10++ What is cdd in kyc process ideas

Home » money laundering Info » 10++ What is cdd in kyc process ideasYour What is cdd in kyc process images are available in this site. What is cdd in kyc process are a topic that is being searched for and liked by netizens today. You can Find and Download the What is cdd in kyc process files here. Download all free photos and vectors.

If you’re searching for what is cdd in kyc process pictures information connected with to the what is cdd in kyc process topic, you have come to the right blog. Our website always gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

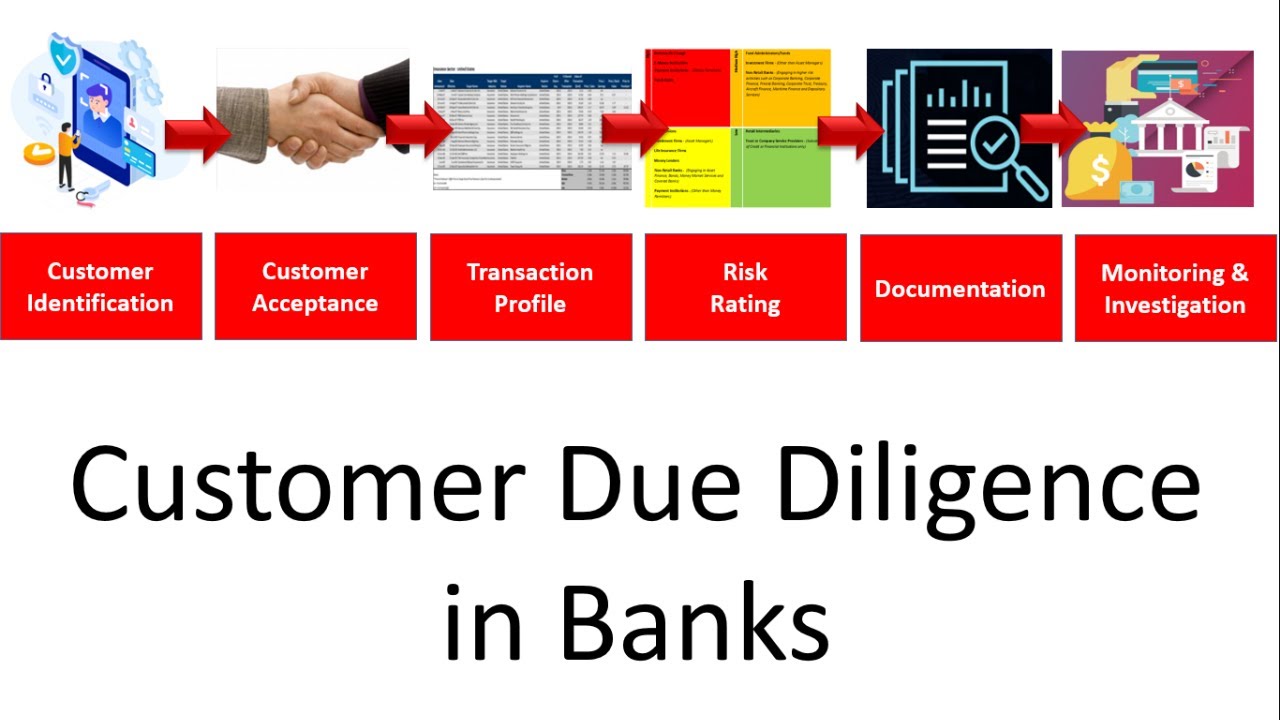

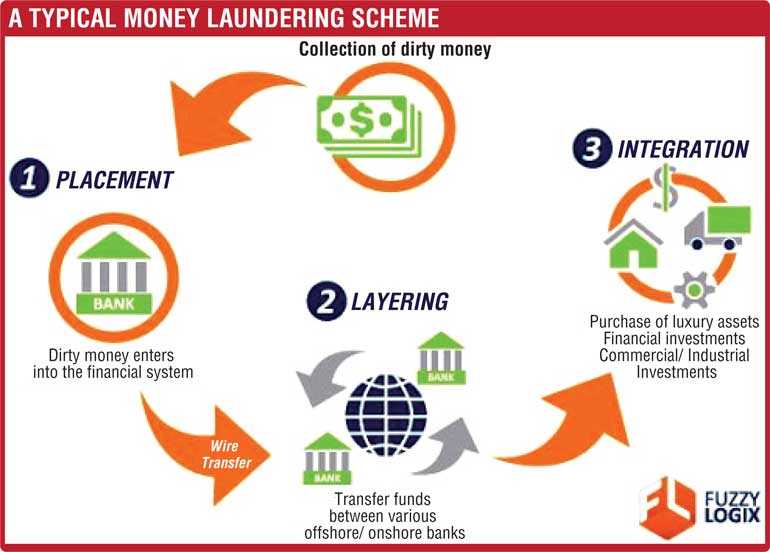

What Is Cdd In Kyc Process. CDD regulations include KYC onboarding. Customer due diligence CDD KYC involves a background check of the customer to analyze the risk they might bring about to the bank or financial institution. It is a part of the client onboarding solution to ensure that the said customer is actually revealing all of hisher assets. According to Wikipedia KYC is is the process of a business verifying the identity of its clients and assessing the potential risks of illegal intentions for the business relationship.

CDD regulations include KYC onboarding. The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. In simple terms Know Your Customer KYC is about demonstrating Customer Due Diligence CDD ie. Customer Due Diligence is a form of a know your customer inventory in the literal sense of the word. Know your Customer checks are performed on initial customer onboarding stages.

Simplified Customer Due Diligence or CDD.

CDD is a compulsory requirement for all financial institutions and business covered by anti-money laundering regulations that enter into a business relationship with a customer. This level of due diligence does not require an in-depth screening. Know your customer KYC and Customer Due Diligence CDD is an effective way safeguard against financial crimes as these processes can. EU member states must implement the directive within two years. At KYC-Chain were using our blog to help educate business owners and provide sophisticated compliance software to automate much of the customer due diligence process. There are some slight variations in how compliance officers use the term KYC vs.

Source: justcoded.com

Source: justcoded.com

Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. CIP CDD and EDD as presented in the diagram below. When some compliance officers refer to KYC they are referring to three key phases in the overall AML onboarding lifecycle. Risk assessment and management due diligence part of the KYC process Ongoing monitoring and record-keeping. What is Customer Due Diligence.

Source: youtube.com

Source: youtube.com

CDD is the requirement in many jurisdictions and applies to financial institutions as well as to crypto business ex. The application of Customer Due Diligence CDD is required when companies with AML processes enter a business relationship with a customer or a potential customer to assess their risk profile and verify their identity. CDD is a compulsory requirement for all financial institutions and business covered by anti-money laundering regulations that enter into a business relationship with a customer. Know your Customer checks are performed on initial customer onboarding stages. CDD across the financial industry.

Source: ft.lk

Source: ft.lk

CIP CDD and EDD as presented in the diagram below. At KYC-Chain were using our blog to help educate business owners and provide sophisticated compliance software to automate much of the customer due diligence process. CDD is no longer the simple matter first outlined in the Securities Act of 1933 but has become a multi-faceted compliance maze which is increasingly difficult to traverse. It is a part of the client onboarding solution to ensure that the said customer is actually revealing all of hisher assets. Know your Customer checks are performed on initial customer onboarding stages.

Source: getid.ee

Source: getid.ee

In many cases there is a need for both CDD and KYC Know Your Customer information in order to get a proper overview of the clients risk profile and simultaneously verify their identity. KYC is about demonstrating that you have done your CDD. Know your customer KYC and Customer Due Diligence CDD is an effective way safeguard against financial crimes as these processes can. After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating. CDD is the requirement in many jurisdictions and applies to financial institutions as well as to crypto business ex.

Source: shuftipro.com

Source: shuftipro.com

After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating. Customer due diligence CDD KYC involves a background check of the customer to analyze the risk they might bring about to the bank or financial institution. The application of Customer Due Diligence CDD is required when companies with AML processes enter a business relationship with a customer or a potential customer to assess their risk profile and verify their identity. However this is not entirely correct. What is CDD platform.

Source: getid.ee

Source: getid.ee

Know your customer KYC and Customer Due Diligence CDD is an effective way safeguard against financial crimes as these processes can. What is CDD platform. Put simply CDD is the act of performing background checks on the. Client Due Diligence CDD Now trade sanction checking is an integral part of client onboarding as failure to comply with trade sanctions is a strict liability offence where no rationale for a breach is entertained by relevant authorities and an essential part of Client Due Diligence CDD. The KYC process mostly used by banks and financial.

Source: advisoryhq.com

Source: advisoryhq.com

CDD is no longer the simple matter first outlined in the Securities Act of 1933 but has become a multi-faceted compliance maze which is increasingly difficult to traverse. Know your Customer checks are performed on initial customer onboarding stages. Both KYC and CDD are integral to the AML process. Risk assessment and management due diligence part of the KYC process Ongoing monitoring and record-keeping. Know your customer KYC and Customer Due Diligence CDD is an effective way safeguard against financial crimes as these processes can.

Put simply CDD is the act of performing background checks on the. CIP CDD and EDD as presented in the diagram below. CDD across the financial industry. Put simply CDD is the act of performing background checks on the. At KYC-Chain were using our blog to help educate business owners and provide sophisticated compliance software to automate much of the customer due diligence process.

Source: processmaker.com

Source: processmaker.com

There are some slight variations in how compliance officers use the term KYC vs. This level of due diligence does not require an in-depth screening. Customer due diligence CDD KYC involves a background check of the customer to analyze the risk they might bring about to the bank or financial institution. Stricter Customer Due Diligence CDD Control customer identity and share data with central administration. In practice Customer Due Diligence CDD and Know Your Customer KYC are often regarded as similar processes.

CDD is the requirement in many jurisdictions and applies to financial institutions as well as to crypto business ex. The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. CDD Customer Due Diligence is the process of a business verifying the identity of its clients and assessing the potential risks to the business relationship. A basic KYC process with customer background checks to measure the risk they pose before dealing with them. CDD across the financial industry.

The KYC policy is a mandatory framework for banks and financial institutions used for the customer identification process. CDD is the requirement in many jurisdictions and applies to financial institutions as well as to crypto business ex. In practice Customer Due Diligence CDD and Know Your Customer KYC are often regarded as similar processes. What are the regulations around CDD. However this is not entirely correct.

Source: advisoryhq.com

Source: advisoryhq.com

Know Your Customer KYC is the process of identifying an individual or corporation before entering into a business relationship. KYC is about demonstrating that you have done your CDD. Verifying the identity of a customer. The application of Customer Due Diligence CDD is required when companies with AML processes enter a business relationship with a customer or a potential customer to assess their risk profile and verify their identity. The business KYC procedure describes what tasks are necessary to perform before the business can credibly say that they know their client.

Source: advisoryhq.com

Source: advisoryhq.com

Simplified Customer Due Diligence or CDD. Put simply CDD is the act of performing background checks on the. Customer Due Diligence is a form of a know your customer inventory in the literal sense of the word. Risk assessment and management due diligence part of the KYC process Ongoing monitoring and record-keeping. CDD is no longer the simple matter first outlined in the Securities Act of 1933 but has become a multi-faceted compliance maze which is increasingly difficult to traverse.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is cdd in kyc process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.