13++ What is kyc process in accenture info

Home » money laundering Info » 13++ What is kyc process in accenture infoYour What is kyc process in accenture images are ready in this website. What is kyc process in accenture are a topic that is being searched for and liked by netizens today. You can Download the What is kyc process in accenture files here. Download all free images.

If you’re looking for what is kyc process in accenture images information linked to the what is kyc process in accenture keyword, you have pay a visit to the right blog. Our website frequently gives you hints for viewing the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

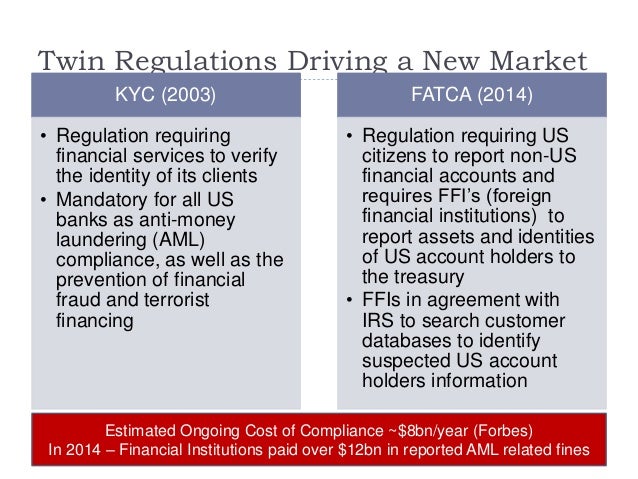

What Is Kyc Process In Accenture. Adverse media screening also known as negative news screening is the interrogation of public data sources and third-party data sources for negative news or broadcasts associated with an individual or company. We believe there is a better way. Name matching against lists of known parties such as PEP Fraud detection - determination of the customers risk in terms of propensity to commit money laundering terrorist finance or identity theft. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process.

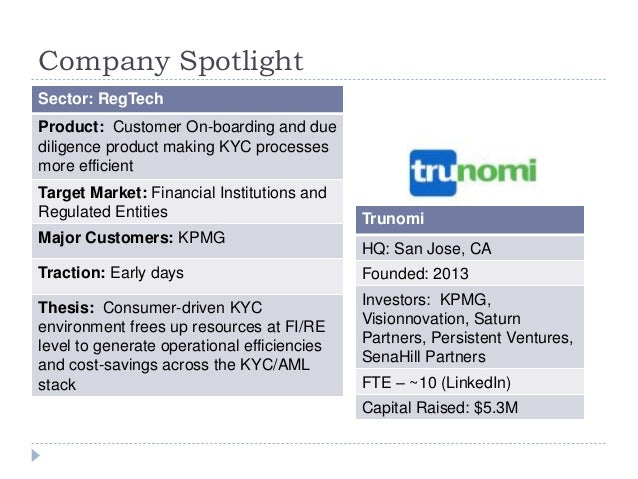

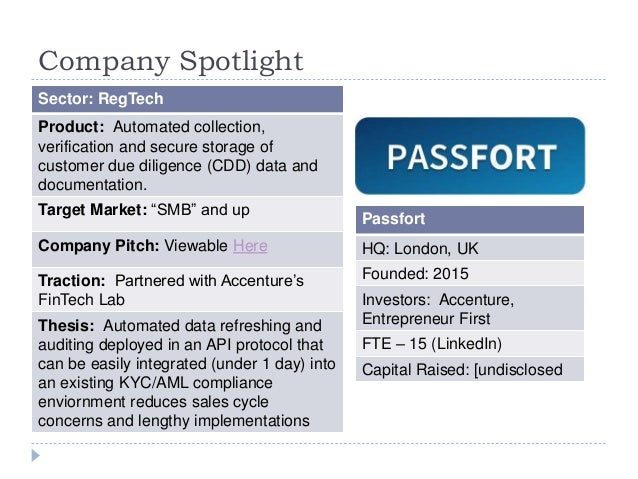

Custody Banking And Emerging Kyc Needs From slideshare.net

Custody Banking And Emerging Kyc Needs From slideshare.net

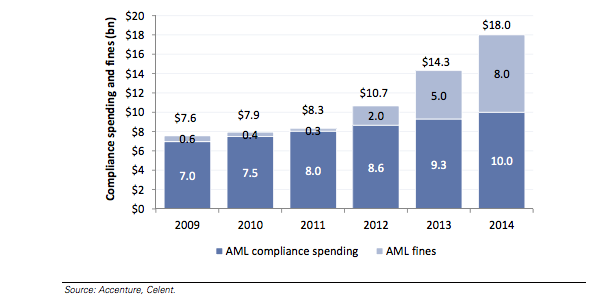

Know Your Customer KYC is a process of verifying a clients identity. Collection and analysis of basic identity information CIP. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. Since the passing of. Accenture has seen multiple use cases in these areas. Six steps to KYC transformation.

Once you are on bench the first thing you should do is update your profile on the Accenture internal portals like myScheduling IJP People etc.

Since the passing of. KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. Accenture has an industry leading Financial Crimes and AML group. Verifying a customers identity is achieved by assessing the customers personal information the nature of the customers business and establishing the beneficial ownership. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process. The customer identification procedure is the process of identifying the customer by documents and available information so as to be compliant to AMLKYC laws.

Source: slideshare.net

Source: slideshare.net

After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating. We believe there is a better way. Accenture has an industry leading Financial Crimes and AML group. Evolving Anti-Money Laundering AML and Know Your Customer KYC functions into a data-driven intelligent managed services operating model. All co-workers are expected to contribute to maintaining improving the KYC processes and tools.

Source: slideshare.net

Source: slideshare.net

With this model in play we think companies can cost-effectively keep pace with regulatory demand deliver strategic guidance and power growth. The Analyst KYC is responsible for the completeness of the legal client files by maintaining monitoring closing files and performing preparatory work for the revision of files. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. Know Your Customer KYC is a process of verifying a clients identity. All co-workers are expected to contribute to maintaining improving the KYC processes and tools.

Source: bi.go.id

Source: bi.go.id

After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating. Know Your Customer KYC is a process of verifying a clients identity. KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. Specifically unfavourable means anyone with political or criminal connections or with a history that otherwise deems them to be high risk for your company. Accentures report The Best Defense is Good Compliance.

Source: slideshare.net

Source: slideshare.net

Specifically unfavourable means anyone with political or criminal connections or with a history that otherwise deems them to be high risk for your company. Also you would be getting a demand sheet in email everyday thats sent to all those who are on bench. Processes Accenture encourages financial institutions to take a more long-term and sustainable approach to transforming their KYC programs. Adverse media screening can occur throughout the AMLKYC customer lifecycle including during onboarding refresh AML investigations and. Specifically unfavourable means anyone with political or criminal connections or with a history that otherwise deems them to be high risk for your company.

Source: financialservicesblog.accenture.com

Source: financialservicesblog.accenture.com

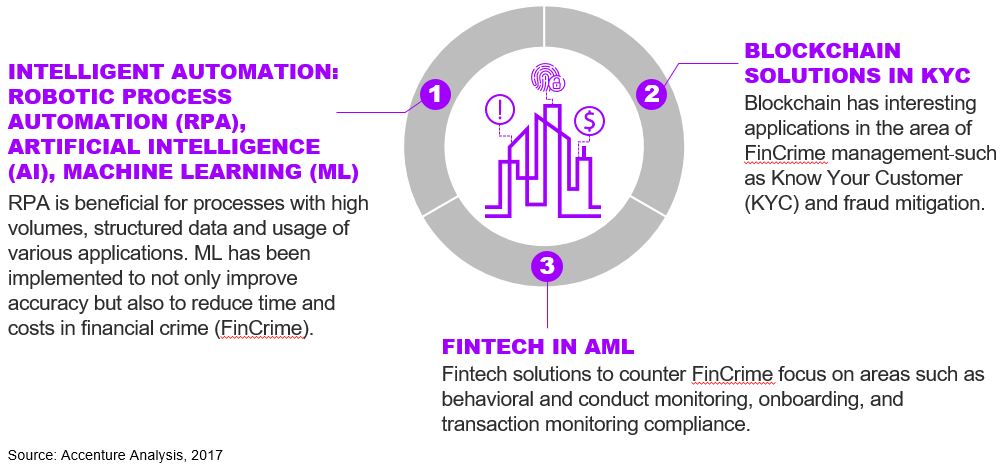

AML KYC Process Flow. A financial crime compliance approach that taps intelligent automation can reap the benefits of smart technologies such as higher quality investigations fewer false positives lower operating costs and higher efficiency overall. Also you would be getting a demand sheet in email everyday thats sent to all those who are on bench. Transforming the KYC function to maintain AML compliance manage costs and deliver a more effective customer experience. Know Your Customer Transformation describes our six-phase transformation process that offers benefits beyond mere compliance.

Source: slideshare.net

Source: slideshare.net

We believe there is a better way. Adverse media screening can occur throughout the AMLKYC customer lifecycle including during onboarding refresh AML investigations and. Accentures report The Best Defense is Good Compliance. Know Your Customer Transformation describes our six-phase transformation process that offers benefits beyond mere compliance. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship.

Source:

Know Your Customer KYC is a process of verifying a clients identity. Accenture has seen multiple use cases in these areas. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. Transforming the KYC function to maintain AML compliance manage costs and deliver a more effective customer experience. The KYC process should take place during onboarding to ensure that customers are being truthful about who they are and the business in which they are involved.

Source: karenhsumar.medium.com

Source: karenhsumar.medium.com

Also you would be getting a demand sheet in email everyday thats sent to all those who are on bench. KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. Know Your Customer Transformation describes our six-phase transformation process that offers benefits beyond mere compliance. Collection and analysis of basic identity information CIP. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering.

Source: slideshare.net

Source: slideshare.net

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process. The Analyst KYC is responsible for the completeness of the legal client files by maintaining monitoring closing files and performing preparatory work for the revision of files. Processes Accenture encourages financial institutions to take a more long-term and sustainable approach to transforming their KYC programs. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process. All co-workers are expected to contribute to maintaining improving the KYC processes and tools.

Source: slideshare.net

Source: slideshare.net

KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. In its simplest terms KYC means being able to tell the difference between favourable and unfavourable clients. Since the passing of. Adverse media screening also known as negative news screening is the interrogation of public data sources and third-party data sources for negative news or broadcasts associated with an individual or company.

Source: arachnys.com

Source: arachnys.com

Processes Accenture encourages financial institutions to take a more long-term and sustainable approach to transforming their KYC programs. Know Your Customer Transformation describes our six-phase transformation process that offers benefits beyond mere compliance. Processes Accenture encourages financial institutions to take a more long-term and sustainable approach to transforming their KYC programs. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process. Transforming the KYC function to maintain AML compliance manage costs and deliver a more effective customer experience.

Source: financialservicesblog.accenture.com

Source: financialservicesblog.accenture.com

Processes Accenture encourages financial institutions to take a more long-term and sustainable approach to transforming their KYC programs. After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating. KYC Know Your Customer is today a significant element in the fight against financial crime and money laundering and customer identification is the most critical aspect as it is the first step to better perform in the other stages of the process. Name matching against lists of known parties such as PEP Fraud detection - determination of the customers risk in terms of propensity to commit money laundering terrorist finance or identity theft. Evolving Anti-Money Laundering AML and Know Your Customer KYC functions into a data-driven intelligent managed services operating model.

Source: akabot.com

Source: akabot.com

Processes Accenture encourages financial institutions to take a more long-term and sustainable approach to transforming their KYC programs. Transforming the KYC function to maintain AML compliance manage costs and deliver a more effective customer experience. The Analyst KYC is responsible for the completeness of the legal client files by maintaining monitoring closing files and performing preparatory work for the revision of files. Job description 277906 - kyc in bangalore Process DetailsDocumentation Verification of Consumer and Business Banking accountInformation to validate customers in compliantwith KYC requirements - Validation of various regulatory documents submitted. An effective KYC transformation can achieve regulatory compliance while helping to reduce operational costs.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is kyc process in accenture by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.