10+ What happens if form 8300 is filed ideas in 2021

Home » money laundering idea » 10+ What happens if form 8300 is filed ideas in 2021Your What happens if form 8300 is filed images are ready in this website. What happens if form 8300 is filed are a topic that is being searched for and liked by netizens now. You can Get the What happens if form 8300 is filed files here. Find and Download all free photos.

If you’re looking for what happens if form 8300 is filed images information linked to the what happens if form 8300 is filed keyword, you have visit the right site. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

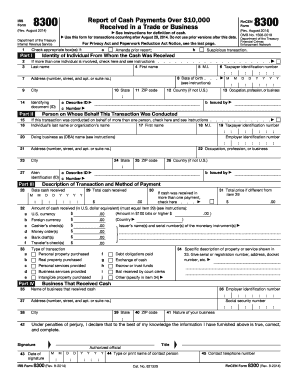

What Happens If Form 8300 Is Filed. When you file form 8300 you provide the IRS and FinCEN with tangible records of large cash transactions. Each time you receive a payment that meets the criteria for filing Form 8300 you must file the form for the transaction within 15 days of receiving the payment. What does the IRS do with forms 8300 they receive. If you report a cash transaction of 10000 or more on the Form 8300 you also have to tell the individual in writing that you made the report.

When And Why You Must File Irs Form 8300 Civic Tax Relief From civictaxrelief.com

When And Why You Must File Irs Form 8300 Civic Tax Relief From civictaxrelief.com

The IRS requires that you file Form 8300 within 15 days of receiving the money in a transaction. What does the IRS do with forms 8300 they receive. Instead of a personal credit card the customer pays the remaining 6000 with his ATM or debit card. Failing to do so will accrue you or your business penalties if the IRS finds out. In addition the filer must provide a statement to the person whose information was included in Form 8300. Failing to file Form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the IRS.

Failing to do so will accrue you or your business penalties if the IRS finds out.

Instead of a personal credit card the customer pays the remaining 6000 with his ATM or debit card. File electronically to avoid the snail mail issue the IRS marks Form 8300 received when they process the form not when its received in house If mailing mail via certified mail return receipt so that there is proof of mailing. IRS Form 8300 is Report of Cash Payments Over 10000 Received in a Trade or Business. No Form 8300 is required. Failing to do so will accrue you or your business penalties if the IRS finds out. Should a Form 8300 be filed.

Source: 8300-form.pdffiller.com

Source: 8300-form.pdffiller.com

When Do I File Form 8300. Structuring occurs when a customer makes multiple payments in an attempt to not pay more than 10000 at one time in order to avoid filing a Form 8300. The IRS requires any trade or business to file Form 8300 if theyve received any cash payments over 10000. If you receive more than 10000 in additional cash payments from that buyer within a 12-month period you must file another Form 8300. You must file the form within 15 days of the.

Source: redeyecpa.com

Source: redeyecpa.com

Financial institutions such as a bank must also report all transactions by through or to the institution by filing a Currency Transaction Report. After you file Form 8300 you must start a new count of cash payments received from that buyer. If you simply fail to file on time then the penalties will be 100 for each occurrence. Less than 10000 in cash was received. Generally the form must be filed within 15 days after receipt of a payment.

Source: communitytax.com

Source: communitytax.com

If a person structures payments they may be liable for both civil and criminal penalties including up to. According to the IRS You may be subject to penalties if you fail to file a correct and complete Form 8300 on time and you cannot show that the failure was due to reasonable cause. Failure to file a timely and accurate IRS Form 8300 may lead to some harsh penalties. File electronically to avoid the snail mail issue the IRS marks Form 8300 received when they process the form not when its received in house If mailing mail via certified mail return receipt so that there is proof of mailing. It doesnt need to be handed to the customer at the dealership although you couldA notice does however need to be provided to the customer by Jan.

Source: alleviatetax.com

Source: alleviatetax.com

Is the ATM or debit card amount considered cash or a cash equivalent that makes the total amount received over 10000 and thus reportable on Form 8300. Therefore the penalties for intentionally failing to file a Form 8300 on time can be severe. The penalty for intentional failure to furnish required information is 250 per incident or 10 percent of the aggregate annual limit of items that should have been reported whichever is greater. You can file online using the Bank Secrecy Act BSA Electronic Filing E-Filing System at the FinCEN website. Each time you receive a payment that meets the criteria for filing Form 8300 you must file the form for the transaction within 15 days of receiving the payment.

Source: civictaxrelief.com

Source: civictaxrelief.com

In the case of Form 8300 the IRS isnt inherently taking any action and the form is not directly linked to income taxes or any other process the IRS manages. How long do you have to file a 8300 form. It doesnt need to be handed to the customer at the dealership although you couldA notice does however need to be provided to the customer by Jan. If a person structures payments they may be liable for both civil and criminal penalties including up to. Failing to file Form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the IRS.

Source: silvertaxgroup.com

Source: silvertaxgroup.com

File electronically to avoid the snail mail issue the IRS marks Form 8300 received when they process the form not when its received in house If mailing mail via certified mail return receipt so that there is proof of mailing. If you receive more than 10000 in additional cash payments from that buyer within a 12-month period you must file another Form 8300. What Are the Penalties for Failing to File Form 8300. Willfully failing to file a Form 8300 Willfully filing a false or fraudulent Form 8300 Stopping or trying to stop a Form 8300 from being filed or. A person may be subject to criminal penalties for.

Source: massrinatp.blogspot.com

Source: massrinatp.blogspot.com

Less than 10000 in cash was received. If you simply fail to file Form 8300 on. Failing to do so will accrue you or your business penalties if the IRS finds out. You must file the form within 15 days of the. What does the IRS do with forms 8300 they receive.

Source: silvertaxgroup.com

Source: silvertaxgroup.com

If you report a cash transaction of 10000 or more on the Form 8300 you also have to tell the individual in writing that you made the report. Failing to file Form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the IRS. Should a Form 8300 be filed. Failure to file a timely and accurate IRS Form 8300 may lead to some harsh penalties. The IRS requires that you file Form 8300 within 15 days of receiving the money in a transaction.

Instead of a personal credit card the customer pays the remaining 6000 with his ATM or debit card. The IRS requires that you file Form 8300 within 15 days of receiving the money in a transaction. A person may be subject to criminal penalties for. Failing to do so will accrue you or your business penalties if the IRS finds out. What does the IRS do with forms 8300 they receive.

Source: taxbandits.com

Source: taxbandits.com

Therefore the penalties for intentionally failing to file a Form 8300 on time can be severe. If you simply fail to file on time then the penalties will be 100 for each occurrence. You do not report it. Instead of a personal credit card the customer pays the remaining 6000 with his ATM or debit card. 31 of the following year.

Source: alleviatetax.com

Source: alleviatetax.com

If you simply fail to file on time then the penalties will be 100 for each occurrence. When Do I File Form 8300. After you file Form 8300 you must start a new count of cash payments received from that buyer. In addition the filer must provide a statement to the person whose information was included in Form 8300. Besides what happens if Form 8300 is filed.

Source: cpajournal.com

Source: cpajournal.com

The IRS requires any trade or business to file Form 8300 if theyve received any cash payments over 10000. Financial institutions such as a bank must also report all transactions by through or to the institution by filing a Currency Transaction Report. Instead of a personal credit card the customer pays the remaining 6000 with his ATM or debit card. It is used to help prevent money laundering. When Do I File Form 8300.

Source: communitytax.com

Source: communitytax.com

After you file Form 8300 you must start a new count of cash payments received from that buyer. When Do I File Form 8300. The IRS requires that you file Form 8300 within 15 days of receiving the money in a transaction. Therefore the penalties for intentionally failing to file a Form 8300 on time can be severe. If you are required to file Form 8300 you must do so by the 15th day after the date the cash transaction occurred.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what happens if form 8300 is filed by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.