10++ Uk fca aml handbook ideas

Home » money laundering idea » 10++ Uk fca aml handbook ideasYour Uk fca aml handbook images are available in this site. Uk fca aml handbook are a topic that is being searched for and liked by netizens now. You can Find and Download the Uk fca aml handbook files here. Download all free vectors.

If you’re searching for uk fca aml handbook pictures information connected with to the uk fca aml handbook topic, you have come to the ideal blog. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Uk Fca Aml Handbook. The European Commission is seeking feedback on four proposals in the area of AML through 17 September 2021and on a proposal to update the eIDAS regulation which interlinks with the new AML proposals until 2 September 2021. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the large-scale obfuscation of funds. According to the latest update of the FCA Handbook in April 2021 for the crypto license UK application the FCA charges to following fees. Compliant Business Management Independent Financial Adviser Information Update Products Services Advisers Miss the new PROD Rules Quoted Post.

Crypto License Uk Fca Crypto Registration Best Explained Psp Lab From psplab.com

Crypto License Uk Fca Crypto Registration Best Explained Psp Lab From psplab.com

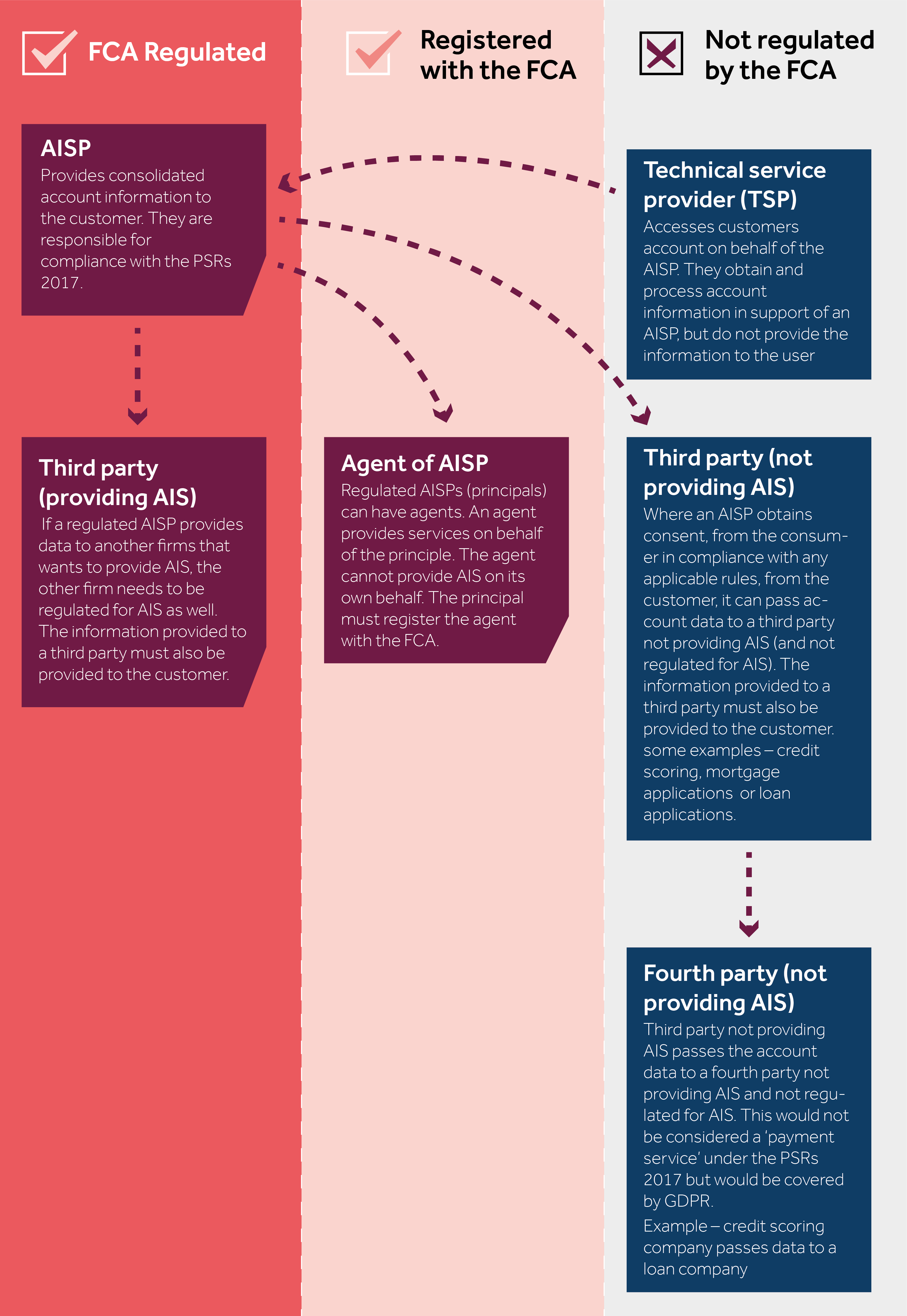

According to the latest update of the FCA Handbook in April 2021 for the crypto license UK application the FCA charges to following fees. The handbook guides Firms across a range of topics from Financial Reporting Requirements2 to Market Abuse Regulation. Its contents are drawn. The FCA oversees compliance with AML regulations in the UK and has the power to investigate money laundering and terrorism financing offenses in conjunction with other law enforcement agencies and authorities such as the Crown Prosecution Service CPS. 2 are comprehensive and proportionate to the nature scale and complexity of. FCGprovides practical assistance and information for firms of all sizes and across allFCA-supervised sectors on actions they can take to counter the risk that they might be used to further financial crime.

OPBAS is the Office for Professional Body Anti-Money Laundering Supervision The Office for Professional Body Anti-Money Laundering Supervision OPBAS is a new regulator set up by the government to strengthen the UKs anti-money laundering AML supervisory regime and ensure the professional body AML supervisors provide consistently high standards of AML supervision.

Posted on August 30 2018 November 25 2018 by Informer. In the United Kingdom one of the most prominent tools in the Anti-Money Laundering AML space is the Financial Conduct Authority FCA handbook1. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the large-scale obfuscation of funds. FCTR 412 G 13122018. On 19 April 2018 the European Parliament adopted the 5th Anti -Money Laundering Directive. The FCA require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk.

Source: psplab.com

Source: psplab.com

As many of us in the industry are aware the Financial system is governed by various bodies and regulators. All regulated firms must comply with the rules set out in the Handbook. 4478 3368 4449 Email. Dual-regulated firms will need to consider both FCA and Prudential Regulation Authority PRA rules so should also refer to the PRA Rulebook. The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the large-scale obfuscation of funds.

Source: fca.org.uk

Source: fca.org.uk

2 are comprehensive and proportionate to the nature scale and complexity of. According to the latest update of the FCA Handbook in April 2021 for the crypto license UK application the FCA charges to following fees. 2 are comprehensive and proportionate to the nature scale and complexity of. All regulated firms must comply with the rules set out in the Handbook. Its contents are drawn.

Source:

Posted on August 30 2018 November 25 2018 by Informer. All regulated firms must comply with the rules set out in the Handbook. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures. The FCA oversees compliance with AML regulations in the UK and has the power to investigate money laundering and terrorism financing offenses in conjunction with other law enforcement agencies and authorities such as the Crown Prosecution Service CPS. 2 are comprehensive and proportionate to the nature scale and complexity of.

Source: financialcrimes.vercel.app

Source: financialcrimes.vercel.app

4478 3368 4449 Email. The handbook guides Firms across a range of topics from Financial Reporting Requirements2 to Market Abuse Regulation. The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. In the United Kingdom one of the most prominent tools in the Anti-Money Laundering AML space is the Financial Conduct Authority FCA handbook1. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Source: psplab.com

Source: psplab.com

2000 for businesses with UK cryptoasset income up to 250000. FCA Handbook Welcome to the website of the Financial Conduct Authoritys Handbook of rules and guidance. AML Beneficial Ownership and Sanctions. The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. You can click Join Up to create an account for adding favourites and setting update alerts.

Source: pinterest.com

Source: pinterest.com

Importance of adopting the 2020 Handbook. You can click Join Up to create an account for adding favourites and setting update alerts. The FCA Handbook contains the complete record of FCA Legal Instruments and presents changes made in a single consolidated view. AML Beneficial Ownership and Sanctions. OPBAS is the Office for Professional Body Anti-Money Laundering Supervision The Office for Professional Body Anti-Money Laundering Supervision OPBAS is a new regulator set up by the government to strengthen the UKs anti-money laundering AML supervisory regime and ensure the professional body AML supervisors provide consistently high standards of AML supervision.

Source:

We also provide policy templates and procedures for the UK GDPR AML Market Abuse Information. Compliant Business Management Independent Financial Adviser Information Update Products Services Advisers Miss the new PROD Rules Quoted Post. FCTR 412 G 13122018. There may be firms particularly smaller firms that monitor credibly and effectively using manual procedures. Suitable for those looking to comly with the FCA Handbook rules or to gain FCA authorisation.

Source: planetcompliance.com

Source: planetcompliance.com

The amendments stemmed from the European Commissions 2016 Action Plan to tackle the use of the financial system for the funding of criminal activities terrorist financing and the large-scale obfuscation of funds. GEN Sch 3 Fees and other required payments. 10000 for businesses with UK cryptoasset income greater than 250000. OPBAS is the Office for Professional Body Anti-Money Laundering Supervision The Office for Professional Body Anti-Money Laundering Supervision OPBAS is a new regulator set up by the government to strengthen the UKs anti-money laundering AML supervisory regime and ensure the professional body AML supervisors provide consistently high standards of AML supervision. A firm must ensure the policies and procedures established under SYSC 611 R include systems and controls that.

Source: psplab.com

Source: psplab.com

These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. The Financial Conduct Authority is the conduct regulator for 58000 financial services firms and financial markets in the UK and the prudential regulator for over 24000 of those firms. FCGprovides practical assistance and information for firms of all sizes and across allFCA-supervised sectors on actions they can take to counter the risk that they might be used to further financial crime. GEN Sch 2 Notification requirements. New FinCEN rules for beneficial ownership reporting are due to come into force 1 January 2022.

Source: pinterest.com

Source: pinterest.com

Financial Conduct Authority FCA. There may be firms particularly smaller firms that monitor credibly and effectively using manual procedures. 1 enable it to identify assess monitor and manage money laundering risk. HIRETT LTD and its staff are committed to the highest standards of anti-money laundering AML including anti-fraud anti-corruption and taking measures to mitigate against financial crime. Compliant Business Management Independent Financial Adviser Information Update Products Services Advisers Miss the new PROD Rules Quoted Post.

Source: fca.org.uk

Source: fca.org.uk

The FCA require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. HIRETT LTD and its staff are committed to the highest standards of anti-money laundering AML including anti-fraud anti-corruption and taking measures to mitigate against financial crime. AML Beneficial Ownership and Sanctions. Know Your Compliance Limited specialise in developing FCA Policy Templates and regulatory compliance policies procedures checklists and training packages. The Financial Conduct Authority is the conduct regulator for 58000 financial services firms and financial markets in the UK and the prudential regulator for over 24000 of those firms.

Source: sumsub.com

The FCA require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk. Importance of adopting the 2020 Handbook. The extent to which we expect a firm to use automated anti-money laundering transaction monitoring AML TM systems depends on considerations such as the nature and scale of its business activities. The FCA Handbook contains the complete record of FCA Legal Instruments and presents changes made in a single consolidated view. 2000 for businesses with UK cryptoasset income up to 250000.

Source: fca.org.uk

Source: fca.org.uk

The FCA oversees compliance with AML regulations in the UK and has the power to investigate money laundering and terrorism financing offenses in conjunction with other law enforcement agencies and authorities such as the Crown Prosecution Service CPS. 10000 for businesses with UK cryptoasset income greater than 250000. 2 are comprehensive and proportionate to the nature scale and complexity of. The handbook guides Firms across a range of topics from Financial Reporting Requirements2 to Market Abuse Regulation. The FCA require all authorised firms subject to the Money Laundering Regulations to meet additional but complementary regulatory obligation to apply policies and procedures to minimise their money laundering risk.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title uk fca aml handbook by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.