13++ What is the maximum penalty for failing to report a case of money laundering ideas in 2021

Home » money laundering Info » 13++ What is the maximum penalty for failing to report a case of money laundering ideas in 2021Your What is the maximum penalty for failing to report a case of money laundering images are ready in this website. What is the maximum penalty for failing to report a case of money laundering are a topic that is being searched for and liked by netizens now. You can Download the What is the maximum penalty for failing to report a case of money laundering files here. Find and Download all royalty-free images.

If you’re looking for what is the maximum penalty for failing to report a case of money laundering images information related to the what is the maximum penalty for failing to report a case of money laundering keyword, you have visit the ideal site. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

What Is The Maximum Penalty For Failing To Report A Case Of Money Laundering. Civil Penalties and Suspension. The proceedings are said to have arisen from a visit by. T he City watchdog has slapped Bank of Scotland with a 455m fine for failing to report suspicions. Section 329 Proceeds of Crime Act 2002.

Https Www Gibsondunn Com Wp Content Uploads 2021 05 Cohen Noonan Chapter 32 Usa Anti Money Laundering 2021 Iclg 05 25 2021 Pdf From

Maximum penalty for failing to report a suspicion of money laundering. Eg money launderer drug trafficker or tax evader that the statute was aimed at as well as the fact that the maximum fine for his conduct under the Federal Sentencing Guidelines was 5000. Causes or attempts to cause a financial institution to file reports or make records that contain material omissions or misstatements of fact. Proceeds Of Crime Act 2002 Under the statutes of the Proceeds of Crime Act 2002 money laundering itself is only one of a number of criminal offences in this field. Failing to report suspicion of money laundering In the original version of the Act tax advisers and accountants were not regarded as carrying on business in the regulated sector. The fine comprises disgorgement of 523 million which is the amount of revenue that Barclays generated from the Transaction and a penalty of 19769400.

The largest was the 102m penalty issued to Standard Chartered Bank for money laundering.

Its a crime. Both of the charges under POCA relate to a failure to disclose information to the Jersey Financial Crimes Unit based on information received. The proceedings are said to have arisen from a visit by. The offences carry with them penalties of up to. Section 328 Proceeds of Crime Act 2002. Failing to report suspicion of money laundering In the original version of the Act tax advisers and accountants were not regarded as carrying on business in the regulated sector.

Source: researchgate.net

Source: researchgate.net

This is the second largest financial penalty for AML controls failings ever imposed by the FCA. Eg money launderer drug trafficker or tax evader that the statute was aimed at as well as the fact that the maximum fine for his conduct under the Federal Sentencing Guidelines was 5000. Where upon the trial of a person for larceny it appears–a that the person had fraudulently appropriated to his or her own use or that of another the property in respect of which the person is indicted although the person had not originally taken the property with. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie. Section 328 Proceeds of Crime Act 2002.

Source:

Conducts or attempts to conduct one or more. Its a crime. Under the applicable statutethat penalty is equal to the greater of 100000 or fifty percent of the balance in the account at the time of violation. The offences carry with them penalties of up to. Non-willful failure to file an FBAR carry a statutory civil penalty of 10000.

Source: researchgate.net

Source: researchgate.net

Non-willful failure to file an FBAR carry a statutory civil penalty of 10000. 4Structuring occurs when a person for the purpose of evading reporting or recordkeeping requirements under the Bank Secrecy Act causes or attempts to cause a financial institution to fail to file reports or make records. Entering into arrangements concerning criminal property. The proceedings are said to have arisen from a visit by. Acquisition use and possession of criminal property Maximum.

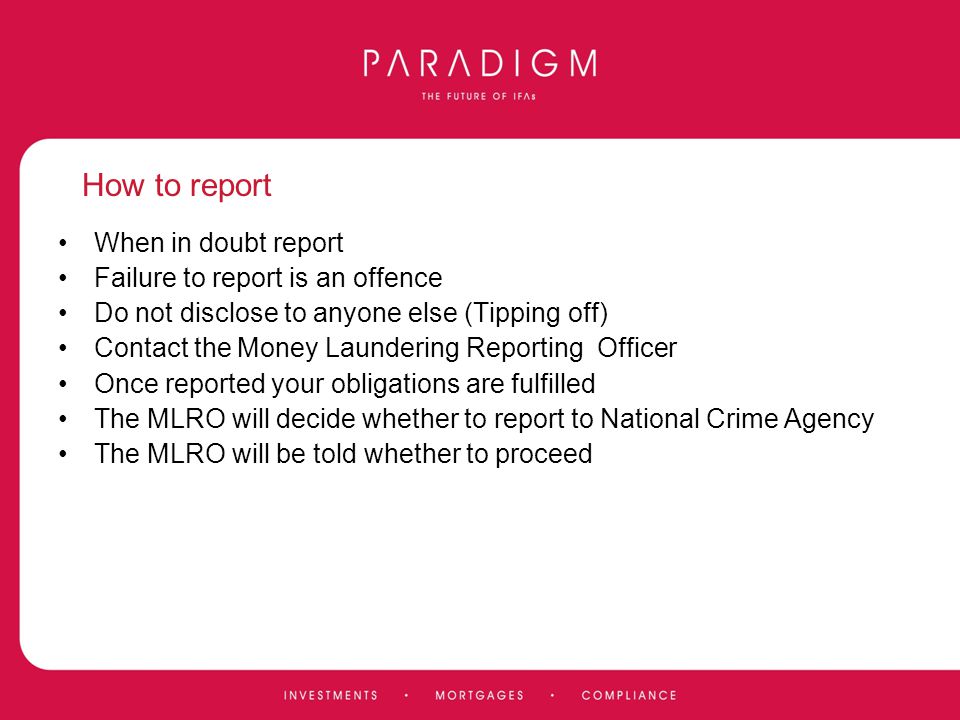

Source: slideplayer.com

Source: slideplayer.com

The proceedings are said to have arisen from a visit by. This is the second largest financial penalty for AML controls failings ever imposed by the FCA. The largest was the 102m penalty issued to Standard Chartered Bank for money laundering. Non-Willful Failure to File an FBAR. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie.

Source:

S124 of the Crimes Act 1900 defines the crime of fraudulent appropriation my emphasis. The proceedings are said to have arisen from a visit by. Entering into arrangements concerning criminal property. An acquittal for all parties. Concealing disguising converting transferring removing criminal property from England Wales.

Source:

However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering. This is the second largest financial penalty for AML controls failings ever imposed by the FCA. This is the least-severe form of violation. Its a crime. Where upon the trial of a person for larceny it appears–a that the person had fraudulently appropriated to his or her own use or that of another the property in respect of which the person is indicted although the person had not originally taken the property with.

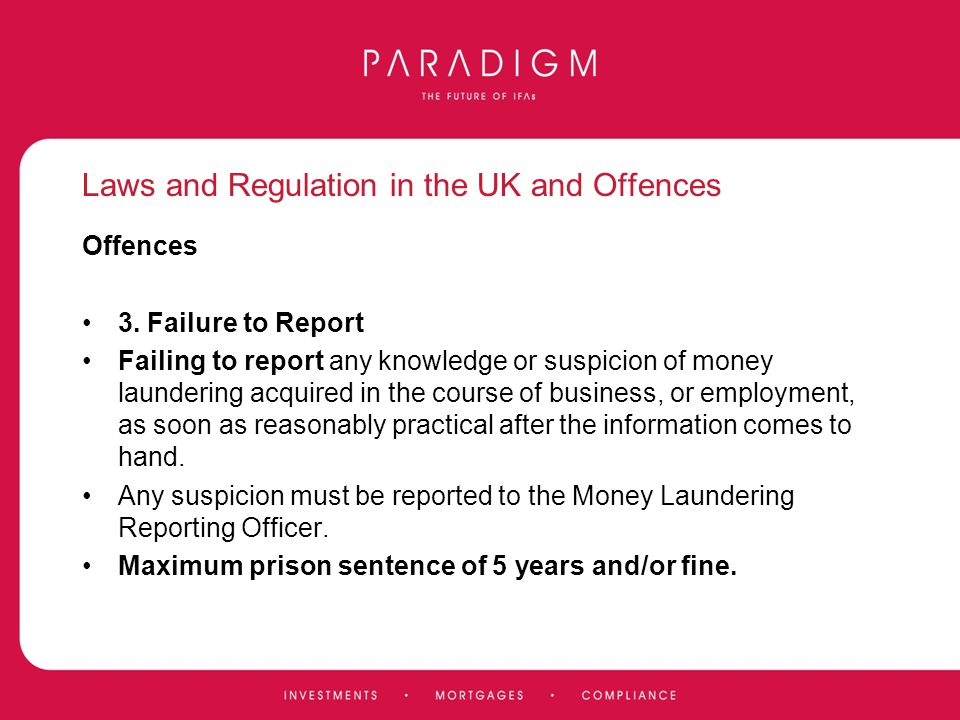

Source: slideplayer.com

Source: slideplayer.com

It can also suspend your payments for six 12 or 24 months. The offences carry with them penalties of up to. The proceedings are said to have arisen from a visit by. However failure to file Form 8300 is a felony offense with a special penalty. Non-willful failure to file an FBAR carry a statutory civil penalty of 10000.

Source:

It can also reclaim the amount you were overpaid by deducting up to the entire amount of your SSI monthly benefits until the debt is paid. The offences carry with them penalties of up to. Section 328 Proceeds of Crime Act 2002. The penalty for negligently failing to file an FBAR is adjusted annually for inflation and currently slightly over 1000 per violation. For this offense the maximum is five-year sentence in federal prison.

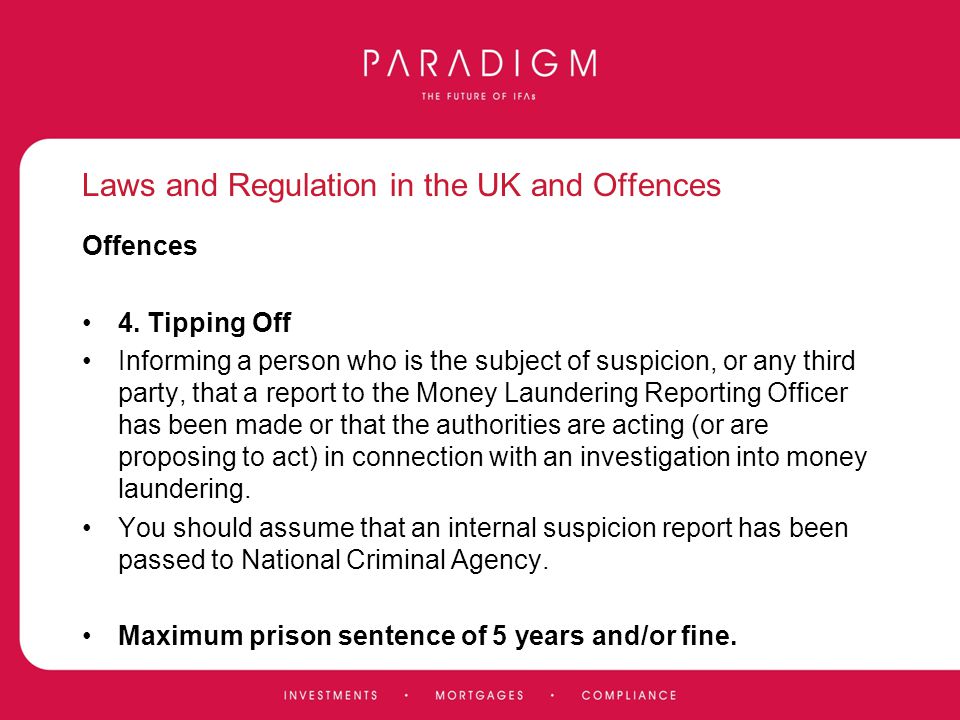

Source: slideplayer.com

Source: slideplayer.com

This is the largest fine that has been imposed by the FCA and its predecessor the FSA for financial crime failings. It can also suspend your payments for six 12 or 24 months. T he City watchdog has slapped Bank of Scotland with a 455m fine for failing to report suspicions. Entering into arrangements concerning criminal property. The changes to the Guidance focus on when prosecutions can be brought in relation to the second circumstance ie.

Source: elibrary.imf.org

Source: elibrary.imf.org

Money laundering regulations penalty for failure to report. S124 of the Crimes Act 1900 defines the crime of fraudulent appropriation my emphasis. Section 328 Proceeds of Crime Act 2002. Money laundering regulations penalty for failure to report. Where upon the trial of a person for larceny it appears–a that the person had fraudulently appropriated to his or her own use or that of another the property in respect of which the person is indicted although the person had not originally taken the property with.

Source: slideplayer.com

Source: slideplayer.com

S124 of the Crimes Act 1900 defines the crime of fraudulent appropriation my emphasis. Failing to report suspicion of money laundering In the original version of the Act tax advisers and accountants were not regarded as carrying on business in the regulated sector. 4Structuring occurs when a person for the purpose of evading reporting or recordkeeping requirements under the Bank Secrecy Act causes or attempts to cause a financial institution to fail to file reports or make records. Eg money launderer drug trafficker or tax evader that the statute was aimed at as well as the fact that the maximum fine for his conduct under the Federal Sentencing Guidelines was 5000. However the offence is not committed unless the nominated officer has actual knowledge or suspicion of money laundering.

Source: slideplayer.com

Source: slideplayer.com

Section 328 Proceeds of Crime Act 2002. For this offense the maximum is five-year sentence in federal prison. The offences carry with them penalties of up to. Section 329 Proceeds of Crime Act 2002. Non-willful failure to file an FBAR carry a statutory civil penalty of 10000.

Source:

An acquittal for all parties. Its a crime. While the Court held the forfeiture to be excessive the Court also discussed the deference that should be given to. This is the largest fine that has been imposed by the FCA and its predecessor the FSA for financial crime failings. Failing to report suspicion of money laundering In the original version of the Act tax advisers and accountants were not regarded as carrying on business in the regulated sector.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the maximum penalty for failing to report a case of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.