16++ What is kyc process in bank ideas in 2021

Home » money laundering Info » 16++ What is kyc process in bank ideas in 2021Your What is kyc process in bank images are available in this site. What is kyc process in bank are a topic that is being searched for and liked by netizens now. You can Download the What is kyc process in bank files here. Find and Download all free vectors.

If you’re searching for what is kyc process in bank pictures information related to the what is kyc process in bank interest, you have visit the ideal site. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

What Is Kyc Process In Bank. KYC Know Your Customer is one of such requirements in which banks and other financial institutions have to adhere to certain guidelines for the verification identification and authentication of their clients. To make your bank account KYC compliant you just have to follow the guidelines from the bank. KYC includes knowing an individual acting on behalf of an organization In 2016 the US. The obtained information includes their identity details and addresses.

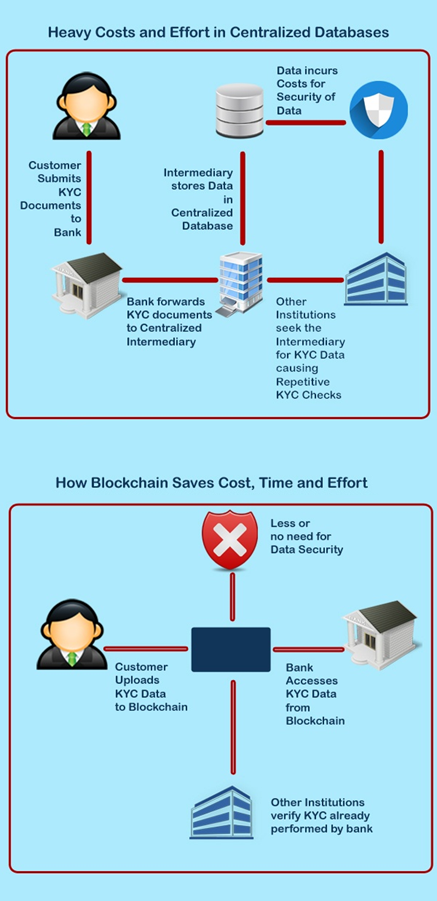

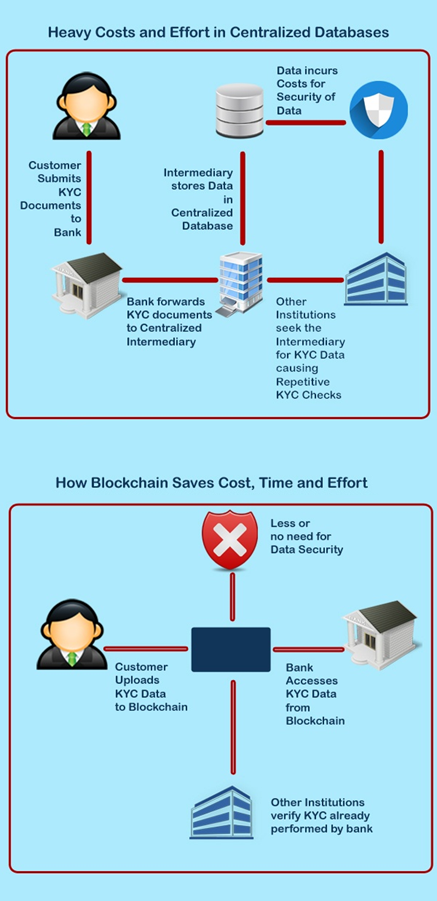

Kyc Using Blockchain By Anupama Jinde By Sukant Khurana The Startup Medium From medium.com

Kyc Using Blockchain By Anupama Jinde By Sukant Khurana The Startup Medium From medium.com

Effective KYC involves knowing a customers identity their financial activities and the risk they pose. KYC Know Your Customer is one of such requirements in which banks and other financial institutions have to adhere to certain guidelines for the verification identification and authentication of their clients. It ensures that there is no misuse of the banks services. KYC and inclusion of biometrics to improve the KYC process in banks will be our points of discussion in the subsequent sections. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. Generally the KYC process works in three steps.

Know Your Customer KYC refers to the process institutions use to verify the identities of their customers and ascertain what fraud risks they may pose.

KYC includes knowing an individual acting on behalf of an organization In 2016 the US. Government issued a rule requiring banks to verify the identities of beneficial owners of legal entity clients such as corporations LLCs partnerships unincorporated non-profits and statutory trusts. Customer Identification Program CIP Customer due diligence. What is Know Your Client KYC. KYC stands for Know Your Customer. KYC Know Your Customer is one of such requirements in which banks and other financial institutions have to adhere to certain guidelines for the verification identification and authentication of their clients.

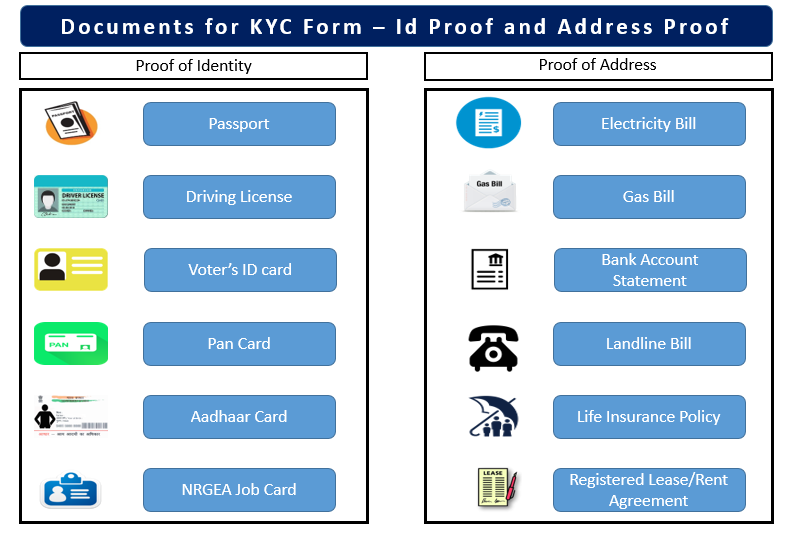

Source: fincash.com

Source: fincash.com

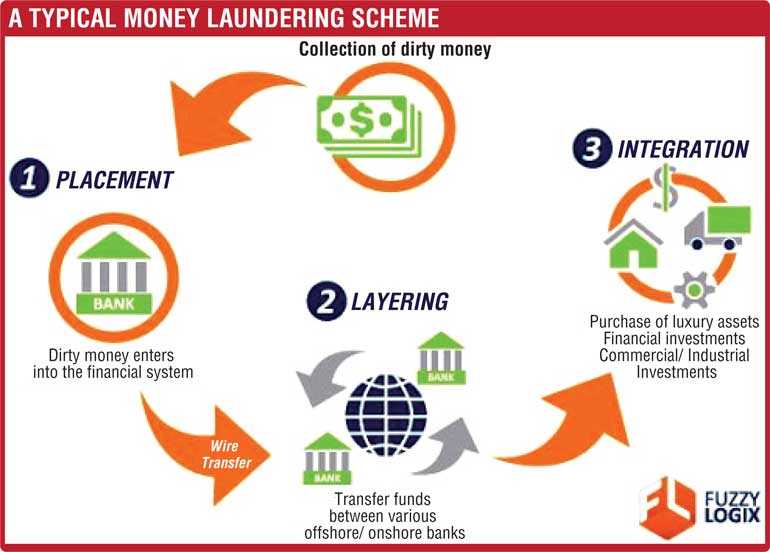

This stops fraudsters who try to imitate or forge identities for financial crimes. KYC Know Your Customer or Know Your Client is the principle for the operation of financial institutions. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts. The goal of KYC is to prevent banks from being used intentionally or. KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks.

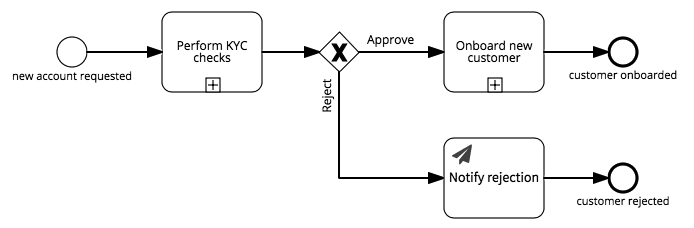

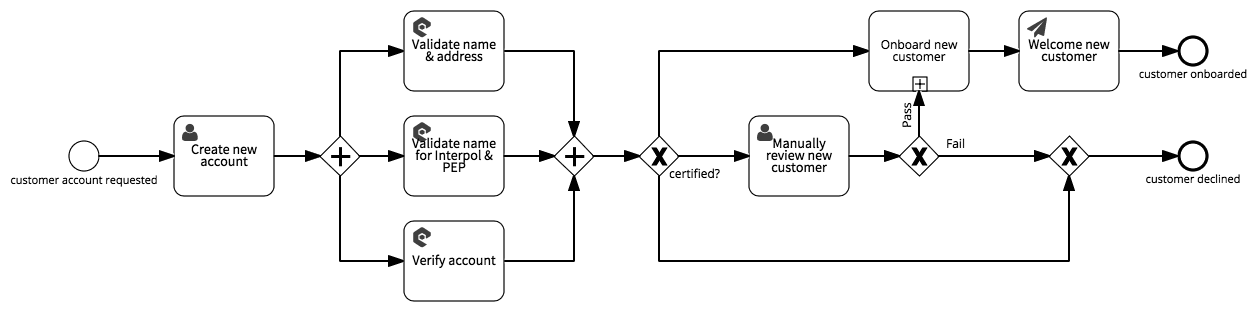

Source: processmaker.com

Source: processmaker.com

The goal of KYC is to prevent banks from being used intentionally or. Initially KYC laws were incorporated and introduced in 2001 as part of the Patriot Act passed to help prevent and monitor terrorist activities. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. The goal of KYC is to prevent banks from being used intentionally or. KYC stands for Know Your Customer It is a process where banks obtain information about their customers identity thereby ensuring that bank services and government regulations not misused.

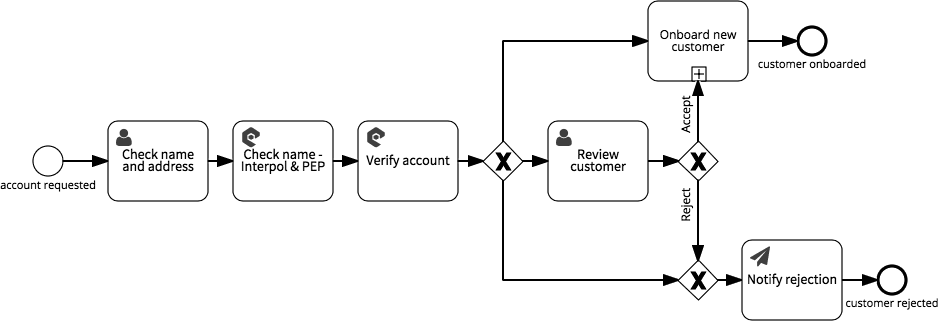

Source: signavio.com

Source: signavio.com

It is the first step in a customer relationship with a company. Government issued a rule requiring banks to verify the identities of beneficial owners of legal entity clients such as corporations LLCs partnerships unincorporated non-profits and statutory trusts. There are many benefits to the KYC policy and these apply to eKYC as well. KYC or Know Your Customer is an identity verification process that all financial institutions perform to ensure fraudsters stay away from the company. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts.

Source: signavio.com

Source: signavio.com

It ensures that there is no misuse of the banks services. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. It ensures that there is no misuse of the banks services. KYC stands for Know Your Customer It is a process where banks obtain information about their customers identity thereby ensuring that bank services and government regulations not misused. This stops fraudsters who try to imitate or forge identities for financial crimes.

Source: medium.com

Source: medium.com

KYC has become a prerequisite for accessing many banking services and other sectors over the past 15 years. KYC is a regulatory process of ascertaining the identity and other information of a financial services user. Customer Identification Program CIP Customer due diligence. There are many benefits to the KYC policy and these apply to eKYC as well. KYC Know Your Customer related practices are especially relevant in user and clients relationships with business.

Source: finextra.com

Source: finextra.com

The goal of KYC is to prevent banks from being used intentionally or. The KYC procedure is used when bank customers open accounts. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts. The Know Your Client KYC or Know Your Customer KYC is a process to verify the identity and other credentials of a financial services user. This stops fraudsters who try to imitate or forge identities for financial crimes.

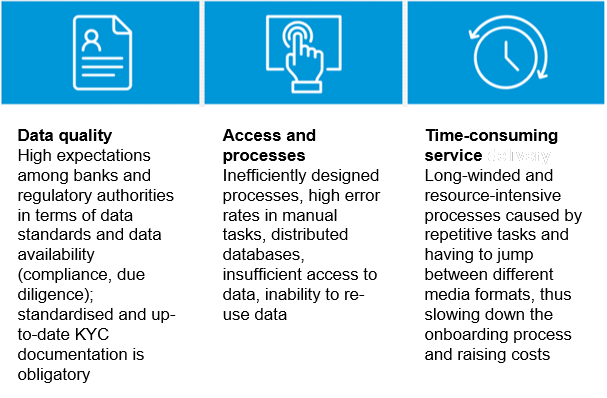

Source: blog.gft.com

Source: blog.gft.com

Banks cannot escape the mandatory KYC process of verifying customers. KYC process in banks is used to obtain information about the customer with their consent. KYC is a process that the RBI has made mandatory for financial institutions to carry out when verifying and authenticating a customers personal data. The obtained information includes their identity details and addresses. KYC procedures defined by banks involve all the necessary actions to ensure their customers are real assess and monitor risks.

Source: researchgate.net

Source: researchgate.net

KYC has become a prerequisite for accessing many banking services and other sectors over the past 15 years. KYC and inclusion of biometrics to improve the KYC process in banks will be our points of discussion in the subsequent sections. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts. KYC Know Your Customer or Know Your Client is the principle for the operation of financial institutions. It is the first step in a customer relationship with a company.

Source: processmaker.com

Source: processmaker.com

KYC is a process that the RBI has made mandatory for financial institutions to carry out when verifying and authenticating a customers personal data. KYC Know Your Customer related practices are especially relevant in user and clients relationships with business. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. KYC is a regulatory process of ascertaining the identity and other information of a financial services user. Initially KYC laws were incorporated and introduced in 2001 as part of the Patriot Act passed to help prevent and monitor terrorist activities.

Source: ft.lk

Source: ft.lk

KYC is also a mandatory process to periodically identify and verify the customers identity when opening an account and over time. The premise is that knowing your customers performing identity verification reviewing their financial activities and assessing their risk factors can keep money laundering terrorism financing and other types. KYC is also a mandatory process to periodically identify and verify the customers identity when opening an account and over time. KYC process in banks is used to obtain information about the customer with their consent. KYC is also meaning know your client.

Source: signavio.com

Source: signavio.com

KYC is also meaning know your client. Government issued a rule requiring banks to verify the identities of beneficial owners of legal entity clients such as corporations LLCs partnerships unincorporated non-profits and statutory trusts. KYC or Know Your Customer is an identity verification process that all financial institutions perform to ensure fraudsters stay away from the company. KYC includes knowing an individual acting on behalf of an organization In 2016 the US. The goal of KYC is to prevent banks from being used intentionally or.

Source: quora.com

KYC Know Your Customer or Know Your Client is the principle for the operation of financial institutions. KYC is also a mandatory process to periodically identify and verify the customers identity when opening an account and over time. The goal of KYC is to prevent banks from being used intentionally or. This stops fraudsters who try to imitate or forge identities for financial crimes. Know Your Customer KYC regulations are a critical component to anti-money laundering efforts.

Source: cryptomathic.com

Source: cryptomathic.com

Generally the KYC process works in three steps. KYC is a process that the RBI has made mandatory for financial institutions to carry out when verifying and authenticating a customers personal data. KYC and inclusion of biometrics to improve the KYC process in banks will be our points of discussion in the subsequent sections. There are many benefits to the KYC policy and these apply to eKYC as well. KYC Know Your Customer or Know Your Client is the principle for the operation of financial institutions.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is kyc process in bank by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.