13++ What is kyc process in investment banking ideas in 2021

Home » money laundering Info » 13++ What is kyc process in investment banking ideas in 2021Your What is kyc process in investment banking images are ready in this website. What is kyc process in investment banking are a topic that is being searched for and liked by netizens today. You can Download the What is kyc process in investment banking files here. Get all royalty-free images.

If you’re searching for what is kyc process in investment banking images information linked to the what is kyc process in investment banking keyword, you have visit the ideal blog. Our site frequently provides you with hints for refferencing the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

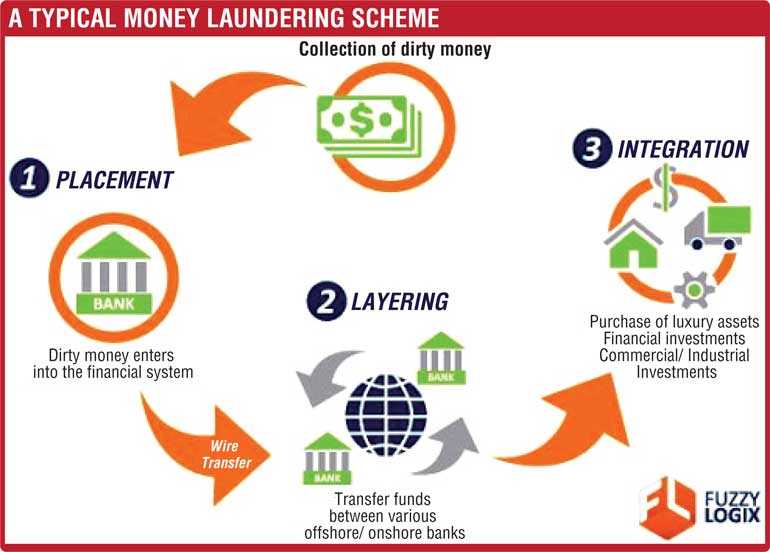

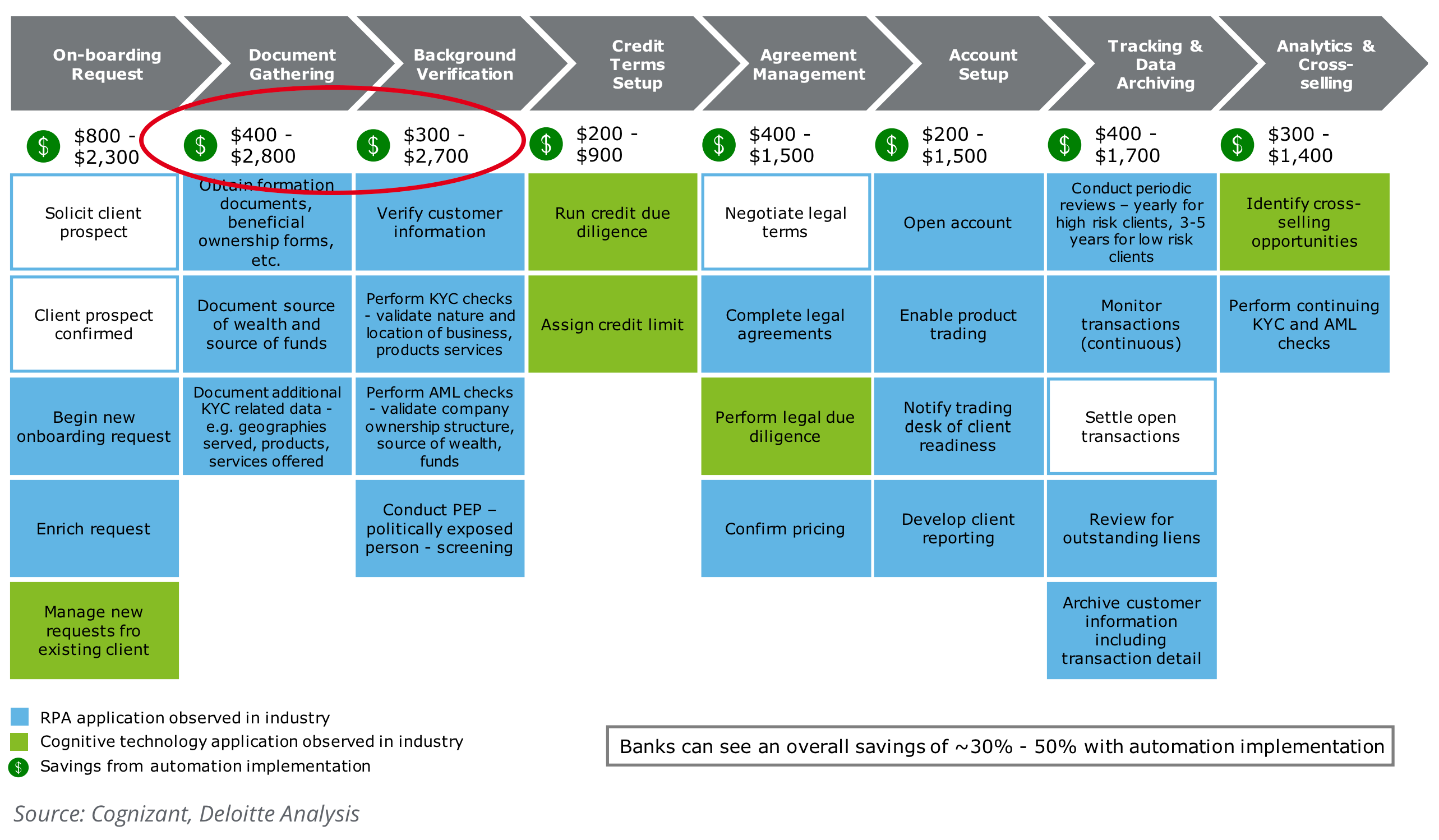

What Is Kyc Process In Investment Banking. Digital KYC records demonstrate compliance to regulators and auditors and seamlessly integrate with CLMs and CRMs for a more streamlined KYC and AML compliance process. Know Your Customer KYC procedure is to be the key principle for identification of an individual corporate opening an account. The customer identification should entail verification through an introductory reference from an existing account holder a person known to the bank or on the basis of documents provided by the customer. This helps cut down unlawful practices like money laundering fraud or financing illegal activities.

What Is Kyc How Kyc Systems Help Customers And Businesses From status200.net

What Is Kyc How Kyc Systems Help Customers And Businesses From status200.net

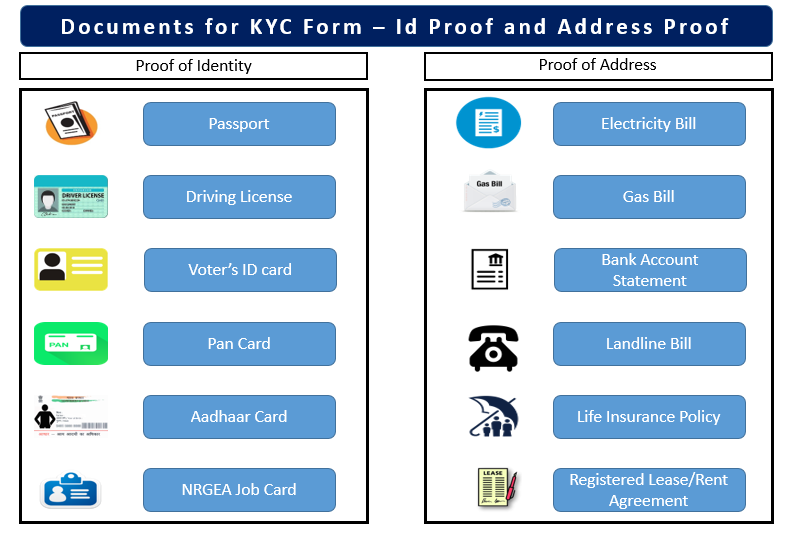

KYC process in banks Banks have to perform thorough investigation and identity verification before client onboarding in order to mitigate risk associated with money laundering. It enables a bank or the financial institution in validating the identity of its customers. The KYC procedure is used when bank customers open accounts. Opening bank account mutual fund account bank locker online investing in the mutual fund or gold your KYC should be updated with bank. KYC full form is Know Your Customer which refers to the process of identity and addresses verification of all customers and clients by banks insurance companies and other institutions either before or while they are conducting transactions with their customers. KYC compliance is required to open bank accounts Demat and trading accounts start fixed deposits or invest in mutual funds.

The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user.

Because money launderers and other criminals tend to use fraudulent identities during the onboarding process to mask their true identities KYC laws require financial institutions to get to know their customers by confirming to a high level of assurance that those customers are. KYC is a process that the RBI has made mandatory for financial institutions to carry out when verifying and authenticating a customers personal data. They do it with different levels of customer due diligence process depending on the risk profile of a potential client. The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user. KYC process in banks Banks have to perform thorough investigation and identity verification before client onboarding in order to mitigate risk associated with money laundering. These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes.

Source: devteam.space

Source: devteam.space

KYC establishes an investors identity address through relevant supporting documents such as prescribed photo id eg PAN card and address proof. The KYC procedure is used when bank customers open accounts. The KYC process helps financial entities verify that investments transactions are being made in a real persons name. There are many benefits to the KYC policy and these apply to eKYC as well. The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user.

Source: fincash.com

Source: fincash.com

About Encompass Since the launch of Encompass in 2012 weve been helping corporate investment banks fight financial crime and streamline their KYC processes to comply with AML regulations and requirements. It enables a bank or the financial institution in validating the identity of its customers. When a prospective customer individual trust or business entity wants to open an account and engage in a relationship with a bank or non-bank financial institution the front office sales or relationship manager initiates the anti-money laundering regulations with the know your customer KYC form. There are many benefits to the KYC policy and these apply to eKYC as well. The Know Your Client KYC process helps against money laundering.

Source: specitec.com

Source: specitec.com

KYC establishes an investors identity address through relevant supporting documents such as prescribed photo id eg PAN card and address proof. The Know Your Client or Know Your Customer is a standard in the investment industry that ensures investment advisors know detailed information about their clients risk tolerance investment. As mentioned earlier it is a mandatory requirement and certain institutions also perform KYC checks periodically to update customer information. The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user. They do it with different levels of customer due diligence process depending on the risk profile of a potential client.

Source:

KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks. These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes. The Know Your Client KYC process helps against money laundering. This helps in banning money laundering activities and further fortify that the investment and deposit are made in the name of a real person not a fictitious one. KYC stands for Know your customer popularly known as KYC.

Source: ft.lk

Source: ft.lk

There are many benefits to the KYC policy and these apply to eKYC as well. KYC process in banks Banks have to perform thorough investigation and identity verification before client onboarding in order to mitigate risk associated with money laundering. The main reason to complete the KYC process is that it is absolutely vital for any banking or investment undertakings. The Know Your Client or Know Your Customer is a standard in the investment industry that ensures investment advisors know detailed information about their clients risk tolerance investment. KYC stands for Know Your Customer It is a process where banks obtain information about their customers identity thereby ensuring that bank services and government regulations not misused.

Source: youtube.com

Source: youtube.com

They do it with different levels of customer due diligence process depending on the risk profile of a potential client. These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes. KYC is a process that the RBI has made mandatory for financial institutions to carry out when verifying and authenticating a customers personal data. KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks. KYC compliance is required to open bank accounts Demat and trading accounts start fixed deposits or invest in mutual funds.

Source: tookitaki.ai

Source: tookitaki.ai

The main reason to complete the KYC process is that it is absolutely vital for any banking or investment undertakings. This helps cut down unlawful practices like money laundering fraud or financing illegal activities. The KYC procedure is used when bank customers open accounts. These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes. They do it with different levels of customer due diligence process depending on the risk profile of a potential client.

Source: arachnys.com

Source: arachnys.com

This helps in banning money laundering activities and further fortify that the investment and deposit are made in the name of a real person not a fictitious one. KYC is a process that the RBI has made mandatory for financial institutions to carry out when verifying and authenticating a customers personal data. KYC stands for Know Your Customer It is a process where banks obtain information about their customers identity thereby ensuring that bank services and government regulations not misused. As mentioned earlier it is a mandatory requirement and certain institutions also perform KYC checks periodically to update customer information. The KYC process helps financial entities verify that investments transactions are being made in a real persons name.

Source: finextra.com

Source: finextra.com

KYC establishes an investors identity address through relevant supporting documents such as prescribed photo id eg PAN card and address proof. It enables a bank or the financial institution in validating the identity of its customers. Prevent Money Laundering Activities Money laundering is the process of transforming the proceeds of crime and corruption into legitimate assets. KYC compliance is required to open bank accounts Demat and trading accounts start fixed deposits or invest in mutual funds. The KYC procedure is used when bank customers open accounts.

Source: status200.net

Source: status200.net

These client-onboarding processes help prevent and identify money laundering terrorism financing and other illegal corruption schemes. The KYC process helps financial entities verify that investments transactions are being made in a real persons name. This helps in banning money laundering activities and further fortify that the investment and deposit are made in the name of a real person not a fictitious one. KYC stands for Know your customer popularly known as KYC. Because money launderers and other criminals tend to use fraudulent identities during the onboarding process to mask their true identities KYC laws require financial institutions to get to know their customers by confirming to a high level of assurance that those customers are.

Source: mckinsey.com

Source: mckinsey.com

When a prospective customer individual trust or business entity wants to open an account and engage in a relationship with a bank or non-bank financial institution the front office sales or relationship manager initiates the anti-money laundering regulations with the know your customer KYC form. The main reason to complete the KYC process is that it is absolutely vital for any banking or investment undertakings. This helps in banning money laundering activities and further fortify that the investment and deposit are made in the name of a real person not a fictitious one. The customer identification should entail verification through an introductory reference from an existing account holder a person known to the bank or on the basis of documents provided by the customer. The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user.

Source: specitec.com

Source: specitec.com

KYC establishes an investors identity address through relevant supporting documents such as prescribed photo id eg PAN card and address proof. About Encompass Since the launch of Encompass in 2012 weve been helping corporate investment banks fight financial crime and streamline their KYC processes to comply with AML regulations and requirements. Digital KYC records demonstrate compliance to regulators and auditors and seamlessly integrate with CLMs and CRMs for a more streamlined KYC and AML compliance process. Because money launderers and other criminals tend to use fraudulent identities during the onboarding process to mask their true identities KYC laws require financial institutions to get to know their customers by confirming to a high level of assurance that those customers are. KYC compliance is required to open bank accounts Demat and trading accounts start fixed deposits or invest in mutual funds.

Source: quora.com

KYC is an acronym for Know Your Customer. Is a general term for the process used for identification of a customer whenever heshe opens an account with a financial entity. Digital KYC records demonstrate compliance to regulators and auditors and seamlessly integrate with CLMs and CRMs for a more streamlined KYC and AML compliance process. The Know Your Client KYC process helps against money laundering. The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is kyc process in investment banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.