19+ Violation bank secrecy act regulations fine up to information

Home » money laundering idea » 19+ Violation bank secrecy act regulations fine up to informationYour Violation bank secrecy act regulations fine up to images are available. Violation bank secrecy act regulations fine up to are a topic that is being searched for and liked by netizens now. You can Get the Violation bank secrecy act regulations fine up to files here. Find and Download all free images.

If you’re searching for violation bank secrecy act regulations fine up to pictures information linked to the violation bank secrecy act regulations fine up to interest, you have pay a visit to the right site. Our website frequently gives you suggestions for refferencing the highest quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

Violation Bank Secrecy Act Regulations Fine Up To. Increased the civil and criminal penal-ties for money laundering. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. On January 15 2021 the Financial Crimes Enforcement Network FinCEN announced that Capital One National Association CONA had been fined 390000000 for willful and negligent violations of the Bank Secrecy Act BSA and its anti-money laundering implementing regulations.

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers From present5.com

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers From present5.com

Any individual including a credit union employee found guilty of this is subject to criminal fines of up to 250000 or five years in prison or both. FDIC claim that it violated the Bank Secrecy Act between April 2014 and September 2018 The Wall Street Journal reported according to an order issued in. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Laws or participating in other criminal activity that individual is subject to a fine of up to 500000 or ten years in prison or both.

August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector.

A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. New York-based Apple Bank agreed to pay 125 million to settle a Federal Deposit Insurance Corp. Small banks other financial institutions need to recognize obligations under Bank Secrecy Act On October 27 2017 the US. Violation Bank Secrecy Act Regulations Fine Up To. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone Star National Bank an independent community bank in Texas for willfully violating anti-money laundering AML requirements of the Bank Secrecy Act BSA. The sources of the money in actual are criminal and the money is invested in a approach that makes it.

Source: compliancealert.org

Source: compliancealert.org

Any individual including a credit union employee found guilty of this is subject to criminal fines of up to 250000 or five years in prison or both. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Small banks other financial institutions need to recognize obligations under Bank Secrecy Act On October 27 2017 the US. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. New York-based Apple Bank agreed to pay 125 million to settle a Federal Deposit Insurance Corp.

Source: slideplayer.com

Source: slideplayer.com

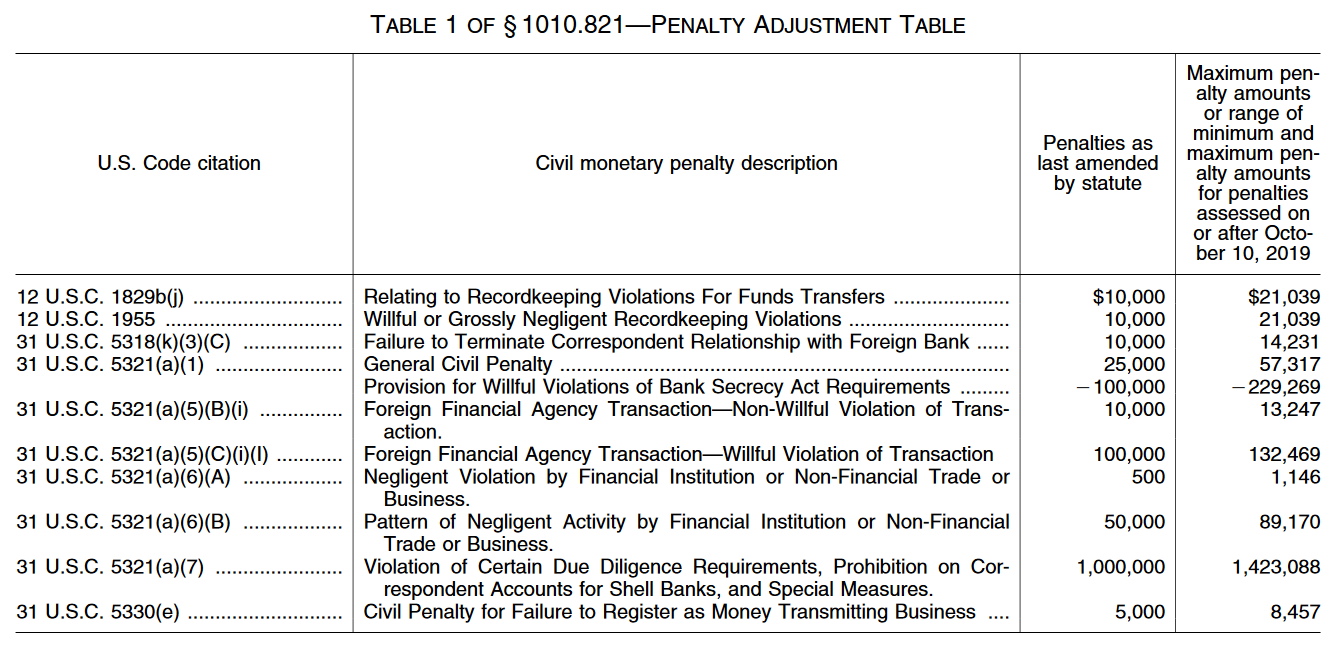

Violation Bank Secrecy Act Regulations Fine Up To. Willful violations of BSA requirements which has increased from a range of 25000100000 to a range of 53907215628. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. Small banks other financial institutions need to recognize obligations under Bank Secrecy Act On October 27 2017 the US. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Source: complyadvantage.com

Source: complyadvantage.com

The penalty amount could not exceed 500. Its a course of by which soiled cash is converted into clean cash. On January 15 2021 the Financial Crimes Enforcement Network FinCEN announced that Capital One National Association CONA had been fined 390000000 for willful and negligent violations of the Bank Secrecy Act BSA and its anti-money laundering implementing regulations. Increased the civil and criminal penal-ties for money laundering. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations.

Source: acamstoday.org

Source: acamstoday.org

31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA. The penalty amount could not exceed 500. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000.

Source: slideserve.com

Source: slideserve.com

Willful violations of BSA requirements which has increased from a range of 25000100000 to a range of 53907215628. The Federal Financial Institutions Examination Council FFIEC Bank Secrecy ActAnti-Money Laundering BSAAML Examination Manual outlines potential penalties. Its a course of by which soiled cash is converted into clean cash. FDIC claim that it violated the Bank Secrecy Act between April 2014 and September 2018 The Wall Street Journal reported according to an order issued in. The Bank Secrecy Act As mentioned in the introduction terms like Bank Secrecy Act or BSA are frequently used in connec - tion with the compliance duties of finan - cial institutions but they do not usually refer to a single statute although as we will discuss there is a federal law called the Bank Secrecy Act.

Source: slideserve.com

Source: slideserve.com

The purpose of the BSA is to require United States US. 5311 et seq is referred to as the Bank Secrecy Act BSA. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. In addition banks risk losing their charters and bank employees risk being removed and barred from banking Criminal penalties can be assessed for willful BSA regulation violations. The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign.

Source: present5.com

Source: present5.com

If the person commits a BSA violation in conjunction with violating other US. CONA is a wholly owned subsidiary of Capital One Financial Corporation COFC. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both. In addition banks risk losing their charters and bank employees risk being removed and barred from banking Criminal penalties can be assessed for willful BSA regulation violations. Any individual including a credit union employee found guilty of this is subject to criminal fines of up to 250000 or five years in prison or both.

Source: slideplayer.com

Source: slideplayer.com

The penalty amount could not exceed 500. On January 15 2021 the Financial Crimes Enforcement Network FinCEN announced that Capital One National Association CONA had been fined 390000000 for willful and negligent violations of the Bank Secrecy Act BSA and its anti-money laundering implementing regulations. August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. Small banks other financial institutions need to recognize obligations under Bank Secrecy Act On October 27 2017 the US. Provided the Secretary of the Trea-sury with the authority to impose 22 T he Bank Secrecy Act BSA and its implementing rules are not new.

Source: slideserve.com

Source: slideserve.com

The penalty amount could not exceed 500. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone Star National Bank an independent community bank in Texas for willfully violating anti-money laundering AML requirements of the Bank Secrecy Act BSA. A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. The penalty amount could not exceed 500. Willful violations of BSA requirements which has increased from a range of 25000100000 to a range of 53907215628.

Source: present5.com

Source: present5.com

August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. Bank was slapped with a 185 million civil penalty for what the Financial Crimes Enforcement Network FinCEN in coordination with the Office. The penalty amount could not exceed 500. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone Star National Bank an independent community bank in Texas for willfully violating anti-money laundering AML requirements of the Bank Secrecy Act BSA. Its a course of by which soiled cash is converted into clean cash.

Source: nafcu.org

Source: nafcu.org

In addition banks risk losing their charters and bank employees risk being removed and barred from banking Criminal penalties can be assessed for willful BSA regulation violations. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations. Bank was slapped with a 185 million civil penalty for what the Financial Crimes Enforcement Network FinCEN in coordination with the Office. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA. Violation Bank Secrecy Act Regulations Fine Up To.

Source: acamstoday.org

Source: acamstoday.org

A person convicted of money laundering can face up to 20 years in prison and a fine of up to 500000. BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROL Section 81 INTRODUCTION TO THE BANK SECRECY ACT The Financial Recordkeeping and Reporting of Currency and Foreign Transactions Act of 1970 31 USC. Financial Crimes Enforcement Network FinCEN announced a 2 million fine against Lone Star National Bank an independent community bank in Texas for willfully violating anti-money laundering AML requirements of the Bank Secrecy Act BSA. The penalty amount could not exceed 500. The increased amounts will apply to any CMP assessed by FinCEN after.

Source: slidetodoc.com

Source: slidetodoc.com

The Act is actually made up of several statutes including the Money Laundering Control Act the Anti-Drug Abuse Act the Currency and Foreign. August 08 2021 The idea of cash laundering is very important to be understood for these working within the monetary sector. New York-based Apple Bank agreed to pay 125 million to settle a Federal Deposit Insurance Corp. Congress enacted the Bank Secrecy Act BSA in 1970 to assist law enforcement in the investigation and thwarting of money laundering terrorist financing tax evasion and other criminal activity. Its a course of by which soiled cash is converted into clean cash.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title violation bank secrecy act regulations fine up to by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.