14+ What is nesting in money laundering info

Home » money laundering idea » 14+ What is nesting in money laundering infoYour What is nesting in money laundering images are available in this site. What is nesting in money laundering are a topic that is being searched for and liked by netizens today. You can Download the What is nesting in money laundering files here. Download all free vectors.

If you’re looking for what is nesting in money laundering images information connected with to the what is nesting in money laundering keyword, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

What Is Nesting In Money Laundering. Determine if there is a readily identifiable cause for the deficiencies Implement a revision to the account-opening training program Revise the policy to simplify Know Your Customer compliance before the report is issued. Nesting refers to the practice among foreign financial institutions conducting international transactions of allowing one foreign bank to process the cross-border bank transactions of another. What is the nest course of action for the anti-money laundering officer to take. The officer reviews the accounts increase in compliance with a long standing know your Customer policy.

Money Laundering Regulatory Risk Evaluation Using Bitmap Index Based Decision Tree Sciencedirect From sciencedirect.com

Money Laundering Regulatory Risk Evaluation Using Bitmap Index Based Decision Tree Sciencedirect From sciencedirect.com

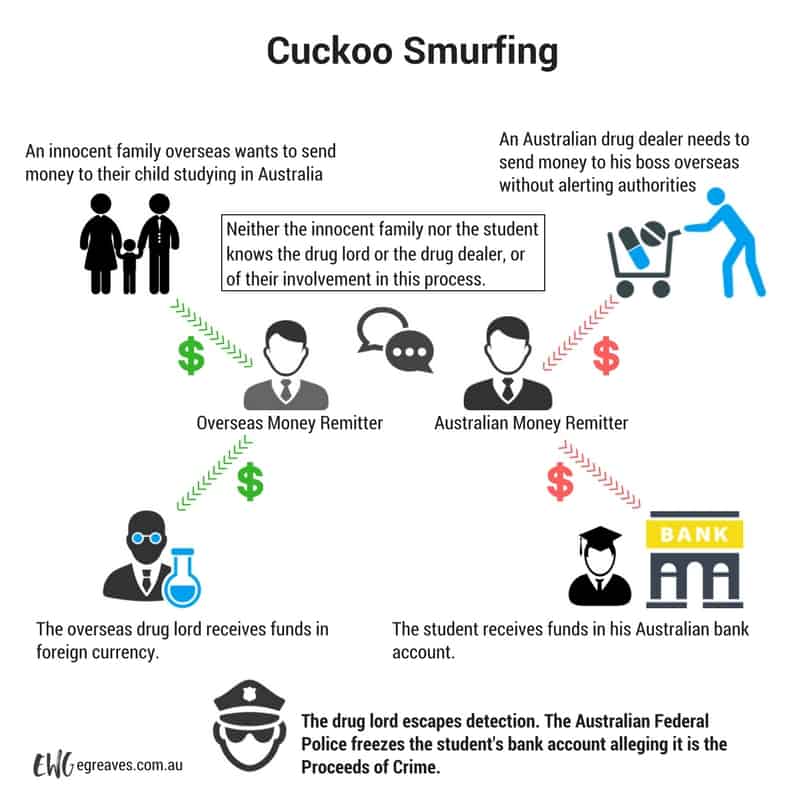

What Is The Cuckoo Smurfing. They are the person being used by the cuckoo and are being used to get money through the system in. And is defined by courts as the âœdeliberate avoidance of knowledge of the factsâ or âœpurposeful indifferenceâ Courts have held that willful blindness is the equivalent of actual knowledge of the illegal source of funds or of the intentions of a customer in a money laundering transaction. The officer reviews the accounts increase in compliance with a long standing know your Customer policy. Bank by a foreign financial institution. Money laundering is the process of making large amounts of money generated by a criminal activity appear to have come from a legitimate source.

The self-assessment for the latest month shows a significant increase in compliance deficiencies for the first time in more than a year.

Worst job ever okay maybe not that bad but you feel me. It becomes a nested account when that institution permits another financial institution access to the. A money laundering scam is an attempt by a scammer to steal money by claiming that there is an employment opportunity requiring the job seeker to make transactions on behalf of someone else. Nesting refers to the practice among foreign financial institutions conducting international transactions of allowing one foreign bank to process the cross-border bank transactions of another. Legal principle that operates in money laundering cases in the US. A Correspondent Bank is effectively acting as its Correspondents agent or conduit executing andor processing payments or other transactions for the Correspondents customers.

The self-assessment for the latest month shows a significant increase in compliance deficiencies for the first time in more than a year. An anti money laundering officer for a financial institution has been conducting a monthly self assessmentThe officer reviews the accounts increase in compliance with a long standing know your Customer policyThe self assessment for the latest month shows a significant increase in compliance deficiencies for thefirst time in more than a year. Question 83 Topic 1. Determine if there is a readily identifiable cause for the deficiencies Implement a revision to the account-opening training program Revise the policy to simplify Know Your Customer compliance before the report is issued. A correspondent account is one maintained in a US.

Source: ppt-online.org

Source: ppt-online.org

Legal principle that operates in money laundering cases in the US. Investment in securities with a significantly lower risk than the customers expressed risk tolerance. What is the nest course of action for the anti-money laundering officer to take. Worst job ever okay maybe not that bad but you feel me. In the last month of my pregnancy I made a vow to keep up with the weekly laundry for myself and for the hubby.

Source: sciencedirect.com

Source: sciencedirect.com

Worst job ever okay maybe not that bad but you feel me. Cuckoo Smurfing which is one of the money laundering methods used by criminals is simpler than other methods. Cuckoo Smurfing is a money launderer that steals or launders money. Legal principle that operates in money laundering cases in the US. For example Bank Apples in Iran is a sanctioned entity.

Source: ppt-online.org

Source: ppt-online.org

A high level of account activity with very low levels of securities transactions. An anti money laundering officer for a financial institution has been conducting a monthly self assessmentThe officer reviews the accounts increase in compliance with a long standing know your Customer policyThe self assessment for the latest month shows a significant increase in compliance deficiencies for thefirst time in more than a year. They are the person being used by the cuckoo and are being used to get money through the system in. The officer reviews the accounts increase in compliance with a long standing know your Customer policy. A Correspondent Bank is effectively acting as its Correspondents agent or conduit executing andor processing payments or other transactions for the Correspondents customers.

Source: pinterest.com

Source: pinterest.com

Investment in securities with a significantly lower risk than the customers expressed risk tolerance. A high level of account activity with very low levels of securities transactions. The self-assessment for the latest month shows a significant increase in compliance deficiencies for the first time in more than a year. Investment in securities with a significantly lower risk than the customers expressed risk tolerance. An anti-money laundering officer for a financial institution has been conducting a monthly self-assessment.

Source: egreaves.com.au

Source: egreaves.com.au

An anti-money laundering officer for a financial institution has been conducting a monthly self-assessment. The self-assessment for the latest month shows a significant increase in compliance deficiencies for the first time in more than a year. These customers may be individuals legal entities or even other financial institutions. Determine if there is a readily identifiable cause for the deficiencies Implement a revision to the account-opening training program Revise the policy to simplify Know Your Customer compliance before the report is issued. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source.

Source: ppt-online.org

Source: ppt-online.org

Investment in securities with a significantly lower risk than the customers expressed risk tolerance. These customers may be individuals legal entities or even other financial institutions. A correspondent payable through a nested account is an arrangement used by some to move money between financial institutions in foreign countries and financial institutions in the United States. And is defined by courts as the âœdeliberate avoidance of knowledge of the factsâ or âœpurposeful indifferenceâ Courts have held that willful blindness is the equivalent of actual knowledge of the illegal source of funds or of the intentions of a customer in a money laundering transaction. Legal principle that operates in money laundering cases in the US.

Source: ppt-online.org

Source: ppt-online.org

Bank by a foreign financial institution. It becomes a nested account when that institution permits another financial institution access to the. Cuckoo Smurfing is a money launderer that steals or launders money. As part of your nesting checklist the last thing you want to worry about is no one having anything to wear. Inform the Board of Directors promptly of the Know Your Customer policy trend over the last six months.

Source: ppt-online.org

Source: ppt-online.org

Nested accounts involve a bank obtaining access to a financial system by anonymously channelling funds through the correspondent bank of another foreign institution rather than having its own accounts. Money laundering is the process of making large amounts of money generated by a criminal activity appear to have come from a legitimate source. Bank by a foreign financial institution. An anti-money laundering officer for a financial institution has been conducting a monthly self-assessment. A Correspondent Bank is effectively acting as its Correspondents agent or conduit executing andor processing payments or other transactions for the Correspondents customers.

Source: pinterest.com

Source: pinterest.com

Nested accounts involve a bank obtaining access to a financial system by anonymously channelling funds through the correspondent bank of another foreign institution rather than having its own accounts. More Anti Money Laundering AML Definition. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. An anti-money laundering officer for a financial institution has been conducting a monthly self-assessment. Bank by a foreign financial institution.

Source: pinterest.com

Source: pinterest.com

For example Bank Apples in Iran is a sanctioned entity. Determine if there is a readily identifiable cause for the deficiencies Implement a revision to the account-opening training program Revise the policy to simplify Know Your Customer compliance before the report is issued. It becomes a nested account when that institution permits another financial institution access to the. An anti money laundering officer for a financial institution has been conducting a monthly self assessmentThe officer reviews the accounts increase in compliance with a long standing know your Customer policyThe self assessment for the latest month shows a significant increase in compliance deficiencies for thefirst time in more than a year. Investment in securities with a significantly lower risk than the customers expressed risk tolerance.

Source: ppt-online.org

Source: ppt-online.org

A correspondent account is one maintained in a US. Cuckoo Smurfing which is one of the money laundering methods used by criminals is simpler than other methods. It becomes a nested account when that institution permits another financial institution access to the. The officer reviews the accounts increase in compliance with a long standing know your Customer policy. In the last month of my pregnancy I made a vow to keep up with the weekly laundry for myself and for the hubby.

Source: ppt-online.org

Source: ppt-online.org

Once the job seeker responds to the ad the scammer extends an offer of employment which includes using the persons bank account to transfer money that has been illegally obtained. Short-term borrowing or investment needs in a particular currency. Nested accounts involve a bank obtaining access to a financial system by anonymously channelling funds through the correspondent bank of another foreign institution rather than having its own accounts. In the last month of my pregnancy I made a vow to keep up with the weekly laundry for myself and for the hubby. Personally I hate laundry.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is nesting in money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.