13+ Traditional stages of aml risk framework information

Home » money laundering idea » 13+ Traditional stages of aml risk framework informationYour Traditional stages of aml risk framework images are available. Traditional stages of aml risk framework are a topic that is being searched for and liked by netizens today. You can Find and Download the Traditional stages of aml risk framework files here. Download all free vectors.

If you’re looking for traditional stages of aml risk framework images information connected with to the traditional stages of aml risk framework interest, you have pay a visit to the right site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

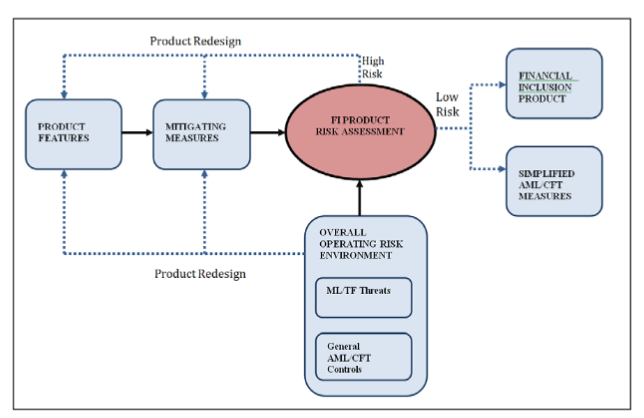

Traditional Stages Of Aml Risk Framework. Representation paradox and the 3rd directive Purpose This paper seeks to deconstruct the proposed riskbased approach to antimoney. Identify the MLTF risks that exist for your business when providing designated services. All of these perspectives can be comple-mentary and valuable in identifying risks and their drivers. Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff.

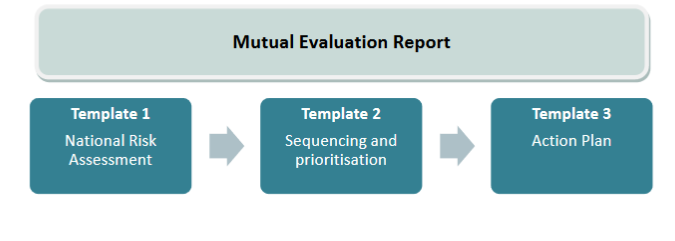

Ad AML coverage from every angle. In the framework of the common uniform standards set out at the international and European level national AMLCFT regimes have to be different to reflect countries peculiarities especially as regards the characteristics of the legal system and the overall risk profile. The Guidance reviews the different steps of the AMLCFT process Customer Due Diligence record-keeping requirements reporting of suspicious transactions use of agents internal controls and. It assists in the prioritisation and efficient allocation of resources by authorities. Your AMLCFT supervisor expects that you will have a clear understanding of the MLTF risks and vulnerabilities you face during the course of business. The post-implementation assessment of systems tools policies and procedures.

The Guidance reviews the different steps of the AMLCFT process Customer Due Diligence record-keeping requirements reporting of suspicious transactions use of agents internal controls and.

Assess and measure risks. Implementation and development of a national anti-money laundering countering the financing of terrorism AMLCFT regime which includes laws regulations enforcementand other measures to mitigate MLTF risks. The risk assessment is the foundation of a proportionate risk-based AMLCFT framework. All of these perspectives can be comple-mentary and valuable in identifying risks and their drivers. Assess and measure risks. AML program Financial crime client lifecycle Four pillars of an effective AML program Three lines of defense model Risk assessment Suspicious transaction reporting Pre-course Pre-course activity 1 2 3 4 Module 1 Anti-Money Laundering and combatting the financing of terrorism Module 2 Fraud risk management Post-course.

Source: service.betterregulation.com

Source: service.betterregulation.com

Representation paradox and the 3rd directive Purpose This paper seeks to deconstruct the proposed riskbased approach to antimoney. Assessing of financial crime units and functions. The focus on risks from a product lifecycle perspective is only one perspective on conduct risks. Assessing advising and assisting in anti-money laundering compliance and reporting obligations Including Gap analysis designing and implementation of improved best practice AMLCFT framework. The risk assessment is.

The risk assessment is. Ad AML coverage from every angle. Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff. Latest news reports from the medical literature videos from the experts and more. Implementation and development of a national anti-money laundering countering the financing of terrorism AMLCFT regime which includes laws regulations enforcementand other measures to mitigate MLTF risks.

Source: elibrary.imf.org

Source: elibrary.imf.org

The post-implementation assessment of systems tools policies and procedures. The financial industry maturity model FIMM for anti-money laundering AML described in this paper is a governance risk and compliance GRC framework that describes the essential business. Of course each company has to consider its AML actions depending on the industry and business specifics. Assess and measure risks. Assessments of the AML risk and control framework of an entity as part of the due diligence process prior to a merger.

Source: shuftipro.com

Source: shuftipro.com

Monitor and review effectiveness. Request PDF The risk-based approach to AML. Assistance during de-risking exercises. Your AMLCFT supervisor expects that you will have a clear understanding of the MLTF risks and vulnerabilities you face during the course of business. On this page you will find a summary of a four-step process to help you to manage MLTF and regulatory risks.

Business model or value chain analysis are two alternative perspectives though some aspects of these are already included in the framework. Assess and measure risks. You must base your programme on your risk assessment. You must consider the risks posed by. Identify the MLTF risks that exist for your business when providing designated services.

Source: rmahq.org

Ad AML coverage from every angle. Request PDF The risk-based approach to AML. Assess and measure risks. The post-implementation assessment of systems tools policies and procedures. On this page you will find a summary of a four-step process to help you to manage MLTF and regulatory risks.

Source: eur-lex.europa.eu

Source: eur-lex.europa.eu

All of these perspectives can be comple-mentary and valuable in identifying risks and their drivers. Assessments of the AML risk and control framework of an entity as part of the due diligence process prior to a merger. Of course each company has to consider its AML actions depending on the industry and business specifics. Implementation and development of a national anti-money laundering countering the financing of terrorism AMLCFT regime which includes laws regulations enforcementand other measures to mitigate MLTF risks. Monitor and review effectiveness.

Source: analystprep.com

Source: analystprep.com

Ad AML coverage from every angle. The risk assessment is the foundation of a proportionate risk-based AMLCFT framework. On this page you will find a summary of a four-step process to help you to manage MLTF and regulatory risks. Monitor and review effectiveness. Implementation and development of a national anti-money laundering countering the financing of terrorism AMLCFT regime which includes laws regulations enforcementand other measures to mitigate MLTF risks.

Source: researchgate.net

Source: researchgate.net

It assists in the prioritisation and efficient allocation of resources by authorities. Latest news reports from the medical literature videos from the experts and more. BSM needs to ensure that the MLTF risks arising. Your AMLCFT supervisor expects that you will have a clear understanding of the MLTF risks and vulnerabilities you face during the course of business. The post-implementation assessment of systems tools policies and procedures.

In the framework of the common uniform standards set out at the international and European level national AMLCFT regimes have to be different to reflect countries peculiarities especially as regards the characteristics of the legal system and the overall risk profile. Latest news reports from the medical literature videos from the experts and more. The financial industry maturity model FIMM for anti-money laundering AML described in this paper is a governance risk and compliance GRC framework that describes the essential business. Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff. These could include involvement during the development of new tools systems policies and procedures or during the development of new products or service lines.

Assessing of financial crime units and functions. Identify the MLTF risks that exist for your business when providing designated services. Assessing advising and assisting in anti-money laundering compliance and reporting obligations Including Gap analysis designing and implementation of improved best practice AMLCFT framework. The post-implementation assessment of systems tools policies and procedures. Request PDF The risk-based approach to AML.

Source:

Request PDF The risk-based approach to AML. Ad AML coverage from every angle. Updating Anti-Money Laundering controls and guidelines according to legislation and sharing the changes with staff. The financial industry maturity model FIMM for anti-money laundering AML described in this paper is a governance risk and compliance GRC framework that describes the essential business. As AML legislation and regulations are always evolving its vital to be aware of new developments and ensure theyre understood and followed across your organisation.

Source: service.betterregulation.com

Source: service.betterregulation.com

Business model or value chain analysis are two alternative perspectives though some aspects of these are already included in the framework. Assessments of the AML risk and control framework of an entity as part of the due diligence process prior to a merger. Ad AML coverage from every angle. You must base your programme on your risk assessment. BSM needs to ensure that the MLTF risks arising.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title traditional stages of aml risk framework by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.