11++ Which countries are high risk for money laundering info

Home » money laundering Info » 11++ Which countries are high risk for money laundering infoYour Which countries are high risk for money laundering images are ready. Which countries are high risk for money laundering are a topic that is being searched for and liked by netizens today. You can Get the Which countries are high risk for money laundering files here. Download all royalty-free photos.

If you’re looking for which countries are high risk for money laundering pictures information connected with to the which countries are high risk for money laundering interest, you have come to the ideal site. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

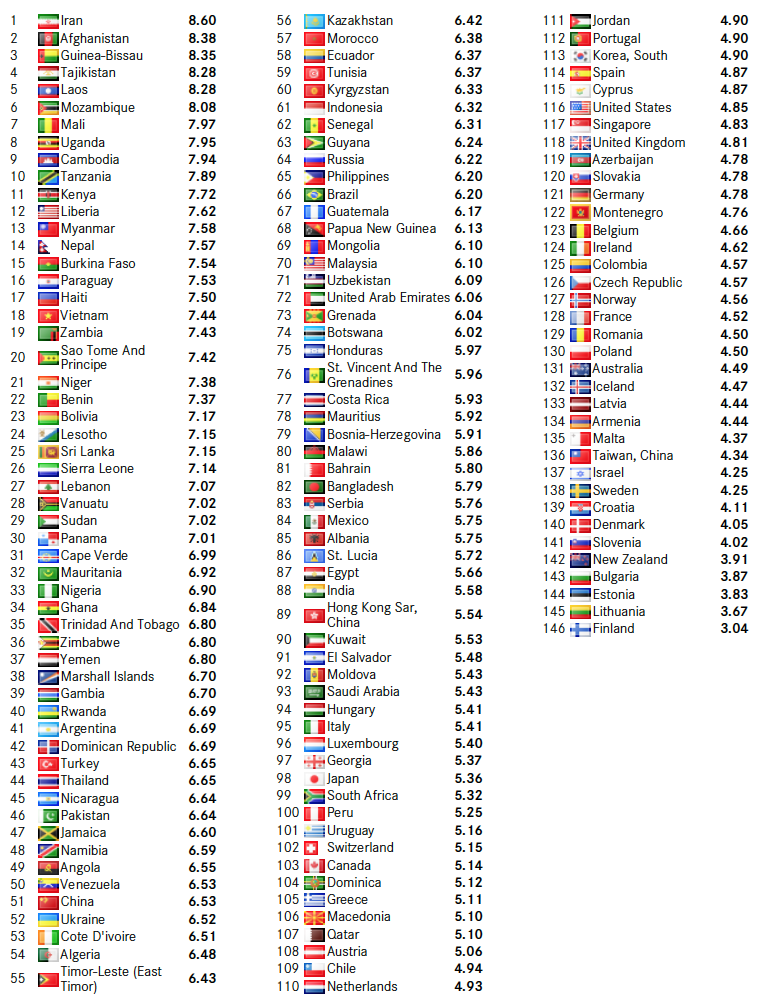

Which Countries Are High Risk For Money Laundering. We list Afghanistan India and Pakistan as major money laundering jurisdictions. Included on the list are Botswana Ghana Zimbabwe and Mauritius. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. New delegated act on high-risk third countries.

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft From ft.lk

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft From ft.lk

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. High-Risk Geographic Locations. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. The Financial Action Task Force FATF or other international governing bodies identify such locations. These jurisdictions fall under the category of high-risk countries thats show strategic deficiencies in their anti-money laundering and counter-terrorist financing framework.

The 24 high-risk third countries are.

On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. EU list of high-risk third countries. Included on the list are Botswana Ghana Zimbabwe and Mauritius. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. High Risk Third Countries Statement UK national risk assessment of money laundering and terrorist financing Money laundering and. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes.

Source: ec.europa.eu

Source: ec.europa.eu

Information on the extent of organized criminal activity corruption drug-related money laundering financial crimes smuggling black market activity and terrorist financing should be included. The region faces high risks of human trafficking including the highest risk in Afghanistan. On 7 May 2020 the European Commission adopted a new delegated regulation in relation to third countries which have strategic deficiencies in their AMLCFT regimes that pose significant threats to the financial system of the Union high-risk third countries. While the statement may not necessarily reflect the most recent status of Iran and the Democratic Peoples Republic of Koreas AMLCFT regimes the FATFs call for action on these highrisk. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD.

Source: bi.go.id

Source: bi.go.id

A risk-based approach means that countries competent authorities and banks identify assess and understand the money laundering and terrorist financing risk to which they are exposed and take the appropriate mitigation measures in accordance with the level of risk. As of October 2018 the FATF has reviewed over 80 countries and. High-Risk Geographic Locations. Although these countries committed to develop and improve their AMLCFT regimes and national compliance efforts they are currently considered high-risk countries for AMLCFT purposes. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk.

Source: bi.go.id

Source: bi.go.id

The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. On the basis of this list banks must apply higher due diligence controls to financial flows to the high risk third countries. Methodology for identifying high-risk third countries. This region has the second-highest overall risk score and scores significantly below average across all categories. High-Risk Geographic Locations.

Source: complyadvantage.com

Source: complyadvantage.com

This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. We list Afghanistan India and Pakistan as major money laundering jurisdictions. Also they called high-risk countries. As of October 2018 the FATF has reviewed over 80 countries and. Fourth Anti-Money Laundering Directive.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

EU list of high-risk third countries. Methodology for identifying high-risk third countries. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk.

Source: pinterest.com

Source: pinterest.com

Under 4MLD the European Commission must from time to time draw up. In February 2016 Vanuatu committed to criminalizing money laundering and terrorist financing by confiscating assets related to money laundering freezing terrorist assets improving financial sector transparency establishing a Financial Intelligence Unit establishing an AMLCFT oversight program for the financial sector and establishing channels for stronger international. Industries that have business locations centered in certain countries have an inherent risk of money laundering and terrorist financing. Also they called high-risk countries. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year.

Source: sanctionscanner.com

Source: sanctionscanner.com

The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. The region faces high risks of human trafficking including the highest risk in Afghanistan. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. New delegated act on high-risk third countries. Fourth Anti-Money Laundering Directive.

Source: baselgovernance.org

Source: baselgovernance.org

Fifth Anti-Money Laundering Directive. The high-risk third country list aims to address risks to the EUs financial system caused by third countries with deficiencies in their anti-money laundering and counter-terrorist financing regimes. High-Risk Geographic Locations. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. New delegated act on high-risk third countries.

Source: pinterest.com

Source: pinterest.com

The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. Identification of such countries is a legal requirement stemming from Article 9 of Directive EU 2015849 4th Anti-Money Laundering. The Financial Action Task Force FATF has released its list of high risk jurisdictions for money laundering and counter terrorist financing. This section provides a historical and economic picture of the country or jurisdiction particularly relating to the countrys vulnerabilities to money launderingterrorist financing MLTF. In February 2016 Vanuatu committed to criminalizing money laundering and terrorist financing by confiscating assets related to money laundering freezing terrorist assets improving financial sector transparency establishing a Financial Intelligence Unit establishing an AMLCFT oversight program for the financial sector and establishing channels for stronger international.

Source: ft.lk

Source: ft.lk

High-Risk Geographic Locations. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. Commission Delegated Regulation EU 2020855 which has been published in the Official Journal of the EU OJ amends the list of high-risk third countries with strategic AMLCTF deficiencies as provided for under Article 92 of the Fourth Money Laundering Directive 4MLD. While the statement may not necessarily reflect the most recent status of Iran and the Democratic Peoples Republic of Koreas AMLCFT regimes the FATFs call for action on these highrisk. Fourth Anti-Money Laundering Directive.

Source: acfcs.org

Source: acfcs.org

The list of high-risk countries is set out in schedule 3ZA of the Money Laundering Terrorist Financing and Transfer of Funds Information on the Payer Regulations 2017. Methodology for identifying high-risk third countries. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. Reporting entities are generally required to apply enhanced due diligence when dealing with funds from jurisdictions that are high risk. In February 2016 Vanuatu committed to criminalizing money laundering and terrorist financing by confiscating assets related to money laundering freezing terrorist assets improving financial sector transparency establishing a Financial Intelligence Unit establishing an AMLCFT oversight program for the financial sector and establishing channels for stronger international.

Source: in.pinterest.com

Source: in.pinterest.com

Included on the list are Botswana Ghana Zimbabwe and Mauritius. Included on the list are Botswana Ghana Zimbabwe and Mauritius. The region faces high risks of human trafficking including the highest risk in Afghanistan. As of October 2018 the FATF has reviewed over 80 countries and. This region has the second-highest overall risk score and scores significantly below average across all categories.

Source: ctmfile.com

Source: ctmfile.com

The 23 jurisdictions are. Fifth Anti-Money Laundering Directive. The list was amended in July 2021 by regulation 2 of the Money Laundering and Terrorist Financing Amendment No 2 High-Risk Countries Regulations 2021. Iran and North Korea the Democratic Peoples Republic of Korea or DPRK are the only two prescribed foreign countriesThey are prescribed in the Anti-Money Laundering and Counter-Terrorism Financing Prescribed Foreign Countries Regulations 2018. Under 4MLD the European Commission must from time to time draw up.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title which countries are high risk for money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.