15+ Zakat declaration for bank ideas in 2021

Home » money laundering idea » 15+ Zakat declaration for bank ideas in 2021Your Zakat declaration for bank images are ready. Zakat declaration for bank are a topic that is being searched for and liked by netizens now. You can Download the Zakat declaration for bank files here. Download all free vectors.

If you’re searching for zakat declaration for bank pictures information linked to the zakat declaration for bank topic, you have pay a visit to the right blog. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

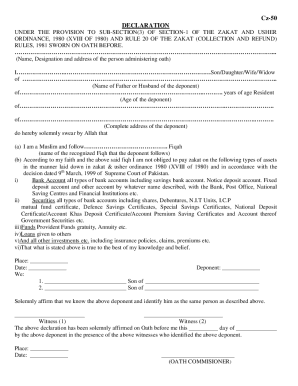

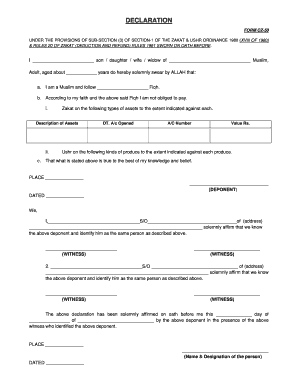

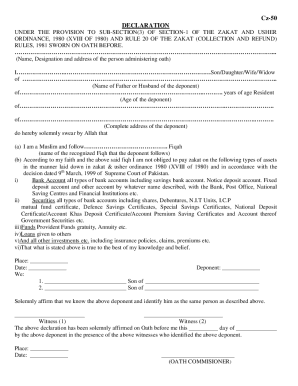

Zakat Declaration For Bank. A person must be major to qualify as a Zakah payer. All banks and DFIs were advised by the SBP to invariably provide acknowledgement to their customers on submission of Zakat Declaration Form. 46329 at source from all bank saving accounts at a rate of 25. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS.

Zakat Declaration Form Meezan Bank Fill Online Printable Fillable Blank Pdffiller From zakat-declaration-form.pdffiller.com

Zakat Declaration Form Meezan Bank Fill Online Printable Fillable Blank Pdffiller From zakat-declaration-form.pdffiller.com

Original identification documents seen by. Customer Declaration Form MCB Salary Gold Account Customer Declaration Form - MCB Salary Gold Account 1. The Premier Islamic Bank Meezan Bank Pakistans first and largest Islamic bank that offers a range of Shariah-compliant products and services to cater your financial needs. In case of exemption from Zakat Zakat declaration on Bond Paper or attested copy of duly executed affidavit 11. In case of Non Muslim Zakat declaration should be on plain paper 12. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath.

The State Bank of Pakistan has fixed the Nisab for Zakat deduction on bank accounts at Rs44415 for the ongoing year.

Start completing the fillable fields and carefully type in required information. All banks and DFIs were advised by the SBP to invariably provide acknowledgement to their customers on submission of Zakat Declaration Form. In case of Non Muslim Zakat declaration should be on plain paper 12. The State Bank of Pakistan has fixed the Nisab for Zakat deduction on bank accounts at Rs44415 for the ongoing year. Customer Declaration Form MCB Salary Gold Account Customer Declaration Form - MCB Salary Gold Account 1. 46329 at source from all bank saving accounts at a rate of 25.

Zakat Deduction from Bank Accounts Banks only deduct Zakat from savings and profit and loss accounts. Name designated of the person administering oath I Name. Banks then collect 25 Zakat from all the accounts that exceed this particular balance. If you have any Saving Bank Account or other bank account and dont what your Zakat to be deducted by the Bank or any other financial institution and want t. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of This tendency on the part of branch officials of such banksDFIs has been viewed seriously as the acknowledgement receipt is considered prime evidence.

Source: zakat-declaration-form.pdffiller.com

Source: zakat-declaration-form.pdffiller.com

Savings bank accounts Banks only deduct Zakat from savings and profit and loss accounts of the clients. 1980 XVIII of 1980 and Rule 20 of. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. They are accordingly exempt from paying Zakah by reason of absence of legal capacity2 The Zakah. Customer Declaration Form MCB Salary Gold Account Customer Declaration Form - MCB Salary Gold Account 1.

Zakat Deduction from Bank Accounts Banks only deduct Zakat from savings and profit and loss accounts. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of This tendency on the part of branch officials of such banksDFIs has been viewed seriously as the acknowledgement receipt is considered prime evidence. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord. A person must be major to qualify as a Zakah payer. The inventory of Zakat-entitled assets includes cash trading stocks business income gold and silver land and livestock.

Original identification documents seen by. 25 Zakat from all the accounts that exceed this particular balance was collected by Banks. Start completing the fillable fields and carefully type in required information. Zakat will be deducted from saving accounts profit and loss sharing accounts and other similar accounts having a balance of Rs44415 or above on the first of Ramazan. All banks and DFIs were advised by the SBP to invariably provide acknowledgement to their customers on submission of Zakat Declaration Form.

Source: zakat-declaration-form.pdffiller.com

Source: zakat-declaration-form.pdffiller.com

There is no minimum balance requirement. Reach someone helpful 247 111-225-111. Specimen Signature Cards for ApplicantsGuardian and Third Party Mandatee 13. Zakat will be deducted from saving accounts profit and loss sharing accounts and other similar accounts having a balance of Rs44415 or above on the first of Ramazan. In case of Non Muslim Zakat declaration should be on plain paper 12.

Source: pdffiller.com

Source: pdffiller.com

Savings bank accounts Banks only deduct Zakat from savings and profit and loss accounts of the clients. MCB Salary Gold Account is a profit bearing rupee Account with profit payment as per rates declared by the Bank in the PLS rate sheet. Rules of Account duly signed 14. If you have any Saving Bank Account or other bank account and dont what your Zakat to be deducted by the Bank or any other financial institution and want t. The Bank operates strictly under the principles of Islamic Shariah and is well-recognized for its product development capability Islamic banking research and advisory services.

Source: dawn.com

Source: dawn.com

Customer Declaration Form MCB Salary Gold Account Customer Declaration Form - MCB Salary Gold Account 1. It is for this reason Islam enjoins to pay Zakat to the poor and the needy as an obligation and declares it essential for prosperity social health and spiritual uplift. Minors are not under a fard obligation to perform acts of ibadah such as prayers salaat and fasting saum because they lack legal capacity. Zakat will be deducted from saving accounts profit and loss sharing accounts and other similar accounts having a balance of Rs44415 or above on the first of Ramazan. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS.

Source: youtube.com

Source: youtube.com

Quick steps to complete and e-sign Zakat Declaration Form online. Zakat declaration form Annexure - A FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. The Bank operates strictly under the principles of Islamic Shariah and is well-recognized for its product development capability Islamic banking research and advisory services. Zakat will be deducted from saving accounts profit and loss sharing accounts and other similar accounts having a balance of Rs44415 or above on the first of Ramazan. MCB Salary Gold Account is a profit bearing rupee Account with profit payment as per rates declared by the Bank in the PLS rate sheet.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of This tendency on the part of branch officials of such banksDFIs has been viewed seriously as the acknowledgement receipt is considered prime evidence. The inventory of Zakat-entitled assets includes cash trading stocks business income gold and silver land and livestock. Reach someone helpful 247 111-225-111. B According to my faith and the above said fiqh I am not obliged to pay zakat on the following types of assets in the manner laid down in zakat usher ordinance 1980 XVIII of 1980 and in accordance with the decision dated 9th March 1999 of Supreme Court of Pakistan.

46329 at source from all bank saving accounts at a rate of 25. However not all types of bank accounts are liable to Zakat deductions. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord. Sample Request Letter for Zakat This is a Sample Request Letter for Zakat. The inventory of Zakat-entitled assets includes cash trading stocks business income gold and silver land and livestock.

Specimen Signature Cards for ApplicantsGuardian and Third Party Mandatee 13. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. I Bank Account all types of bank accounts including savings bank account. In case of Non Muslim Zakat declaration should be on plain paper 12. Name designated of the person administering oath I Name.

Source: pdf4pro.com

Source: pdf4pro.com

The government sets the Nisab for Zakat deduction on bank accounts shortly before Ramadan. 1980 XVIII of 1980 and Rule 20 of. FORMAT OF ZAKAT DECLARATION FORM CZ-50 TO BE MADE ON A STAMP PAPER OF RS. 50- DULY NOTARIZED DECLARATION FORM CZ-50 Under the provision of Sub Section 3 of section 1 of Zakat and Ushr ord. Specimen Signature Cards for ApplicantsGuardian and Third Party Mandatee 13.

They are accordingly exempt from paying Zakah by reason of absence of legal capacity2 The Zakah. Quick steps to complete and e-sign Zakat Declaration Form online. Zakat will be deducted from saving accounts profit and loss sharing accounts and other similar accounts having a balance of Rs44415 or above on the first of Ramazan. B According to my faith and the above said fiqh I am not obliged to pay zakat on the following types of assets in the manner laid down in zakat usher ordinance 1980 XVIII of 1980 and in accordance with the decision dated 9th March 1999 of Supreme Court of Pakistan. UNDER THE PROVISIONS TO SUB- SECTION 3 OF SECTION 1 OF THE ZAKAT AND USHR ORDINANCE 1980 AND RULE 20 OF THE ZAKAT COLLECTION AND REFUND RULES 1981 SWORN ON OATH BEFORE _____ Name designated of the person administering oath.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title zakat declaration for bank by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.