13++ What products are zero rated for vat information

Home » money laundering idea » 13++ What products are zero rated for vat informationYour What products are zero rated for vat images are ready. What products are zero rated for vat are a topic that is being searched for and liked by netizens today. You can Download the What products are zero rated for vat files here. Find and Download all royalty-free photos.

If you’re searching for what products are zero rated for vat images information related to the what products are zero rated for vat topic, you have come to the right blog. Our site frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that match your interests.

What Products Are Zero Rated For Vat. VAT-exempt and zero rated VAT. Certain food and drink. It means that you have to keep a record of them and report them on VAT return even if the rate is 0. January 12 2021.

Zero Rated Vat Items Fincor From fincor.co.za

Zero Rated Vat Items Fincor From fincor.co.za

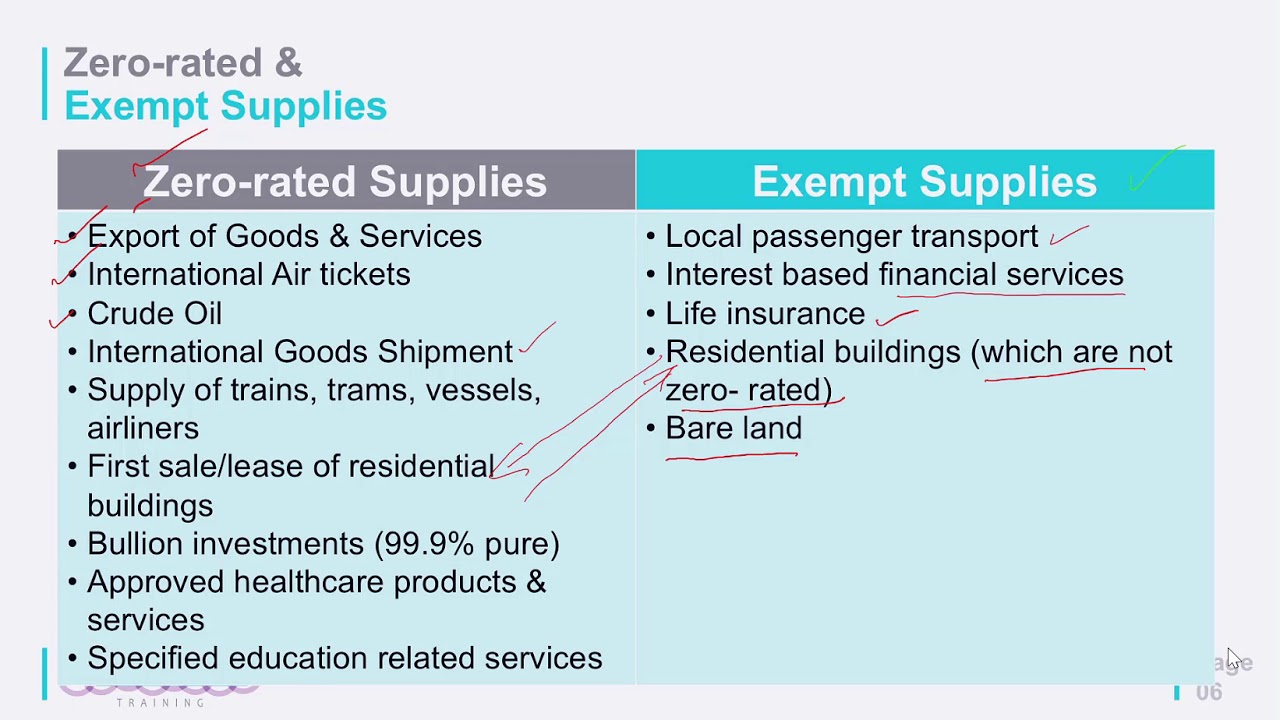

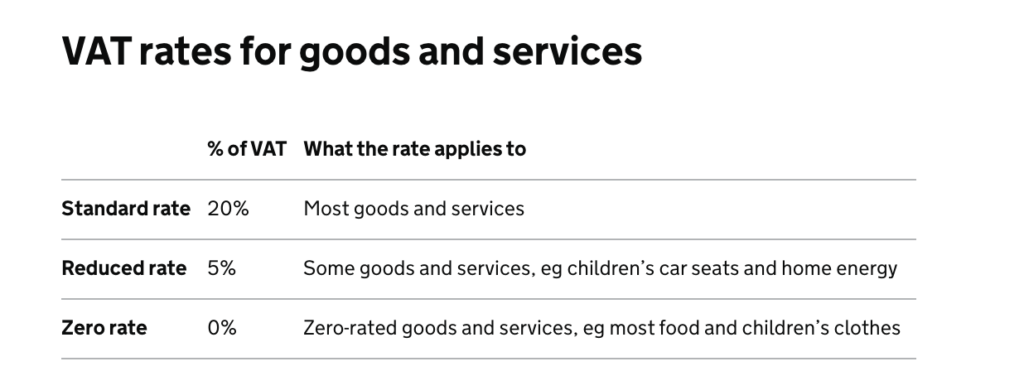

Oman published a Ministerial Decree 22021 dated 4 January 2021 specifying the list of food articles subject to zero-rated VAT in Oman. You should charge this rate unless the goods or services are classed as reduced or zero-rated. When charging Value Added Tax or VAT in UAE rates that are charged greatly depend on what the products or services are. Most goods and services are standard rate. Examples to help determine whether a product is zero or standard-rated. It consists of 93 food items with their HS codes.

It means that you have to keep a record of them and report them on VAT return even if the rate is 0.

But Tibetan goat is standard-rated for VAT. The majority of items in the country are subject to five percent VAT which is currently the standard rate. You should charge this rate unless the goods or services are classed as reduced or zero-rated. It means that you have to keep a record of them and report them on VAT return even if the rate is 0. Reduced and zero-rated goods or services although charged a low amount or no amount of VAT at all are still considered taxable and thus must count towards your taxable income. You likely are already aware that zero-rated is very different from VAT-exempt.

Source: debitoor.com

Source: debitoor.com

January 12 2021. But Tibetan goat is standard-rated for VAT. Products with a zero rating may include certain food items medical equipment trading pure gold silver and platinum trading authentic gems and pearls trading preschool education services and products etc. Goods and services exempted from VAT are. Most goods and services are standard rate.

Source: youtube.com

Source: youtube.com

But Tibetan goat is standard-rated for VAT. VAT-exempt and zero rated VAT. Businesses dealing with Zero-Rated goods and services can reclaim their input VAT as they are VAT registered companies in the UAE. What is Zero-Rated VAT. Oman published a Ministerial Decree 22021 dated 4 January 2021 specifying the list of food articles subject to zero-rated VAT in Oman.

This includes any goods below the distance selling. Basic foodstuffs zero-rated in South Africa Brown bread. January 12 2021. To learn more about the difference between reduced and exempt items read our guide to VAT exemption and who it. Zero-Rated VAT includes goods and services that are VAT taxable but at the rate of 0.

Source: yumpu.com

Source: yumpu.com

You likely are already aware that zero-rated is very different from VAT-exempt. Under Section 106 A 2 of the National Internal Revenue Code as amended the following are zero-rated sales of goods or properties in the Philippines. Zero-rated goods are products for which value added tax VAT is not imposed. Resellers who sell zero-rate merchandise can recover VAT on costs incurred in any purchases that are directly related to sales of zero-rated products. Zero rated goods may include certain food items goods sold by charities equipment such as wheelchairs for the disabled medicine water books childrens clothing etc.

Source: retailerpsolutions.wordpress.com

Source: retailerpsolutions.wordpress.com

To learn more about the difference between reduced and exempt items read our guide to VAT exemption and who it. Resellers who sell zero-rate merchandise can recover VAT on costs incurred in any purchases that are directly related to sales of zero-rated products. VAT-exempt productsservices include for example. Biscuits covered or partly covered in chocolate or some other products similar in taste and appearance to chocolate are standard rated. Products with a zero rating may include certain food items medical equipment trading pure gold silver and platinum trading authentic gems and pearls trading preschool education services and products etc.

Source: youtube.com

Source: youtube.com

It means that you have to keep a record of them and report them on VAT return even if the rate is 0. What is Zero-Rated VAT. But Tibetan goat is standard-rated for VAT. Zero rated goods may include certain food items goods sold by charities equipment such as wheelchairs for the disabled medicine water books childrens clothing etc. Under Section 106 A 2 of the National Internal Revenue Code as amended the following are zero-rated sales of goods or properties in the Philippines.

Source: tide.co

Source: tide.co

But Tibetan goat is standard-rated for VAT. Basic foodstuffs zero-rated in South Africa Brown bread. Intra-Community supplies of goods to VAT-registered persons in other European Union EU Member States. Some childrens clothing made with fur skin is zero-rated including rabbit gazelles and dog skin. It consists of 93 food items with their HS codes.

Certain food and drink. Products with a zero rating may include certain food items medical equipment trading pure gold silver and platinum trading authentic gems and pearls trading preschool education services and products etc. When charging Value Added Tax or VAT in UAE rates that are charged greatly depend on what the products or services are. Here tax is charged at zero-rate either based on the nature of supply regardless of the goods or services supplied or the specified goods or services which are listed under zero-rated list. You should charge this rate unless the goods or services are classed as reduced or zero-rated.

Source: bdo.co.za

Source: bdo.co.za

January 12 2021. Some childrens clothing made with fur skin is zero-rated including rabbit gazelles and dog skin. Certain books and booklets. When charging Value Added Tax or VAT in UAE rates that are charged greatly depend on what the products or services are. VAT-exempt productsservices include for example.

Source: fincor.co.za

Source: fincor.co.za

This includes any goods below the distance selling. The zero rate of Value-Added Tax VAT applies to certain goods and services including. VAT-exempt productsservices in the UK. But Tibetan goat is standard-rated for VAT. VAT-exempt and zero rated VAT.

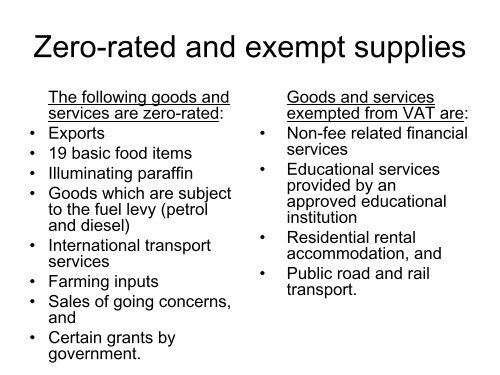

The ministerial decision 652021 determines the food products that are subject to VAT at the rate of 0. What is Zero-Rated VAT. Non-fee related financial services Educational services provided by an approved educational institution Residential rental accommodation and Public road and rail transport. Certain books and booklets. Resellers who sell zero-rate merchandise can recover VAT on costs incurred in any purchases that are directly related to sales of zero-rated products.

Source: reliabooks.ph

Source: reliabooks.ph

Examples to help determine whether a product is zero or standard-rated. However there are two other categories. The primary difference of concern is that for VAT-exempt items no VAT should be included in invoicing. VAT-exempt and zero rated VAT. When charging Value Added Tax or VAT in UAE rates that are charged greatly depend on what the products or services are.

Source: slideplayer.com

Source: slideplayer.com

Resellers who sell zero-rate merchandise can recover VAT on costs incurred in any purchases that are directly related to sales of zero-rated products. Supply of food products subjected to zero-rated VAT in Oman Poultry Meat and Fish. This includes any goods below the distance selling. Oman published a Ministerial Decree 22021 dated 4 January 2021 specifying the list of food articles subject to zero-rated VAT in Oman. However there are two other categories.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what products are zero rated for vat by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.