19+ What is the first step to preventing money laundering ideas

Home » money laundering idea » 19+ What is the first step to preventing money laundering ideasYour What is the first step to preventing money laundering images are ready. What is the first step to preventing money laundering are a topic that is being searched for and liked by netizens today. You can Get the What is the first step to preventing money laundering files here. Download all royalty-free vectors.

If you’re looking for what is the first step to preventing money laundering pictures information connected with to the what is the first step to preventing money laundering topic, you have pay a visit to the right site. Our site frequently provides you with hints for viewing the highest quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

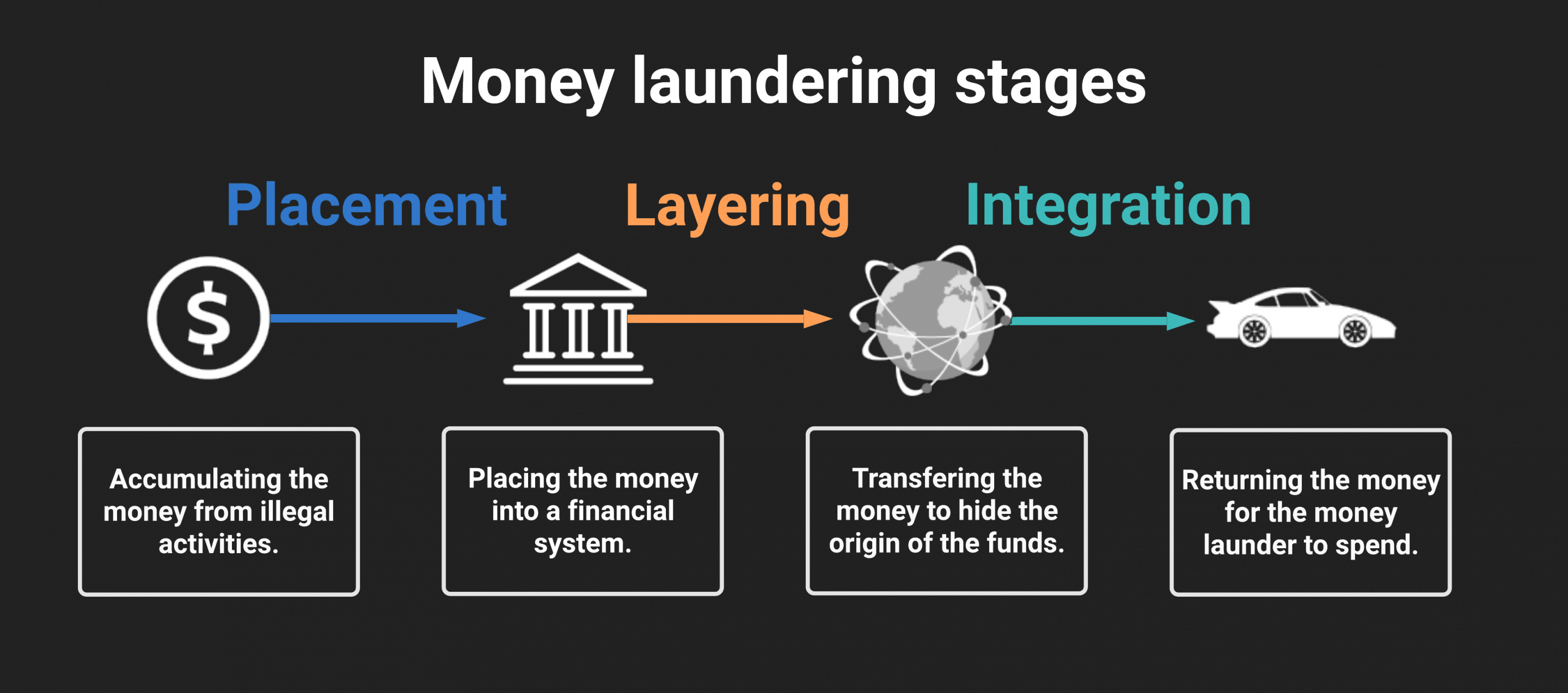

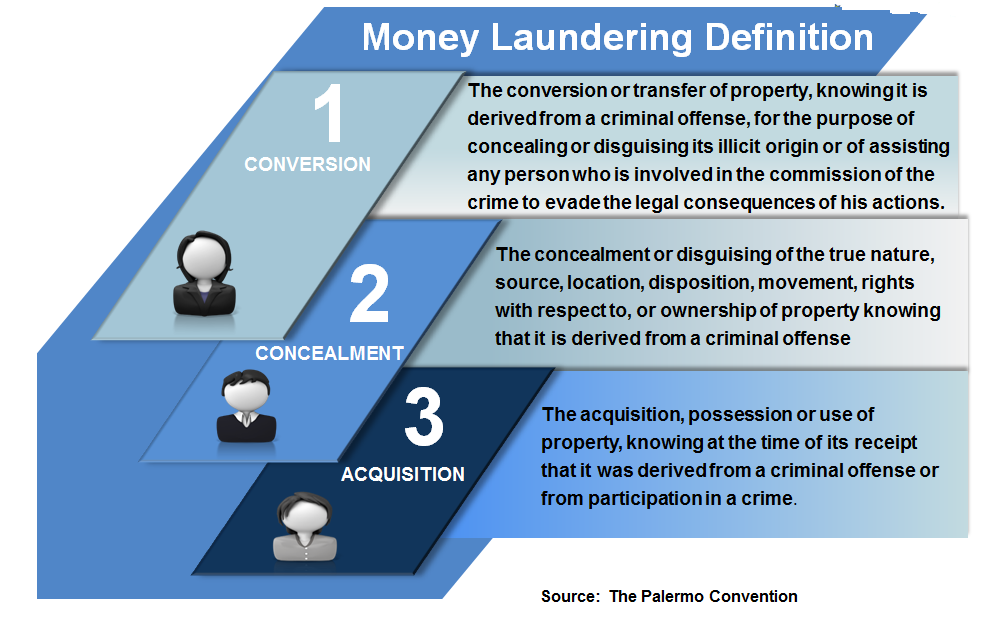

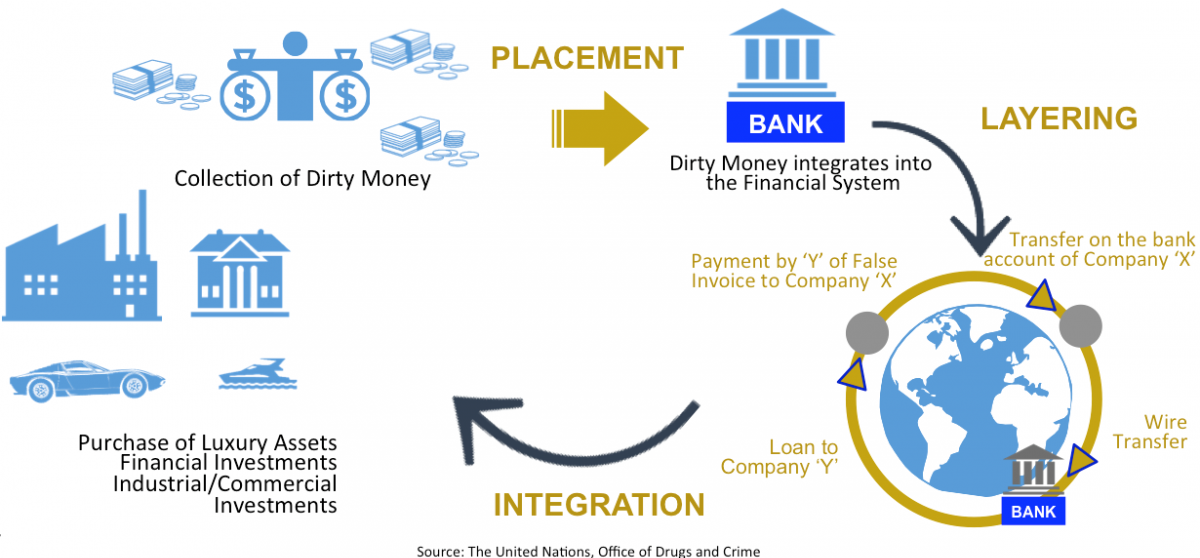

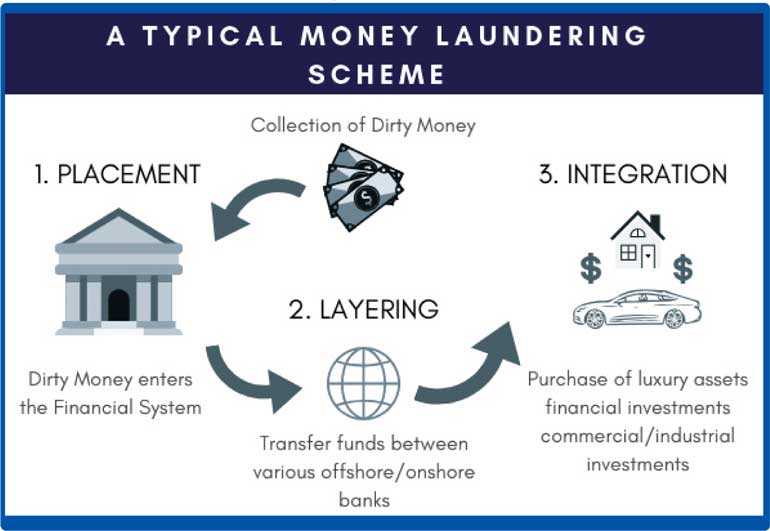

What Is The First Step To Preventing Money Laundering. There should be a verification of. A great deal can be done to fight money laundering and indeed many governments have already established comprehensive anti-money laundering regimes. Undertake risk management and implement. Typically it involves three steps.

Layering Aml Anti Money Laundering From amlbot.com

Layering Aml Anti Money Laundering From amlbot.com

During this stage for example the money launderers may begin by moving funds electronically from one country to another then divide them into investments placed in advanced financial options or overseas markets. Legislation now in force states that companies to which the law applies so-called obliged entities are obliged to do the following. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system. The first relates to customer identification and due diligence. The development of internal policies procedures and controls to prevent money laundering fits. Gross Profit Gross profit is the.

Complete a policy statement for your business A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money.

First the illegitimate funds are furtively introduced into. The first relates to customer identification and due diligence. Banks are required to report large cash transactions and other suspicious activities that might be signs of money laundering. The money is stored in the form of cash deposits in the banks. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering.

Source: pinterest.com

Source: pinterest.com

Each time exploiting loopholes or discrepancies in legislation and taking advantage of delays in judicial or police cooperation. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits. First the illegitimate funds are furtively introduced into. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. These regimes aim to increase awareness of the phenomenon both within the government and the private business sector and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem.

Source: brittontime.com

Source: brittontime.com

The money is stored in the form of cash deposits in the banks. To achieve this purpose three important steps are required. While this stage is the first step to secure the dirty money it also has the highest risk factor for the launderer to get exposed as money laundering placements require large value transactions which the bank has to report to the financial authorities. The money laundering process begins after criminals acquire illegal funds from criminal activity and seek to introduce them into the legitimate financial system. Foster a culture of anti-money laundering and compliance by establishing an official AML policy that indicates appropriate and inappropriate procedures in your company.

Source: researchgate.net

Source: researchgate.net

Banks are required to report large cash transactions and other suspicious activities that might be signs of money laundering. Legislation now in force states that companies to which the law applies so-called obliged entities are obliged to do the following. A great deal can be done to fight money laundering and indeed many governments have already established comprehensive anti-money laundering regimes. The first concerns customer identification and due diligence. First the illegitimate funds are furtively introduced into.

Source: eimf.eu

Source: eimf.eu

Placement layering and integration. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to appear as legitimate business profits. Financial institutions and authorities in order to avoid the risk of integrating dirty money into the financial system must have adequate and appropriate systems to identify and presuit of money laundering. The first concerns customer identification and due diligence. Complete a policy statement for your business A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money.

Source: gov.si

Source: gov.si

Besides fulfilling national anti-money laundering laws companies can take some further steps to fight money-laundering within their own ranks. The European Union adopted the first anti-money laundering Directive in 1990 in order to prevent the misuse of the financial system for the purpose of money laundering. The development of internal policies procedures and controls to prevent money laundering fits. To achieve this purpose three important steps are required. Legislation now in force states that companies to which the law applies so-called obliged entities are obliged to do the following.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

First the illegitimate funds are furtively introduced into. Legislation now in force states that companies to which the law applies so-called obliged entities are obliged to do the following. Banks are required to report large cash transactions and other suspicious activities that might be signs of money laundering. Constantly moving them to elude detection. The money is stored in the form of cash deposits in the banks.

Source: pinterest.com

Source: pinterest.com

Financial institutions and authorities in order to avoid the risk of integrating dirty money into the financial system must have adequate and appropriate systems to identify and presuit of money laundering. Foster a culture of anti-money laundering and compliance by establishing an official AML policy that indicates appropriate and inappropriate procedures in your company. These regimes aim to increase awareness of the phenomenon both within the government and the private business sector and then to provide the necessary legal or regulatory tools to the authorities charged with combating the problem. Constantly moving them to elude detection. While this stage is the first step to secure the dirty money it also has the highest risk factor for the launderer to get exposed as money laundering placements require large value transactions which the bank has to report to the financial authorities.

The first relates to customer identification and due diligence. Legislation now in force states that companies to which the law applies so-called obliged entities are obliged to do the following. The money is stored in the form of cash deposits in the banks. To achieve this purpose three important steps are required. To achieve this goal three important steps are needed.

Source: pinterest.com

Source: pinterest.com

Constantly moving them to elude detection. Banks are typically seeing these schemes before law enforcement is. The second involves carrying out complex financial transactions to camouflage the illegal source of the cash layering. Gross Profit Gross profit is the. Layering and Placement Pre-Layering.

Source: bi.go.id

Source: bi.go.id

Forensic accounting skills as well as audit expertise are needed to help in combating this crime. Dirty money appear legal ie. Layering and Placement Pre-Layering. Financial institutions and authorities in order to avoid the risk of integrating dirty money into the financial system must have adequate and appropriate systems to identify and presuit of money laundering. There are three major steps in money laundering placement layering and integration and various controls are put in place to monitor suspicious activity that could be involved in money laundering.

Source: ft.lk

Source: ft.lk

To achieve this purpose three important steps are required. Forensic accounting skills as well as audit expertise are needed to help in combating this crime. Banks are typically seeing these schemes before law enforcement is. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Undertake risk management and implement.

Source: bi.go.id

Source: bi.go.id

Dirty money appear legal ie. Legislation now in force states that companies to which the law applies so-called obliged entities are obliged to do the following. Gross Profit Gross profit is the. Anti-Money Laundering AML is a set of policies procedures and technologies that prevents money laundering. Banks are required to report large cash transactions and other suspicious activities that might be signs of money laundering.

Source: amlbot.com

Source: amlbot.com

Undertake risk management and implement. Gross Profit Gross profit is the. Complete a policy statement for your business A policy statement is a document that includes your anti-money laundering policy controls and the procedures your business will take to prevent money. 3 The process of laundering money typically involves three steps. Foster a culture of anti-money laundering and compliance by establishing an official AML policy that indicates appropriate and inappropriate procedures in your company.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the first step to preventing money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.