12+ What influence does money laundering have on economic development info

Home » money laundering Info » 12+ What influence does money laundering have on economic development infoYour What influence does money laundering have on economic development images are ready in this website. What influence does money laundering have on economic development are a topic that is being searched for and liked by netizens now. You can Get the What influence does money laundering have on economic development files here. Download all royalty-free images.

If you’re looking for what influence does money laundering have on economic development pictures information related to the what influence does money laundering have on economic development keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

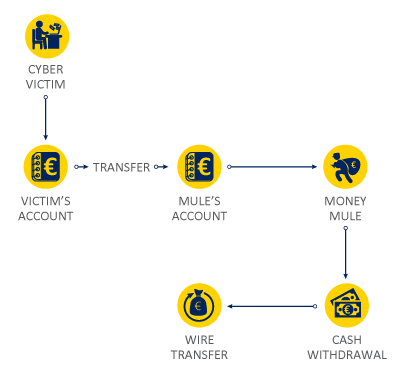

What Influence Does Money Laundering Have On Economic Development. Money laundering and terrorist financing can have devastating consequences on economic security and social aspects. What influence does money laundering have on economic development. While these crimes can occur in any country they have particularly important economic and social consequences for developing countries or in emerging markets and countries with fragile financial systems. People launder money by putting away their gains into multiple bank accounts with a series of complex transactions.

Understand The Background Of Role Of Entrepreneur In Economic Development Now Role Of Entrepreneur In Economi Entrepreneur Economic Development Understanding From pinterest.com

Understand The Background Of Role Of Entrepreneur In Economic Development Now Role Of Entrepreneur In Economi Entrepreneur Economic Development Understanding From pinterest.com

Economies with growing or developing financial centers but inadequate controls are particularly vulnerable as established financial center countries implement comprehensive anti-money laundering regimes. Money laundering is the criminals way of trying to. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of. Launderers are continuously looking for new routes for laundering their funds. It consists of various steps technique and approach of undertaking such unlawful activity. The professional skills internal auditors Suit for the war against money laundering.

Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of.

Money laundering has catastrophic effects on economies. While these crimes can occur in any country they have particularly important economic and social consequences for developing countries or in emerging markets and countries with fragile financial systems. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of. It stops the economic growth of a country. Money laundering has catastrophic effects on economies. This weakness is exploited by launderers as they are always looking for new routes to launder their funds.

Source: sciencedirect.com

Source: sciencedirect.com

It is basically illegal money. Money laundering and terrorist financing can have devastating consequences on economic security and social aspects. Money laundering harms financial sector institutions critical to economic growth. While these crimes can occur in any country they have particularly important economic and social consequences for developing countries or in emerging markets and countries with fragile financial systems. Launderers look for growing economies as these economies have inadequate anti-money laundering controls and regimes in place.

Source: researchgate.net

Source: researchgate.net

While these crimes can occur in any country they have particularly important economic and social consequences for developing countries or in emerging markets and countries with fragile financial systems. To increase the Aggregate Production Function technological enhancement have to be done in the economy. It consists of various steps technique and approach of undertaking such unlawful activity. Launderers look for growing economies as these economies have inadequate anti-money laundering controls and regimes in place. About the re-use of money laundering 80salary persons and 462 businessmen said that laundered money can be used for the welfare of the people of Pakistan20 538 said the laundered money cannot be used for the welfare of the people of Pakistan72 salary persons and 577 businessmen said that this money can be used in development.

Source: openknowledge.worldbank.org

Source: openknowledge.worldbank.org

Money Laundering is very vast in nature. It stops the economic growth of a country. Economies with growing or developing financial centres but inadequate controls are particularly vulnerable as established financial centre countries implement comprehensive anti-money laundering regimes. Most fundamentally money laundering is inextricably linked to the underlying criminal activity that generated it. Money laundering promotes crime and corruption that slows economic growth and decreases productivity in the real sector economy.

Source: sanctionscanner.com

Source: sanctionscanner.com

Money laundering has catastrophic effects on economies. Economies with growing or developing financial centres but inadequate controls are particularly vulnerable as established financial centre countries implement comprehensive anti-money laundering regimes. The Money laundering has negative effects on economic developmentMoney laundering constitutes a serious threat to national economies and respective governments. What influence does money laundering have on economic development. Launderers are continuously looking for new routes for laundering their funds.

Source: researchgate.net

Source: researchgate.net

It increased the outflow of capital exchange rate fluctuation. It increased the outflow of capital exchange rate fluctuation. Money laundering is the criminals way of trying to. It consists of various steps technique and approach of undertaking such unlawful activity. Money laundering is a problem both in the worlds major financial markets both in emerging markets.

Source: infinitysolutions.com

Source: infinitysolutions.com

Launderers are continuously looking for new routes for laundering their funds. Money laundering harms financial sector institutions critical to economic growth. Launderers are continuously looking for new routes for laundering their funds. Bartlett 2002 concluded that allowing money laundering activity to continue without any challenge is not a sound economic-development policy as it damages the financial institutes that are critical to economic growth reduces productivity in the economys real sector by diverting resources and encouraging crime and corruption and can distort the economys international trade and capital flows to the detriment of long-term economic development. Impact on economic development.

Source: researchgate.net

Source: researchgate.net

The Economic Cost of Money Laundering. About the re-use of money laundering 80salary persons and 462 businessmen said that laundered money can be used for the welfare of the people of Pakistan20 538 said the laundered money cannot be used for the welfare of the people of Pakistan72 salary persons and 577 businessmen said that this money can be used in development. Money laundering has negative side effects in the development of a country. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of. It consists of various steps technique and approach of undertaking such unlawful activity.

Source: sanctionscanner.com

Source: sanctionscanner.com

Bartlett 2002 concluded that allowing money laundering activity to continue without any challenge is not a sound economic-development policy as it damages the financial institutes that are critical to economic growth reduces productivity in the economys real sector by diverting resources and encouraging crime and corruption and can distort the economys international trade and capital flows to the detriment of long-term economic development. Bartlett 2002 concluded that allowing money laundering activity to continue without any challenge is not a sound economic-development policy as it damages the financial institutes that are critical to economic growth reduces productivity in the economys real sector by diverting resources and encouraging crime and corruption and can distort the economys international trade and capital flows to the detriment of long-term economic development. This weakness is exploited by launderers as they are always looking for new routes to launder their funds. The professional skills internal auditors Suit for the war against money laundering. It is basically illegal money.

Source: europol.europa.eu

Source: europol.europa.eu

The phenomenon of money laundering amongst other economic and financial crimes have had better success in infiltrating into the economic and political structures of most developing countries therefore resulting to economic digression and political instability. Money laundering and terrorist financing can have devastating consequences on economic security and social aspects. Launderers look for growing economies as these economies have inadequate anti-money laundering controls and regimes in place. Most fundamentally money laundering is inextricably linked to the underlying criminal activity that generated it. What influence does money laundering have on economic development.

Source: bi.go.id

Source: bi.go.id

In this day and age as technology increases exponentially so too does the potential for money laundering. The Money laundering has negative effects on economic developmentMoney laundering constitutes a serious threat to national economies and respective governments. What influence does money laundering have on economic development. Effects of Money Laundering on the Economy The purpose of the study concerned the impact of money laundering and its effects on the local economic and method of laundering technique in Mauritius. Launderers look for growing economies as these economies have inadequate anti-money laundering controls and regimes in place.

Source: researchgate.net

Source: researchgate.net

Money laundering promotes crime and corruption that slows economic growth and decreases productivity in the real sector economy. In this day and age as technology increases exponentially so too does the potential for money laundering. Economies with growing or developing financial centers but inadequate controls are particularly vulnerable as established financial center countries implement comprehensive anti-money laundering regimes. Innovation of new product and services improve the productivity of the economy. Money laundering threatens financial and economic systems in many countries and the international financial community should strongly support anti-money laundering efforts.

Source: regtechtimes.com

Source: regtechtimes.com

People launder money by putting away their gains into multiple bank accounts with a series of complex transactions. It increased the outflow of capital exchange rate fluctuation. People launder money by putting away their gains into multiple bank accounts with a series of complex transactions. The phenomenon of money laundering amongst other economic and financial crimes have had better success in infiltrating into the economic and political structures of most developing countries therefore resulting to economic digression and political instability. The Money laundering has negative effects on economic developmentMoney laundering constitutes a serious threat to national economies and respective governments.

Source: pinterest.com

Source: pinterest.com

Money laundering harms financial sector institutions critical to economic growth. Money laundering damages financial sector institutions that are critical for economic growth promoting crime and corruption that slow economic growth reducing efficiency in the real sector of. Economies with growing or developing financial centres but inadequate controls are particularly vulnerable as established financial centre countries implement comprehensive anti-money laundering regimes. What influence does money laundering have on economic development. The negative economic effects of money laundering on economic development are difficult to quantify yet it is clear that such activity damages the financial-sector institutions that are critical to economic growth reduces productivity in the economys real sector by diverting resources and encouraging crime and corruption which slow economic growth and can distort the economys external sector international.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what influence does money laundering have on economic development by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.