14++ Types of risk associated with money laundering information

Home » money laundering idea » 14++ Types of risk associated with money laundering informationYour Types of risk associated with money laundering images are ready. Types of risk associated with money laundering are a topic that is being searched for and liked by netizens now. You can Download the Types of risk associated with money laundering files here. Find and Download all royalty-free images.

If you’re looking for types of risk associated with money laundering images information linked to the types of risk associated with money laundering keyword, you have come to the ideal site. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

Types Of Risk Associated With Money Laundering. However non-financial institutions are subject to two basic AML criminal statutes 18 United States Code Sections 1956 and 1957. Risk of Money Laundering through Financial Instruments Users and Employees of Financial Institutions Page Image Number 11. The highly lucrative gold market also presents proceed-generating opportunities. A bank should take such business diversity.

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic From in.pinterest.com

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic From in.pinterest.com

Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. 32 Image Number 12. The complex set of money laundering statutes and regulations apply to financial institutions as defined under Title 31 of the United States Code. There are EU laws and directives stating that if a financial institution in the EU is found to be assisting a money launderer and failed to follow the appropriate procedures as laid out by the EU the individual employee and respective supervisors. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. Risk of Money Laundering through Financial Instruments Users and Employees of Financial Institutions Page Image Number 11.

However a much graver risk that banks face is the risk of criminal prosecution for laundering money whether they know the funds are criminally obtained or not.

Whereas funds destined for money laundering are by definition derived from criminal activities such as drug trafficking and fraud terrorist financing may include funds from perfectly legitimate sources used to finance acts of terrorism. According to the Report from the Commission to the European Parliament and to the Council on the assessment. The highly lucrative gold market also presents proceed-generating opportunities. You can decide which areas of. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. Risk of Money Laundering through Financial Instruments Users and Employees of Financial Institutions Page Image Number 11.

Source: pinterest.com

Source: pinterest.com

Savings account withdrawal slips. âœif one customer coming to the bank to open an account and the frontline officer failed to detect money laundering risk associated with the said customer the account opened is unlikely to be cancelled or terminatedâ CO1. Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. The Department of Justice can initiate criminal andor civil actions under 18 USC 1956. It has a stable value it is anonymous and easily transformable and interchangeable.

Source: financetrainingcourse.com

Source: financetrainingcourse.com

However non-financial institutions are subject to two basic AML criminal statutes 18 United States Code Sections 1956 and 1957. When assessing the money laundering and terrorist financing risks relating to types of customers countries or geographic areas and particular. Cash Intensive Businesses Managing Their Money Laundering Risks. Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. There are EU laws and directives stating that if a financial institution in the EU is found to be assisting a money launderer and failed to follow the appropriate procedures as laid out by the EU the individual employee and respective supervisors.

Source: ec.europa.eu

Source: ec.europa.eu

However a much graver risk that banks face is the risk of criminal prosecution for laundering money whether they know the funds are criminally obtained or not. According to the Report from the Commission to the European Parliament and to the Council on the assessment. High value products or services increase the risk of money laundering occurringEnhanced due diligence should be considered for high value products by verifying the source of funds or wealth of the customerAMLCFT risks. There are circumstances where the risk of money laundering or terrorist financing is higher and enhanced CDD measures have to be taken. Savings account withdrawal slips.

Source: acamstoday.org

Source: acamstoday.org

There are EU laws and directives stating that if a financial institution in the EU is found to be assisting a money launderer and failed to follow the appropriate procedures as laid out by the EU the individual employee and respective supervisors. Whereas funds destined for money laundering are by definition derived from criminal activities such as drug trafficking and fraud terrorist financing may include funds from perfectly legitimate sources used to finance acts of terrorism. The Department of Justice can initiate criminal andor civil actions under 18 USC 1956. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. 34 Image Number 13.

Source: slideplayer.com

Source: slideplayer.com

According to the Report from the Commission to the European Parliament and to the Council on the assessment. Risk of Money Laundering through Financial Instruments Users and Employees of Financial Institutions Page Image Number 11. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with. 34 Image Number 13.

Source: in.pinterest.com

Source: in.pinterest.com

Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. There are unavoidable damages if money laundering risk has passed through the frontline officers. More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. 32 Image Number 12. The National Crime Agency NCA believes that there is a realistic possibility that money laundering is in the hundreds of billions of pounds annually.

Source:

High-risk industries include for example cash-intensive businesses or. The complex set of money laundering statutes and regulations apply to financial institutions as defined under Title 31 of the United States Code. Risks associated with each business are different. While most Cash Intensive Businesses CIBs are conducting legitimate business some aspects of these businesses may be susceptible to money laundering or terrorist financing. Risk of Money Laundering through Financial Instruments Users and Employees of Financial Institutions Page Image Number 11.

Source: pinterest.com

Source: pinterest.com

Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. It has a stable value it is anonymous and easily transformable and interchangeable. The complex set of money laundering statutes and regulations apply to financial institutions as defined under Title 31 of the United States Code. Savings account withdrawal slips. There are EU laws and directives stating that if a financial institution in the EU is found to be assisting a money launderer and failed to follow the appropriate procedures as laid out by the EU the individual employee and respective supervisors.

Source: redalyc.org

Source: redalyc.org

The complex set of money laundering statutes and regulations apply to financial institutions as defined under Title 31 of the United States Code. You can decide which areas of. Whereas funds destined for money laundering are by definition derived from criminal activities such as drug trafficking and fraud terrorist financing may include funds from perfectly legitimate sources used to finance acts of terrorism. Money laundering underpins and enables most forms of organised crime allowing crime groups to further their operations and conceal their assets. Determine specific risk categories based on the risk identified in order to further control.

Source: redalyc.org

Source: redalyc.org

There are unavoidable damages if money laundering risk has passed through the frontline officers. High-risk industries include for example cash-intensive businesses or. Risk of Money Laundering through Financial Instruments Users and Employees of Financial Institutions Page Image Number 11. While most Cash Intensive Businesses CIBs are conducting legitimate business some aspects of these businesses may be susceptible to money laundering or terrorist financing. It has a stable value it is anonymous and easily transformable and interchangeable.

Source: pideeco.be

Source: pideeco.be

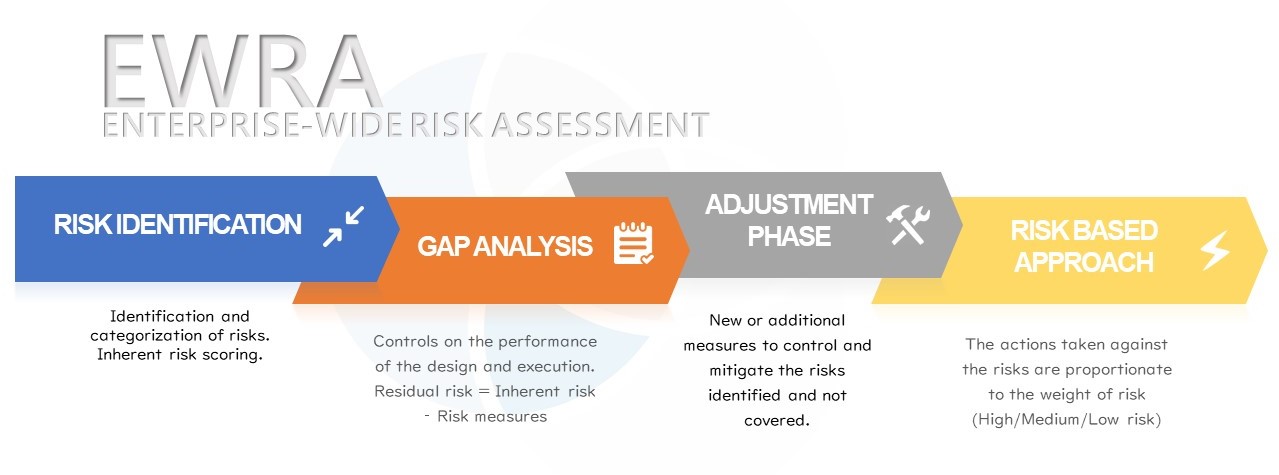

The money-laundering risks we identified are mitigated to an extent by the nature of the firms in the market however there remain some risks particular to the capital markets. In view of these requirements companies need to conduct an AML risk. When assessing the money laundering and terrorist financing risks relating to types of customers countries or geographic areas and particular. Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. According to the Report from the Commission to the European Parliament and to the Council on the assessment.

Source: pinterest.com

Source: pinterest.com

Determine specific risk categories based on the risk identified in order to further control. High-risk industries include for example cash-intensive businesses or. When assessing the money laundering and terrorist financing risks relating to types of customers countries or geographic areas and particular. Determine specific risk categories based on the risk identified in order to further control. Risks associated with each business are different.

Source: pinterest.com

Source: pinterest.com

32 Image Number 12. However non-financial institutions are subject to two basic AML criminal statutes 18 United States Code Sections 1956 and 1957. We found that some we visited needed to be more aware of the money-laundering risks in the capital markets and many were in the early stages of their thinking in relation to these risks and needed to do more to fully. Savings account withdrawal slips. High value products or services offer those seeking to undertake money laundering and the financing of terrorism the opportunity to move illicit funds in large amounts with.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title types of risk associated with money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.