16++ What is the fine for violating the bank secrecy act ideas in 2021

Home » money laundering idea » 16++ What is the fine for violating the bank secrecy act ideas in 2021Your What is the fine for violating the bank secrecy act images are ready in this website. What is the fine for violating the bank secrecy act are a topic that is being searched for and liked by netizens today. You can Find and Download the What is the fine for violating the bank secrecy act files here. Find and Download all royalty-free vectors.

If you’re searching for what is the fine for violating the bank secrecy act images information related to the what is the fine for violating the bank secrecy act keyword, you have come to the ideal site. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

What Is The Fine For Violating The Bank Secrecy Act. FinCEN imposes 2 million penalty against community bank. Bank failed to conduct appropriate due diligence related to Mexican customer. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. Bank Secrecy Act Policy And Procedures.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today From acamstoday.org

The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. While most insured financial institutions examined. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the. Department of Justice today announced the assessment of a 185 million civil money penalty against US. Structuring and Related Prohibited Actions.

Department of Justice today announced the assessment of a 185 million civil money penalty against US.

Bank for willful violations of several provisions of the Bank Secrecy Act BSA. It is a course of by which dirty cash is transformed into clear cash. Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. Bank Secrecy Act Policy And Procedures. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. That same year AmSouth was fined 50 million and barred from branch expansion until 2006 for violating the Bank Secrecy Act.

Source: complianceonline.com

Source: complianceonline.com

FinCEN imposes 2 million penalty against community bank. He Bank Secrecy Act BSA and its implementing rules are not new. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone. Bank Secrecy Act Policy And Procedures.

Specifically the act requires financial institutions to keep records of cash purchases of negotiable instruments file reports if the daily aggregate exceeds. WASHINGTON The Financial Crimes Enforcement Network FinCEN in coordination with the Office of the Comptroller of the Currency and the US. Structuring and Related Prohibited Actions. Law requiring financial institutions in the United States to assist US. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

On October 27 2017 the US. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. The OCCs implementing regulations are found at. The Secretary of the Treasury is authorized by 31 USC 5321 a 4 Structured Transaction Violation to impose a civil money penalty on any person who structures or attempts to structure a transaction with the intent to evade a Bank Secrecy Act BSA requirement. The sources of the money in precise are legal and the cash is invested in a way that makes it appear to be clear.

Source: acamstoday.org

Source: acamstoday.org

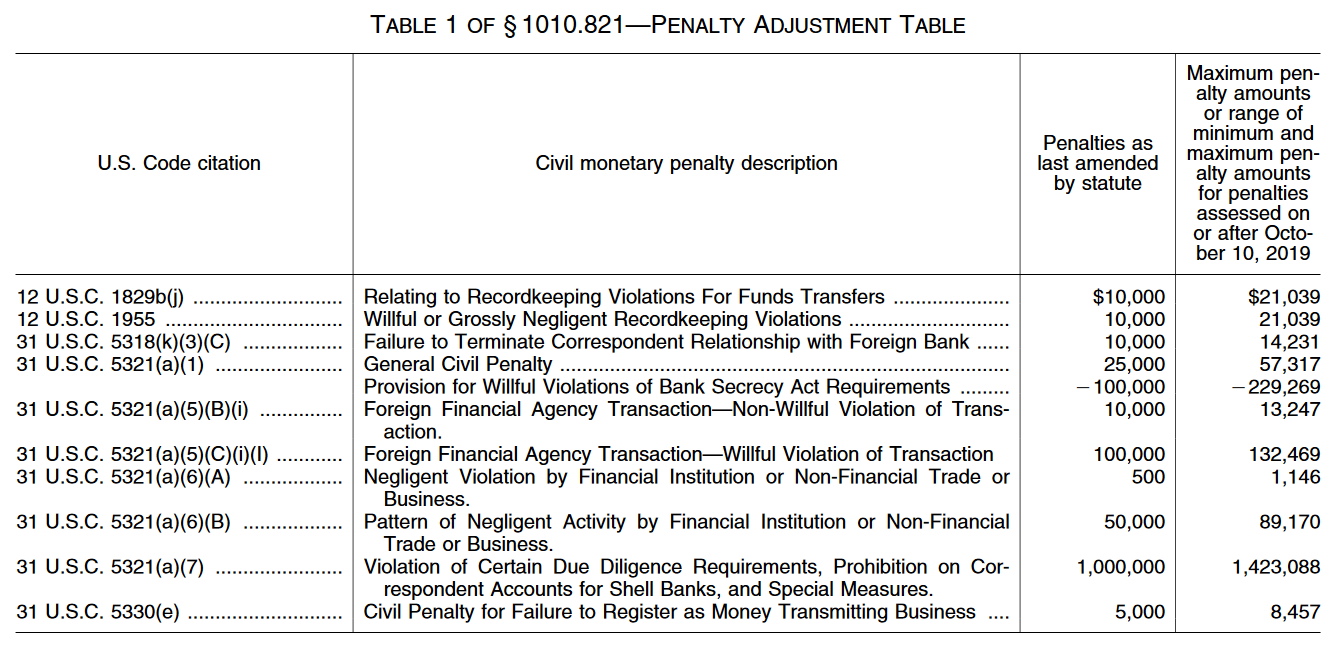

Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the. The Bank Secrecy Act of 1970 also known as the Currency and Foreign Transactions Reporting Act is a US. That same year AmSouth was fined 50 million and barred from branch expansion until 2006 for violating the Bank Secrecy Act. WASHINGTON The Financial Crimes Enforcement Network FinCEN in coordination with the Office of the Comptroller of the Currency and the US. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

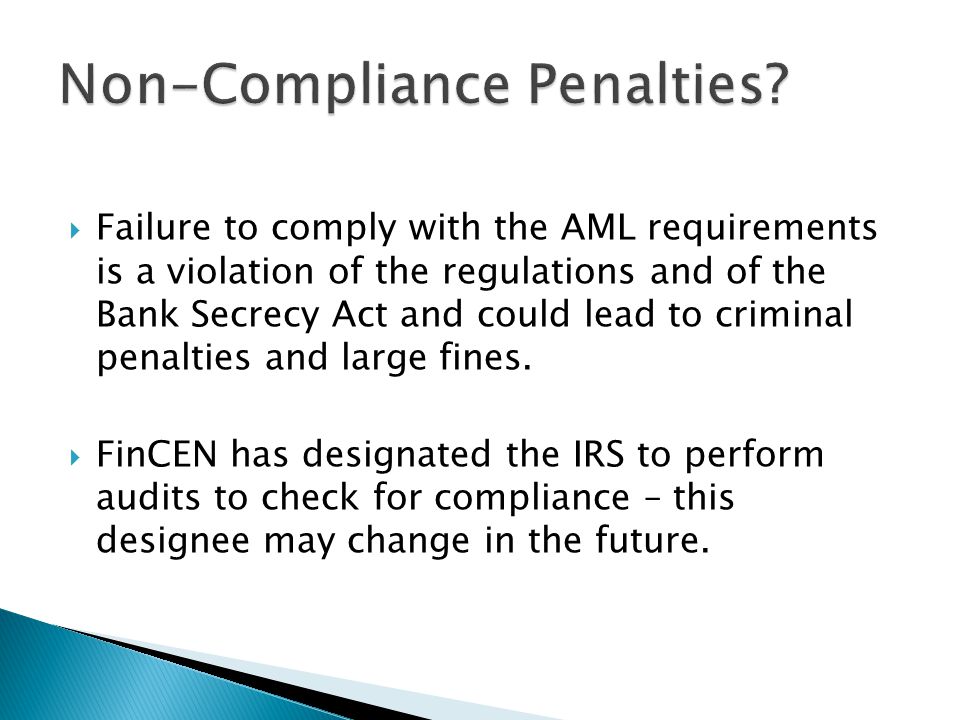

Source: slideplayer.com

Source: slideplayer.com

The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. Small banks other financial institutions need to recognize obligations under Bank Secrecy Act. It is a course of by which dirty cash is transformed into clear cash. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. Bank Secrecy Act Policy And Procedures.

Source: nafcu.org

Source: nafcu.org

What is the fine for violating the Bank Secrecy Act. The sources of the money in precise are legal and the cash is invested in a way that makes it appear to be clear. The company was accused of. Structuring and Related Prohibited Actions. While most insured financial institutions examined.

Source: acamstoday.org

Source: acamstoday.org

Government agencies in detecting and preventing money laundering. What is the fine for violating Bank Secrecy Act regulations. FinCEN imposes 2 million penalty against community bank. The OCCs implementing regulations are found at. Law requiring financial institutions in the United States to assist US.

Source: nafcu.org

Source: nafcu.org

August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. Bank was slapped with a 185 million civil penalty for what the Financial Crimes Enforcement Network FinCEN in coordination with the Office. The Bank Secrecy Act BSA 31 USC 5311 et seq establishes program recordkeeping and reporting requirements for national banks federal savings associations federal branches and agencies of foreign banks. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. Government agencies in detecting and preventing money laundering.

Source: slideplayer.com

Source: slideplayer.com

Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. FinCEN imposes 2 million penalty against community bank. The sources of the money in actual are criminal and the money is invested in a approach that makes it. The Secretary of the Treasury is authorized by 31 USC 5321 a 4 Structured Transaction Violation to impose a civil money penalty on any person who structures or attempts to structure a transaction with the intent to evade a Bank Secrecy Act BSA requirement.

Source: slideplayer.com

Source: slideplayer.com

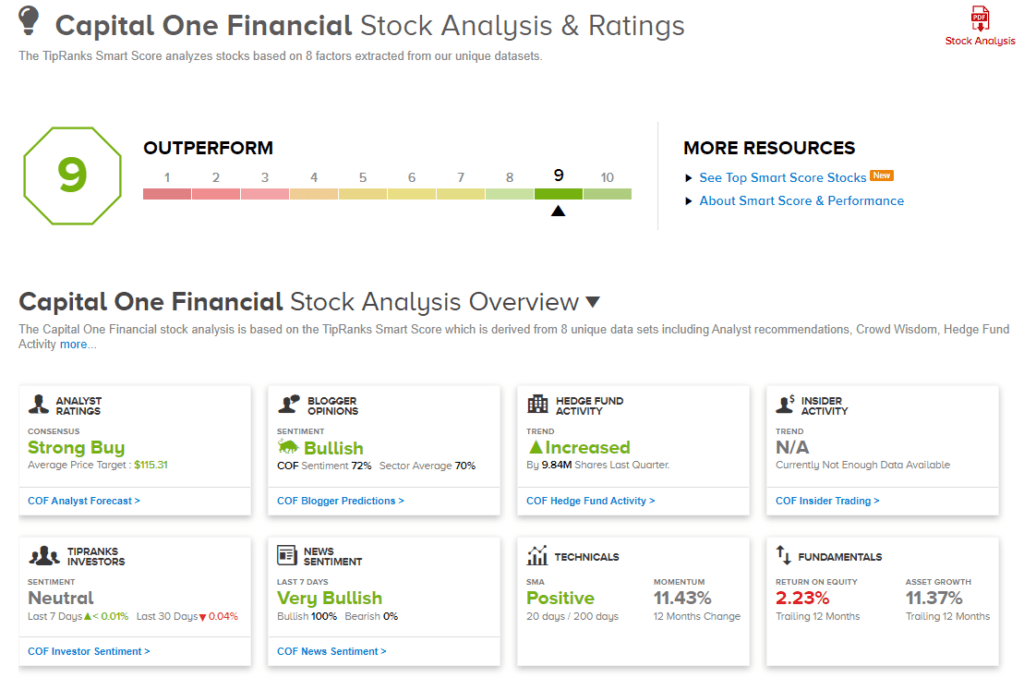

Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty for recordkeeping violations for funds transfers which has increased from 10000 to 19787. Department of Justice today announced the assessment of a 185 million civil money penalty against US. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. Violation Bank Secrecy Act Regulations Fine Up To. The sources of the money in precise are legal and the cash is invested in a way that makes it appear to be clear.

Source: complyadvantage.com

Source: complyadvantage.com

WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. While most insured financial institutions examined. Structuring and Related Prohibited Actions. Department of Justice today announced the assessment of a 185 million civil money penalty against US. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties.

Source: nasdaq.com

Source: nasdaq.com

What is the fine for violating Bank Secrecy Act regulations. While most insured financial institutions examined. FinCEN imposes 2 million penalty against community bank. Its a course of by which soiled cash is converted into clean cash. Department of Justice today announced the assessment of a 185 million civil money penalty against US.

Source: nafcu.org

Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone. Bank failed to conduct appropriate due diligence related to Mexican customer. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the. It is a course of by which dirty cash is transformed into clear cash. WASHINGTON The Financial Crimes Enforcement Network FinCEN in coordination with the Office of the Comptroller of the Currency and the US.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is the fine for violating the bank secrecy act by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.