11+ Why are solicitors at risk of money laundering ideas in 2021

Home » money laundering Info » 11+ Why are solicitors at risk of money laundering ideas in 2021Your Why are solicitors at risk of money laundering images are ready. Why are solicitors at risk of money laundering are a topic that is being searched for and liked by netizens today. You can Find and Download the Why are solicitors at risk of money laundering files here. Download all royalty-free photos.

If you’re looking for why are solicitors at risk of money laundering images information linked to the why are solicitors at risk of money laundering keyword, you have visit the ideal blog. Our site frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

Why Are Solicitors At Risk Of Money Laundering. Our experienced money laundering defence solicitors have extensive expertise in handling these types of complex cases so can give you the best possible defence from the point of arrest onwards. It is clear money laundering continues to be a major challenge for the legal profession. Eight law firms have been shut over money laundering concerns in the past three years. Simply put the act of money laundering is the process by which the proceeds of criminal activities enter the financial system.

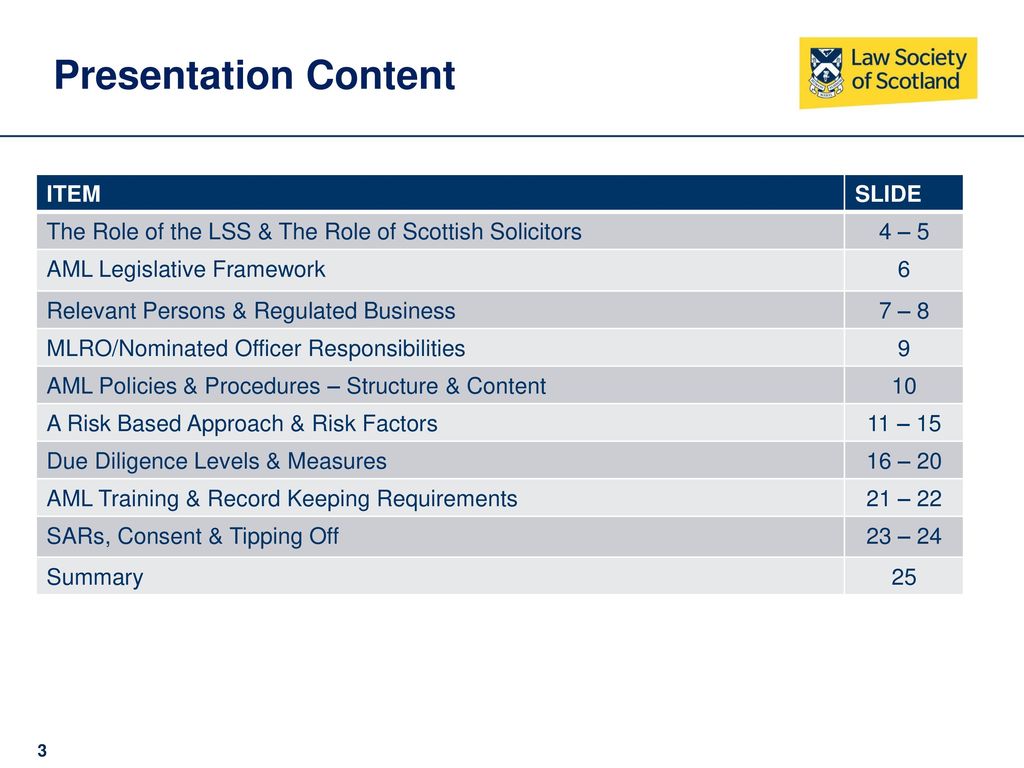

Anti Money Laundering Ppt Video Online Download From slideplayer.com

Anti Money Laundering Ppt Video Online Download From slideplayer.com

The Legal Profession has been identified as high risk for money laundering although low risk for terrorist financing. Even major law firms might inadvertently assist clients with money laundering. Under the Code of Conduct all solicitors have a duty to ensure that their firm has sufficient safeguards and systems in place which comply with anti-money laundering legislation. Department of Justice DOJ alleged that major law firms were used to launder approximately 1 billion stolen from the. The UK is seen as a high-risk jurisdiction for money laundering. For example in a civil asset forfeiture case opened in July 2016 the US.

Youre required to conduct EDD on these clients because.

This course will highlight the on-going requirements for lawyers and their firms to be up to date with developments relating to and concerning how best to ensure effective anti-money laundering compliance. Being accused of involvement in money laundering can be very worrying and confusing with the potential for a long prison sentence if you are convicted. Now there are plenty of good reasons why a firm that is not bound by the 2017 Money Laundering Regulations would choose to follow them anyway. This course will highlight the on-going requirements for lawyers and their firms to be up to date with developments relating to and concerning how best to ensure effective anti-money laundering compliance. The National Risk Assessment rated the legal profession as. However money laundering is a common and genuine threat in many instances in todays world.

Source: slideplayer.com

Source: slideplayer.com

Mr Passmore says this reflected the. Solicitors who do not follow the rules are at risk of very heavy penalties and could even end up in prison if it was thought they were involved in money laundering themselves. High risk of being used for money laundering although low risk of being used for terrorist financing. Under the Code of Conduct all solicitors have a duty to ensure that their firm has sufficient safeguards and systems in place which comply with anti-money laundering legislation. By acting in sham litigation we could be guilty of money laundering.

Source: sra.org.uk

Source: sra.org.uk

Here Crispin Passmore executive director at Solicitors Regulation Authority highlights the dangers of money laundering on small businesses. The Legal Profession has been identified as high risk for money laundering although low risk for terrorist financing. Our experienced money laundering defence solicitors have extensive expertise in handling these types of complex cases so can give you the best possible defence from the point of arrest onwards. Under the Code of Conduct all solicitors have a duty to ensure that their firm has sufficient safeguards and systems in place which comply with anti-money laundering legislation. And understand that it is not a victimless crime.

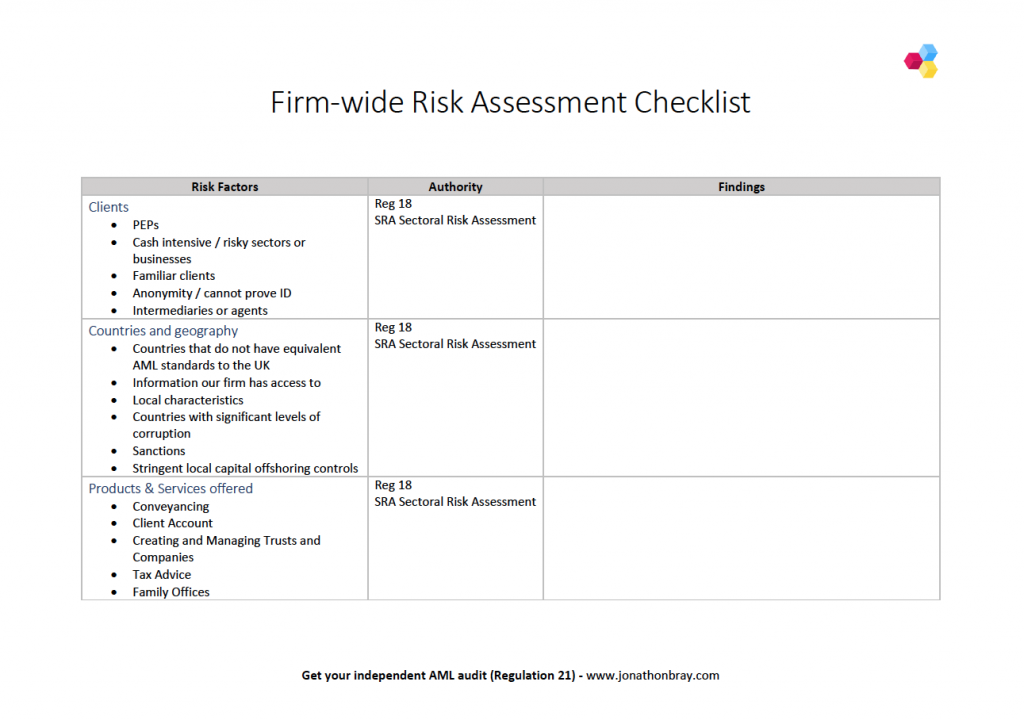

Source: bdo.co.uk

Source: bdo.co.uk

The SRA has outlined a number of core issues of which solicitors need to be aware in order to ensure they remain compliant with money laundering regulations. By acting in sham litigation we could be guilty of money laundering. Its good practice for a start full CDD and interrogation as to source of funds and beneficial owners will put you in the best position possible to spot financial crime and report where necessary. High risk of being used for money laundering although low risk of being used for terrorist financing. In particular the risk assessment identifies solicitors as being at a high risk of money laundering because of the range of high risk services they may offer.

Source: sra.org.uk

Source: sra.org.uk

This makes them attractive targets for criminals and funders of terrorism who want to launder money. That is why the spotlight is now increasingly on the role of lawyers who may be at risk of being deceived into facilitating money laundering. Here Crispin Passmore executive director at Solicitors Regulation Authority highlights the dangers of money laundering on small businesses. Now there are plenty of good reasons why a firm that is not bound by the 2017 Money Laundering Regulations would choose to follow them anyway. And understand that it is not a victimless crime.

Source: dia.govt.nz

If you believe your Solicitor is not following the rules then please seek advice and prevent providing them with any money. Simply put the act of money laundering is the process by which the proceeds of criminal activities enter the financial system. For example in a civil asset forfeiture case opened in July 2016 the US. Our experienced money laundering defence solicitors have extensive expertise in handling these types of complex cases so can give you the best possible defence from the point of arrest onwards. High risk of being used for money laundering although low risk of being used for terrorist financing.

Source: dia.govt.nz

Why this risk matters. That is why the spotlight is now increasingly on the role of lawyers who may be at risk of being deceived into facilitating money laundering. Even major law firms might inadvertently assist clients with money laundering. That is not to say that all Solicitors are money laundering but rather where Law Enforcement see money laundering there is a high risk that lawyers are involved. Now there are plenty of good reasons why a firm that is not bound by the 2017 Money Laundering Regulations would choose to follow them anyway.

Source: slideplayer.com

Source: slideplayer.com

Why this risk matters. For example in a civil asset forfeiture case opened in July 2016 the US. If you believe your Solicitor is not following the rules then please seek advice and prevent providing them with any money. Mr Passmore says this reflected the. This makes them attractive targets for criminals and funders of terrorism who want to launder money.

Source: slidetodoc.com

Source: slidetodoc.com

The Legal Profession has been identified as high risk for money laundering although low risk for terrorist financing. While the 2015 UK National Risk Assessment of Money Laundering and Terrorist Financing Report made no mention of vulnerabilities associated with capital markets the 2017 assessment acknowledged that capital markets raising and trading equity and debt and trading derivatives currency and commodities are assessed as to be exposed to high risks of money laundering. And understand that it is not a victimless crime. It is clear money laundering continues to be a major challenge for the legal profession. Forty-nine solicitors were referred to the Solicitors Disciplinary Tribunal resulting in 12 being struck off the suspension of 13 and more than 800000 in fines.

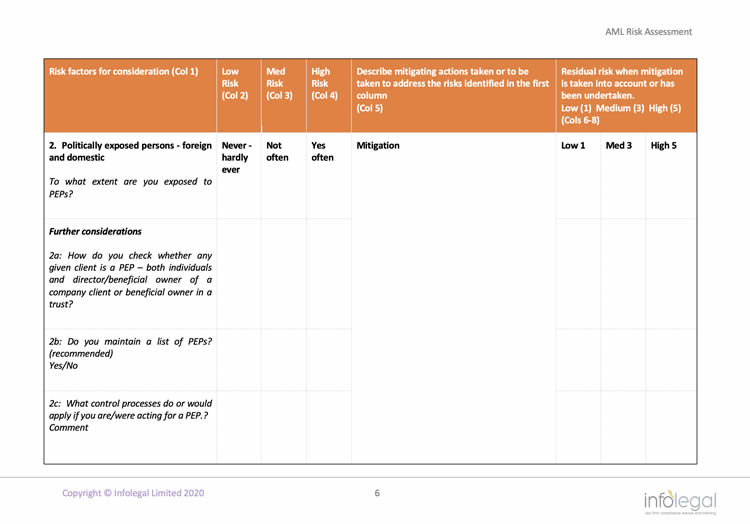

Source: infolegal.co.uk

Source: infolegal.co.uk

This makes them attractive targets for criminals and funders of terrorism who want to launder money. It is clear money laundering continues to be a major challenge for the legal profession. The NRA views the rapid and often large-scale movement of funds through client accounts as a money laundering risk. The vast majority of solicitors would be horrified to discover they had unwittingly helped money launderers. Even major law firms might inadvertently assist clients with money laundering.

Source: lexology.com

Source: lexology.com

However it can be purchased to set up a network of opaque company structures or to create cash-intensive businesses involving money laundering or predicate offences. Under the Code of Conduct all solicitors have a duty to ensure that their firm has sufficient safeguards and systems in place which comply with anti-money laundering legislation. Mr Passmore says this reflected the. The MLR 2017 states that not meeting a client in person poses a higher risk of money laundering. It is clear money laundering continues to be a major challenge for the legal profession.

Source: slidetodoc.com

Source: slidetodoc.com

And understand that it is not a victimless crime. This course will highlight the on-going requirements for lawyers and their firms to be up to date with developments relating to and concerning how best to ensure effective anti-money laundering compliance. That is not to say that all Solicitors are money laundering but rather where Law Enforcement see money laundering there is a high risk that lawyers are involved. Why are solicitors at risk of money laundering. Youre required to conduct EDD on these clients because.

Source: researchgate.net

Source: researchgate.net

Youre required to conduct EDD on these clients because. However money laundering is a common and genuine threat in many instances in todays world. The MLR 2017 states that not meeting a client in person poses a higher risk of money laundering. Hence the money appears clean or laundered because it looks as though it has come from a legitimate source. This course will highlight the on-going requirements for lawyers and their firms to be up to date with developments relating to and concerning how best to ensure effective anti-money laundering compliance.

Source: slideplayer.com

Source: slideplayer.com

Forty-nine solicitors were referred to the Solicitors Disciplinary Tribunal resulting in 12 being struck off the suspension of 13 and more than 800000 in fines. It is clear money laundering continues to be a major challenge for the legal profession. By acting in sham litigation we could be guilty of money laundering. High risk of being used for money laundering although low risk of being used for terrorist financing. Department of Justice DOJ alleged that major law firms were used to launder approximately 1 billion stolen from the.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title why are solicitors at risk of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.