17+ Which step in the money laundering process do law enforcement efforts focus info

Home » money laundering idea » 17+ Which step in the money laundering process do law enforcement efforts focus infoYour Which step in the money laundering process do law enforcement efforts focus images are ready in this website. Which step in the money laundering process do law enforcement efforts focus are a topic that is being searched for and liked by netizens today. You can Get the Which step in the money laundering process do law enforcement efforts focus files here. Download all free photos.

If you’re searching for which step in the money laundering process do law enforcement efforts focus pictures information connected with to the which step in the money laundering process do law enforcement efforts focus topic, you have pay a visit to the right blog. Our site frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

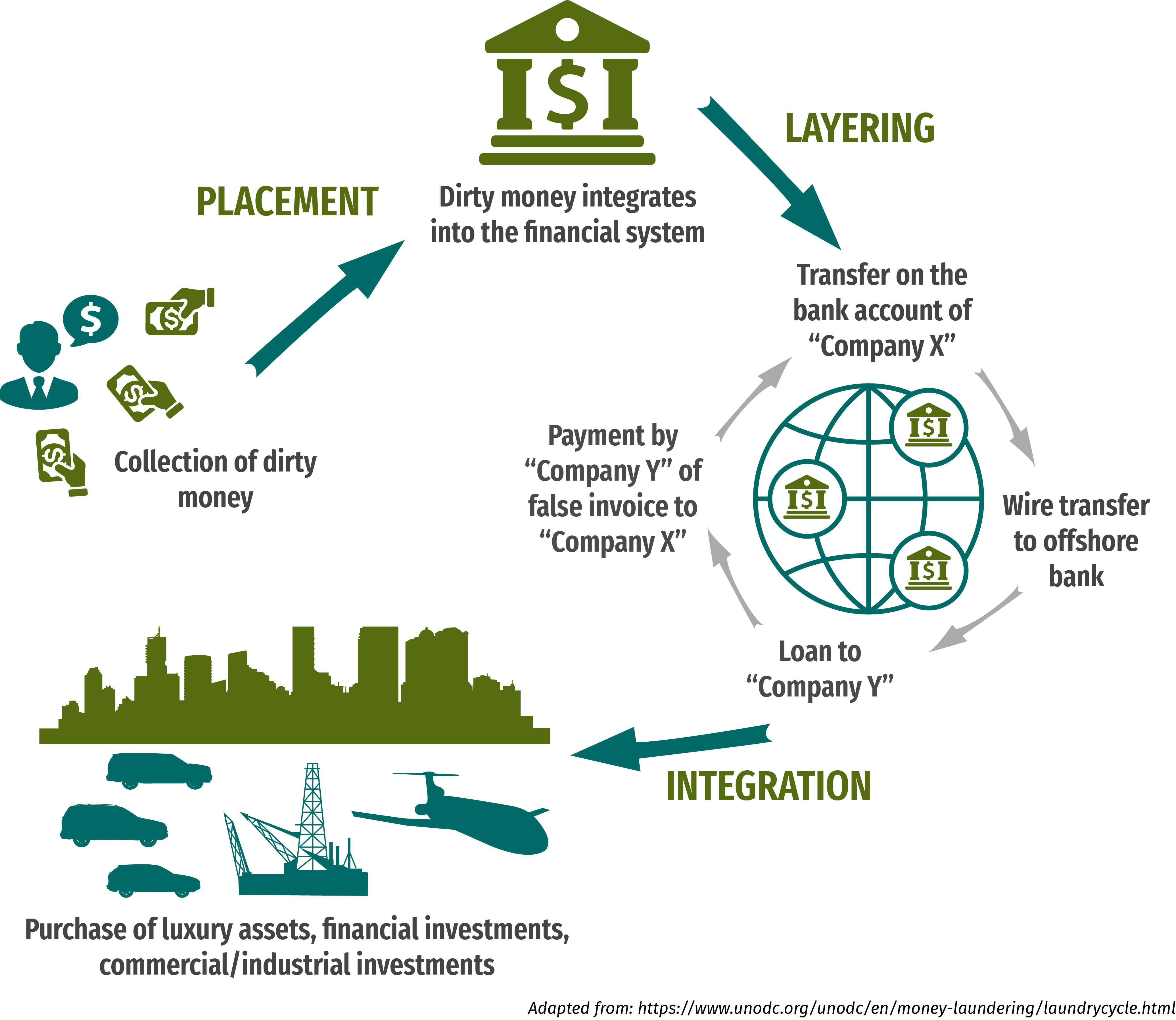

Which Step In The Money Laundering Process Do Law Enforcement Efforts Focus. Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. In cases of transnational fraud the first stage in the money-laundering process is often the physical movement of the money abroad. Methods and Markets 25 Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. Placement can take place via cash deposit wire transfer check money order or other methods.

Anti Money Laundering Blacklist Spells Trouble From bangkokpost.com

Anti Money Laundering Blacklist Spells Trouble From bangkokpost.com

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. The Money Laundering Process. The European Unions banking regulator has proposed guidance for financial-sector compliance officers another step in the blocs effort to revamp its anti-money-laundering system. This is the first step of the money-launderingprocess and the ultimate aim of this phase is toremove the cash from the location of acquisitionso as. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. It allows drug traffickers smugglers and other criminals to expand their operations.

The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation.

The Legal Sector Affinity Group which represents the legal sector. Dirty money appear legal ie. It will keep the regulators focused on money laundering controls in sectors beyond banks. The placement stage involves the phys-. Money laundering schemes are used to conceal the source and possession of money obtained through illegal activities such as drug trafficking. At the placement stage for example the funds are usually processed relatively close to the under-lying activity.

Source: redalyc.org

Source: redalyc.org

This drives up the cost of government due to the need for increased law enforcement and health care expenditures for example for treatment of drug addicts. Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. The institution may be anything from a brokerage house or bank to a casino or insurance company. Large corporations and financial institutions hire their own experts to ensure that they are complying with anti-laundering processes. Institutions can best use their limited resources to focus on matters where the money laundering risks are highest.

Source: worldwildlife.org

Source: worldwildlife.org

At the placement stage for example the funds are usually processed relatively close to the under-lying activity. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. Methods and Markets 25 Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. Law enforcement officers and financial regulators are trained to look for signs of money laundering in their everyday dealings. This overview presents recommendations made by the OECD in relation to Latvias efforts.

Source: moneylaundering.ca

Source: moneylaundering.ca

Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. Such a strategy had also the advantage of targeting efforts on the richest and thus most dangerous criminal organizations. The tragic events of September 11 showed that the rationale of this strategy could be. This is the first step of the money-launderingprocess and the ultimate aim of this phase is toremove the cash from the location of acquisitionso as. The institution may be anything from a brokerage house or bank to a casino or insurance company.

Source: shuftipro.com

Source: shuftipro.com

Placement layering and integration stage. At the placement stage for example the funds are usually processed relatively close to the under-lying activity. This overview presents recommendations made by the OECD in relation to Latvias efforts. In cases of transnational fraud the first stage in the money-laundering process is often the physical movement of the money abroad. A quantitative approach will generate better results than a qualitative approach.

Source: bangkokpost.com

Source: bangkokpost.com

The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. This is the first step of the money-launderingprocess and the ultimate aim of this phase is toremove the cash from the location of acquisitionso as. PLACEMENT Placement refers to the physical disposal ofbulk cash proceeds derived from illegal activity. Placement layering and integration stage. The Money Laundering Process.

Source: bi.go.id

Source: bi.go.id

The money laundering cycle can be broken down into three distinct stages. Such a strategy had also the advantage of targeting efforts on the richest and thus most dangerous criminal organizations. A robust and resilient anti-money laundering and combating of terrorism financing AMLCFT regime is the first step towards being able to implement effective legal regulatory and operational measures. There are many ways of money laundering which are explained in the. Dirty money appear legal ie.

Source: pideeco.be

Source: pideeco.be

Our quick guide gives you an overview of the key issues firms need to be aware of as a result of the transposition of the Fourth EU Money Laundering Directive. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. The Financial Action Task Force on Money Laundering FATF was created as a G-7 initiative to develop more effective financial standards and anti-laundering legislation. However it is important to remember that money laundering is a single process. A quantitative approach will generate better results than a qualitative approach.

Source: researchgate.net

Source: researchgate.net

Money laundering activity may also be concentrated geographically according to the stage the laundered funds have reached. The first stage in the process is placement. A robust and resilient anti-money laundering and combating of terrorism financing AMLCFT regime is the first step towards being able to implement effective legal regulatory and operational measures. The institution may be anything from a brokerage house or bank to a casino or insurance company. However it is important to remember that money laundering is a single process.

Source: acfcs.org

Source: acfcs.org

It allows drug traffickers smugglers and other criminals to expand their operations. Money laundering schemes are used to conceal the source and possession of money obtained through illegal activities such as drug trafficking. It will keep the regulators focused on money laundering controls in sectors beyond banks. The Legal Sector Affinity Group which represents the legal sector. The institution may be anything from a brokerage house or bank to a casino or insurance company.

Source: bi.go.id

Source: bi.go.id

To this end currency smuggling that is. The institution may be anything from a brokerage house or bank to a casino or insurance company. The Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017 MLR 2017 came into force in June 2017. Money laundering typically includes three stages. This is the act of moving the ill-gotten funds into a financial institution.

Source: en.ppt-online.org

Source: en.ppt-online.org

Large corporations and financial institutions hire their own experts to ensure that they are complying with anti-laundering processes. This distances the money from the location where the predicate offense was committed. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial instruments etc. Money laundering is the process of making illegally-gained proceeds ie. The institution may be anything from a brokerage house or bank to a casino or insurance company.

Source: complyadvantage.com

Source: complyadvantage.com

Such a strategy had also the advantage of targeting efforts on the richest and thus most dangerous criminal organizations. This distances the money from the location where the predicate offense was committed. Institutions can best use their limited resources to focus on matters where the money laundering risks are highest. Money laundering schemes are used to conceal the source and possession of money obtained through illegal activities such as drug trafficking. The laundering process was a more cost-effective and a less dangerous means to achieve law enforcement objectives.

Source: researchgate.net

Source: researchgate.net

This is the first step of the money-launderingprocess and the ultimate aim of this phase is toremove the cash from the location of acquisitionso as. Institutions can best use their limited resources to focus on matters where the money laundering risks are highest. A robust and resilient anti-money laundering and combating of terrorism financing AMLCFT regime is the first step towards being able to implement effective legal regulatory and operational measures. The money laundering cycle can be broken down into three distinct stages. Money laundering schemes are used to conceal the source and possession of money obtained through illegal activities such as drug trafficking.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which step in the money laundering process do law enforcement efforts focus by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.