11++ What does the term anti money laundering mean ideas

Home » money laundering idea » 11++ What does the term anti money laundering mean ideasYour What does the term anti money laundering mean images are available in this site. What does the term anti money laundering mean are a topic that is being searched for and liked by netizens now. You can Find and Download the What does the term anti money laundering mean files here. Get all free photos.

If you’re looking for what does the term anti money laundering mean pictures information linked to the what does the term anti money laundering mean topic, you have come to the ideal site. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly surf and locate more enlightening video content and images that fit your interests.

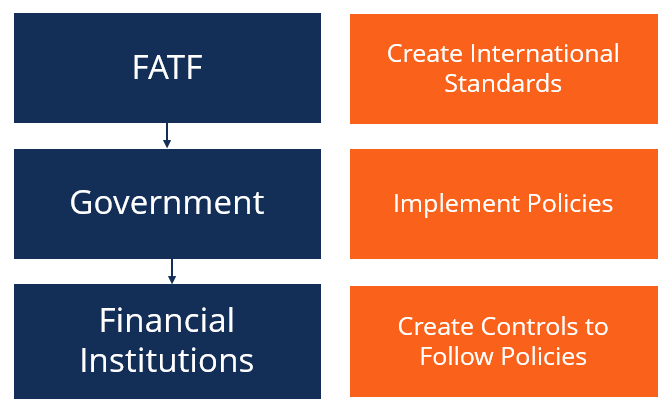

What Does The Term Anti Money Laundering Mean. Anti-money laundering refers to all policies and regulations that are in place to prevent the abuse of legitimate financial systems to hide or disguise the proceeds of crime. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Anti money laundering transactions monitoring allows controlling the transaction proceedings preventing possible risks. January 2019 was a landmark month for the European Unions fight against financial crime.

What To Know About Anti Money Laundering As A P2p Investor Viainvest Blog From viainvest.com

What To Know About Anti Money Laundering As A P2p Investor Viainvest Blog From viainvest.com

What is expected of an AML analyst. Every member state was required to write the 5th Anti-Money Laundering Directive or 5AMLD into national law by January 10 bringing in tighter controls around cross-border transactions customer due diligence and outsourcing. AML is an abbreviation for anti-money laundering. AML stands for Anti-Money Laundering also Acute Myeloid Leukemia and 438 more. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions.

What is AML Anti-Money Laundering.

Every member state was required to write the 5th Anti-Money Laundering Directive or 5AMLD into national law by January 10 bringing in tighter controls around cross-border transactions customer due diligence and outsourcing. January 2019 was a landmark month for the European Unions fight against financial crime. It prevents criminals from recovering illegal gains of their crimes as well as using the money for future criminal activity. Anti money laundering transactions monitoring allows controlling the transaction proceedings preventing possible risks. AML is an abbreviation for anti-money laundering. KYC and KYCC are effective defences against laundering money or terrorist financing.

Source: en.ppt-online.org

Source: en.ppt-online.org

Guide to anti-money laundering checks Businesses in the affected sectors have to constantly adapt to a plethora of laws directives and regulations. AML is an abbreviation for anti-money laundering. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. KYC means know your customer and it help in banking business to know the customer through business personally. Since they lack jurisdiction overseas law enforcement must coordinate with their foreign counterparts which can delay the tracking of the funds while complicating the document trail associated with the funds.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

January 2019 was a landmark month for the European Unions fight against financial crime. What does AML mean. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Since they lack jurisdiction overseas law enforcement must coordinate with their foreign counterparts which can delay the tracking of the funds while complicating the document trail associated with the funds. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions.

Source: sas.com

Source: sas.com

The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money. January 2019 was a landmark month for the European Unions fight against financial crime. KYC means know your customer and it help in banking business to know the customer through business personally. KYC and KYCC are effective defences against laundering money or terrorist financing. Guide to anti-money laundering checks Businesses in the affected sectors have to constantly adapt to a plethora of laws directives and regulations.

Source: viainvest.com

Source: viainvest.com

It prevents criminals from recovering illegal gains of their crimes as well as using the money for future criminal activity. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. KYC means know your customer and it help in banking business to know the customer through business personally. What is AML Anti-Money Laundering.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

It prevents criminals from recovering illegal gains of their crimes as well as using the money for future criminal activity. The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money. KYC and KYCC are effective defences against laundering money or terrorist financing. KYC means know your customer and it help in banking business to know the customer through business personally. Although financial institutions are obliged to follow anti-money laundering regulations this does not necessarily mean that they agree with themRecently many banks have become vocal about their dislike of anti-money laundering policies and their belief that these policies are both costly and ineffective.

Source: amlbot.com

Source: amlbot.com

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. KYC and KYCC are effective defences against laundering money or terrorist financing. Anti money laundering transactions monitoring allows controlling the transaction proceedings preventing possible risks. January 2019 was a landmark month for the European Unions fight against financial crime. They allow analyzing each clients information and in such a way finding out the most suspicious figures.

Source: quora.com

Source: quora.com

January 2019 was a landmark month for the European Unions fight against financial crime. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. As a rule AML transactions monitoring requires using software programs and applications. AML is an abbreviation for anti-money laundering. What does AML mean.

Source: shuftipro.com

Source: shuftipro.com

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Anti-money laundering refers to all policies and regulations that are in place to prevent the abuse of legitimate financial systems to hide or disguise the proceeds of crime. The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities.

Source: complyadvantage.com

Source: complyadvantage.com

The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money. The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money. Anti-money laundering refers to all policies and regulations that are in place to prevent the abuse of legitimate financial systems to hide or disguise the proceeds of crime. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Source: acumen-corporate-services.lu

Source: acumen-corporate-services.lu

Anti money laundering transactions monitoring allows controlling the transaction proceedings preventing possible risks. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. AML stands for Anti-Money Laundering also Acute Myeloid Leukemia and 438 more. What does AML mean. Although financial institutions are obliged to follow anti-money laundering regulations this does not necessarily mean that they agree with themRecently many banks have become vocal about their dislike of anti-money laundering policies and their belief that these policies are both costly and ineffective.

Source: researchgate.net

Source: researchgate.net

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. KYC means Know your customer is the process of a business identifying and verifying the identity of its clients. Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to.

Source: amlbot.com

Source: amlbot.com

Anti-Money Laundering Any law or regulation requiring an institution to perform due diligence on potential clients to ensure that it is not aiding in a money laundering scheme. Anti-money laundering refers to all policies and regulations that are in place to prevent the abuse of legitimate financial systems to hide or disguise the proceeds of crime. If the institution does not conduct due diligence properly it may be held legally liable for the money laundering activities. Also a process of criminal activities And obtains a large amount of money from crime and drugs people earn profit and money from illegal activities named as corruptions. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Also a process of criminal activities And obtains a large amount of money from crime and drugs people earn profit and money from illegal activities named as corruptions. Under the guidelines set forth by anti-money laundering or AML financial institutions are required to verify large sums of money passing through the institution and they are required to report suspicious transactions. As a rule AML transactions monitoring requires using software programs and applications. Anti-money laundering refers to all policies and regulations that are in place to prevent the abuse of legitimate financial systems to hide or disguise the proceeds of crime. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does the term anti money laundering mean by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.