13++ What are the risks of correspondent banking ideas in 2021

Home » money laundering Info » 13++ What are the risks of correspondent banking ideas in 2021Your What are the risks of correspondent banking images are ready in this website. What are the risks of correspondent banking are a topic that is being searched for and liked by netizens today. You can Find and Download the What are the risks of correspondent banking files here. Find and Download all free images.

If you’re looking for what are the risks of correspondent banking pictures information connected with to the what are the risks of correspondent banking topic, you have pay a visit to the right blog. Our website frequently provides you with hints for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

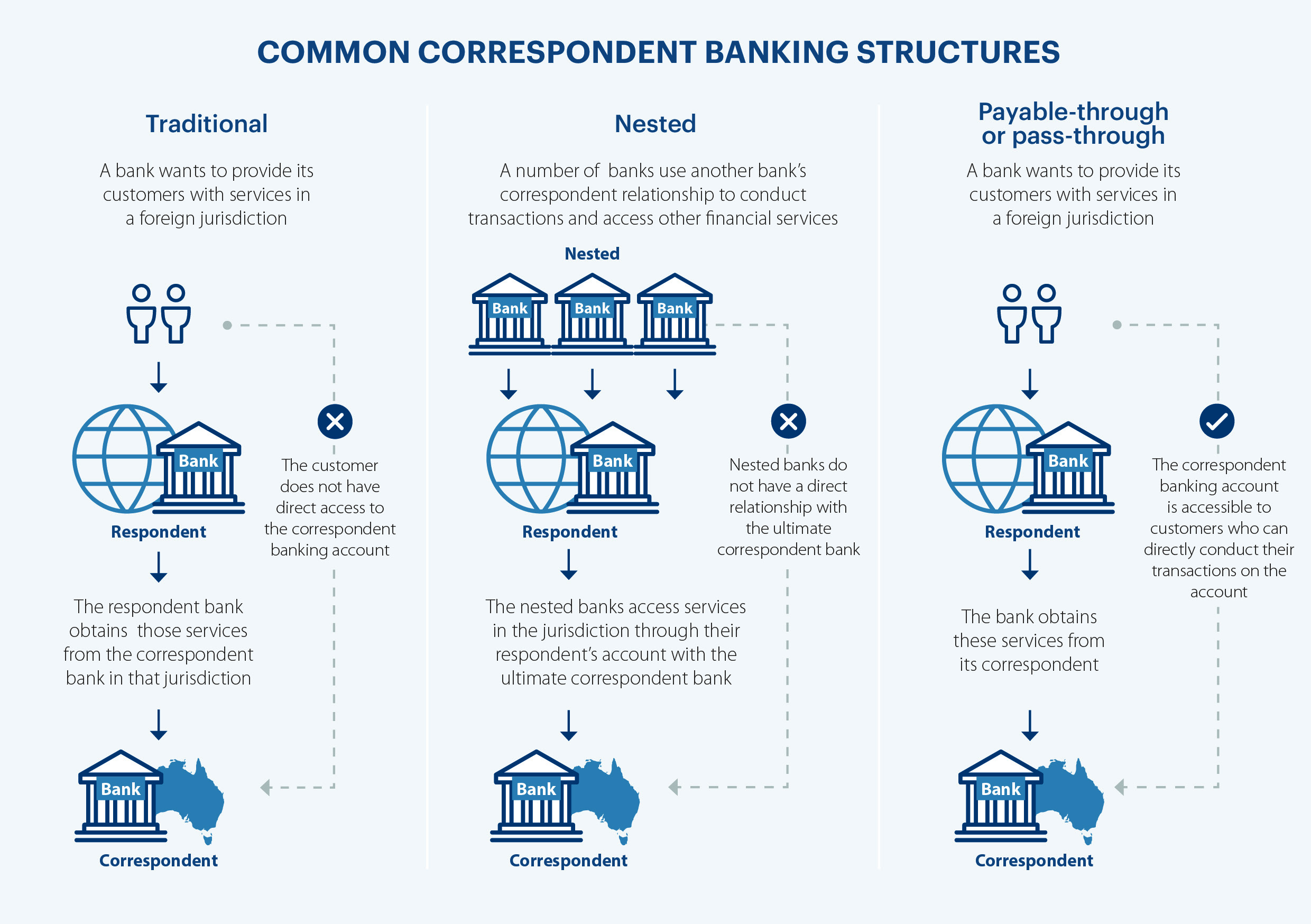

What Are The Risks Of Correspondent Banking. Risks associated with correspondent banking. Correspondent banking transactions are but a mere representation of the underlying business transactions. Reference evann159 for the link to this. Those types of correspondent banking services that are perceived to have higher associated risks nested correspondent banking payable-through accounts are being scaled back so that traditional correspondent banking clearly predominates in the remaining relationships.

Challenges In Correspondent Banking In The Small States Of The Pacific In Imf Working Papers Volume 2017 Issue 090 2017 From elibrary.imf.org

Challenges In Correspondent Banking In The Small States Of The Pacific In Imf Working Papers Volume 2017 Issue 090 2017 From elibrary.imf.org

The main risks related to correspondent banking centre around the fact that the correspondent bank typically doesnt have a direct relationship with the underlying customers of the respondent bank. Correspondent banking can give rise to various risks. In the United States Congress specifically addressed the AML risks of correspondent banking relationships in sections 311 to 313 of the USA PATRIOT Act which require US correspondent banks to conduct specific enhanced due diligence on relationships with respondent banks or terminate those relationships. While there is little evidence of rising costs we do find that costs are higher in countries with more limited access to correspondent banking services. The ultimate transaction remitters or beneficiaries are not direct clients of the respondent. In 2014 AML penalties peaked at US10bn compounding the challenges banks face in high-risk geographies as shown in Figure 1 below.

De-risking and the decline in correspondent banking.

Greater concentration in correspondent banking could keep costs elevated. Those transactions include foreign exchange money market loans and deposits trade finance liquidity and cash management. Often they may be two or more levels away from the correspondent bank that processes the payment. For some correspondent banks the enforcement risks may be too high and the compliance burdens too onerous to continue to offer correspondent accounts resulting in decisions to close or de-risk. Greater concentration in correspondent banking could keep costs elevated. The ownership and management structure of the Correspondent Banking Client may present increased risksThe presence of any politically exposed persons PEPs in the Executive Management or ownership structure is also an important consideration.

Correspondent banking transactions are but a mere representation of the underlying business transactions. One of the main risks associated with correspondent banking is the fact that the correspondent often has no direct relationships with the underlying parties to a transaction and is therefore not in a position to verify their identities or conduct the necessary due diligence. De-risking and the decline in correspondent banking. In the wake of the global financial crisis correspondent banking relationships have reduced globally by 25 reports Accuity. The main risks related to correspondent banking centre around the fact that the correspondent bank typically doesnt have a direct relationship with the underlying customers of the respondent bank.

Source: tookitaki.ai

Source: tookitaki.ai

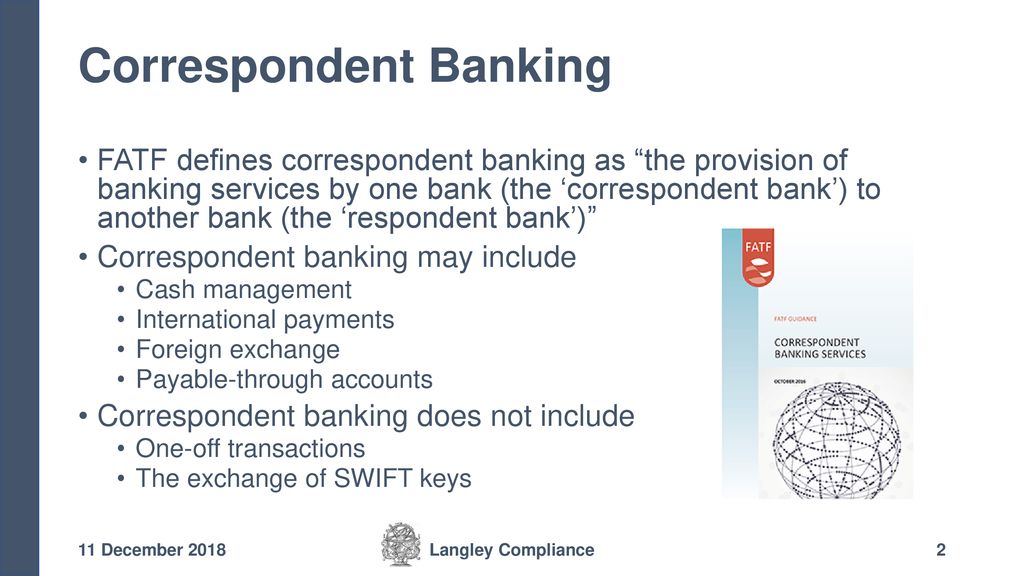

The second one is B. FATF the international AMLCFT watchdog recommended various measured to counter money laundering via correspondent banking. Those types of correspondent banking services that are perceived to have higher associated risks nested correspondent banking payable-through accounts are being scaled back so that traditional correspondent banking clearly predominates in the remaining relationships. Reference evann159 for the link to this. While there is little evidence of rising costs we do find that costs are higher in countries with more limited access to correspondent banking services.

Source: in.pinterest.com

Source: in.pinterest.com

FATF the international AMLCFT watchdog recommended various measured to counter money laundering via correspondent banking. This means that nesting can expose both the correspondent and respondent FIs to high-risk. Greater concentration in correspondent banking could keep costs elevated. The main risks related to correspondent banking centre around the fact that the correspondent bank typically doesnt have a direct relationship with the underlying customers of the respondent bank. Correspondent banks may have no pre-existing relationships with parties with which the respondent transacts making them vulnerable to corruption and money laundering.

Source: professional.dowjones.com

Source: professional.dowjones.com

Correspondent banks may have no pre-existing relationships with parties with which the respondent transacts making them vulnerable to corruption and money laundering. Yet ARM and the correspondent banking risks are not the whole risk management story. The ownership and management structure of the Correspondent Banking Client may present increased risksThe presence of any politically exposed persons PEPs in the Executive Management or ownership structure is also an important consideration. In the United States Congress specifically addressed the AML risks of correspondent banking relationships in sections 311 to 313 of the USA PATRIOT Act which require US correspondent banks to conduct specific enhanced due diligence on relationships with respondent banks or terminate those relationships. De-risking and the decline in correspondent banking.

While there is little evidence of rising costs we do find that costs are higher in countries with more limited access to correspondent banking services. For some correspondent banks the enforcement risks may be too high and the compliance burdens too onerous to continue to offer correspondent accounts resulting in decisions to close or de-risk. Changes in relationships. Respondent banks are already aware that maintaining correspondent accounts in countries with a robust enforcement record carries certain risks as these countries may leverage their market strength to pursue domestic and foreign policy objectives. Those transactions include foreign exchange money market loans and deposits trade finance liquidity and cash management.

Source: pinterest.com

Source: pinterest.com

Those transactions include foreign exchange money market loans and deposits trade finance liquidity and cash management. Correspondent banking can give rise to various risks. Respondent banks are already aware that maintaining correspondent accounts in countries with a robust enforcement record carries certain risks as these countries may leverage their market strength to pursue domestic and foreign policy objectives. The ultimate transaction remitters or beneficiaries are not direct clients of the respondent. The main risks related to correspondent banking centre around the fact that the correspondent bank typically doesnt have a direct relationship with the underlying customers of the respondent bank.

Source: indeed.headlink-partners.com

Source: indeed.headlink-partners.com

Correspondent banking transactions are but a mere representation of the underlying business transactions. This means that nesting can expose both the correspondent and respondent FIs to high-risk. While there is little evidence of rising costs we do find that costs are higher in countries with more limited access to correspondent banking services. The ownership and management structure of the Correspondent Banking Client may present increased risksThe presence of any politically exposed persons PEPs in the Executive Management or ownership structure is also an important consideration. In 2014 AML penalties peaked at US10bn compounding the challenges banks face in high-risk geographies as shown in Figure 1 below.

Source: pinterest.com

Source: pinterest.com

Correspondent banking relationships create significant money laundering and terrorist financing risks because the domestic bank carrying out the transaction has to rely on the foreign bank. FATF noted that financial institutions have increasingly decided to avoid rather than to manage possible money laundering or terrorist financing risks by terminating business relationships with entire regions. Reference evann159 for the link to this. De-risking and the decline in correspondent banking. Yet ARM and the correspondent banking risks are not the whole risk management story.

Source: austrac.gov.au

Source: austrac.gov.au

Respondent banks are already aware that maintaining correspondent accounts in countries with a robust enforcement record carries certain risks as these countries may leverage their market strength to pursue domestic and foreign policy objectives. While there is little evidence of rising costs we do find that costs are higher in countries with more limited access to correspondent banking services. 2 Despite the heightened risks posed by correspondent relationships and the expectations for enhanced due diligence US regulators have issued guidance emphasizing that due diligence. FATF the international AMLCFT watchdog recommended various measured to counter money laundering via correspondent banking. The second one is B.

Source: slideplayer.com

Source: slideplayer.com

Correspondent banking can give rise to various risks. Greater concentration in correspondent banking could keep costs elevated. FATF the international AMLCFT watchdog recommended various measured to counter money laundering via correspondent banking. Correspondent banking transactions are but a mere representation of the underlying business transactions. While there is little evidence of rising costs we do find that costs are higher in countries with more limited access to correspondent banking services.

Respondent banks are already aware that maintaining correspondent accounts in countries with a robust enforcement record carries certain risks as these countries may leverage their market strength to pursue domestic and foreign policy objectives. In 2014 AML penalties peaked at US10bn compounding the challenges banks face in high-risk geographies as shown in Figure 1 below. The main risks related to correspondent banking centre around the fact that the correspondent bank typically doesnt have a direct relationship with the underlying customers of the respondent bank. Those types of correspondent banking services that are perceived to have higher associated risks nested correspondent banking payable-through accounts are being scaled back so that traditional correspondent banking clearly predominates in the remaining relationships. De-risking and the decline in correspondent banking.

Source: elibrary.imf.org

Source: elibrary.imf.org

The ownership and management structure of the Correspondent Banking Client may present increased risksThe presence of any politically exposed persons PEPs in the Executive Management or ownership structure is also an important consideration. In the wake of the global financial crisis correspondent banking relationships have reduced globally by 25 reports Accuity. The ultimate transaction remitters or beneficiaries are not direct clients of the respondent. FATF noted that financial institutions have increasingly decided to avoid rather than to manage possible money laundering or terrorist financing risks by terminating business relationships with entire regions. Often they may be two or more levels away from the correspondent bank that processes the payment.

Source: pinterest.com

Source: pinterest.com

Risks associated with correspondent banking. In 2014 AML penalties peaked at US10bn compounding the challenges banks face in high-risk geographies as shown in Figure 1 below. Respondent banks are already aware that maintaining correspondent accounts in countries with a robust enforcement record carries certain risks as these countries may leverage their market strength to pursue domestic and foreign policy objectives. Those types of correspondent banking services that are perceived to have higher associated risks nested correspondent banking payable-through accounts are being scaled back so that traditional correspondent banking clearly predominates in the remaining relationships. In the wake of the global financial crisis correspondent banking relationships have reduced globally by 25 reports Accuity.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what are the risks of correspondent banking by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.