18++ Which federal law requires financial institutions to file reports of cash ideas

Home » money laundering Info » 18++ Which federal law requires financial institutions to file reports of cash ideasYour Which federal law requires financial institutions to file reports of cash images are available in this site. Which federal law requires financial institutions to file reports of cash are a topic that is being searched for and liked by netizens today. You can Get the Which federal law requires financial institutions to file reports of cash files here. Download all royalty-free images.

If you’re looking for which federal law requires financial institutions to file reports of cash pictures information linked to the which federal law requires financial institutions to file reports of cash keyword, you have visit the right blog. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Which Federal Law Requires Financial Institutions To File Reports Of Cash. The Bank Secrecy Act BSA requires financial institutions to assist US. To help the government fight the funding of terrorism and money laundering activities Federal law requires all financial institutions to obtain verify and record information that identifies each person who opens an account. Depositing a big amount of cash that is 10000 or more means your bank or credit union will report it to the federal government. In the event of any of the below activities scenario a financial institution is required to perform suspicious activity reporting.

Education What Is The Fed Supervision And Regulation From frbsf.org

Education What Is The Fed Supervision And Regulation From frbsf.org

Pursuant to federal statute financial institutions are required to report cash deposits in excess of 10000 to the IRS. Financial institutions are required to file with FinCEN for each deposit withdrawal exchange of currency or other payment or transfer by through or to the financial institution which involves a transaction in currency of more than 10000. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. The guidelines for large cash transactions for banks and financial institutions are set by the Bank Secrecy Act also known as the Currency and Foreign Transactions Reporting Act. Federal law requires financial institutions to report currency cash or coin transactions over 10000 conducted by or on behalf of one person as well as multiple currency transactions. General Requirements for Filing a SAR.

5311 et seq is referred to as the Bank Secrecy Act BSA.

The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. The 10000 threshold was created as part of the Bank. Banks are required to make these reports. To help the government fight the funding of terrorism and money laundering activities Federal law requires all financial institutions to obtain verify and record information that identifies each person who opens an account. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. The first two reporting categories categories one and two characterized as detailed reporting apply to institutions that are not exempt from reserve requirements nonexempt institutions.

Source: investopedia.com

Source: investopedia.com

Banks are required to make these reports. Regulations established under BSA mandate that banks and other financial institutions establish Customer identification programs CIPs to verify the identities of their customers. The financial services firm identifies or has reasons to suspect violation of a federal criminal law and has substantial reason to believe that one of its employees agents. General Requirements for Filing a SAR. The goal is to prevent money laundering by criminals.

Source: dfi.wa.gov

Source: dfi.wa.gov

To help the government fight the funding of terrorism and money laundering activities Federal law requires all financial institutions to obtain verify and record information that identifies each person who opens an account. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. The financial services firm identifies or has reasons to suspect violation of a federal criminal law and has substantial reason to believe that one of its employees agents. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. The Bank Secrecy Act BSA requires financial institutions to assist US.

Source: psu.instructure.com

Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report. The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report. Financial institutions are required to file with FinCEN for each deposit withdrawal exchange of currency or other payment or transfer by through or to the financial institution which involves a transaction in currency of more than 10000.

Source: br.pinterest.com

Source: br.pinterest.com

Depositing a big amount of cash that is 10000 or more means your bank or credit union will report it to the federal government. A currency transaction report CTR is a report that US. If you deposit more than 10000 cash in your bank account your bank has to report the deposit to the government. Federal law requires financial institutions to report currency cash or coin transactions over 10000 conducted by or on behalf of one person as well as multiple currency transactions. Bank Secrecy Act BSA Bank Secrecy Act of 1970 Requires financial institutions in the US to assist US Govt agencies to detect and prevent money laundering Act requires financial institutions to keep records of cash purchases of negotiable instruments and file reports of cash purchases of these negotiable instruments of more than 10000.

Source: id.pinterest.com

Source: id.pinterest.com

In the event of any of the below activities scenario a financial institution is required to perform suspicious activity reporting. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. If you deposit more than 10000 cash in your bank account your bank has to report the deposit to the government.

Source: pinterest.com

Source: pinterest.com

The 10000 threshold was created as part of the Bank. The goal is to prevent money laundering by criminals. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a. Depositing a big amount of cash that is 10000 or more means your bank or credit union will report it to the federal government. Government agencies to detect and prevent money laundering.

Source: jagranjosh.com

Source: jagranjosh.com

Government agencies to detect and prevent money laundering. Government agencies in detecting and preventing money laundering. Law requiring financial institutions in the United States to assist US. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions. Bank Secrecy Act BSA Bank Secrecy Act of 1970 Requires financial institutions in the US to assist US Govt agencies to detect and prevent money laundering Act requires financial institutions to keep records of cash purchases of negotiable instruments and file reports of cash purchases of these negotiable instruments of more than 10000.

Source: businessinsider.com

Why is my financial institution asking me for identification and personal information. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions. The guidelines for large cash transactions for banks and financial institutions are set by the Bank Secrecy Act also known as the Currency and Foreign Transactions Reporting Act. To help the government fight the funding of terrorism and money laundering activities Federal law requires all financial institutions to obtain verify and record information that identifies each person who opens an account. The goal is to prevent money laundering by criminals.

Source: pinterest.com

Source: pinterest.com

Law requiring financial institutions in the United States to assist US. Law requiring financial institutions in the United States to assist US. Institutions subject to detailed reporting file the Report of Transaction Accounts Other Deposits and Vault Cash FR 2900. To help the government fight the funding of terrorism and money laundering activities Federal law requires all financial institutions to obtain verify and record information that identifies each person who opens an account. Financial institutions defined as financial institutions under the BSA regulations must file CTRs with FinCEN on all transactions in physical currency in excess of 10000 or the foreign equivalent conducted by through or to the financial institution by or.

Source: frbsf.org

Source: frbsf.org

Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. The financial services firm identifies or has reasons to suspect violation of a federal criminal law and has substantial reason to believe that one of its employees agents. If you deposit more than 10000 cash in your bank account your bank has to report the deposit to the government. Banks are required to make these reports. Government agencies to detect and prevent money laundering.

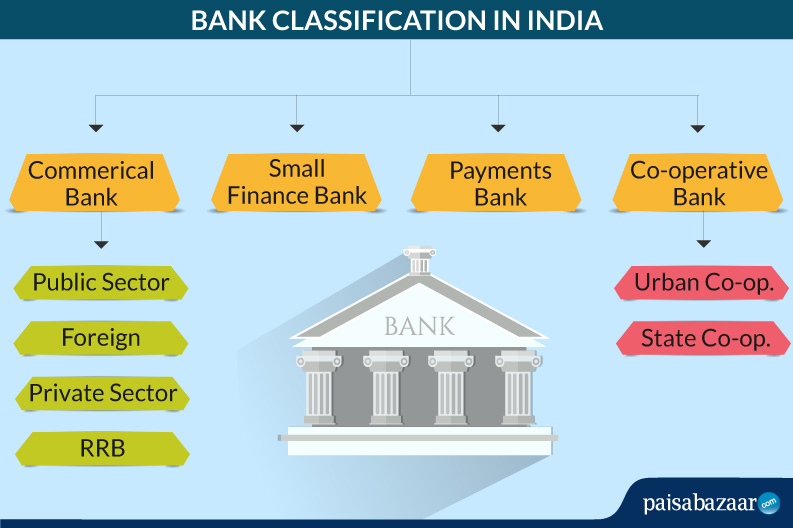

Source: paisabazaar.com

Source: paisabazaar.com

The financial services firm identifies or has reasons to suspect violation of a federal criminal law and has substantial reason to believe that one of its employees agents. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports of cash transactions exceeding 10000 daily aggregate amount and to report suspicious activity that might signify money laundering tax evasion or other criminal activities. The goal is to prevent money laundering by criminals. Financial institutions are required to file with FinCEN for each deposit withdrawal exchange of currency or other payment or transfer by through or to the financial institution which involves a transaction in currency of more than 10000. The purpose of the BSA is to require United States US financial institutions to maintain appropriate records and file certain reports involving currency transactions and a.

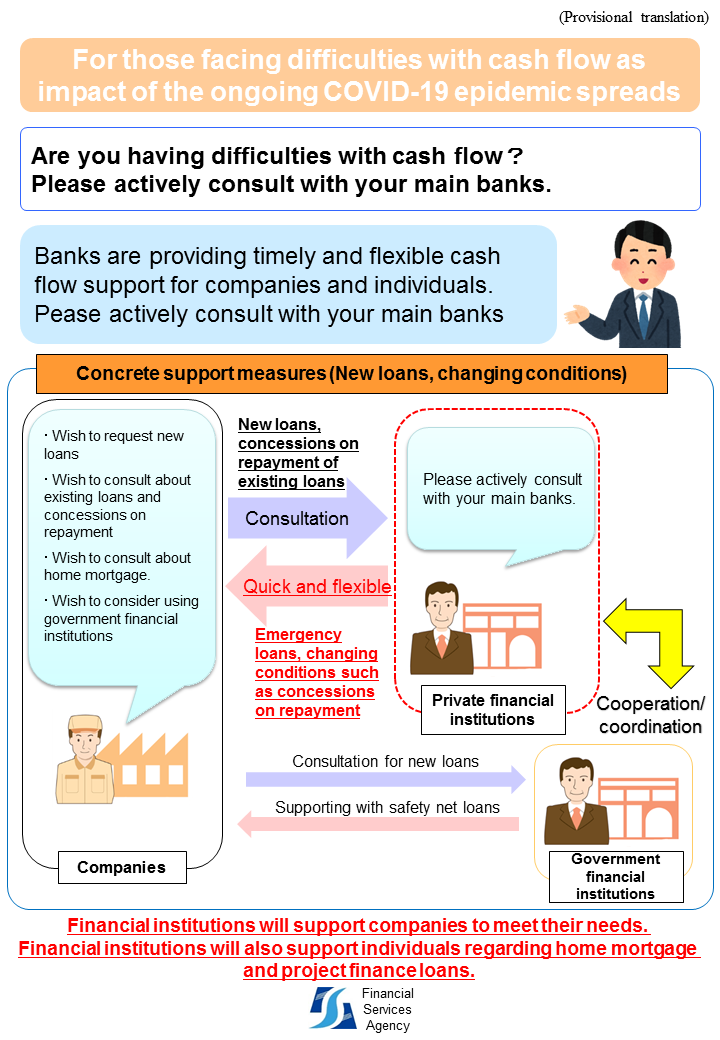

Source: fsa.go.jp

Source: fsa.go.jp

The first two reporting categories categories one and two characterized as detailed reporting apply to institutions that are not exempt from reserve requirements nonexempt institutions. Banks are required to make these reports. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. 5311 et seq is referred to as the Bank Secrecy Act BSA. In the event of any of the below activities scenario a financial institution is required to perform suspicious activity reporting.

Source: pinterest.com

Source: pinterest.com

Why is my financial institution asking me for identification and personal information. The goal is to prevent money laundering by criminals. The 10000 threshold was created as part of the Bank. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Government agencies in detecting and preventing money laundering.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which federal law requires financial institutions to file reports of cash by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.