10++ What is the first step in the kyc process info

Home » money laundering Info » 10++ What is the first step in the kyc process infoYour What is the first step in the kyc process images are ready in this website. What is the first step in the kyc process are a topic that is being searched for and liked by netizens now. You can Download the What is the first step in the kyc process files here. Find and Download all free vectors.

If you’re searching for what is the first step in the kyc process images information related to the what is the first step in the kyc process interest, you have pay a visit to the right blog. Our site always gives you hints for seeking the maximum quality video and picture content, please kindly search and locate more informative video content and images that match your interests.

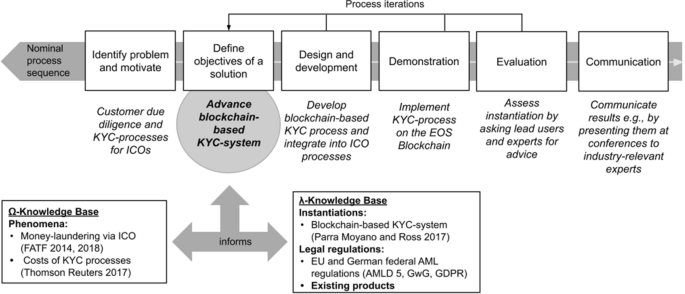

What Is The First Step In The Kyc Process. However an individual has to do it only once when he. Understand the nature of the customers activities primary goal is to satisfy that the source of the customers funds is. Manual KYC costs are pretty high automating know your customer procedures using identity verification solutions is a step in the right direction Replacing manual Know your customer with online KYC verification is time and cost-effective Automation and digitization is reducing manual labor consequently eliminating errors. Whether this information is correct and updated will depend on the due diligence of the.

Market Trends Archives Cedar Rose Newsroom From cedar-rose-news.com

Market Trends Archives Cedar Rose Newsroom From cedar-rose-news.com

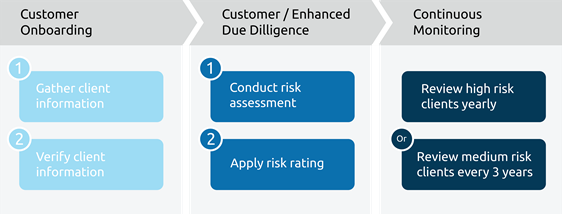

The importance of KYC in banks are numerous. The KYC procedure is to be completed by the banks while opening accounts and also periodically update the. The company house will tell you. Whether this information is correct and updated will depend on the due diligence of the. A customer has to submit his KYC before he starts investing in various instruments such as mutual funds fixed deposits bank accounts etc. Understand the nature of the customers activities primary goal is to satisfy that the source of the customers funds is.

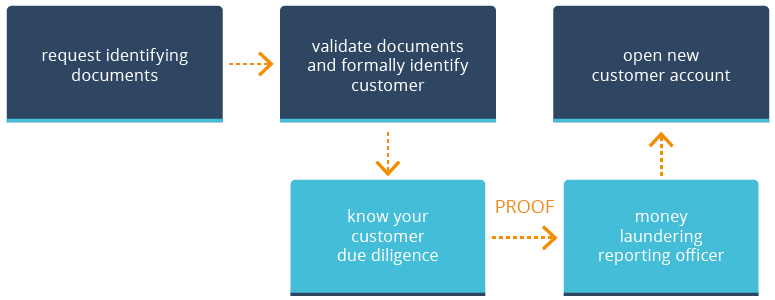

Establish the identify of the customer.

However an individual has to do it only once when he. The first phase of the AML review process is the Customer Identification Program CIP which involves collecting and verifying the new customers information and the forms of proof of identity that they provided along with the KYC form. Start Enrolment Process Aadhaar eKYC Service implementation process starts with submitting and enquiry on the UIDAI Auth Portal. KYC refers to the steps taken by a financial institution or business to. Where can I learn more about the KYC checks. KYC is mandatory for previously registered users who are logging in for the first time after the launch of the new platform.

Source: youtube.com

Source: youtube.com

The KYC procedure is to be completed by the banks while opening accounts and also periodically update the. Some practical steps to include in your customer due diligence program include. KYC is mandatory for previously registered users who are logging in for the first time after the launch of the new platform. Know Your Customer procedures are a critical function to assess and monitor customer risk. This process helps to ensure that banks services are not misused.

Source: businessprocessincubator.com

Source: businessprocessincubator.com

They protect against identity theft and ensure that banks and other financial institutions arent involved knowingly or not with terrorist money laundering human trafficking or other criminal organizations. Where can I learn more about the KYC checks. KYC is simply the process of authenticating or verifying a customers identity and address details when he or she is availing financial offerings. A bank must understand a customers profile and how they will be using their accounts assess the risks of the customers profile and monitor the transactions performed by the customer and ensure they align with expected behavior. The global anti-money laundering AML and countering the financing of.

Source: shuftipro.com

Source: shuftipro.com

KYC is mandatory for previously registered users who are logging in for the first time after the launch of the new platform. The Business registration numbers. KYC refers to the steps taken by a financial institution or business to. It is a process by which banks obtain information about the identity and address of the customers. Businesses can and must learn about the KYC requirements from a regulator in their jurisdiction.

Source: businessprocessincubator.com

Source: businessprocessincubator.com

Integrate it with CRM core banking systems for a more customer-oriented approach. It is a process by which banks obtain information about the identity and address of the customers. KYC enables an institution to authenticate the identity and address of an investor. The importance of KYC in banks are numerous. The web form collects the basic details about your organisation and the business scope for Aadhaar authentication.

Whether this information is correct and updated will depend on the due diligence of the. The KYC process is the process of identifying a user identity based on his personal documents passport or ID card. The very first step in the KYC procedure is to collect any personal information about the customer. The first step in KYC verification involves the collection of personal information from an online user. Through the Digital Account and eKYC Virtual Assistant banks and insurance companies can Seamlessly complete the process of digital onboarding of customers.

Source: basisid.com

Source: basisid.com

KYC is also mandatory for users who want to use the EUR wallet or buy hashpower on our open marketplace. The user is supposed to enter all the personal details at the time of account registration. The Business registration numbers. Through the Digital Account and eKYC Virtual Assistant banks and insurance companies can Seamlessly complete the process of digital onboarding of customers. The very first step in the KYC procedure is to collect any personal information about the customer.

Source: networkustad.com

Source: networkustad.com

KYC policies are the first step in a holistic AML approach to financial security. They protect against identity theft and ensure that banks and other financial institutions arent involved knowingly or not with terrorist money laundering human trafficking or other criminal organizations. The global anti-money laundering AML and countering the financing of. Where can I learn more about the KYC checks. Here financial institutions establish a customers identity and address based on the supporting documents submitted.

Source: link.springer.com

Source: link.springer.com

A customer has to submit his KYC before he starts investing in various instruments such as mutual funds fixed deposits bank accounts etc. The first step in KYC verification involves the collection of personal information from an online user. Whether this information is correct and updated will depend on the due diligence of the. Start Enrolment Process Aadhaar eKYC Service implementation process starts with submitting and enquiry on the UIDAI Auth Portal. KYC is also mandatory for users who want to use the EUR wallet or buy hashpower on our open marketplace.

Source: shuftipro.com

Source: shuftipro.com

Some practical steps to include in your customer due diligence program include. However an individual has to do it only once when he. Establish the identify of the customer. Gathering and verifying information about the business owners is the first and most important step in corporate KYC. KYC is also mandatory for users who want to use the EUR wallet or buy hashpower on our open marketplace.

Source: encompasscorporation.com

Source: encompasscorporation.com

KYC refers to the steps taken by a financial institution or business to. Gathering and verifying information about the business owners is the first and most important step in corporate KYC. Ask the user to Upload an Evidence. KYC is simply the process of authenticating or verifying a customers identity and address details when he or she is availing financial offerings. Know Your Customer in banking.

Source: status200.net

Source: status200.net

Manual KYC costs are pretty high automating know your customer procedures using identity verification solutions is a step in the right direction Replacing manual Know your customer with online KYC verification is time and cost-effective Automation and digitization is reducing manual labor consequently eliminating errors. Manual KYC costs are pretty high automating know your customer procedures using identity verification solutions is a step in the right direction Replacing manual Know your customer with online KYC verification is time and cost-effective Automation and digitization is reducing manual labor consequently eliminating errors. The first step in KYC verification involves the collection of personal information from an online user. Whether this information is correct and updated will depend on the due diligence of the. KYC Know Your Customer related practices are especially relevant in user and clients relationships with business.

Source: cedar-rose-news.com

Source: cedar-rose-news.com

Through the Digital Account and eKYC Virtual Assistant banks and insurance companies can Seamlessly complete the process of digital onboarding of customers. Know Your Customer procedures are a critical function to assess and monitor customer risk. Whether this information is correct and updated will depend on the due diligence of the. It is the first step in a customer relationship with a company. Establish the identify of the customer.

Source: shuftipro.com

Source: shuftipro.com

KYC policies are the first step in a holistic AML approach to financial security. Some practical steps to include in your customer due diligence program include. It is the first step in a customer relationship with a company. The KYC process is the process of identifying a user identity based on his personal documents passport or ID card. The company house will tell you.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is the first step in the kyc process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.