14+ Which three stages of money laundering are online banking vulnerable to ideas

Home » money laundering idea » 14+ Which three stages of money laundering are online banking vulnerable to ideasYour Which three stages of money laundering are online banking vulnerable to images are ready in this website. Which three stages of money laundering are online banking vulnerable to are a topic that is being searched for and liked by netizens today. You can Find and Download the Which three stages of money laundering are online banking vulnerable to files here. Download all free photos.

If you’re looking for which three stages of money laundering are online banking vulnerable to images information related to the which three stages of money laundering are online banking vulnerable to keyword, you have come to the ideal site. Our website always gives you hints for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

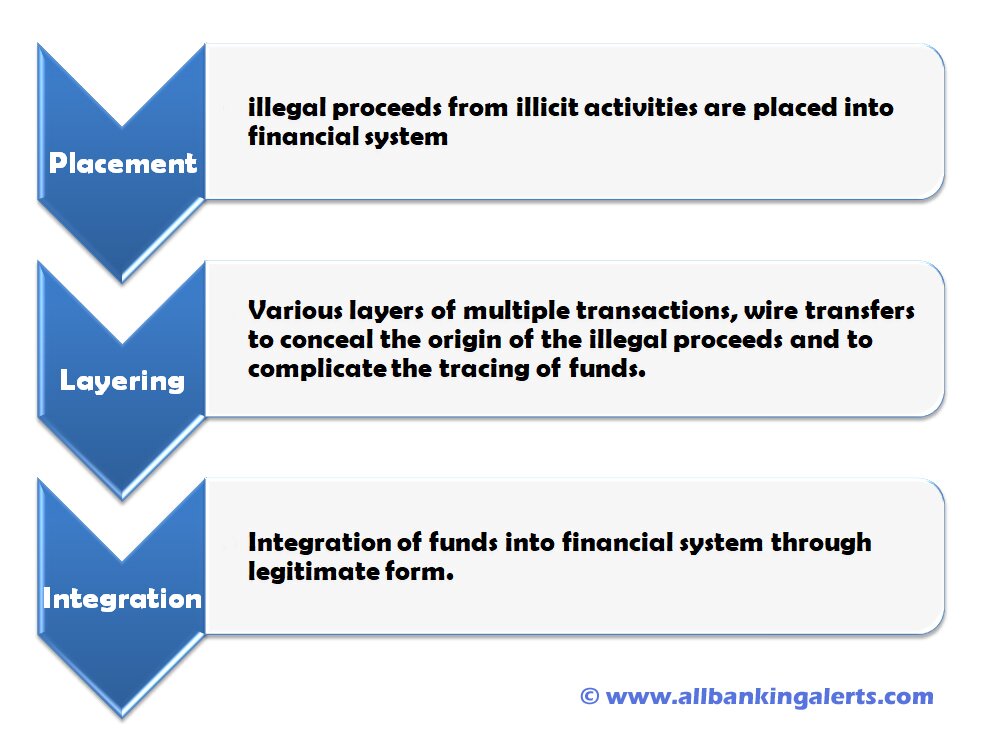

Which Three Stages Of Money Laundering Are Online Banking Vulnerable To. At this stage the laundered funds may also only transit bank accounts at various locations where this can be done without leaving traces of their source or ultimate destination. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. Money laundering basically involves three independent steps that can occur simultaneously. Finally at the integration phase launderers might choose to invest laundered funds in still other locations if they were generated in unstable economies or locations offering limited investment opportunities.

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn From ppt-online.org

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn From ppt-online.org

The way criminals place funds are by exchanging currencies and so receiving washed money that can be deposit into a bank. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system. Money laundering is a diverse and often complex process that need not involve cash transactions. Finally at the integration phase launderers might choose to invest laundered funds in still other locations if they were generated in unstable economies or locations offering limited investment opportunities. Insider trading market manipulation and fraud. The institution may be anything from a brokerage house or bank to a casino or insurance company.

Money laundering has one purpose.

The layering stage is. Placement in which the money is. Money laundering is a process of converting ill-gotten money into legitimate. The institution may be anything from a brokerage house or bank to a casino or insurance company. Accordingly the first stage of the money laundering process is known as placement Placement. The placement stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

Source: iuricorn.com

Source: iuricorn.com

Insider trading market manipulation and fraud. Moving the funds from direct association with. It is during the placement stage that money launderers are the most vulnerable to being caught. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. FX-based money laundering commonly affects private and public business such as clearinghouses FX bureau banks and digital exchangesFATF 2010 p9.

Source: calert.info

Source: calert.info

Placement in which the money is. Moving the funds from direct association with. The stages of money-laundering include. The FATF glossary includes among the designated categories of offences three offences that are predicate offences to money laundering. The institution may be anything from a brokerage house or bank to a casino or insurance company.

Source: amlbot.com

Source: amlbot.com

Money laundering is a process of converting ill-gotten money into legitimate. Four methods of money launderingcash smuggling casinos and other gambling venues insurance. The layering stage is. This is where the dirty money or cash proceeds of criminal activity first enter the mainstream financial system. Three phases of money laundering are - Placement - layering - Integration The most vulnerable stage to detect is supposed the first stage the placement.

Source: bitquery.io

Source: bitquery.io

Money laundering is a process of converting ill-gotten money into legitimate. I will make an explanation to why convicted criminals should help combat future methods of money laundering in FX. The money-laundering cycle can be broken down into three distinct stages. The money laundering cycle can be broken down into three distinct stages. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion.

Source: calert.info

Source: calert.info

At this stage the laundered funds may also only transit bank accounts at various locations where this can be done without leaving traces of their source or ultimate destination. The layering stage is. Four methods of money launderingcash smuggling casinos and other gambling venues insurance. However it is important to remember that money laundering is a single process. Finally at the integration phase launderers might choose to invest laundered funds in still other locations if they were generated in unstable economies or locations offering limited investment opportunities.

Source: ft.lk

Source: ft.lk

The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system. At this stage the laundered funds may also only transit bank accounts at various locations where this can be done without leaving traces of their source or ultimate destination. Accordingly the first stage of the money laundering process is known as placement Placement. Moving the funds from direct association with. It is during the placement stage that money launderers are the most vulnerable to being caught.

Source: amlbot.com

Source: amlbot.com

However it is important to remember that money laundering is a single process. This is where the dirty money or cash proceeds of criminal activity first enter the mainstream financial system. That the aggregate size of money laundering in the world could be somewhere between 2 and 5 percent of the worlds gross domestic product. The stages of money-laundering include. The institution may be anything from a brokerage house or bank to a casino or insurance company.

Source: allbankingalerts.com

Source: allbankingalerts.com

There are usually two or three phases to the laundering. The institution may be anything from a brokerage house or bank to a casino or insurance company. Finally at the integration phase launderers might choose to invest laundered funds in still other locations if they were generated in unstable economies or locations offering limited investment opportunities. What stage of money laundering is most vulnerable. While money laundering is a single process it does have three stages.

Source: amlbot.com

Source: amlbot.com

In many cases organised criminals are systemically probing the various weaknesses within these AML systems and are actively capitalising on them in order to turn the profits of crime into ostensibly legitimate assets. Are associated with only one of the three phases of money laundering while others are usable in any of the phases of placement layering and integration. Money laundering has one purpose. All banks have Anti-Money Laundering AML systems in place but they are crippled by a variety of different inefficiencies that are allowing criminal activity to remain undetected. The money-laundering cycle can be broken down into three distinct stages.

Source: allbankingalerts.com

Source: allbankingalerts.com

The layering stage is. I will make an explanation to why convicted criminals should help combat future methods of money laundering in FX. Three phases of money laundering are - Placement - layering - Integration The most vulnerable stage to detect is supposed the first stage the placement. While money laundering is a single process it does have three stages. Finally at the integration phase launderers might choose to invest laundered funds in still other locations if they were generated in unstable economies or locations offering limited investment opportunities.

Source: bi.go.id

Source: bi.go.id

Here are some of the most common ways this is achieved. The way criminals place funds are by exchanging currencies and so receiving washed money that can be deposit into a bank. However it is important to remember that money laundering is a single process. All banks have Anti-Money Laundering AML systems in place but they are crippled by a variety of different inefficiencies that are allowing criminal activity to remain undetected. In many cases organised criminals are systemically probing the various weaknesses within these AML systems and are actively capitalising on them in order to turn the profits of crime into ostensibly legitimate assets.

Source: ppt-online.org

Source: ppt-online.org

The stages of money-laundering include. The money-laundering cycle can be broken down into three distinct stages. Money laundering is a process of converting ill-gotten money into legitimate. In many cases organised criminals are systemically probing the various weaknesses within these AML systems and are actively capitalising on them in order to turn the profits of crime into ostensibly legitimate assets. Money laundering basically involves three independent steps that can occur simultaneously.

Source: amlbot.com

Source: amlbot.com

Money laundering basically involves three independent steps that can occur simultaneously. Money laundering is a diverse and often complex process that need not involve cash transactions. Insider trading market manipulation and fraud. Money laundering has one purpose. Money laundering involves three basic steps to disguise the source of illegally earned money and make it usable.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title which three stages of money laundering are online banking vulnerable to by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.