16+ What are kyc and aml checks ideas in 2021

Home » money laundering Info » 16+ What are kyc and aml checks ideas in 2021Your What are kyc and aml checks images are available in this site. What are kyc and aml checks are a topic that is being searched for and liked by netizens now. You can Get the What are kyc and aml checks files here. Download all free photos.

If you’re searching for what are kyc and aml checks images information related to the what are kyc and aml checks interest, you have come to the right blog. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that fit your interests.

What Are Kyc And Aml Checks. KYC and AML checks have targeted the traditional financial industry. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. A recent report stated that 80 of Law Firms find process-oriented AML and KYC screening challenging.

Kyc Chain Blockchain Banking Kyc Aml Compliance Solution From kyc-chain.com

Kyc Chain Blockchain Banking Kyc Aml Compliance Solution From kyc-chain.com

KYC stands for client verification and identification process implemented with different tools and software. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably. To build a strong and robust. Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant regulatory body. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. They also apply to other firms undertaking certain financial activities see Schedule 2 of the regulations.

Anti-Money Laundering AML compliance is a regulatory requirement that applies to banks building societies and credit unions.

To build a strong and robust. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. What is AML KYC compliance. A recent report stated that 80 of Law Firms find process-oriented AML and KYC screening challenging. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering.

Source: blog.complycube.com

Source: blog.complycube.com

KYC and AML checks have been an integral part of financial institutions for a while now. An Anti-Money Laundering check is a process your business needs to undertake to prevent Money Laundering activity. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. KYC means Know your customer. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures.

Source: signzy.com

Source: signzy.com

Regular Anti Money Laundering AML and Know Your Customer KYC checks should be an integral part of the compliance management system of every regulated business. They also apply to other firms undertaking certain financial activities see Schedule 2 of the regulations. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations. Latest news reports from the medical literature videos from the experts and more.

Source: processmaker.com

Source: processmaker.com

You must document the customer identification procedures you use for different types of customers. Ad AML coverage from every angle. To build a strong and robust. What is AML KYC compliance. Latest news reports from the medical literature videos from the experts and more.

Source: quora.com

Whether you run a bank or you are a customer KYC and AML. As mentioned before KYC Know Your Customer and AML Anti Money Laundering checks are important as they help to identify and prevent fraudulent activity. Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant regulatory body. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers.

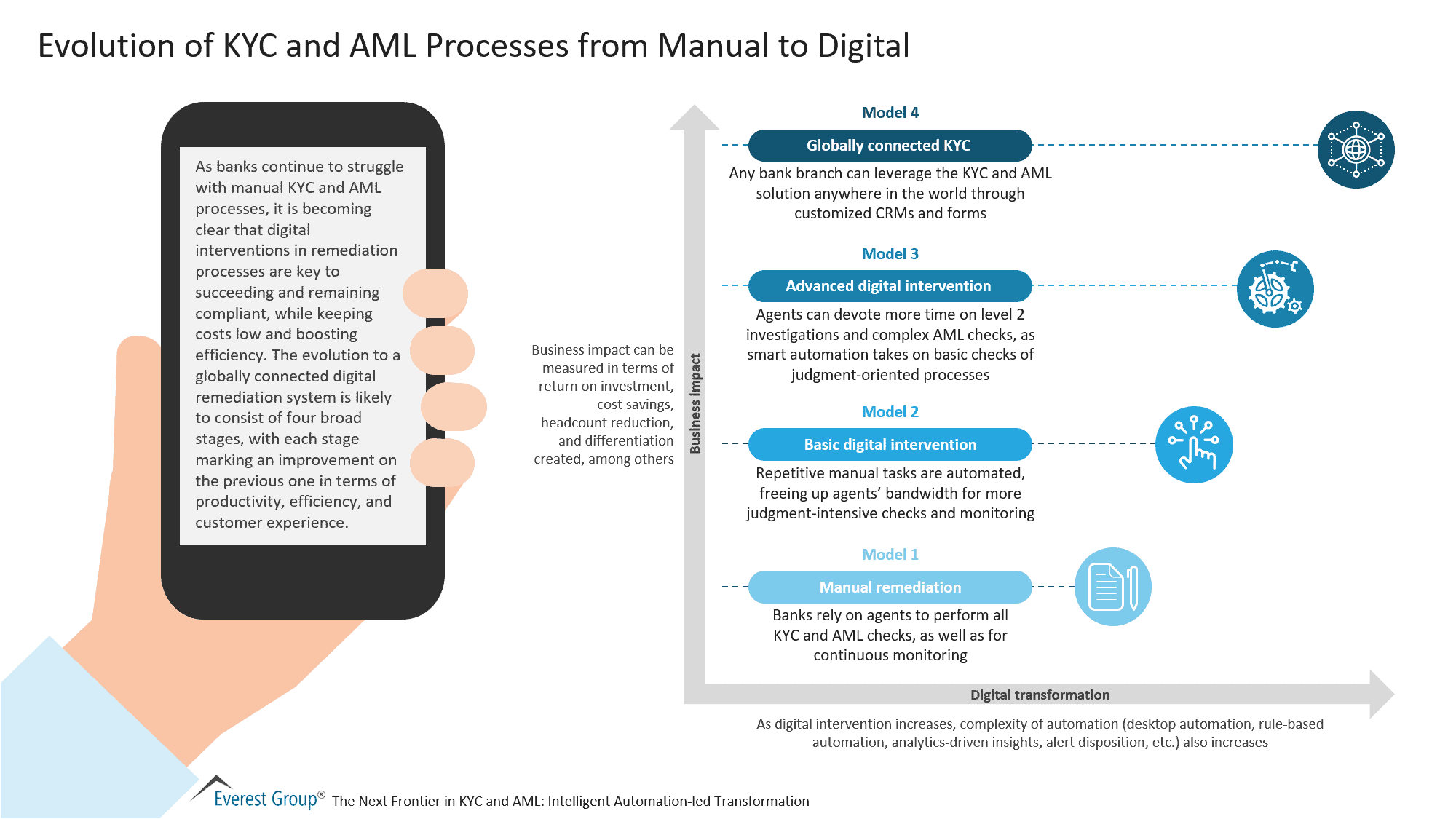

Source: everestgrp.com

Source: everestgrp.com

They also apply to other firms undertaking certain financial activities see Schedule 2 of the regulations. Perform seamless but random identity checks throughout the lifespan of client accounts. Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant regulatory body. Why Are KYC And AML Important. The Anti-Money Laundering AML regulations are governed by 4 Acts.

Source: kyc-chain.com

Source: kyc-chain.com

As mentioned before KYC Know Your Customer and AML Anti Money Laundering checks are important as they help to identify and prevent fraudulent activity. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. As required by several financial regulators across the world these mandatory checks have helped curb identity fraud cases and other financial crimes. Know Your Customer KYC is a process of verifying a clients identity. You must document the customer identification procedures you use for different types of customers.

Source: blog.covery.ai

KYC or performing customer due diligence CDD should be performed regardless if AML regulations exist. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. Oftentimes the sense of both terms is mixed. KYC and AML checks have been an integral part of financial institutions for a while now. The Proceeds of Crime Act The Serious Organised Crime and Police Act The Terrorist Act and the Money Laundering Regulations.

Source: kyc-chain.com

Source: kyc-chain.com

It is considered a major part of customer due diligence processes to prevent fraud and financial crimes. Know your customer KYC As a reporting entity you must apply customer identification procedures to all your customers. SeedLegals Confirmation that you have completed AML Anti-Money Laundering and KYC Know your Customer checks are a requirement for application under the Governments Future Fund. As required by several financial regulators across the world these mandatory checks have helped curb identity fraud cases and other financial crimes. To build a strong and robust.

Source: lawsonconner.com

Source: lawsonconner.com

Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant regulatory body. Perform seamless but random identity checks throughout the lifespan of client accounts. Why Are KYC And AML Important. You must document the customer identification procedures you use for different types of customers. Ad AML coverage from every angle.

Source: blog.complycube.com

Source: blog.complycube.com

An AML check should include Know Your Customer KYC procedures so you can prove you know who you are dealing with. It is considered a major part of customer due diligence processes to prevent fraud and financial crimes. Oftentimes the sense of both terms is mixed. Latest news reports from the medical literature videos from the experts and more. Anti-Money Laundering AML compliance is a regulatory requirement that applies to banks building societies and credit unions.

Source: tookitaki.ai

Source: tookitaki.ai

Latest news reports from the medical literature videos from the experts and more. KYC is a part of Anti-Money Laundering AML measures which aim to prevent money laundering. As mentioned before KYC Know Your Customer and AML Anti Money Laundering checks are important as they help to identify and prevent fraudulent activity. An AML check involves identity checks and verification plus monitoring of financial transactions to detect fraud. Failure to report suspicious activity can carry a criminal sentence and lead to substantial fines from the relevant regulatory body.

Source: blog.covery.ai

Source: blog.covery.ai

Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. Part B of your AMLCTF program is solely focused on these know your customer KYC procedures. KYC means Know your customer. Know Your Customer KYC procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering AML laws. Those AML obligations include the Know Your Customer KYC process however given the proximity of the terms AML and KYC and the fact that they are often used interchangeably.

KYC and AML checks have targeted the traditional financial industry. Ad AML coverage from every angle. KYC and AML checks have been an integral part of financial institutions for a while now. Why Are KYC And AML Important. What are the KYC Know Your Investor and AML Anti Money Laundering checks.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what are kyc and aml checks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.