17+ What is related party declaration form information

Home » money laundering idea » 17+ What is related party declaration form informationYour What is related party declaration form images are available. What is related party declaration form are a topic that is being searched for and liked by netizens now. You can Find and Download the What is related party declaration form files here. Download all royalty-free images.

If you’re searching for what is related party declaration form images information connected with to the what is related party declaration form topic, you have pay a visit to the ideal blog. Our website always provides you with suggestions for downloading the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

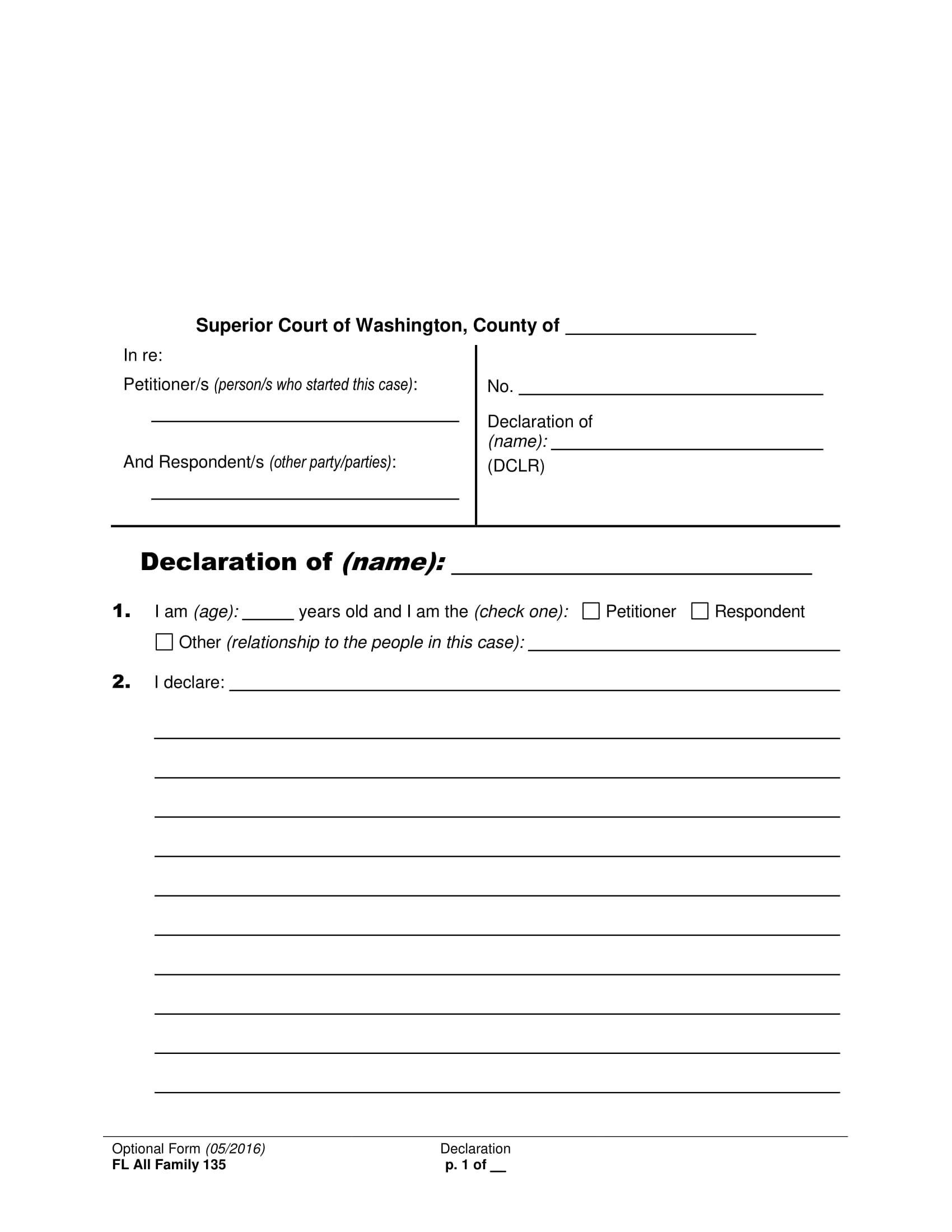

What Is Related Party Declaration Form. You can give each witness one to fill out and have one for yourself. For example an entity that sells goods to its parent at cost might not sell on those terms to another customer. Put the name age and relationship to the parties in the case. Disclose all material related party transactions including the nature of the relationship the nature of the transactions the dollar amounts of the transactions the amounts due to or from related parties and the settlement terms including tax-related balances and the method by which any current and deferred tax expense is allocated to the members of a group.

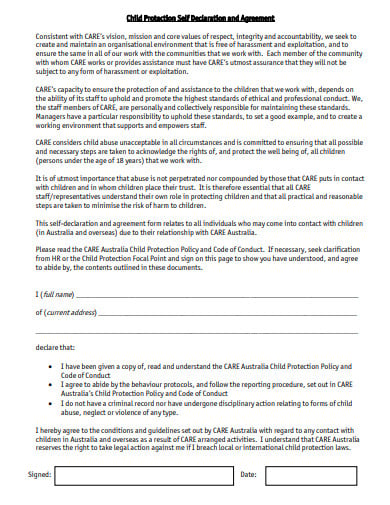

16 Declaration Agreement Templates Pdf Free Premium Templates From template.net

16 Declaration Agreement Templates Pdf Free Premium Templates From template.net

For example an entity that sells goods to its parent at cost might not sell on those terms to another customer. See Note 1 You will need your companys audited accounts and details of RPT to complete the Form. Of accounts fully disclosing related party transactions. Particulars of RPTRRPT are as follows. IAS 24 was reissued in November 2009 and applies to annual periods beginning on or after. The online form is for academy trusts to declare or seek approval for an agreement or contract with a related party before its confirmed with the supplier.

If importer and vendor are related there should be an R or the word Related in the field.

Required to complete a new Form for Reporting of Related Party Transactions RPT Form only if the value of RPT exceeds S15 million. IAS 24 was reissued in November 2009 and applies to annual periods beginning on or after. The standard defines various classes of entities and people as related parties and sets out the disclosures required in respect of those parties including the compensation of key management personnel. Summary guidance explains the reporting. When the relationship arises as a result of the transaction the transaction is not one between related parties. Put the name age and relationship to the parties in the case.

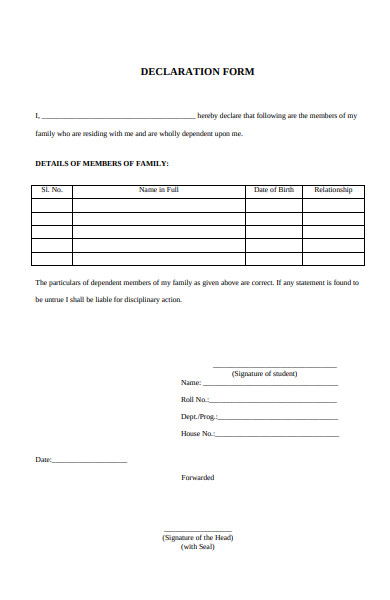

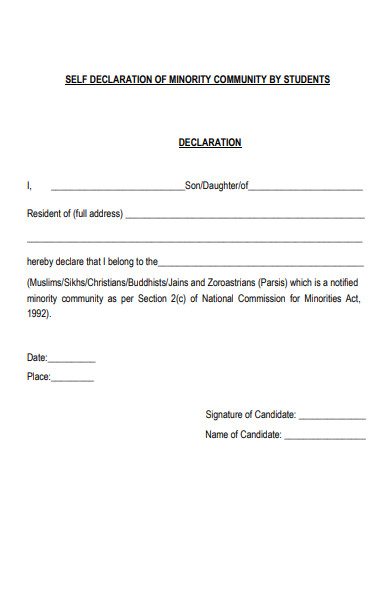

Source: sampleforms.com

Source: sampleforms.com

Disclose all material related party transactions including the nature of the relationship the nature of the transactions the dollar amounts of the transactions the amounts due to or from related parties and the settlement terms including tax-related balances and the method by which any current and deferred tax expense is allocated to the members of a group. No relationship direct or indirect exists between or among the Company on the one hand and any Insider on the other hand which is required by the Act the Exchange Act or the Regulations to be described in the Registration Statement the Sale Preliminary Prospectus and the Prospectus which is not so described as required. IAS 24 was reissued in November 2009 and applies to annual periods beginning on or after. A related party relationship could have an effect on the profit or loss and financial position of an entity. If the value of RPT disclosed in the financial statements for the financial period exceeds S15 million companies should indicate 1 Yes in Box 31 of the Form C and complete the Form for Reporting RPT.

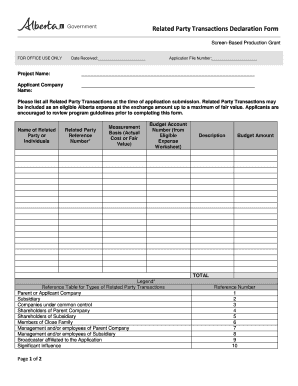

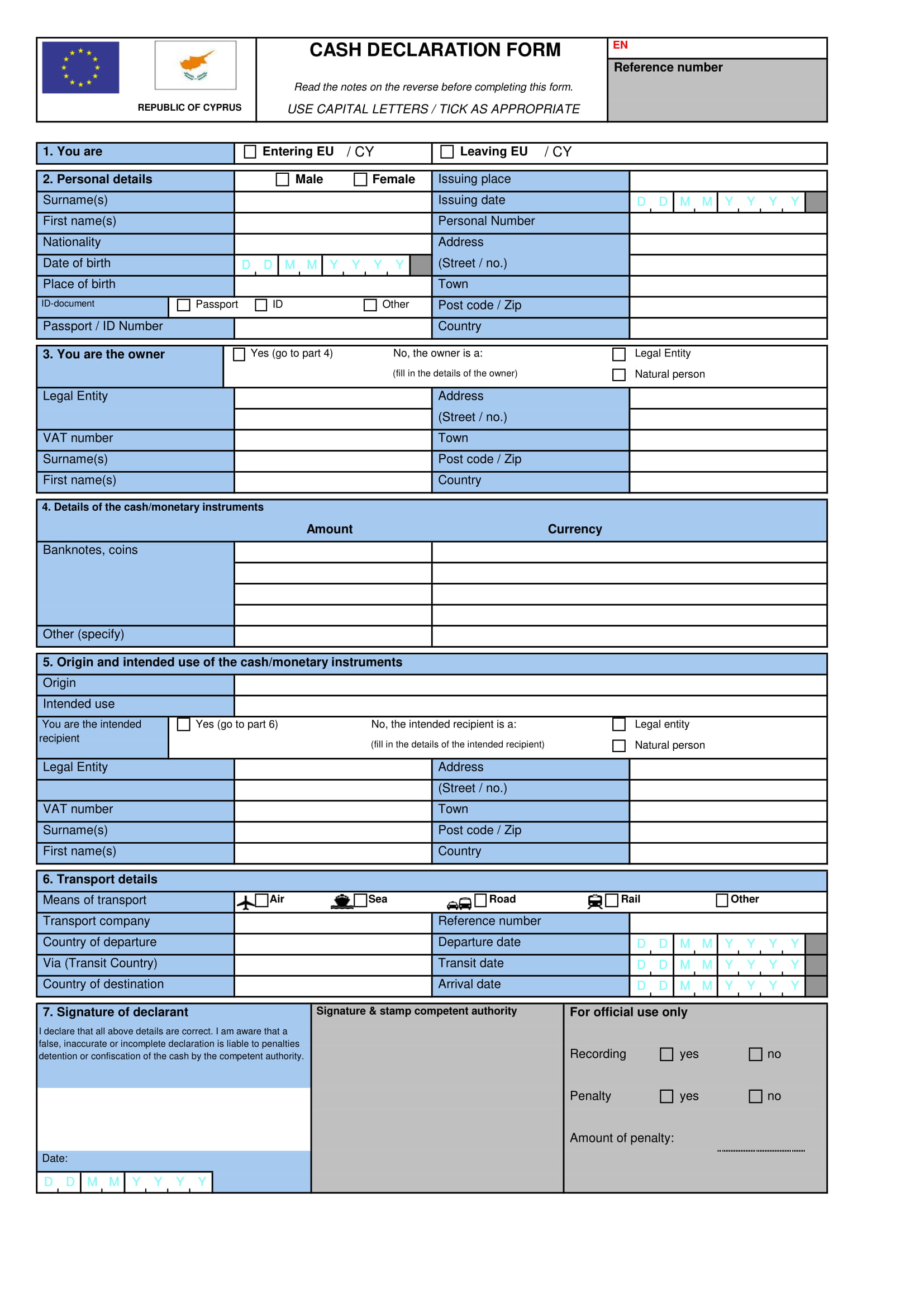

Source: pdffiller.com

Source: pdffiller.com

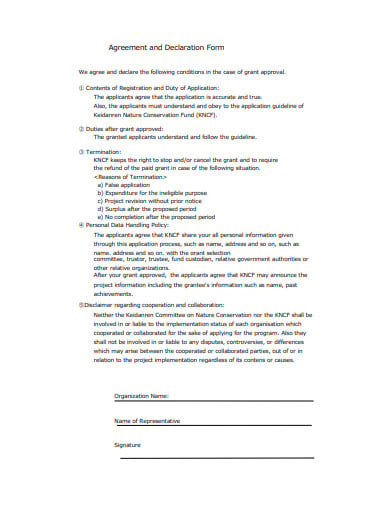

66 of 100 charities 1 million and greater. A related party transaction is a transaction that involves a Mirvac Entity providing a financial benefit to a Related Party see definition in. Customs Regulations an importer of record must determine if and how the seller in an international transaction is related to it. 66 of 100 charities 1 million and greater. The disclosures made via the Declaration of Interest link will form the Declaration Register which is maintained by Group Compliance and made available to the Mirvac Group Board ELT Audit Risk.

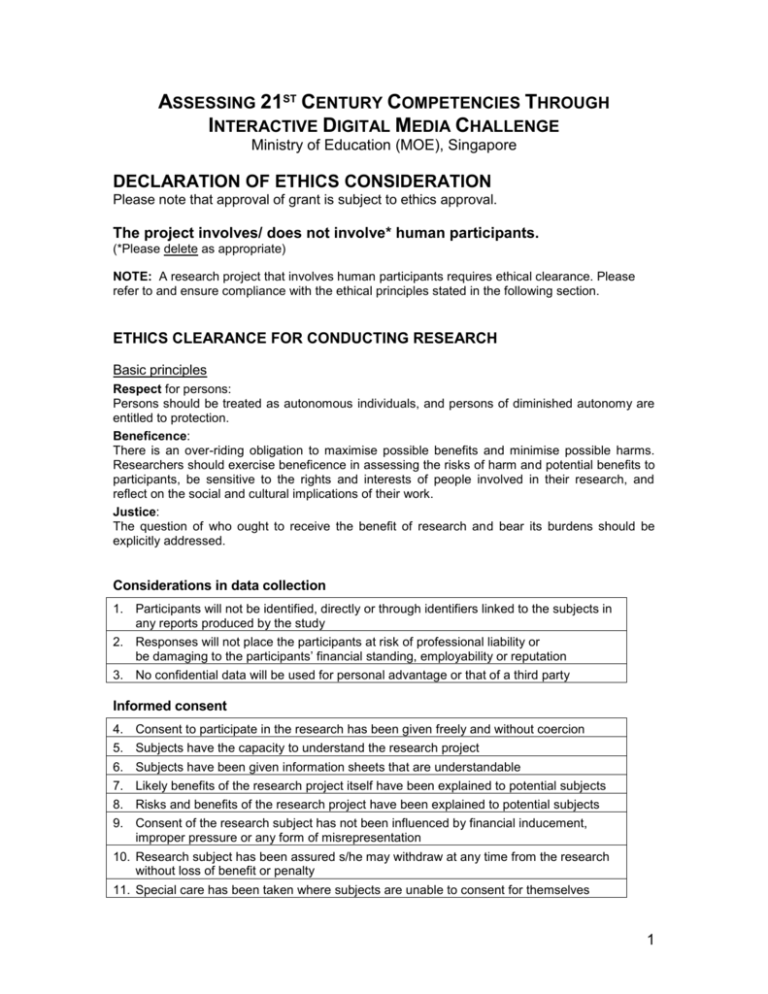

Source: studylib.net

Source: studylib.net

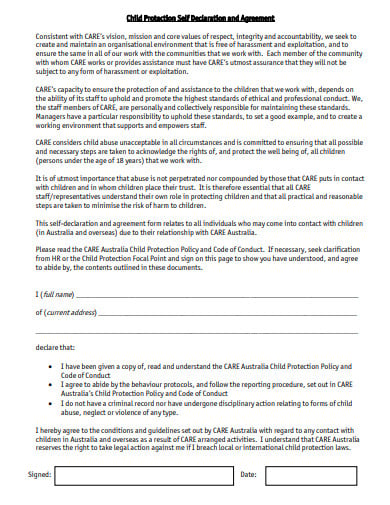

Related parties may enter into transactions that unrelated parties would not. In addition to maintaining business records supporting the transaction value between related parties the importer must declare the relationship on each and every customs entry. A related party transaction is a transaction that involves a Mirvac Entity providing a financial benefit to a Related Party see definition in. In case a related party is not registered they are served a PD Circular along with a questionnaire to clarify their transaction process and the methodology adopted for valuation. A related party transaction is a transfer of economic resources or obligations between related parties or the provision of services by one party to a related party regardless of whether any consideration is exchanged.

Source: sampleforms.com

Source: sampleforms.com

IAS 24 requires disclosures about transactions and outstanding balances with an entitys related parties. If importer and vendor are related there should be an R or the word Related in the field. Disclose all material related party transactions including the nature of the relationship the nature of the transactions the dollar amounts of the transactions the amounts due to or from related parties and the settlement terms including tax-related balances and the method by which any current and deferred tax expense is allocated to the members of a group. This declaration occurs on the entry summary CBP form 7501 in field 33. Ii is Related Party Transaction RPT Recurrent Related Party Transaction RRPT please provide particulars of RPTRRPT in Item 2 below 2.

Source: sampleforms.com

Source: sampleforms.com

See Note 1 You will need your companys audited accounts and details of RPT to complete the Form. Year-end balances of loans and non-trade amounts due from to all related parties. A related party relationship could have an effect on the profit or loss and financial position of an entity. Defining related parties in a customs transaction can seem just as confusing. The caption and make several copies of the declaration form before putting any other information.

Source: pdffiller.com

Source: pdffiller.com

Ii is Related Party Transaction RPT Recurrent Related Party Transaction RRPT please provide particulars of RPTRRPT in Item 2 below 2. Particulars of RPTRRPT are as follows. See Note 1 You will need your companys audited accounts and details of RPT to complete the Form. IAS 24 was reissued in November 2009 and applies to annual periods beginning on or after. 55 of 66 charities 250000 - 1 million.

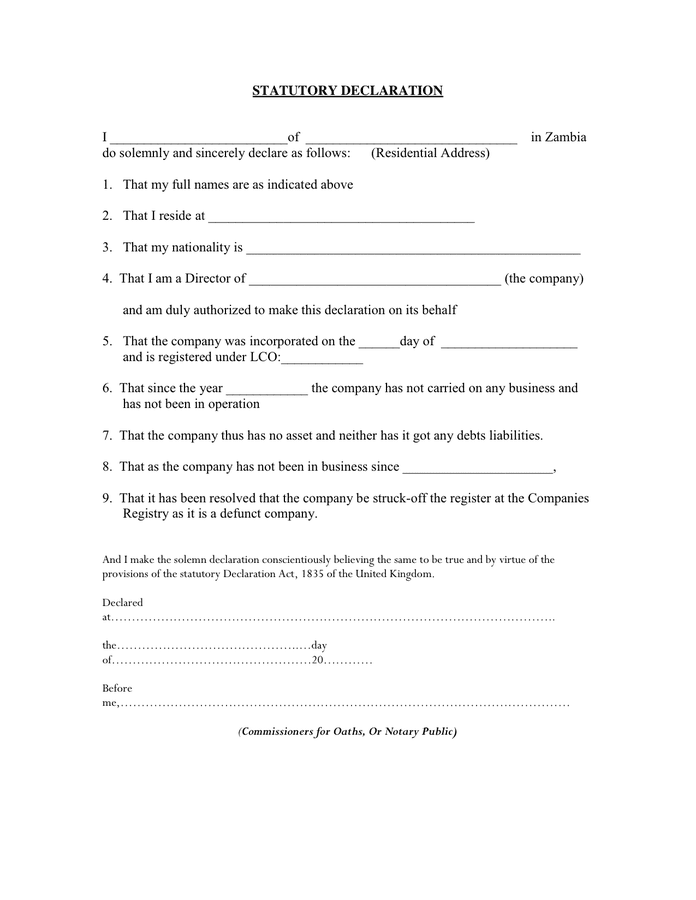

Source: dexform.com

Source: dexform.com

The parties to the transaction are related prior to the transaction. IAS 24 was reissued in November 2009 and applies to annual periods beginning on or after. Particulars of RPTRRPT are as follows. When the relationship arises as a result of the transaction the transaction is not one between related parties. Required to complete a new Form for Reporting of Related Party Transactions RPT Form only if the value of RPT exceeds S15 million.

Source: pdfprof.com

Source: pdfprof.com

This declaration is made by. A related party transaction is a transaction that involves a Mirvac Entity providing a financial benefit to a Related Party see definition in. Also transactions between related parties may not. A related party relationship could have an effect on the profit or loss and financial position of an entity. Ii is Related Party Transaction RPT Recurrent Related Party Transaction RRPT please provide particulars of RPTRRPT in Item 2 below 2.

Source: sampleforms.com

Source: sampleforms.com

Put the name age and relationship to the parties in the case. Summary guidance explains the reporting. For example an entity that sells goods to its parent at cost might not sell on those terms to another customer. Related party or an existing company that is to initiate imports with related party. You can give each witness one to fill out and have one for yourself.

Source: pdffiller.com

Source: pdffiller.com

For example an entity that sells goods to its parent at cost might not sell on those terms to another customer. Part 1 - Particulars of Company. Ii is Related Party Transaction RPT Recurrent Related Party Transaction RRPT please provide particulars of RPTRRPT in Item 2 below 2. Required to complete a new Form for Reporting of Related Party Transactions RPT Form only if the value of RPT exceeds S15 million. The online form is for academy trusts to declare or seek approval for an agreement or contract with a related party before its confirmed with the supplier.

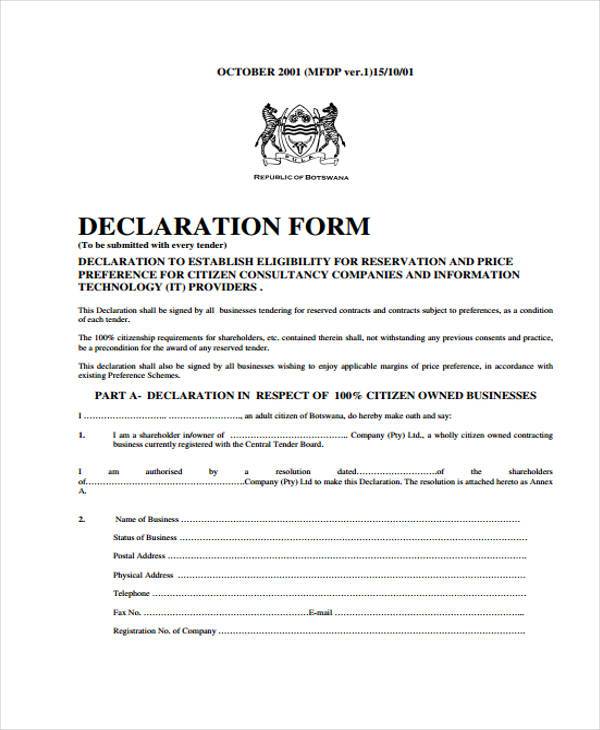

Source: template.net

Source: template.net

Then you will have blank forms with just your case caption on them. IAS 24 requires disclosures about transactions and outstanding balances with an entitys related parties. For example an entity that sells goods to its parent at cost might not sell on those terms to another customer. Also transactions between related parties may not. If importer and vendor are related there should be an R or the word Related in the field.

Source: pdfprof.com

Source: pdfprof.com

From YA 2020 the Form for Reporting RPT is available as part of the Income Tax Return Form C. IAS 24 requires disclosures about transactions and outstanding balances with an entitys related parties. Related parties may enter into transactions that unrelated parties would not. The caption and make several copies of the declaration form before putting any other information. If importer and vendor are related there should be an R or the word Related in the field.

Source: template.net

Source: template.net

This declaration occurs on the entry summary CBP form 7501 in field 33. The information necessary to complete the RPT Form can be obtained readily from the companies financial statements and accounting systems. Complete this Form if the value of the companys related party transactions RPT disclosed in the audited accounts for the financial year exceeds S15 million. Then you will have blank forms with just your case caption on them. Required to complete a new Form for Reporting of Related Party Transactions RPT Form only if the value of RPT exceeds S15 million.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is related party declaration form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.