14++ Who is subject to the money laundering regulations 2017 ideas

Home » money laundering Info » 14++ Who is subject to the money laundering regulations 2017 ideasYour Who is subject to the money laundering regulations 2017 images are available in this site. Who is subject to the money laundering regulations 2017 are a topic that is being searched for and liked by netizens today. You can Get the Who is subject to the money laundering regulations 2017 files here. Find and Download all free photos and vectors.

If you’re searching for who is subject to the money laundering regulations 2017 images information linked to the who is subject to the money laundering regulations 2017 interest, you have visit the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

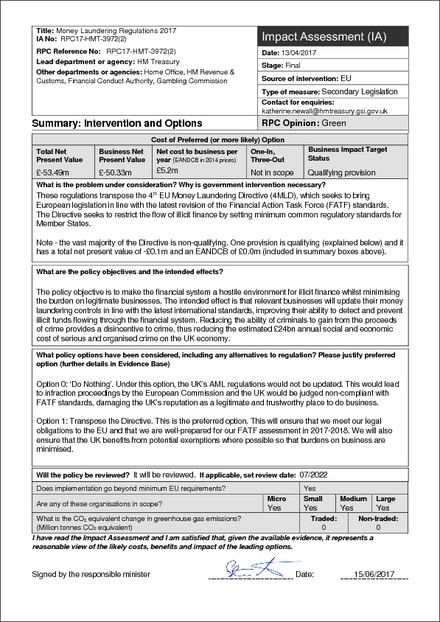

Who Is Subject To The Money Laundering Regulations 2017. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 2017 Regulations require firms in the regulated sector to conduct customer due diligence monitor transactions and implement effective policies and procedures to manage the risks of money laundering. Purpose of this guidance. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the. The 2017 Regulations largely apply to the same entities and individuals as the 2007 Regulations including accountancy services.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Money Laundering Regulations 2017 Background. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. Overview Whole firm risk assessment s18. Essentially those covered by MLR 2017 remain the same as under the previous rules. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 2017 Regulations require firms in the regulated sector to conduct customer due diligence monitor transactions and implement effective policies and procedures to manage the risks of money laundering. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

As a general rule the beneficial owner is the person whos behind the customer and who owns or controls the customer or its the person on whose behalf a transaction or activity is carried out. The Money Laundering Regulations 2017 MLR2017 introduced a number of new provisions that replace and expand the requirements of the Money Laundering Regulations 2007. It therefore covers accountants auditors legal advisers and tax advisers. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 2017 Regulations require firms in the regulated sector to conduct customer due diligence monitor transactions and implement effective policies and procedures to manage the risks of money laundering. The office is a new regulatory body with the general oversight pf the supervisory anti-money laundering regime and the OPBAS has duties and powers to ensure the professional body anti-money laundering supervisors meet the standards required by the Money Laundering Regulations 2017.

Source: researchgate.net

Source: researchgate.net

Overview Whole firm risk assessment s18. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. The Money Laundering Regulations 2017 MLR2017 introduced a number of new provisions that replace and expand the requirements of the Money Laundering Regulations 2007. European Union incorporates developments of the Financial Action Task Force agenda for anti- money laundering AML and counter-terrorist financing CTF. The 4MLD gives.

Source: researchgate.net

Source: researchgate.net

Aa identification or mitigation of the risks of money laundering and terrorist financing to which the relevant persons business is subject or bb prevention or detection of money laundering. However it should be noted that the 2017 regulations have raised the base level for their general application from 64000 to 100000. A another relevant person who is subject to these Regulations under regulation 8. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities.

Source: bi.go.id

Source: bi.go.id

On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. This warning notice is relevant to firms and individuals we regulate who are subject to The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the money laundering regulations. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk.

Source: bi.go.id

Source: bi.go.id

A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 effective on 26 June 2017 replaced the 2007 Regulations. As a general rule the beneficial owner is the person whos behind the customer and who owns or controls the customer or its the person on whose behalf a transaction or activity is carried out. This warning notice is relevant to firms and individuals we regulate who are subject to The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the money laundering regulations.

Source: bi.go.id

Source: bi.go.id

Money Laundering Regulations 2017 Background. Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 effective on 26 June 2017 replaced the 2007 Regulations. This warning notice is relevant to firms and individuals we regulate who are subject to The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the money laundering regulations. This guidance is for firms and individuals we regulate that are subject to The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which came into force on 26 June 2017. Which their business is subject taking into account where relevant the findings from the NRA and.

Source:

Trust or company services. The office is a new regulatory body with the general oversight pf the supervisory anti-money laundering regime and the OPBAS has duties and powers to ensure the professional body anti-money laundering supervisors meet the standards required by the Money Laundering Regulations 2017. Aa identification or mitigation of the risks of money laundering and terrorist financing to which the relevant persons business is subject or bb prevention or detection of money laundering. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. European Union incorporates developments of the Financial Action Task Force agenda for anti- money laundering AML and counter-terrorist financing CTF.

Source: bi.go.id

Source: bi.go.id

The 2017 Regulations largely apply to the same entities and individuals as the 2007 Regulations including accountancy services. This warning notice is relevant to firms and individuals we regulate who are subject to The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 the money laundering regulations. European Union incorporates developments of the Financial Action Task Force agenda for anti- money laundering AML and counter-terrorist financing CTF. Purpose of this guidance. Trust or company services.

Source: landlordsguild.com

Source: landlordsguild.com

Aa identification or mitigation of the risks of money laundering and terrorist financing to which the relevant persons business is subject or bb prevention or detection of money laundering. A another relevant person who is subject to these Regulations under regulation 8. On 15 March 2017 HM Treasury published a consultation draft of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the. European Union incorporates developments of the Financial Action Task Force agenda for anti- money laundering AML and counter-terrorist financing CTF.

Source: insight.rwabusiness.com

Source: insight.rwabusiness.com

The Money Laundering Regulations 2017 MLR2017 introduced a number of new provisions that replace and expand the requirements of the Money Laundering Regulations 2007. Trust or company services. Regulations 2017 the MLR 2017 came into force on the 26 June 2017 repealing the Money Laundering Regulations 2007 2007 MLR and transposed the EU Fourth Money Laundering Directive 4MLD into UK law. This guidance has been updated for the 2017 Regulations and approved by HM Treasury. Overview Whole firm risk assessment s18.

Source: bi.go.id

Essentially those covered by MLR 2017 remain the same as under the previous rules. Individuals and companies can be prosecuted for committing any of the substantive money laundering offenses under POCA whether or not they are part of the regulated sector. The Money Laundering Regulations 2017 MLR2017 introduced a number of new provisions that replace and expand the requirements of the Money Laundering Regulations 2007. However you should be aware that the presence of one or. This guidance is for firms and individuals we regulate that are subject to The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which came into force on 26 June 2017.

Source: bi.go.id

MLR2017 was laid before parliament with only a single working day before the deadline for its coming into force which left those regulated by MLR2017 very little time to update. This guidance is for firms and individuals we regulate that are subject to The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLRs which came into force on 26 June 2017. A firm may rely on another person who is subject to the MLR 2017 or equivalent to carry out CDD but only if it obtains from that third party significant amounts of the CDD information required and enters into a written agreement with the third party under which the third party agrees to provide within two working days of a request to do so copies of any identification and verification data on the. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. However you should be aware that the presence of one or.

Source: legislation.gov.uk

Source: legislation.gov.uk

Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 effective on 26 June 2017 replaced the 2007 Regulations. However you should be aware that the presence of one or. Regulation 373 sets out a list of factors to be taken into account in determining whether a situation poses a lower risk of money laundering or terrorist financing such that SDD measures can be applied. We require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. Individuals and companies can be prosecuted for committing any of the substantive money laundering offenses under POCA whether or not they are part of the regulated sector.

Source: legislation.gov.uk

Source: legislation.gov.uk

Individuals and companies can be prosecuted for committing any of the substantive money laundering offenses under POCA whether or not they are part of the regulated sector. It therefore covers accountants auditors legal advisers and tax advisers. This is a change from the Money Laundering Regulations 2007 under which SDD was the default option for a defined list of entities. B a person who carries on business in an EEA state other than the United Kingdom who is i subject to the. Regulations 2017 the MLR 2017 came into force on the 26 June 2017 repealing the Money Laundering Regulations 2007 2007 MLR and transposed the EU Fourth Money Laundering Directive 4MLD into UK law.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title who is subject to the money laundering regulations 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.