial needs. In this video you can see the process that how to submit Zakat Declaration Form to Commercial Banks National Savings Government Institutions Insurance Po.

Source:

In fact banks can only deduct Zakat from the savings and profit and loss sharing accounts. There is no minimum balance requirement. However not all types of bank accounts are liable to Zakat deductions. In fact banks can only deduct Zakat from the savings and profit and loss sharing accounts. Specimen Signature Cards for ApplicantsGuardian and Third Party Mandatee 13.

Rules of Account duly signed 14. There is no minimum balance requirement. View Investor-Account–Zakat-Declaration-Formdoc from BVU 300 at Buena Vista University. The Bank operates strictly under the principles of Islamic Shariah and is well-recognized for its product development capability Islamic banking research and advisory services. Banks then collect 25 Zakat from all the accounts that exceed this particular balance.

Source: pdf4pro.com

Source: pdf4pro.com

FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. TO BE MADE ON STAMP PAPER OF RS. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of zakat declaration form meezan bank This tendency on the part of branch officials of such banksDFIs has been viewed seriously as the acknowledgement receipt is considered prime evidence. However not all types of bank accounts are liable to Zakat deductions. View Investor-Account–Zakat-Declaration-Formdoc from BVU 300 at Buena Vista University.

Specimen Signature Cards for ApplicantsGuardian and Third Party Mandatee 13. Rules of Account duly signed 14. There is no minimum balance requirement. Zakat Affidavit of all Applicants zakat Examption Operation of account clearly from MBA 059 at IoBM. After opening the account A Letter Of Thanks is send to the customer in order to thank the customer for opening an account in the Bank.

Source: formsbank.com

Source: formsbank.com

To be liable for Zakat which is one of the five pillars of Islam ones wealth must amount to more than a threshold figure which is called Nisab. View Investor-Account–Zakat-Declaration-Formdoc from BVU 300 at Buena Vista University. 50- Form CZ-50 DECLARATION UNDER THE PROVISIONS TO SUB- SECTION 3 OF. In fact banks can only deduct Zakat from the savings and profit and loss sharing accounts. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord.

Source: pdffiller.com

Source: pdffiller.com

MCB Salary Gold Account is a profit bearing rupee Account with profit payment as per rates declared by the Bank in the PLS rate sheet. Banks then collect 25 Zakat from all the accounts that exceed this particular balance. DECLARATION UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath I Name MUHAMMAD WASIM SO MAHMOOD ALI Age 32 YEARS. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. The government sets the Nisab for Zakat deduction on bank accounts shortly before Ramadan.

Customer Declaration Form MCB Salary Gold Account Customer Declaration Form - MCB Salary Gold Account 1. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. In this video you can see the process that how to submit Zakat Declaration Form to Commercial Banks National Savings Government Institutions Insurance Po. Those who do not want Zakat deduction from their accounts had until 15th of Shaaban to submit a Zakat exemption form in their respective banks. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath.

Source: zakat-declaration-form.pdffiller.com

Source: zakat-declaration-form.pdffiller.com

Original identification documents seen by. 1980 XVIII of 1980 and Rule 20 of Zakat. In fact banks can only deduct Zakat from the savings and profit and loss sharing accounts. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title zakat declaration form for bank account by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.