10++ What should an effective anti money laundering training program include ideas

Home » money laundering Info » 10++ What should an effective anti money laundering training program include ideasYour What should an effective anti money laundering training program include images are available. What should an effective anti money laundering training program include are a topic that is being searched for and liked by netizens today. You can Find and Download the What should an effective anti money laundering training program include files here. Find and Download all free photos and vectors.

If you’re searching for what should an effective anti money laundering training program include pictures information connected with to the what should an effective anti money laundering training program include interest, you have pay a visit to the right blog. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

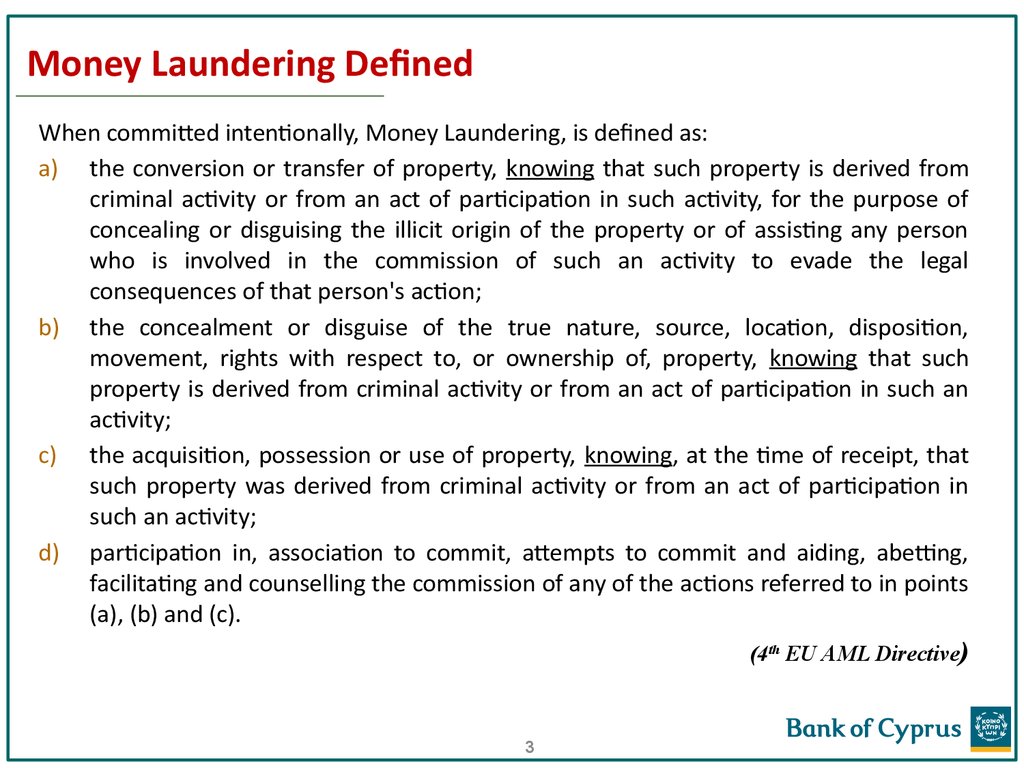

What Should An Effective Anti Money Laundering Training Program Include. Real-life money laundering examples. Join millions of learners from around the world already learning on Udemy. The Four Pillars of an Anti-Money Laundering Program. A copy of the training materials.

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Anti Money Laundering And Counter Terrorism Financing From bi.go.id

Random testing of employees to ensure proper understanding of policies C. Computer-based modules titles differently for each job description in the bank. Written Internal Policies Procedures and Controls. Having written policies and procedures. Staff training should be given at regular intervals and details recorded. Standardized forms to collect comprehensive client information.

What should an effective anti-money laundering training program include.

Start today with a special offer. Conducting independent testing of the institutions AML program. Real-life money laundering examples. AML training allows employees to understand the current laws their part in upholding them and the best actions to take if they identify a problem. Start today with a special offer. Your training should encourage employees to be responsible vigilant and to act fast whenever they suspect money-laundering.

Source: fr.pinterest.com

Source: fr.pinterest.com

Interactive Services is now part of LRN. Conducting independent testing of the institutions AML program. Having written policies and procedures. For example training for tellers should focus on examples involving large currency transactions or other suspicious activities. Join millions of learners from around the world already learning on Udemy.

Source: researchgate.net

Source: researchgate.net

Internal privacy and security guidelines. Join millions of learners from around the world already learning on Udemy. Its imperative that financial institutions including broker-dealers investment companies futures commission merchants FCMs and introducing brokers IBs have effective anti-money laundering AML programs to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. A successful training program not only should meet the standards set out in the laws and regulations that apply to an institution but should also satisfy internal policies and procedures and should mitigate the risk of getting caught up in a money laundering scandal. Start today with a special offer.

Source: tookitaki.ai

Source: tookitaki.ai

Join millions of learners from around the world already learning on Udemy. An effective training program should also include real-life ML case studies how the activity was detected and its impact on the FI. For example training for tellers should focus on examples involving large currency transactions or other suspicious activities. Anti-money laundering is all about being proactive and alert so that the instances of the crime are detected and eliminated swiftly. What should an effective anti-money laundering training program include.

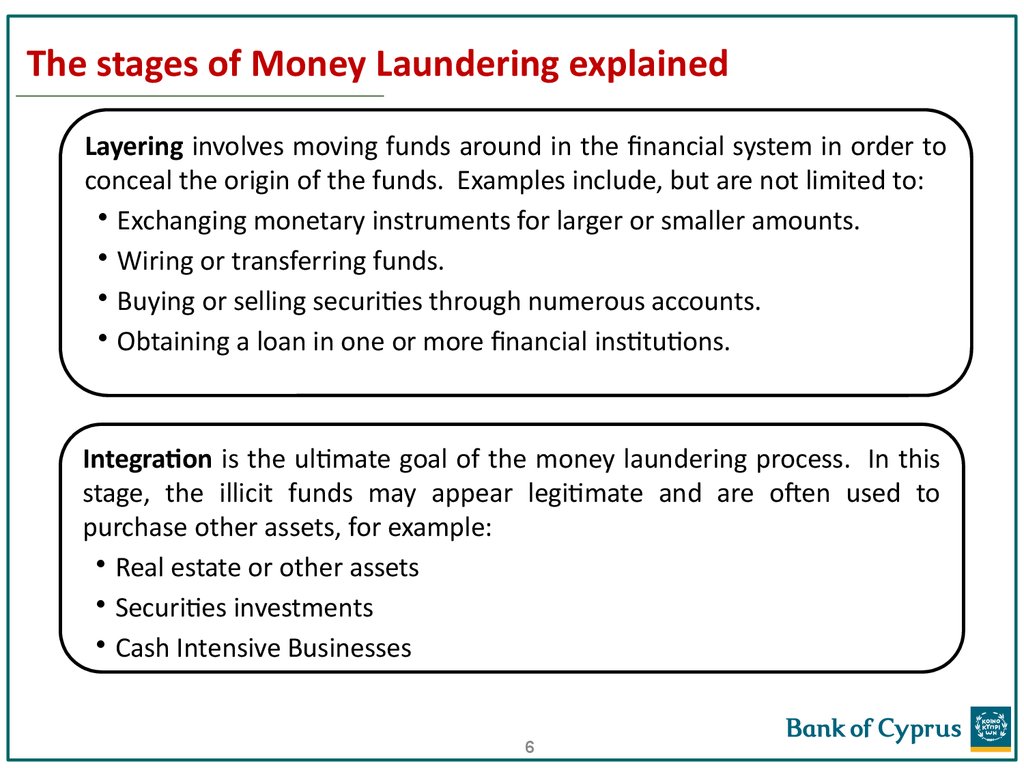

Source: ppt-online.org

Source: ppt-online.org

Having written policies and procedures. What use to be known as the four absolutes for an AML compliance program should be revised to reflect a new absolute. Your training should encourage employees to be responsible vigilant and to act fast whenever they suspect money-laundering. More specific and targeted case studies could be used to train the employees involved in areas with heightened ML risk such as account opening trade finance correspondent banking private banking etc. Designating an AML compliance officer.

Source: id.pinterest.com

Source: id.pinterest.com

The training should include examples of money laundering activity and suspicious activity monitoring and reporting. Computer-based modules titles differently for each job description in the bank. Designation of a Compliance Officer. Start today with a special offer. The purpose of the course is to help you identify money laundering activities if and when they occur at your financial institution.

Source: ppt-online.org

Source: ppt-online.org

Interactive Services is now part of LRN. The Companies have established the policies procedures and controls necessary to detect deter and prevent using the Companies and their Covered Products for money-laundering and terrorist financing activities. Computer-based modules titles differently for each job description in the bank. Random testing of employees to ensure proper understanding of policies C. Its imperative that financial institutions including broker-dealers investment companies futures commission merchants FCMs and introducing brokers IBs have effective anti-money laundering AML programs to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation.

Source: bi.go.id

Source: bi.go.id

Lists of anti-money laundering regulations. Ad Learn Anti-Money Laundering online at your own pace. The Companies have established the policies procedures and controls necessary to detect deter and prevent using the Companies and their Covered Products for money-laundering and terrorist financing activities. What use to be known as the four absolutes for an AML compliance program should be revised to reflect a new absolute. Random testing of employees to ensure proper understanding of policies C.

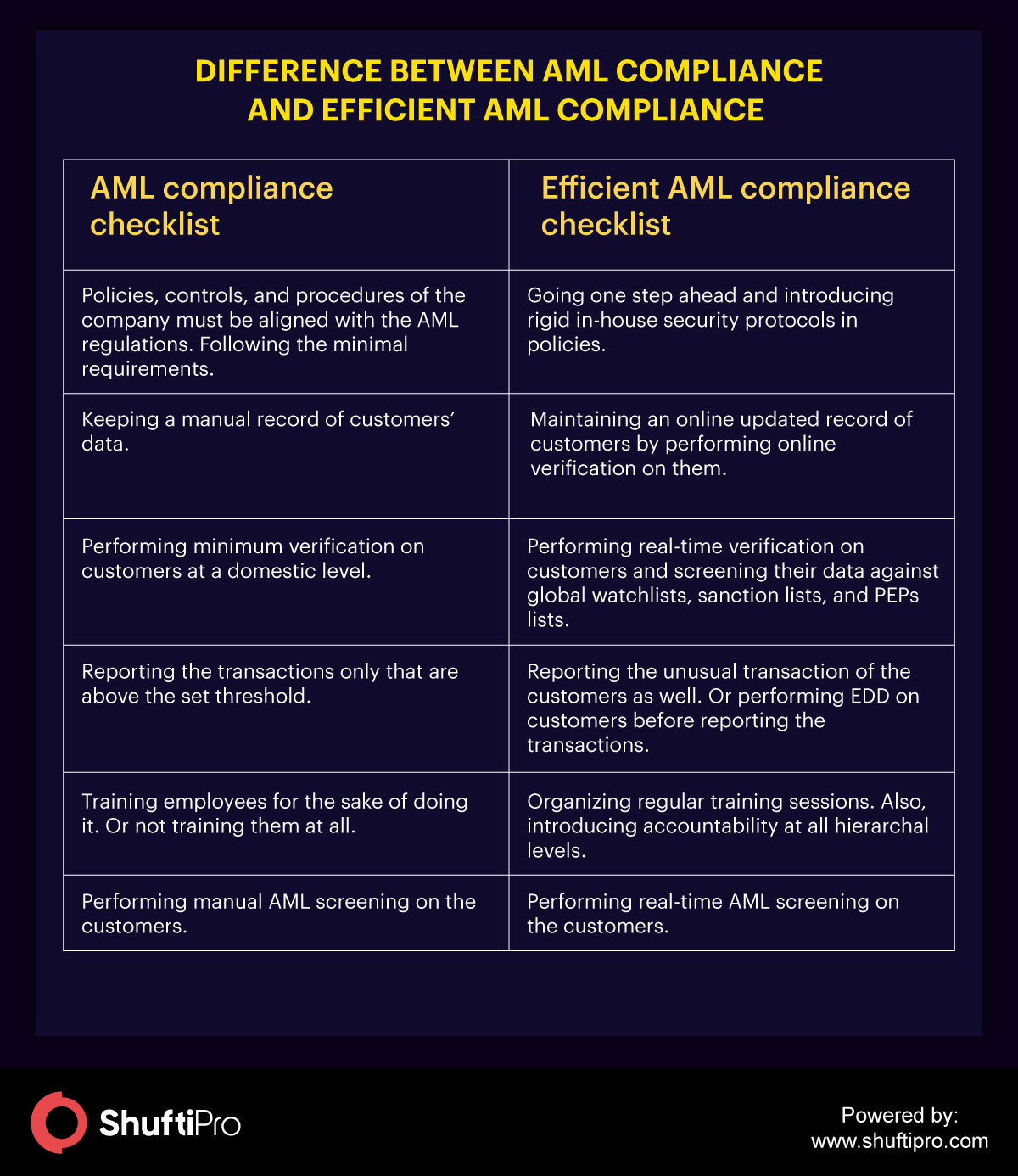

Source: shuftipro.com

Source: shuftipro.com

Computer-based modules titles differently for each job description in the bank. What use to be known as the four absolutes for an AML compliance program should be revised to reflect a new absolute. Written Internal Policies Procedures and Controls. Staff training should be given at regular intervals and details recorded. The Companies have established the policies procedures and controls necessary to detect deter and prevent using the Companies and their Covered Products for money-laundering and terrorist financing activities.

Source: trulioo.com

Source: trulioo.com

Levels of employees with corresponding access to information. Risk that each industry is exposed to. AML training allows employees to understand the current laws their part in upholding them and the best actions to take if they identify a problem. Lists of anti-money laundering regulations. Internal privacy and security guidelines.

Source: bi.go.id

Source: bi.go.id

More specific and targeted case studies could be used to train the employees involved in areas with heightened ML risk such as account opening trade finance correspondent banking private banking etc. Lists of anti-money laundering regulations. The training should include examples of money laundering activity and suspicious activity monitoring and reporting. A successful training program not only should meet the standards set out in the laws and regulations that apply to an institution but should also satisfy internal policies and procedures and should mitigate the risk of getting caught up in a money laundering scandal. Start today with a special offer.

Source: ppt-online.org

Source: ppt-online.org

Conducting independent testing of the institutions AML program. The Four Pillars of an Anti-Money Laundering Program. Having written policies and procedures. Join millions of learners from around the world already learning on Udemy. An effective training program should also include real-life ML case studies how the activity was detected and its impact on the FI.

Source: pinterest.com

Source: pinterest.com

Standardized forms to collect comprehensive client information. Start today with a special offer. An effective training program should also include real-life ML case studies how the activity was detected and its impact on the FI. Designation of a Compliance Officer. Staff training should be given at regular intervals and details recorded.

Source: ppt-online.org

Source: ppt-online.org

Written Internal Policies Procedures and Controls. Anti-money laundering laws and regulations in the jurisdiction. What should an effective anti-money laundering training program include. More specific and targeted case studies could be used to train the employees involved in areas with heightened ML risk such as account opening trade finance correspondent banking private banking etc. Join millions of learners from around the world already learning on Udemy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what should an effective anti money laundering training program include by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.