16+ What items are zero rated for vat ideas in 2021

Home » money laundering Info » 16+ What items are zero rated for vat ideas in 2021Your What items are zero rated for vat images are available. What items are zero rated for vat are a topic that is being searched for and liked by netizens today. You can Download the What items are zero rated for vat files here. Download all royalty-free images.

If you’re searching for what items are zero rated for vat pictures information related to the what items are zero rated for vat topic, you have pay a visit to the ideal site. Our website frequently gives you hints for viewing the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

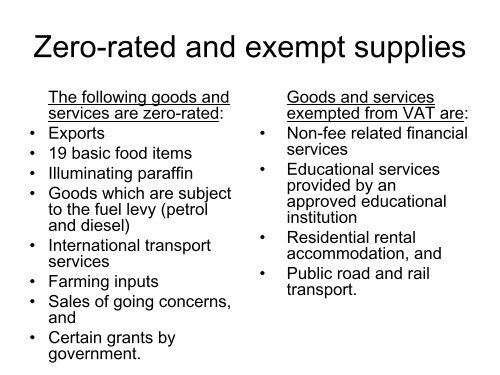

What Items Are Zero Rated For Vat. You still have to record them in your VAT accounts and report them on. Petrol or distillate fuel oil subject to fuel levy. Basic foodstuffs zero-rated in South Africa Brown bread. However the rate for VAT is charged at zero percent.

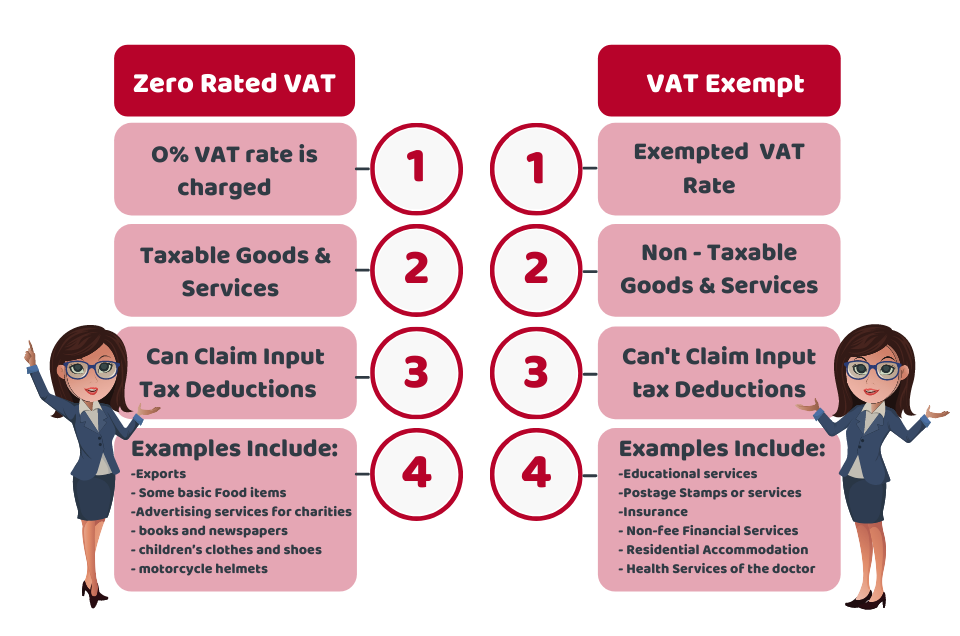

Businesses dealing with Zero-Rated goods and services can reclaim their input VAT as they are VAT registered companies in the UAE. For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. Non-fee related financial services Educational services provided by an approved educational institution Residential rental accommodation and Public road and rail transport. Subject to the limitations mentioned in the Executive Regulations the following supplies will be zero-rated. Registered VAT entities making zero-rated supplies are entitled to claim their input tax deductions on goods or services acquired in the course of making such taxable supplies. Seeds and other means of propagation of plants and plants that are used forproviding a a food referred to in item 11a b or c.

Preparations for agricultural use including peat moss fertilizers.

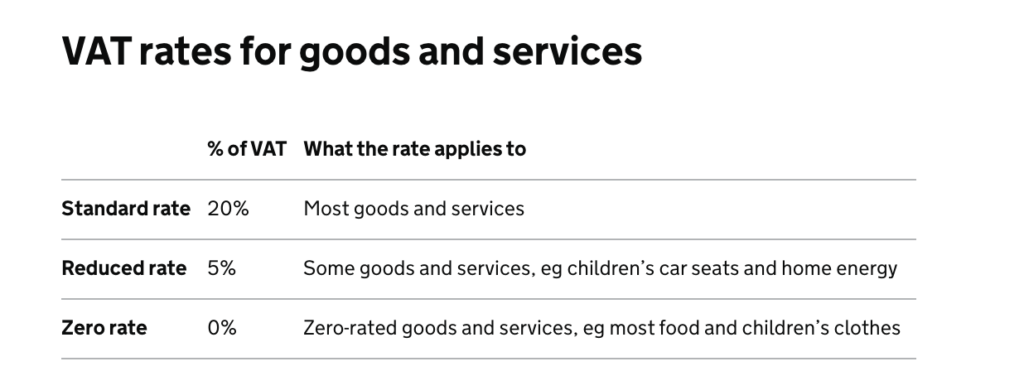

VAT on Food in the UK. VAT-exempt productsservices include for example. Zero-rated goods are products for which value added tax VAT is not imposed. The zero rate of Value-Added Tax VAT applies to certain goods and services including. Goods and services exempted from VAT are. A zero-rated supply is a taxable supply on which VAT is levied at the rate of 0.

Non-fee related financial services Educational services provided by an approved educational institution Residential rental accommodation and Public road and rail transport. What is Zero-Rated VAT. Goods and services that are categorized as zero-rated for VAT purposes are still goods that are taxable. Preparations for agricultural use including peat moss fertilizers. Significant changes were recently made to the rules for the zero-rating of export sales.

Source: debitoor.com

Source: debitoor.com

It means that you have to keep a record of them and report them on VAT return even if the rate is 0. Goods and services that are categorized as zero-rated for VAT purposes are still goods that are taxable. Registered VAT entities making zero-rated supplies are entitled to claim their input tax deductions on goods or services acquired in the course of making such taxable supplies. Businesses dealing with Zero-Rated goods and services can reclaim their input VAT as they are VAT registered companies in the UAE. Zero-rated goods are products for which value added tax VAT is not imposed.

Source: yumpu.com

Source: yumpu.com

Goods and services exempted from VAT are. The primary difference of concern is that for VAT-exempt items no VAT should be included in invoicing. Here tax is charged at zero-rate either based on the nature of supply regardless of the goods or services supplied or the specified goods or services which are listed under zero-rated list. Petrol or distillate fuel oil subject to fuel levy. However the rate for VAT is charged at zero percent.

Source: tide.co

Source: tide.co

Under zero-rated 0 VAT sales rule the seller does not impose the 12 value added tax in the Philippines to the buyer who is within the Philippines or abroad. You likely are already aware that zero-rated is very different from VAT-exempt. Certain food and drink. Here tax is charged at zero-rate either based on the nature of supply regardless of the goods or services supplied or the specified goods or services which are listed under zero-rated list. Standard Zero-Rated VAT Items Zero-rated VAT on food items Raw meats and fish.

Source: jacarandafm.com

Source: jacarandafm.com

On the part of the VAT-registered seller it could make use of the 12 value added tax passed on to them by their suppliers of goods or services and on importation as follows. Registered VAT entities making zero-rated supplies are entitled to claim their input tax deductions on goods or services acquired in the course of making such taxable supplies. Goods and services that are categorized as zero-rated for VAT purposes are still goods that are taxable. You still have to record them in your VAT accounts and report them on. Seeds and other means of propagation of plants and plants that are used forproviding a a food referred to in item 11a b or c.

Source: accotax.co.uk

Source: accotax.co.uk

The primary difference of concern is that for VAT-exempt items no VAT should be included in invoicing. Supply of medicines and medical equipment in accordance with the rules specified in a decision by the Head and after coordination with the competent authorities. The zero rate of Value-Added Tax VAT applies to certain goods and services including. For a zero-rated good the government doesnt tax its retail sale but allows credits for the value-added tax VAT paid on inputs. It means that you have to keep a record of them and report them on VAT return even if the rate is 0.

Under zero-rated 0 VAT sales rule the seller does not impose the 12 value added tax in the Philippines to the buyer who is within the Philippines or abroad. Seeds and other means of propagation of plants and plants that are used forproviding a a food referred to in item 11a b or c. Goods and services exempted from VAT are. Under zero-rated 0 VAT sales rule the seller does not impose the 12 value added tax in the Philippines to the buyer who is within the Philippines or abroad. What is Zero-Rated VAT.

Source: fincor.co.za

Source: fincor.co.za

Basic foodstuffs zero-rated in South Africa Brown bread. Seeds and other means of propagation of plants and plants that are used forproviding a a food referred to in item 11a b or c. Goods and services that are categorized as zero-rated for VAT purposes are still goods that are taxable. Goods and services exempted from VAT are. A zero-rated supply is a taxable supply on which VAT is levied at the rate of 0.

Source: bdo.co.za

Source: bdo.co.za

The supply of illuminating kerosene paraffin. Governments commonly lower the tax burden on low-income households by zero rating essential goods such. Export of products and services that are outside any GCC implementing state. Goods and services that are categorized as zero-rated for VAT purposes are still goods that are taxable. On the part of the VAT-registered seller it could make use of the 12 value added tax passed on to them by their suppliers of goods or services and on importation as follows.

Source: slideshare.net

Source: slideshare.net

VAT-exempt productsservices include for example. Supply of food items specified by a decision of the Head. On the part of the VAT-registered seller it could make use of the 12 value added tax passed on to them by their suppliers of goods or services and on importation as follows. Non-fee related financial services Educational services provided by an approved educational institution Residential rental accommodation and Public road and rail transport. VAT on Food in the UK.

Source: bdo.co.za

Source: bdo.co.za

Standard Zero-Rated VAT Items Zero-rated VAT on food items Raw meats and fish. Preparations for agricultural use including peat moss fertilizers. Seeds and other means of propagation of plants and plants that are used forproviding a a food referred to in item 11a b or c. You still have to record them in your VAT accounts and report them on. Significant changes were recently made to the rules for the zero-rating of export sales.

Registered VAT entities making zero-rated supplies are entitled to claim their input tax deductions on goods or services acquired in the course of making such taxable supplies. Intra-Community supplies of goods to VAT-registered persons in other European Union EU Member States. Zero rate Zero-rated means that the goods are still VAT -taxable but the rate of VAT you must charge your customers is 0. Businesses dealing with Zero-Rated goods and services can reclaim their input VAT as they are VAT registered companies in the UAE. Governments commonly lower the tax burden on low-income households by zero rating essential goods such.

Source: reliabooks.ph

Source: reliabooks.ph

Non-fee related financial services Educational services provided by an approved educational institution Residential rental accommodation and Public road and rail transport. Supply of medicines and medical equipment in accordance with the rules specified in a decision by the Head and after coordination with the competent authorities. Non-compliance could result in the seller of the movable goods being liable for output tax at the standard rate. VAT zero-rating rules for exports recently changed Tax Alerts An overview of the most significant changes. Under zero-rated 0 VAT sales rule the seller does not impose the 12 value added tax in the Philippines to the buyer who is within the Philippines or abroad.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what items are zero rated for vat by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.