10++ What are the primary money laundering offences ideas in 2021

Home » money laundering idea » 10++ What are the primary money laundering offences ideas in 2021Your What are the primary money laundering offences images are ready. What are the primary money laundering offences are a topic that is being searched for and liked by netizens today. You can Get the What are the primary money laundering offences files here. Download all free photos and vectors.

If you’re looking for what are the primary money laundering offences pictures information related to the what are the primary money laundering offences interest, you have come to the ideal site. Our website always gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

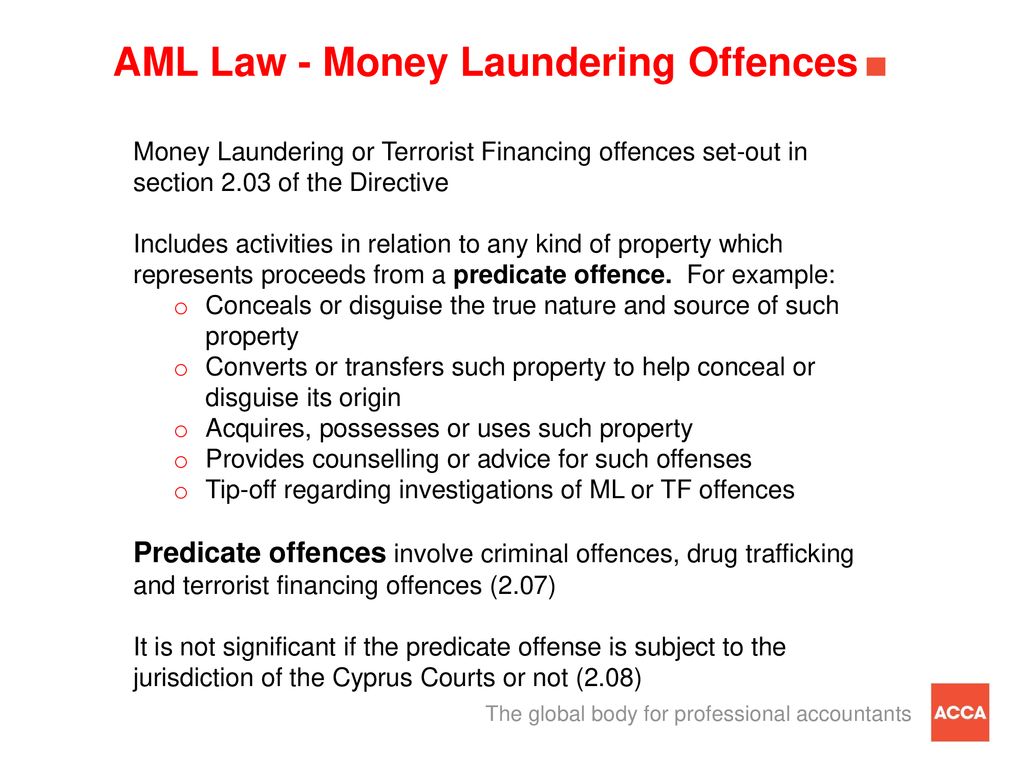

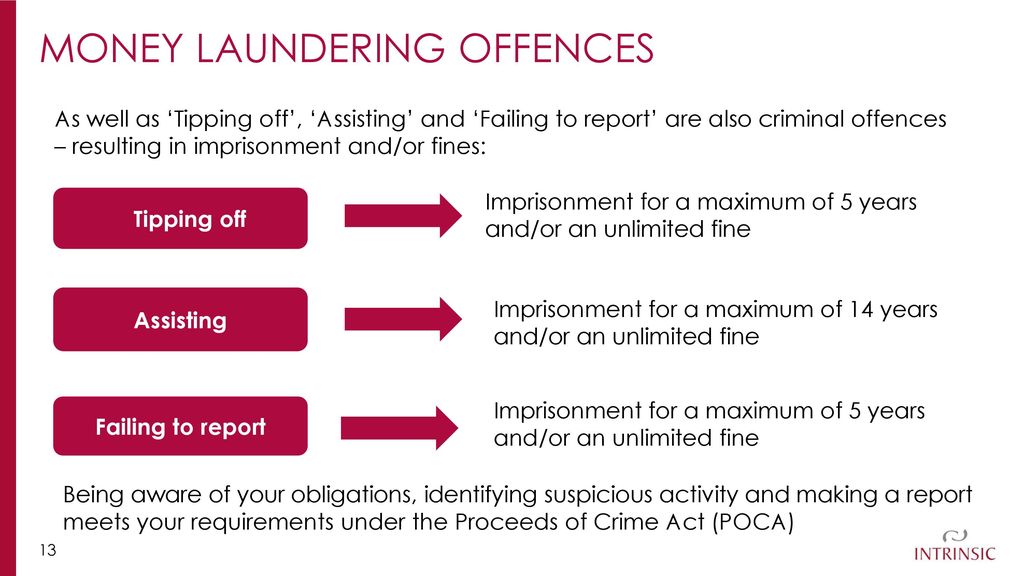

What Are The Primary Money Laundering Offences. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Charges and offences of money laundering Subject. For a legal entity the maximum penalty is an unlimited fine. The money laundering offence committed in Luxembourg is punishable in Luxembourg even if the primary offence.

Money Laundering Offences Comsurecomsure From archive.comsuregroup.com

Money Laundering Offences Comsurecomsure From archive.comsuregroup.com

In each case it is necessary to show that the person knows or suspects that the property in question is criminal. The principal money laundering offences are set out in Sections 327 to 329 of the Proceeds of Crime Act and include various acts in relation to criminal property from disguising or converting the. The offence can only be committed if the information on which the disclosure is based came to the person in the course of business in the regulated sector. For an offence to be committed there must be. The principal money laundering offences created by the Proceeds of Crime Act 2002 are. The primary money laundering offences are set out at sections 327 to 329 of POCA.

Dishonesty is not required to commit these offences.

The principal money laundering offences are set out in Sections 327 to 329 of the Proceeds of Crime Act and include various acts in relation to criminal property from disguising or converting the. Maximum penalty is a HK 5000000 fine and 14-year imprisonment. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. There are now five basic money-laundering offences. Under sections 327-329 of POCA it is a money laundering offence to deal in any of three broad ways with a persons benefit from criminal conduct knowing or suspecting that it is such a benefit. Dishonesty is not required to commit these offences.

Source: slideplayer.com

Source: slideplayer.com

The primary money laundering offences are set out at sections 327 to 329 of POCA. In general any offence punishable by a minimum term of imprisonment of at least six months is considered as a money laundering primary offence. The principal money laundering offences are set out in Sections 327 to 329 of the Proceeds of Crime Act and include various acts in relation to criminal property from disguising or converting the. Countries should apply the crime of money laundering to all serious offences with a view to including the widest range of predicate offences. Maximum penalty is a HK 5000000 fine and 14-year imprisonment.

Source: archive.comsuregroup.com

Source: archive.comsuregroup.com

With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. The offence can only be committed if the information on which the disclosure is based came to the person in the course of business in the regulated sector. The primary money laundering offences are set out at sections 327 to 329 of POCA. The money laundering offences cover every type of offence and are all either way offences.

Source: wikiwand.com

Source: wikiwand.com

The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329 The money laundering offences cover every type of offence and are all either way offences. What does terrorist financing mean. The principal money laundering offences created by the Proceeds of Crime Act 2002 are. In general any offence punishable by a minimum term of imprisonment of at least six months is considered as a money laundering primary offence. Dishonesty is not required to commit these offences.

Source: slideplayer.com

Source: slideplayer.com

In each case it is necessary to show that the person knows or suspects that the property in question is criminal. The penalty for commission of an offence under this section is imprisonment of up to six. There are now five basic money-laundering offences. For a legal entity the maximum penalty is an unlimited fine. What does terrorist financing mean.

Source: slideplayer.com

Source: slideplayer.com

On Money Laundering The Nipfp Report Has Noted That Organised Tax Evasion Should Be Included In The List Of Predicate Offences Money Laundering Money Report. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. In general any offence punishable by a minimum term of imprisonment of at least six months is considered as a money laundering primary offence. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. Maximum penalty is a HK 5000000 fine and 14-year imprisonment.

Source: slideplayer.com

Source: slideplayer.com

For an offence to be committed there must be. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. For an offence to be committed there must be. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The primary money laundering offences are set out at sections 327 to 329 of POCA.

Source: researchgate.net

Source: researchgate.net

The primary money laundering offences are set out at sections 327 to 329 of POCA. Acquiring possession and use of criminal proceeds. 250K and 3yrs imprisonment upon summary conviction 500K and 5yrs imprisonment upon summary conviction Sec. Maximum penalty is a HK 5000000 fine and 14-year imprisonment. Breaking this down there are essentially four elements to the money laundering offences.

Source: slideplayer.com

Source: slideplayer.com

The penalty for commission of an offence under this section is imprisonment of up to six. It is an offence to disclose that an investigation into a money laundering offence is being contemplated or carried out if that disclosure is likely to prejudice that investigation. Acquiring possession and use of criminal proceeds. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. The concealing offence POCA 2002 s 327 the arranging offence POCA 2002 s 328 the acquisition use or possession offence POCA 2002 s 329 The money laundering offences cover every type of offence and are all either way offences.

Source: slideplayer.com

Source: slideplayer.com

The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Under sections 327-329 of POCA it is a money laundering offence to deal in any of three broad ways with a persons benefit from criminal conduct knowing or suspecting that it is such a benefit. Dishonesty is not required to commit these offences.

Source: slideplayer.com

Source: slideplayer.com

Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The primary money laundering offences are set out at sections 327 to 329 of POCA. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine. Acquiring possession and use of criminal proceeds. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments.

Source: researchgate.net

Source: researchgate.net

What does terrorist financing mean. Charges and offences of money laundering Subject. On Money Laundering The Nipfp Report Has Noted That Organised Tax Evasion Should Be Included In The List Of Predicate Offences Money Laundering Money Report. Acquiring possession and use of criminal proceeds. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the.

Source: wikiwand.com

Source: wikiwand.com

Maximum penalty is a HK 5000000 fine and 14-year imprisonment. This note explains the primary money laundering offences that can be committed under sections 327 to 329 of the Proceeds of Crime Act 2002 POCA and the offences of failing to report and tipping off that can be committed when discovering suspicious payments. Offences under the Regulations are punishable with a maximum penalty of two years imprisonment for individuals and an unlimited fine. The money laundering offence committed in Luxembourg is punishable in Luxembourg even if the primary offence. Maximum penalty is a HK 5000000 fine and 14-year imprisonment.

Source: delta-net.com

Source: delta-net.com

For an offence to be committed there must be. With effect from 1 January 2017 the Law of 23 December 2016 relating to the implementation of the 2017 tax reform has included aggravated tax evasion fraude fiscale aggravée and tax fraud escroquerie fiscale or attempts to commit such offences as criminal tax offences constituting primary offences infractions primaires of money laundering under Article 506-1 of the. Crimes or offences which generate the funds to be laundered are commonly referred to as money laundering primary offences or predicate offences. The primary money laundering offences are set out at sections 327 to 329 of POCA. The primary money laundering offences carry a maximum penalty of 14 years imprisonment and an unlimited fine.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what are the primary money laundering offences by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.