14+ Us treasury money laundering risk assessment ideas in 2021

Home » money laundering idea » 14+ Us treasury money laundering risk assessment ideas in 2021Your Us treasury money laundering risk assessment images are available. Us treasury money laundering risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Us treasury money laundering risk assessment files here. Find and Download all royalty-free images.

If you’re searching for us treasury money laundering risk assessment images information related to the us treasury money laundering risk assessment keyword, you have pay a visit to the right site. Our site frequently gives you hints for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

Us Treasury Money Laundering Risk Assessment. The purpose of these assessments is to help the public and private sectors understand the money laundering and terrorist financing methods used in the United States the risks that these activities pose to the US. The 2020 Strategy as well as the 2018 National Risk Assessments identifies the most significant illicit finance threats vulnerabilities and risks facing the US. The ability to form anonymous shell companies in the US is a significant risk factor for money laundering and has been a subject of proposed legislation for decades. Financial institutions will find these documents helpful in informing their own risk assessments and examiners will be able to use them in assessing whether AMLCFT compliance is tailored to the risks faced by their.

The Treasury says that financial institutions will find these documents helpful in informing their own risk assessments and examiners will be able to use them in assessing whether AMLCFT compliance is tailored to the risks faced by their supervised. The ability to form anonymous shell companies in the US is a significant risk factor for money laundering and has been a subject of proposed legislation for decades. The US Department of Treasury has published its annual National Money Laundering Risk Assessment report a 100-page document focusing on the threat that money laundering. Money laundering has been considered a crime in the United States since 1986. The 2020 Strategy as well as the 2018 National Risk Assessments identifies the most significant illicit finance threats vulnerabilities and risks facing the United States. Supervisors oversee the measures put in place by the private sector to implement anti-money laundering checks and report suspicions.

WASHINGTON The US.

Financial system that were identified in three separate risk assessments also released today. Treasury Departments anti-money laundering AML unit recently issued the much-anticipated AML priorities Congress demanded in the Anti-Money Laundering Act of 2020 a legislative effort to clarify where financial institutions should focus their efforts to more effectively police transactions for illicit activity. The National Proliferation Financing Risk Assessment the National Terrorist Financing Risk Assessment and the National Money Laundering Risk Assessment. The purpose of these assessments is to help the public and private sectors understand the money laundering and terrorist financing methods used in the United States the risks that these activities pose to the US. The stated purpose of these two assessments is. Government employs targeted financial sanctions formulates systemic safeguards and seeks to increase financial transparency to make accessing the US.

Source: researchgate.net

Source: researchgate.net

Money laundering is a serious crime in the USA and the United States effectively fights against money laundering. The ability to form anonymous shell companies in the US is a significant risk factor for money laundering and has been a subject of proposed legislation for decades. Effective risk-based supervision is an essential part of a strong anti-money laundering system. Money laundering is a serious crime in the USA and the United States effectively fights against money laundering. Government employs targeted financial sanctions formulates systemic safeguards and seeks to increase financial transparency to make accessing the US.

Source: lexology.com

Source: lexology.com

The National Proliferation Financing Risk Assessment the National Terrorist Financing Risk Assessment and the National Money Laundering Risk Assessment. Financial institutions will find these documents helpful in informing their own risk assessments and examiners will be able to use them in assessing whether AMLCFT compliance is tailored to the risks faced by their. Financial system that were identified in three separate risk assessments also released today. Department of the Treasury today issued the National Money Laundering Risk Assessment NMLRA and the National Terrorist Financing Risk Assessment NTFRA. Department of the Treasury Treasury which leads financial and regulatory CFT efforts for the US.

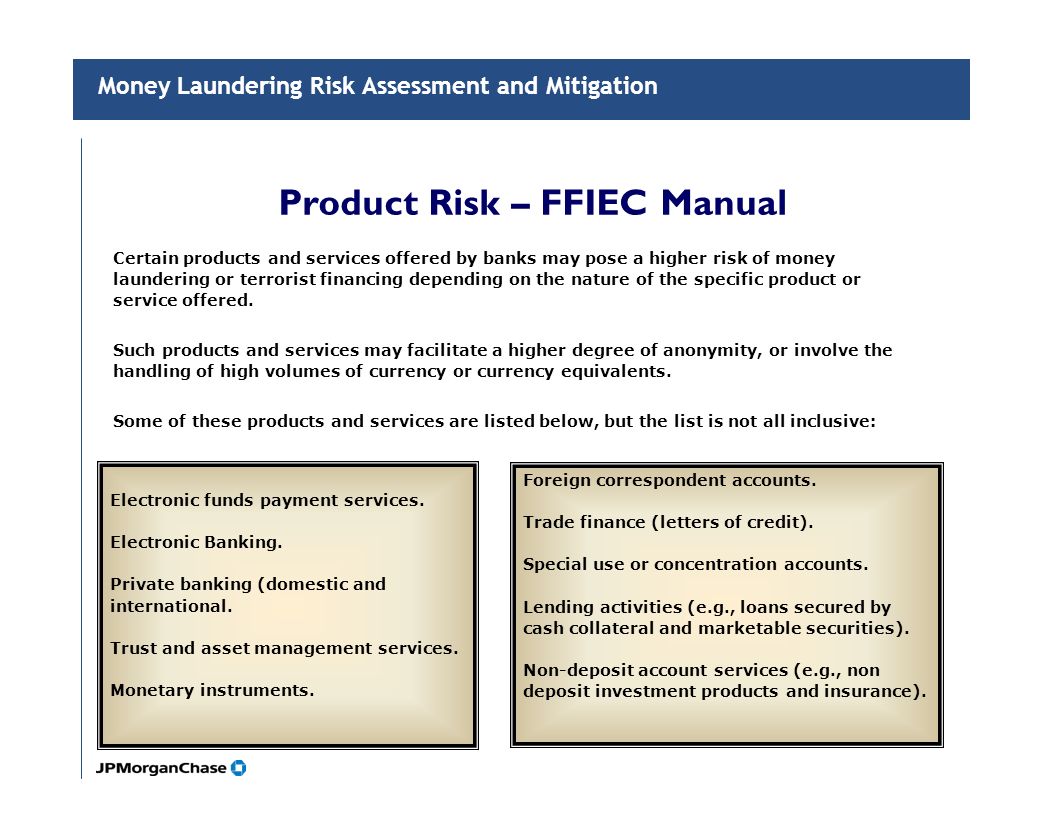

Source: slideplayer.com

Source: slideplayer.com

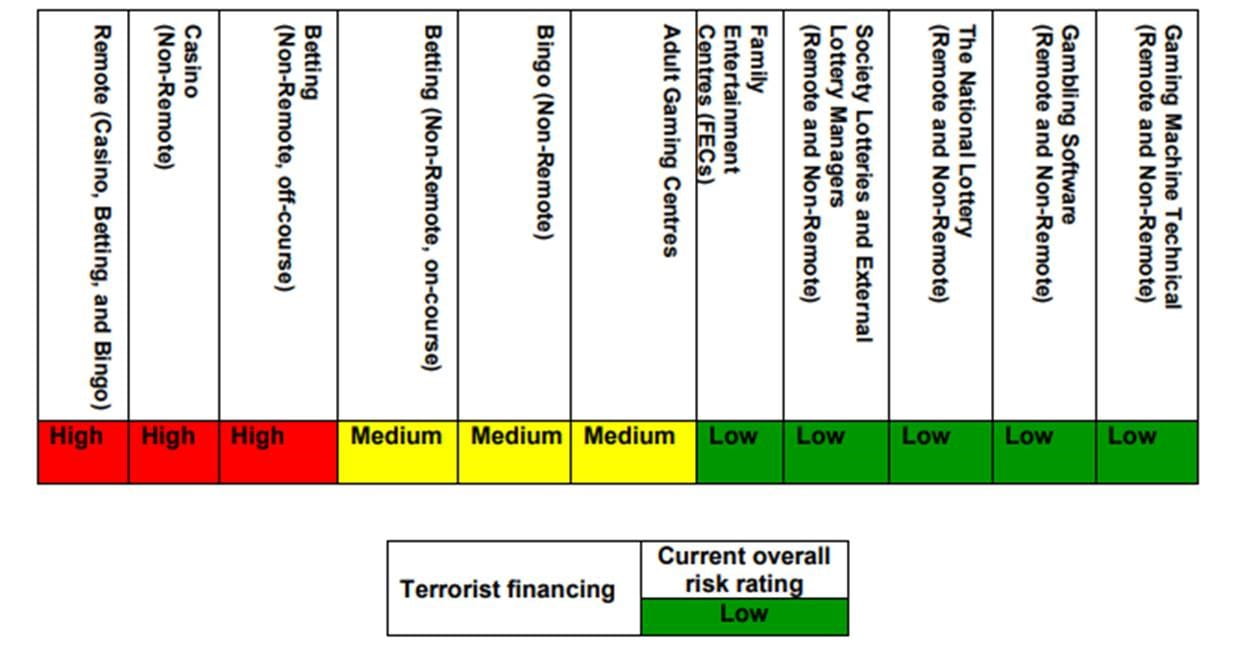

The US treasury has been ordered to carry out a study on money laundering by China that will rely substantially on information obtained through the trade-based money laundering TBML analyses behind the US Government Accountability Offices GAOs detailed report that examines US agencies efforts to combat TBML Trade-based Financial Crime 3 February 2020. US treasury issues 2020 strategy for combatting illicit finance By Mark Ford on March 20 2020 The US treasury department has issued the 2020 National Strategy for Combating Terrorist and Other Illicit Financing to provide a roadmap to modernise the countrys anti-money launderingcountering the financing of terrorism AMLCFT regime to make it more effective and. The National Illicit Finance Strategy addresses the threats and risks to the US. Department of the Treasury Treasury which leads financial and regulatory CFT efforts for the US. Last week saw the release of the Treasury Departments national money laundering risk assessment which is viewable here the casino section starts on page 74 although be forewarned that it.

Source: slideplayer.com

Source: slideplayer.com

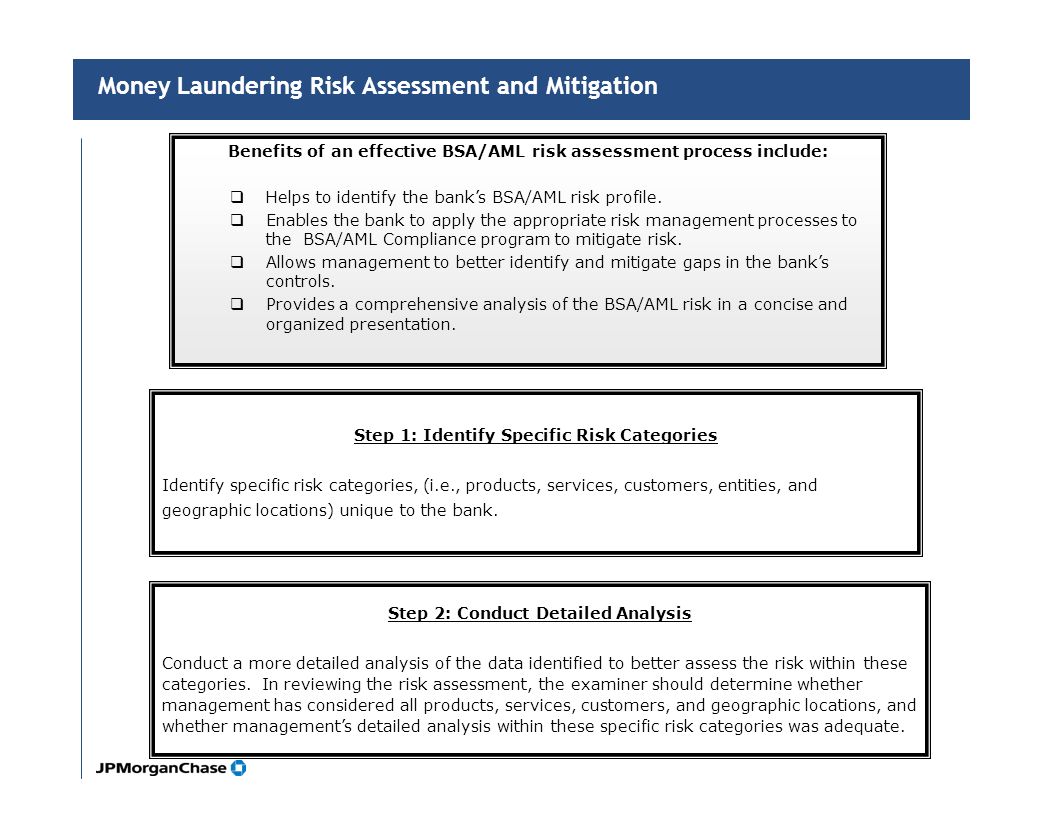

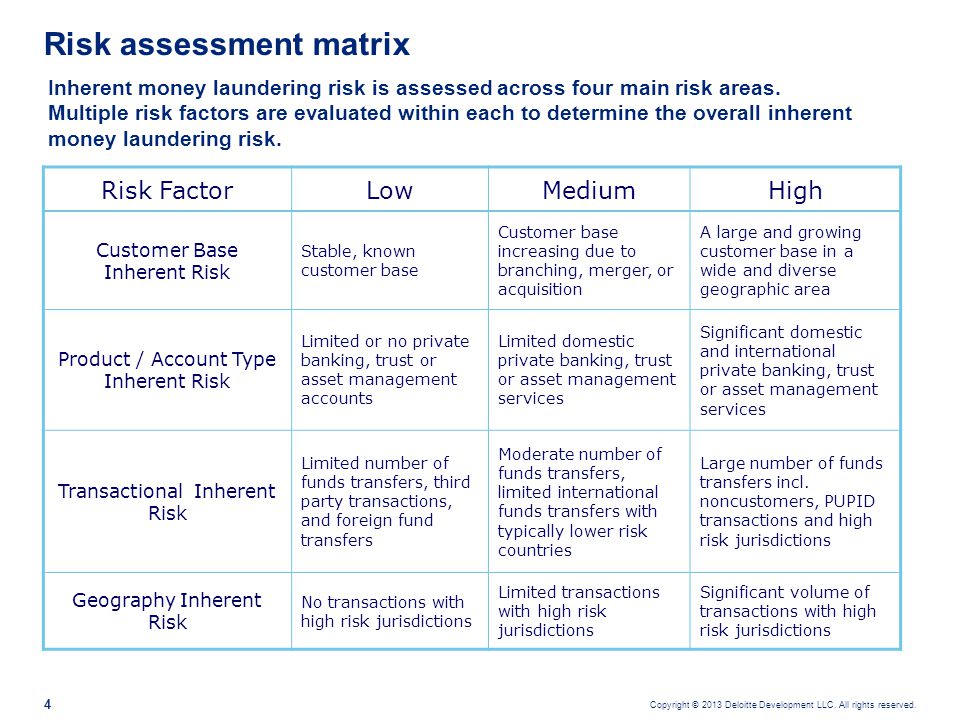

The risk assessment must create an overview of and understanding of the companys inherent risks that the company can be used for money laundering or terrorist financing. The 2020 Strategy as well as the 2018 National Risk Assessments identifies the most significant illicit finance threats vulnerabilities and risks facing the United States. US treasury issues 2020 strategy for combatting illicit finance By Mark Ford on March 20 2020 The US treasury department has issued the 2020 National Strategy for Combating Terrorist and Other Illicit Financing to provide a roadmap to modernise the countrys anti-money launderingcountering the financing of terrorism AMLCFT regime to make it more effective and. Financial system more difficult and risky for terrorists and their facilitators. The Treasury says that financial institutions will find these documents helpful in informing their own risk assessments and examiners will be able to use them in assessing whether AMLCFT compliance is tailored to the risks faced by their supervised.

Source: worldbank.org

Source: worldbank.org

Financial institutions will find these documents helpful in informing their own risk assessments and examiners will be able to use them in assessing whether AMLCFT compliance is tailored to the risks faced by their. The stated purpose of these two assessments is. Financial system that were identified in three separate risk assessments also released today. The US treasury has been ordered to carry out a study on money laundering by China that will rely substantially on information obtained through the trade-based money laundering TBML analyses behind the US Government Accountability Offices GAOs detailed report that examines US agencies efforts to combat TBML Trade-based Financial Crime 3 February 2020. The inherent risks follow from the companys business model and it depends among other things of the companys products and customer types and the markets in which the company operates.

Source: slideplayer.com

Source: slideplayer.com

Treasury published its National Money Laundering Risk Assessment NMLRA and National Terrorist Financing Risk Assessment NTFRA on June 12 2015. The 2015 National Money Laundering Risk Assessment NMLRA identifies the money laundering risks that are of priority concern to the United States. The National Proliferation Financing Risk Assessment the National Terrorist Financing Risk Assessment and the National Money Laundering Risk Assessment. US government reports and the 2016 Financial Action Task Force Mutual Evaluation Report identified the ability to form legal entities in the US without disclosing beneficial ownership as a key vulnerability to the US. Last week saw the release of the Treasury Departments national money laundering risk assessment which is viewable here the casino section starts on page 74 although be forewarned that it.

Source: olc.worldbank.org

Source: olc.worldbank.org

The ability to form anonymous shell companies in the US is a significant risk factor for money laundering and has been a subject of proposed legislation for decades. Government employs targeted financial sanctions formulates systemic safeguards and seeks to increase financial transparency to make accessing the US. The US treasury has been ordered to carry out a study on money laundering by China that will rely substantially on information obtained through the trade-based money laundering TBML analyses behind the US Government Accountability Offices GAOs detailed report that examines US agencies efforts to combat TBML Trade-based Financial Crime 3 February 2020. Financial system more difficult and risky for terrorists and their facilitators. Last week saw the release of the Treasury Departments national money laundering risk assessment which is viewable here the casino section starts on page 74 although be forewarned that it.

Source: baselgovernance.org

Source: baselgovernance.org

Department of the Treasury today issued the National Money Laundering Risk Assessment NMLRA and the National Terrorist Financing Risk Assessment NTFRA. Treasury published its National Money Laundering Risk Assessment NMLRA and National Terrorist Financing Risk Assessment NTFRA on June 12 2015. The US Department of Treasury has published its annual National Money Laundering Risk Assessment report a 100-page document focusing on the threat that money laundering. Department of the Treasury today issued the National Money Laundering Risk Assessment NMLRA and the National Terrorist Financing Risk Assessment NTFRA. Financial system that were identified in three separate risk assessments also released today.

The National Illicit Finance Strategy addresses the threats and risks to the US. The risk assessment must create an overview of and understanding of the companys inherent risks that the company can be used for money laundering or terrorist financing. Department of the Treasury Treasury which leads financial and regulatory CFT efforts for the US. The National Proliferation Financing Risk Assessment the National Terrorist Financing Risk Assessment and the National Money Laundering Risk Assessment. Money laundering is a serious crime in the USA and the United States effectively fights against money laundering.

Source: slideplayer.com

Source: slideplayer.com

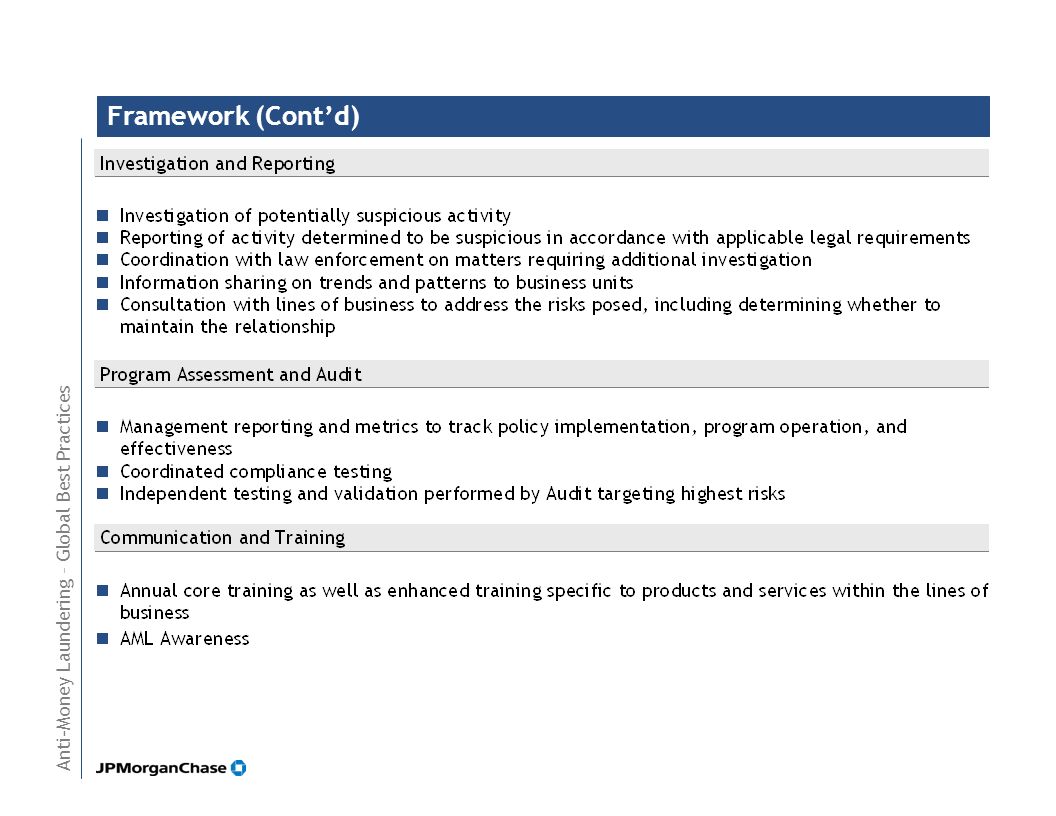

According to the Department of the Treasury TBML is one of the most challenging forms of money laundering to investigate because of the complexities of trade transactions and the large volume of international trade. The risk assessment must create an overview of and understanding of the companys inherent risks that the company can be used for money laundering or terrorist financing. US treasury issues 2020 strategy for combatting illicit finance By Mark Ford on March 20 2020 The US treasury department has issued the 2020 National Strategy for Combating Terrorist and Other Illicit Financing to provide a roadmap to modernise the countrys anti-money launderingcountering the financing of terrorism AMLCFT regime to make it more effective and. This document guides supervisors on how to assess risks in the sectors they oversee. The Treasury says that financial institutions will find these documents helpful in informing their own risk assessments and examiners will be able to use them in assessing whether AMLCFT compliance is tailored to the risks faced by their supervised.

Source: researchgate.net

Source: researchgate.net

Money laundering is a serious crime in the USA and the United States effectively fights against money laundering. Together these Risk Assessments constitute the. Supervisors oversee the measures put in place by the private sector to implement anti-money laundering checks and report suspicions. Treasury Departments anti-money laundering AML unit recently issued the much-anticipated AML priorities Congress demanded in the Anti-Money Laundering Act of 2020 a legislative effort to clarify where financial institutions should focus their efforts to more effectively police transactions for illicit activity. The National Illicit Finance Strategy addresses the threats and risks to the US.

Source: slidetodoc.com

Source: slidetodoc.com

The stated purpose of these two assessments is. The purpose of these assessments is to help the public and private sectors understand the money laundering and terrorist financing methods used in the United States the risks that these activities pose to the US. The purpose of the NMLRA is to help the public and private sectors recognize and understand the money laundering methods used in the United States the. The 2020 Strategy as well as the 2018 National Risk Assessments identifies the most significant illicit finance threats vulnerabilities and risks facing the United States. The National Proliferation Financing Risk Assessment the National Terrorist Financing Risk Assessment and the National Money Laundering Risk Assessment.

Source: acamstoday.org

Source: acamstoday.org

Department of the Treasury today issued the National Money Laundering Risk Assessment NMLRA and the National Terrorist Financing Risk Assessment NTFRA. Treasury published its National Money Laundering Risk Assessment NMLRA and National Terrorist Financing Risk Assessment NTFRA on June 12 2015. WASHINGTON USA The US Department of the Treasury issued the 2020 National Strategy for Combating Terrorist and Other Illicit Financing 2020 Strategy which provides a roadmap to modernize the US anti-money launderingcountering the financing of terrorism AMLCFT regime to make it more effective and efficient. Financial system that were identified in three separate risk assessments also released today. The ability to form anonymous shell companies in the US is a significant risk factor for money laundering and has been a subject of proposed legislation for decades.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title us treasury money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.