18++ Who is required to have an aml policy ideas

Home » money laundering Info » 18++ Who is required to have an aml policy ideasYour Who is required to have an aml policy images are available. Who is required to have an aml policy are a topic that is being searched for and liked by netizens today. You can Download the Who is required to have an aml policy files here. Download all free vectors.

If you’re looking for who is required to have an aml policy images information connected with to the who is required to have an aml policy topic, you have come to the ideal blog. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

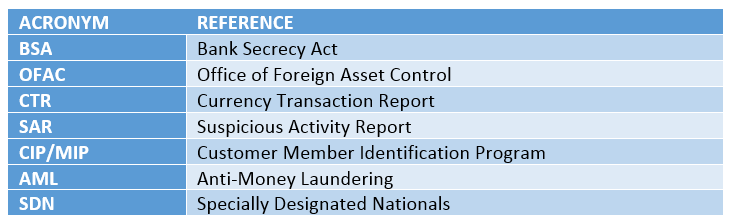

Who Is Required To Have An Aml Policy. It is also known as money-laundering act or. 5 To establish effective AML procedures and controls an MSB principals program requirements properly include agent. This version of the Guide has expanded to more than 600 pages covering thousands of questions. Anti-money laundering controls they put in place.

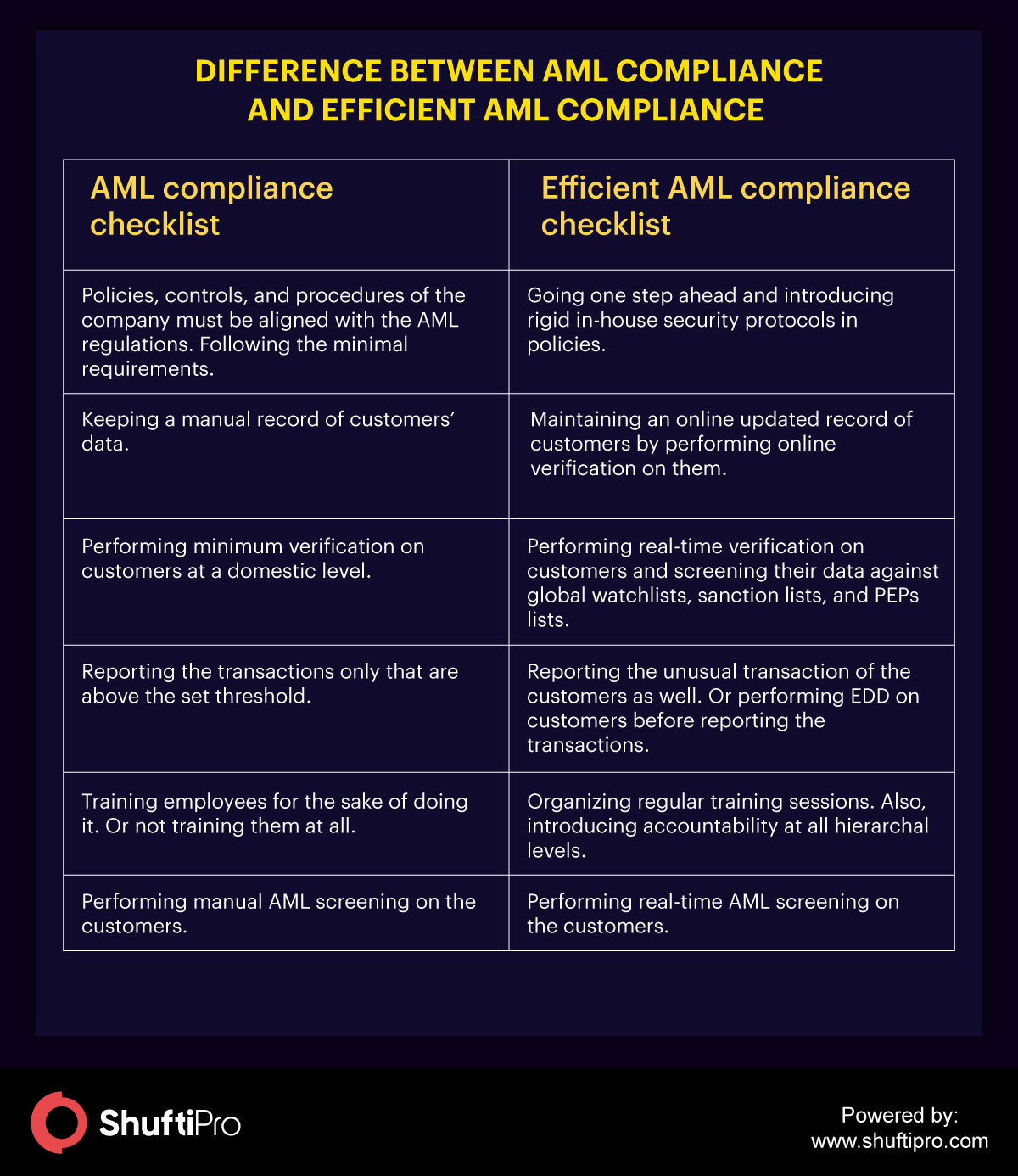

Anti Money Laundering What Is Aml Compliance And Why Is It Important From shuftipro.com

Anti Money Laundering What Is Aml Compliance And Why Is It Important From shuftipro.com

Ad AML coverage from every angle. In order to combat financial crime banks credit unions and a variety of other financial institutions across the world are required to develop and put in place Anti-Money Laundering AML Compliance Programs. What is an AML Compliance Program required to have. Every bank must have a comprehensive BSAAML compliance program that addresses BSA requirements applicable to all operations of the organization. Evolving regulatory expectations for anti-money laundering and sanctions compliance and there seems to be no end to the questions. Staying two steps ahead of criminals demands a fast-evolving regulatory environment.

It is also known as money-laundering act or.

Staying two steps ahead of criminals demands a fast-evolving regulatory environment. They must then apply to register their premises instead. The investment adviser would be required to designate at least one person as responsible for implementing and monitoring the AML program. Are all employees of the firm required to have AML training. It is also known as money-laundering act or. US financial institutions must develop and implement an internal anti-money laundering program to suit their risk profile.

Source: shuftipro.com

Source: shuftipro.com

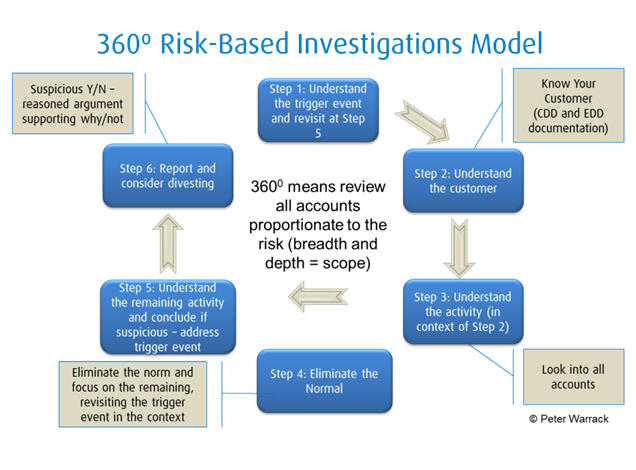

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. Anti-money laundering controls they put in place. 21 An effective Anti-Money Laundering and Countering the Financing of Terrorism AMLCFT regime requires financial institutions to adopt and effectively implement appropriate ML and TF control processes and procedures not only as a principle of good governance but also as an essential tool to avoid involvement in ML and TF. You should contact HMRC if youre not sure which premises to include or youre an. It is the policy of ALT 5 Pro The Company to reach for the highest level of integrity and prohibit and actively prevent money laundering or the funding of terrorist or criminal activities by complying with all applicable requirements under the.

Source: shuftipro.com

Source: shuftipro.com

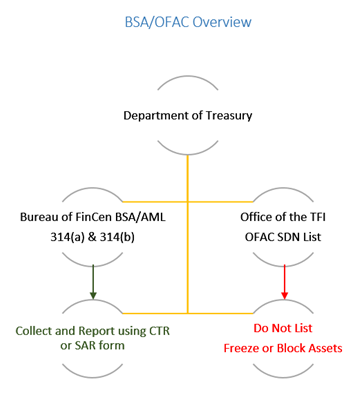

The Bank Secrecy Act among other things requires financial institutions including broker-dealers to develop and implement AML compliance programs. The new AMLD5 directive will impact governments as well as companies and here is everything you need to know to stay compliant in 2020. Latest news reports from the medical literature videos from the experts and more. It is the policy of ALT 5 Pro The Company to reach for the highest level of integrity and prohibit and actively prevent money laundering or the funding of terrorist or criminal activities by complying with all applicable requirements under the. You should contact HMRC if youre not sure which premises to include or youre an.

Source: complianceonline.com

Source: complianceonline.com

Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. What is an AML Compliance Program required to have. Ad AML coverage from every angle. 166 Neither FinCEN nor banking agency rules impose a specific BSAAML compliance program obligation on Bank Holding Companies Unitary Savings and Loan Holding Companies and parents of Industrial Loan Companies. Every bank must have a comprehensive BSAAML compliance program that addresses BSA requirements applicable to all operations of the organization.

Source: bi.go.id

Source: bi.go.id

Latest news reports from the medical literature videos from the experts and more. This version of the Guide has expanded to more than 600 pages covering thousands of questions. The Bank Secrecy Act BSA was originally enacted in 1970 and subsequently amended many times. 166 Neither FinCEN nor banking agency rules impose a specific BSAAML compliance program obligation on Bank Holding Companies Unitary Savings and Loan Holding Companies and parents of Industrial Loan Companies. The investment adviser would be required to designate at least one person as responsible for implementing and monitoring the AML program.

Source: bi.go.id

Source: bi.go.id

What is an AML Compliance Program required to have. In order to combat financial crime banks credit unions and a variety of other financial institutions across the world are required to develop and put in place Anti-Money Laundering AML Compliance Programs. Evolving regulatory expectations for anti-money laundering and sanctions compliance and there seems to be no end to the questions. 166 Neither FinCEN nor banking agency rules impose a specific BSAAML compliance program obligation on Bank Holding Companies Unitary Savings and Loan Holding Companies and parents of Industrial Loan Companies. The Bank Secrecy Act among other things requires financial institutions including broker-dealers to develop and implement AML compliance programs.

Source: aml-program-template.pdffiller.com

Source: aml-program-template.pdffiller.com

Are all employees of the firm required to have AML training. This version of the Guide has expanded to more than 600 pages covering thousands of questions. 166 Neither FinCEN nor banking agency rules impose a specific BSAAML compliance program obligation on Bank Holding Companies Unitary Savings and Loan Holding Companies and parents of Industrial Loan Companies. US financial institutions must develop and implement an internal anti-money laundering program to suit their risk profile. It is the policy of ALT 5 Pro The Company to reach for the highest level of integrity and prohibit and actively prevent money laundering or the funding of terrorist or criminal activities by complying with all applicable requirements under the.

Source: bi.go.id

Source: bi.go.id

What is AML Compliance Program. What is AML Compliance Program. Staying two steps ahead of criminals demands a fast-evolving regulatory environment. The financial institutions are also required to report any suspicious activity that may show any signs of money laundering tax evasion etc. US financial institutions must develop and implement an internal anti-money laundering program to suit their risk profile.

The new AMLD5 directive will impact governments as well as companies and here is everything you need to know to stay compliant in 2020. Ad AML coverage from every angle. Ad AML coverage from every angle. It includes new and expanded information on a range of topics such as human trafficking and smuggling virtual. In order to combat financial crime banks credit unions and a variety of other financial institutions across the world are required to develop and put in place Anti-Money Laundering AML Compliance Programs.

5 To establish effective AML procedures and controls an MSB principals program requirements properly include agent. Every bank must have a comprehensive BSAAML compliance program that addresses BSA requirements applicable to all operations of the organization. Ad AML coverage from every angle. This version of the Guide has expanded to more than 600 pages covering thousands of questions. 21 An effective Anti-Money Laundering and Countering the Financing of Terrorism AMLCFT regime requires financial institutions to adopt and effectively implement appropriate ML and TF control processes and procedures not only as a principle of good governance but also as an essential tool to avoid involvement in ML and TF.

Source: acamstoday.org

Source: acamstoday.org

Firms must have in place policies and procedures in relation to customer due diligence and monitoring among others but neither the law nor our rules prescribe in detail how firms have to do this. The Bank Secrecy Act among other things requires financial institutions including broker-dealers to develop and implement AML compliance programs. Ad AML coverage from every angle. The Bank Secrecy Act BSA requires all MSBs both principals and their agents to establish and maintain an effective written AML program reasonably designed to prevent the MSB from being used to facilitate money laundering and the financing of terrorist activities. Blog A Guide to Anti-Money Laundering AML Compliance.

It is the policy of ALT 5 Pro The Company to reach for the highest level of integrity and prohibit and actively prevent money laundering or the funding of terrorist or criminal activities by complying with all applicable requirements under the. The Bank Secrecy Act among other things requires financial institutions including broker-dealers to develop and implement AML compliance programs. It is the policy of ALT 5 Pro The Company to reach for the highest level of integrity and prohibit and actively prevent money laundering or the funding of terrorist or criminal activities by complying with all applicable requirements under the. Ad AML coverage from every angle. 166 Neither FinCEN nor banking agency rules impose a specific BSAAML compliance program obligation on Bank Holding Companies Unitary Savings and Loan Holding Companies and parents of Industrial Loan Companies.

Evolving regulatory expectations for anti-money laundering and sanctions compliance and there seems to be no end to the questions. They must then apply to register their premises instead. Firms that apply a risk-based approach to anti-money laundering AML will focus AML resources where they will have the biggest impact. The Bank Secrecy Act BSA was originally enacted in 1970 and subsequently amended many times. 5 To establish effective AML procedures and controls an MSB principals program requirements properly include agent.

The investment adviser would be required to designate at least one person as responsible for implementing and monitoring the AML program. It includes new and expanded information on a range of topics such as human trafficking and smuggling virtual. 166 Neither FinCEN nor banking agency rules impose a specific BSAAML compliance program obligation on Bank Holding Companies Unitary Savings and Loan Holding Companies and parents of Industrial Loan Companies. It is the policy of ALT 5 Pro The Company to reach for the highest level of integrity and prohibit and actively prevent money laundering or the funding of terrorist or criminal activities by complying with all applicable requirements under the. Alt 5 Pro AML Policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title who is required to have an aml policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.