20++ Types of money laundering in aml ideas

Home » money laundering idea » 20++ Types of money laundering in aml ideasYour Types of money laundering in aml images are ready. Types of money laundering in aml are a topic that is being searched for and liked by netizens today. You can Get the Types of money laundering in aml files here. Download all royalty-free photos and vectors.

If you’re searching for types of money laundering in aml pictures information related to the types of money laundering in aml keyword, you have pay a visit to the ideal blog. Our site always provides you with hints for refferencing the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

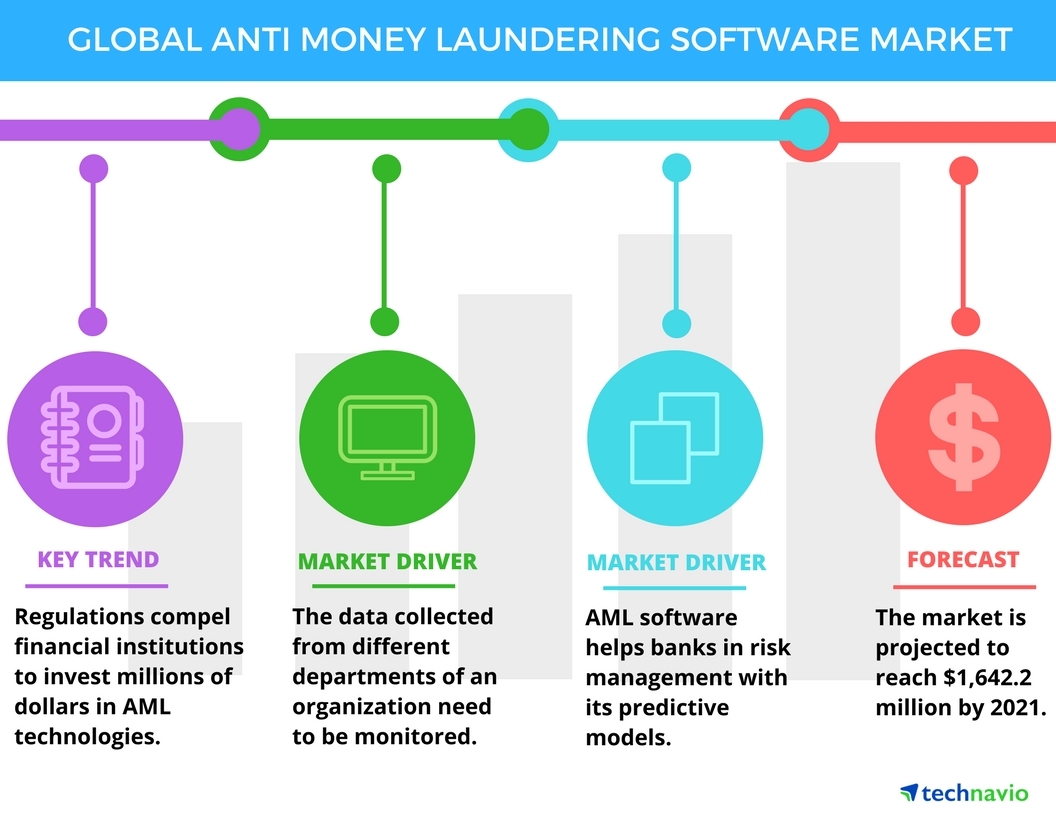

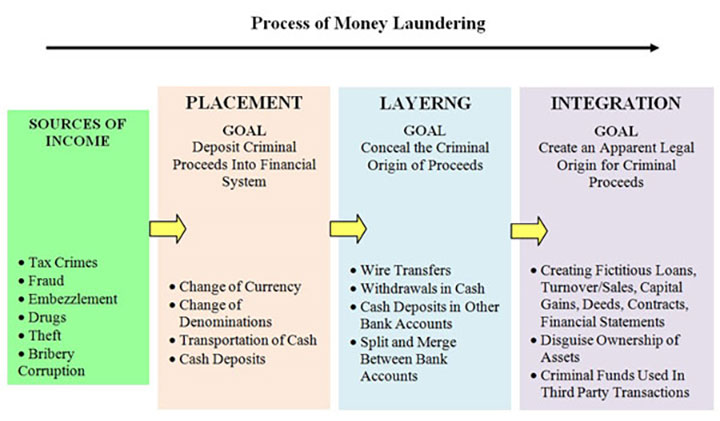

Types Of Money Laundering In Aml. The AML 2020 Act is the most extensive reform to the US. Its a process by which soiled cash is transformed into clean cash. Investing in other legitimate business interests. A designated AML compliance officer.

Infographic Money Laundering Is The Process By Which Criminals Conceal The Original Source Of Money To Make It Appear As It S Been Earned Via A Legitimate From pinterest.com

Infographic Money Laundering Is The Process By Which Criminals Conceal The Original Source Of Money To Make It Appear As It S Been Earned Via A Legitimate From pinterest.com

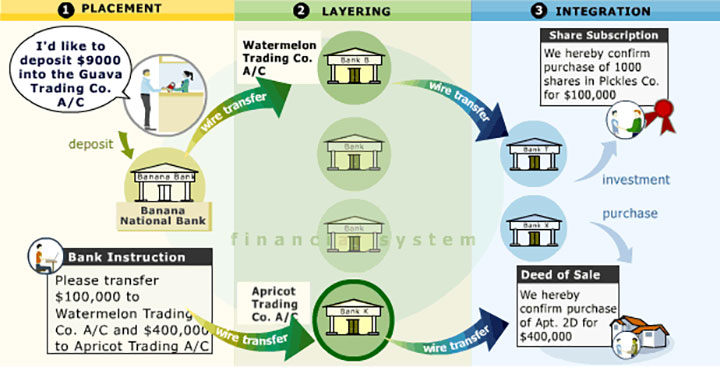

STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement. This creates a credit balance of 20000 which is highly unusual for a credit card account because normally you owe the bank money not the other way around. Investing in real estate. Both businesses and governments are constantly looking for new ways to combat money launderers and financial criminals. Its a process by which soiled cash is transformed into clean cash. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

The idea of cash laundering is essential to be understood for those working in the monetary sector.

As a point of reference the United Nations Office of Drugs and Crime UNODC estimates the total amount of money laundered is somewhere between 2 and 5 of global GDP or 800 billion to 2 trillion in US dollars annually. It is the illegal process of concealing the origins of money obtained through illicit means by passing it through. It is not necessary for the person or entity to know the specific unlawful activity that generated the illegal proceeds. Its a process by which soiled cash is transformed into clean cash. At a minimum the anti-money laundering program should include. Your internal controls effectively monitor and manage your firms compliance with anti-money-laundering AML policies and procedures.

Source: pinterest.com

Source: pinterest.com

There are many different types of anti-money laundering jobs including those of forensic accountant those of investigations. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. AML regulations since the Patriot Act almost two decades ago. Investing in real estate.

Source: unodc.org

Source: unodc.org

Investing in other legitimate business interests. Money laundering and terrorism financing typologies in any given location are heavily influenced by the economy financial. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. Both businesses and governments are constantly looking for new ways to combat money launderers and financial criminals.

Source: coinfirm.com

Source: coinfirm.com

Independent review to test the program Anti-Money Laundering and Counter-Financing of Terrorism Program. Both businesses and governments are constantly looking for new ways to combat money launderers and financial criminals. There are many different types of anti-money laundering jobs including those of forensic accountant those of investigations. It is not necessary for the person or entity to know the specific unlawful activity that generated the illegal proceeds. It is the illegal process of concealing the origins of money obtained through illicit means by passing it through.

Source: pinterest.com

Source: pinterest.com

The AML 2020 Act is the most extensive reform to the US. Authorities have also developed anti-money laundering AML policies to boost their efforts in this fight. Money laundering is a major financial crime. Regulation EU 2015847 on information on the payer accompanying transfers of funds makes fund transfers more transparent thereby helping law enforcement authorities to track down terrorists and criminals. These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services.

Source: pinterest.com

Source: pinterest.com

As a point of reference the United Nations Office of Drugs and Crime UNODC estimates the total amount of money laundered is somewhere between 2 and 5 of global GDP or 800 billion to 2 trillion in US dollars annually. Regulation EU 2015847 on information on the payer accompanying transfers of funds makes fund transfers more transparent thereby helping law enforcement authorities to track down terrorists and criminals. Money laundering is a major financial crime. It is not necessary for the person or entity to know the specific unlawful activity that generated the illegal proceeds. Money laundering and terrorism financing typologies in any given location are heavily influenced by the economy financial.

Source: in.pinterest.com

Source: in.pinterest.com

Client is self-employed working as a. At a minimum the anti-money laundering program should include. Money laundering is a major financial crime. Directive EU 2015849 on preventing the use of the financial system for money laundering or terrorist financing 4 th anti-money laundering Directive. Authorities have also developed anti-money laundering AML policies to boost their efforts in this fight.

Source: bcfocus.com

Source: bcfocus.com

Investing in real estate. Independent review to test the program Anti-Money Laundering and Counter-Financing of Terrorism Program. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. Authorities have also developed anti-money laundering AML policies to boost their efforts in this fight. Criminals are very creative in developing methods to launder money and finance terrorism.

Source: voyagerlabs.co

Source: voyagerlabs.co

Money laundering is a major financial crime. Independent review to test the program Anti-Money Laundering and Counter-Financing of Terrorism Program. Given the clandestine illicit nature of money laundering it is impossible to know how much dirty money enters the international banking system each year. What is money laundering. Authorities have also developed anti-money laundering AML policies to boost their efforts in this fight.

Source: pinterest.com

Source: pinterest.com

Independent review to test the program Anti-Money Laundering and Counter-Financing of Terrorism Program. See Anti-Money Laundering Program Arrest. It is not necessary for the person or entity to know the specific unlawful activity that generated the illegal proceeds. The idea of cash laundering is essential to be understood for those working in the monetary sector. Examples may include mechanics landscapers or hairstylists.

Source: unodc.org

Source: unodc.org

These controls need to be appropriate to the size of your firm the products you offer the parts of the world where you do business and types of customers who use your services. Written internal policies procedures and controls. The client makes a large check payment of 20000 via ATM. The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short.

Source: in.pinterest.com

Source: in.pinterest.com

There are many different types of anti-money laundering jobs including those of forensic accountant those of investigations. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. The FATF Recommendations are recognised as the global anti-money laundering AML and counter-terrorist financing CFT standard. Its a process by which soiled cash is transformed into clean cash. Independent review to test the program Anti-Money Laundering and Counter-Financing of Terrorism Program.

Source: pinterest.com

Source: pinterest.com

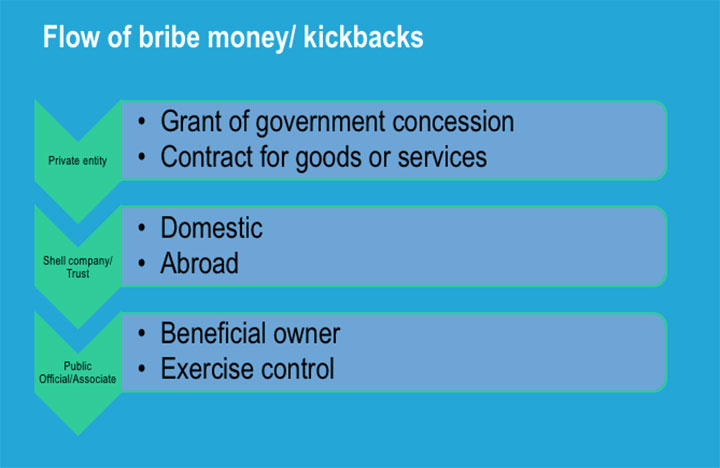

So if a launderer has 250000 in cash he needs to get into the financial system he. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets. Investing in real estate. As a point of reference the United Nations Office of Drugs and Crime UNODC estimates the total amount of money laundered is somewhere between 2 and 5 of global GDP or 800 billion to 2 trillion in US dollars annually. Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards.

Source: unodc.org

Source: unodc.org

Reselling high-value goods such as artwork or any type of stored-value product such as jewelry or prepaid cards. Investing in real estate. Authorities have also developed anti-money laundering AML policies to boost their efforts in this fight. Money laundering and terrorism financing typologies in any given location are heavily influenced by the economy financial. Setting up or using shell companies to move illegal funds and obscure ultimate beneficial ownership and assets.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title types of money laundering in aml by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.