17++ What is cft under kycaml regulations ideas

Home » money laundering idea » 17++ What is cft under kycaml regulations ideasYour What is cft under kycaml regulations images are ready. What is cft under kycaml regulations are a topic that is being searched for and liked by netizens today. You can Get the What is cft under kycaml regulations files here. Find and Download all free vectors.

If you’re searching for what is cft under kycaml regulations pictures information linked to the what is cft under kycaml regulations topic, you have visit the ideal site. Our site always provides you with hints for downloading the highest quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

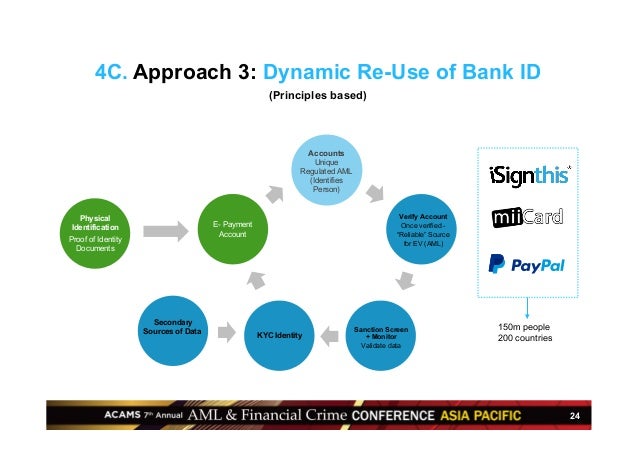

What Is Cft Under Kycaml Regulations. The introduction of new or tightened AMLCFT regulations may have the unintended and undesirable consequence of reducing the access of low-income people to formal financial services. CFT short for Counter Financing of Terrorism goes hand-in-hand with AML regulations. An Overview of KYC CFT and AML While each country has its respective laws that govern KYC CFT and AML practices these laws often lack specific standards. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

Kyc Vs Aml What Is The Difference From blog.complycube.com

Kyc Vs Aml What Is The Difference From blog.complycube.com

FinCEN is responsible for combating money laundering the financing of terrorism and other financial crimes by monitoring banks financial institutions and individuals and analyzing suspicious transactions and. According to regulators financial institutions will be given with clear guidelines it will just set the bar and theres a likelihood that they will settle on minimum requirements. The Commission is conscious that the requirements of the regulations and the rules will appear to be rather complex and onerous especially to firms which have not previously been subject to any form of AMLCFT regulation or supervision. Those activities cover the perpetration and facilitation of money laundering and the acquisition or. The introduction of new or tightened AMLCFT regulations may have the unintended and undesirable consequence of reducing the access of low-income people to formal financial services. KYC also known as Know Your Customer represents today a significant element in the banking industry especially when it comes to security Anti-Money Laundering AML and Countering of Financial Terrorism CFT.

Customer Onboarding Process Under KYC and AML Requirements Financial institutions have to comply with various AML CFT and KYC regulations in customer onboarding processes.

It should be noted that technically KYC regulations are part and parcel of AML too but they serve a more specific purpose. In short AML regulations are mainly to keep bad actors from taking advantage of cryptocurrencies. The introduction of new or tightened AMLCFT regulations may have the unintended and undesirable consequence of reducing the access of low-income people to formal financial services. In order to assist. The global AML and CFT landscape raised the stake for financial institutions worldwide forcing them to invest in extensive KYC processes and comply with PSD2 directive in the. Regulation 6 Internal Controls Policies Compliance Audit Training 13 Annexure I Minimum Documents to be obtained from Various Types of Customers under AMLCFT Regulations 16 Annexure II Examples or Characteristics of Suspicious Transactions Red Alerts that May be a Cause for Increased Scrutiny for AMLCFT Purposes 20.

Source: bi.go.id

Source: bi.go.id

Of course AML KYC and CFT regulations vary greatly in different jurisdictions which can lead to other issues as well. According to regulators financial institutions will be given with clear guidelines it will just set the bar and theres a likelihood that they will settle on minimum requirements. AMLCFT Regulations in the UK Proceeds of Crime Act. As a means to avoid this outcome this paper argues in favor of 1 gradual implementation of new measures. It should be noted that technically KYC regulations are part and parcel of AML too but they serve a more specific purpose.

Source: bi.go.id

Source: bi.go.id

You must document the customer identification procedures you use for different types of customers. As a means to avoid this outcome this paper argues in favor of 1 gradual implementation of new measures. 2 the adoption of a risk-based approach to regulation. Regulation 6 Internal Controls Policies Compliance Audit Training 13 Annexure I Minimum Documents to be obtained from Various Types of Customers under AMLCFT Regulations 16 Annexure II Examples or Characteristics of Suspicious Transactions Red Alerts that May be a Cause for Increased Scrutiny for AMLCFT Purposes 20. Commission or comply with the Regulations and the rules in the Handbooks.

Source: slideshare.net

Source: slideshare.net

As a means to avoid this outcome this paper argues in favor of 1 gradual implementation of new measures. The Anti-Money Laundering Combating the Financing of Terrorism Policy AMFCFT Policy sets out the guidelines for FMDQs compliance with AMLCFT obligations under the law as well as regulatory directives and actively prevents any transaction that facilitates criminal activities. CFT short for Counter Financing of Terrorism goes hand-in-hand with AML regulations. In order to assist. The level of implementation required for compliance can differ and some the standards in some jurisdictions may be far more relaxed than others.

Source: blog.tremend.com

Source: blog.tremend.com

Of course AML KYC and CFT regulations vary greatly in different jurisdictions which can lead to other issues as well. According to regulators financial institutions will be given with clear guidelines it will just set the bar and theres a likelihood that they will settle on minimum requirements. Customer Onboarding Process Under KYC and AML Requirements Financial institutions have to comply with various AML CFT and KYC regulations in customer onboarding processes. And 3 the use of exemptions. CFT short for Counter Financing of Terrorism goes hand-in-hand with AML regulations.

Source: blog.complycube.com

Source: blog.complycube.com

The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose. An Overview of KYC CFT and AML While each country has its respective laws that govern KYC CFT and AML practices these laws often lack specific standards. The global AML and CFT landscape raised the stake for financial institutions worldwide forcing them to invest in extensive KYC processes and comply with PSD2 directive in the. The CSSF has all the supervisory and investigatory powers provided for in the Law of 12 November 2004 on the fight against money laundering and terrorist financing AMLCTF Law and in various sectorial laws for the purpose of carrying out its duties. The introduction of new or tightened AMLCFT regulations may have the unintended and undesirable consequence of reducing the access of low-income people to formal financial services.

The Financial Crimes Enforcement Network FinCEN is the primary AMLCFT regulator in the United States and operates under the authority of the United States Treasury Department. AMLCFT Regulations in the UK Proceeds of Crime Act. The level of implementation required for compliance can differ and some the standards in some jurisdictions may be far more relaxed than others. The CSSF has all the supervisory and investigatory powers provided for in the Law of 12 November 2004 on the fight against money laundering and terrorist financing AMLCTF Law and in various sectorial laws for the purpose of carrying out its duties. According to Anti Money Laundering and Know Your Customer KYC regulations financial institutions must apply a risk assessment to their new customers.

Source: coinmod.com

Source: coinmod.com

The CSSF has all the supervisory and investigatory powers provided for in the Law of 12 November 2004 on the fight against money laundering and terrorist financing AMLCTF Law and in various sectorial laws for the purpose of carrying out its duties. KYC also known as Know Your Customer represents today a significant element in the banking industry especially when it comes to security Anti-Money Laundering AML and Countering of Financial Terrorism CFT. 2 the adoption of a risk-based approach to regulation. In order to assist. In short AML regulations are mainly to keep bad actors from taking advantage of cryptocurrencies.

Source: bi.go.id

Source: bi.go.id

Customer Onboarding Process Under KYC and AML Requirements Financial institutions have to comply with various AML CFT and KYC regulations in customer onboarding processes. Aml cft and kyc procedure The following policy has been derived from the general principles laws regulations and directives for combating money laundering. Customer Onboarding Process Under KYC and AML Requirements Financial institutions have to comply with various AML CFT and KYC regulations in customer onboarding processes. Commission or comply with the Regulations and the rules in the Handbooks. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose.

Source: blog.complycube.com

Source: blog.complycube.com

KadoCapital is taking security measures and has adopted policies practices and procedures that promote high ethical and professional standards and prevent KadoCapital from being used intentionally or unintentionally by criminal elements. FinCEN is responsible for combating money laundering the financing of terrorism and other financial crimes by monitoring banks financial institutions and individuals and analyzing suspicious transactions and. And 3 the use of exemptions. AMLCFT Regulations in the UK Proceeds of Crime Act. The level of implementation required for compliance can differ and some the standards in some jurisdictions may be far more relaxed than others.

Source: datalog-finance.com

Source: datalog-finance.com

Customer Onboarding Process Under KYC and AML Requirements Financial institutions have to comply with various AML CFT and KYC regulations in customer onboarding processes. According to Anti Money Laundering and Know Your Customer KYC regulations financial institutions must apply a risk assessment to their new customers. The difference between AML and KYC is that AML anti-money laundering is an umbrella term for the range of regulatory processes firms must have in place whereas KYC Know Your Customer is a component part of AML that consists of firms verifying their customers identity. KadoCapital is taking security measures and has adopted policies practices and procedures that promote high ethical and professional standards and prevent KadoCapital from being used intentionally or unintentionally by criminal elements. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

Source: in.pinterest.com

Source: in.pinterest.com

According to regulators financial institutions will be given with clear guidelines it will just set the bar and theres a likelihood that they will settle on minimum requirements. The global AML and CFT landscape raised the stake for financial institutions worldwide forcing them to invest in extensive KYC processes and comply with PSD2 directive in the. KYC also known as Know Your Customer represents today a significant element in the banking industry especially when it comes to security Anti-Money Laundering AML and Countering of Financial Terrorism CFT. What is Combating the Financing of Terrorism CFT. You must document the customer identification procedures you use for different types of customers.

Source: slideshare.net

Source: slideshare.net

What is Combating the Financing of Terrorism CFT. Those activities cover the perpetration and facilitation of money laundering and the acquisition or. Of course AML KYC and CFT regulations vary greatly in different jurisdictions which can lead to other issues as well. 2 the adoption of a risk-based approach to regulation. And 3 the use of exemptions.

Source: pinterest.com

Source: pinterest.com

The Anti-Money Laundering Combating the Financing of Terrorism Policy AMFCFT Policy sets out the guidelines for FMDQs compliance with AMLCFT obligations under the law as well as regulatory directives and actively prevents any transaction that facilitates criminal activities. In order to assist. The procedures you use must be based on the level of money launderingterrorism financing risk that different customers pose. The CSSF has all the supervisory and investigatory powers provided for in the Law of 12 November 2004 on the fight against money laundering and terrorist financing AMLCTF Law and in various sectorial laws for the purpose of carrying out its duties. Regulation 6 Internal Controls Policies Compliance Audit Training 13 Annexure I Minimum Documents to be obtained from Various Types of Customers under AMLCFT Regulations 16 Annexure II Examples or Characteristics of Suspicious Transactions Red Alerts that May be a Cause for Increased Scrutiny for AMLCFT Purposes 20.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is cft under kycaml regulations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.