14++ Three types of money laundering information

Home » money laundering idea » 14++ Three types of money laundering informationYour Three types of money laundering images are ready in this website. Three types of money laundering are a topic that is being searched for and liked by netizens now. You can Find and Download the Three types of money laundering files here. Download all free images.

If you’re searching for three types of money laundering images information connected with to the three types of money laundering keyword, you have visit the right blog. Our site frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

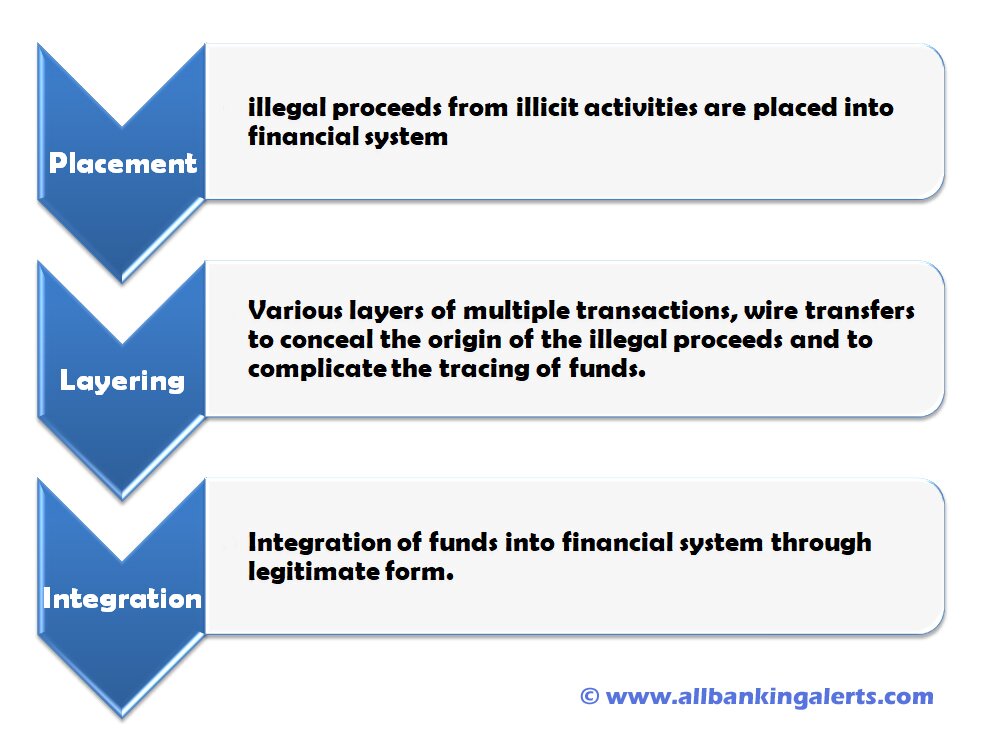

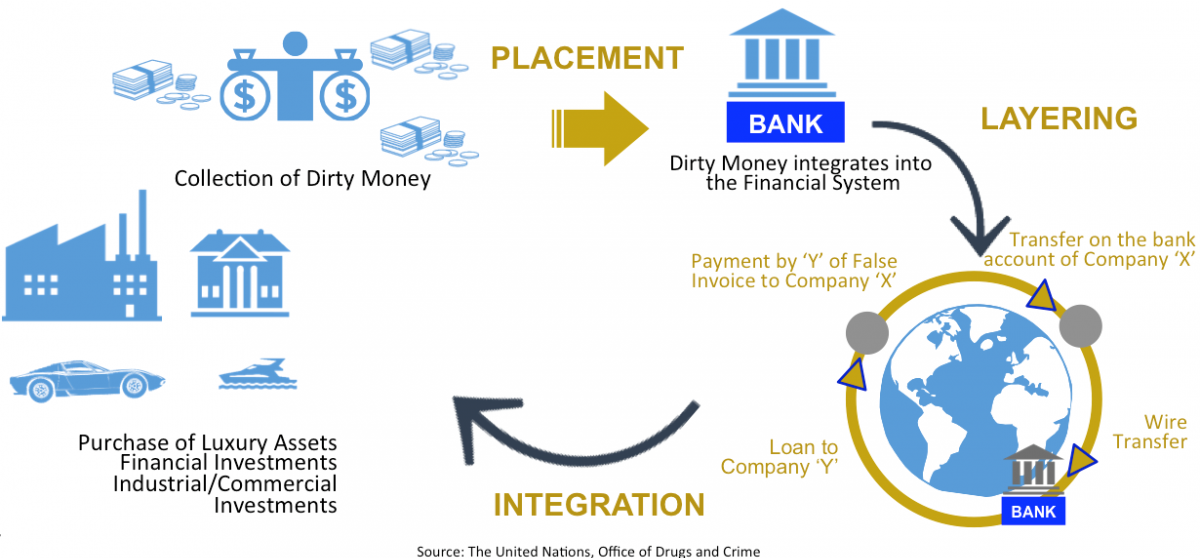

Three Types Of Money Laundering. There are three stages involved in money laundering. Banks are required to report large cash transactions and other suspicious activities that might be signs of money laundering. Which are types of risk associated with money laundering. Stage 1 of Money Laundering.

Cryptocurrency Money Laundering Explained Bitquery From bitquery.io

Cryptocurrency Money Laundering Explained Bitquery From bitquery.io

Placement layering and integration. What is the connection with society at large. There are usually two or three phases to the laundering. 3 Types of White-Collar Crime. The first involves introducing cash into the financial system by some means placement. Its a process by which soiled cash is transformed into clean cash.

The idea of cash laundering is essential to be understood for those working in the monetary sector.

Here are some of the most common ways this is achieved. Money laundering has one purpose. Fighting money laundering and terrorist financing is therefore a part of creating a business friendly environment which is a precondition for lasting economic development. Organizations dedicated to money laundering infiltrate legally constituted companies to intervene in the operation and in the financial system allocating resources for the creation of new companies. 3 The process of laundering money typically involves three steps. Anti Money Laundering Compliance Program Steps To Mitigate Risks Simplified Customer Due Diligence For customers that you deem low-risk you can perform simplified CDD.

Source: pinterest.com

Source: pinterest.com

Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often. 3 Types of White-Collar Crime. There are usually two or three phases to the laundering. There are several different types of money laundering including shell companies small bank deposits and regular consistent. Fighting money laundering and terrorist financing is therefore a part of creating a business friendly environment which is a precondition for lasting economic development.

Source: amlcompliance.ie

Source: amlcompliance.ie

While the government has the will to fight money laundering it remains to be seen how it will do so effectively. Money laundering typically occurs in three phases. The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of. Here are some of the most common ways this is achieved. There are three stages involved in money laundering.

Source: allbankingalerts.com

Source: allbankingalerts.com

The Monetary Intelligence Office of the Macau government in 2020 formulated the second five-year plan to fight money laundering including terrorist financing and the setting of short-term medium and long-term targets. Placement layering and integration. Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. Here are some of the most common ways this is achieved. The second involves carrying out complex financial transactions to camouflage the illegal source of the cash layering.

Source: allbankingalerts.com

Source: allbankingalerts.com

3 Types of White-Collar Crime. Money laundering has one purpose. Placement layering and integration. The Monetary Intelligence Office of the Macau government in 2020 formulated the second five-year plan to fight money laundering including terrorist financing and the setting of short-term medium and long-term targets. Money laundering typically involves three steps.

Source: gkeducation.epizy.com

Source: gkeducation.epizy.com

The idea of cash laundering is essential to be understood for those working in the monetary sector. Money laundering is the act of concealing illegal profits and making them appear to come from legitimate businesses. Which are types of risk associated with money laundering. 3 Types of White-Collar Crime. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious.

Source: calert.info

Source: calert.info

Money laundering typically involves three steps. Fighting money laundering and terrorist financing is therefore a part of creating a business friendly environment which is a precondition for lasting economic development. Money laundering is usually described as having three sequential elements placement layering and integrationas defined in a report by the Board of Governors of the Federal Reserve System 2002 7. Through money laundering criminals can accumulate and hide wealth and further fund illegal enterprises. There are three stages involved in money laundering.

Source: slideplayer.com

Source: slideplayer.com

3 Types of White-Collar Crime. Each of these risks will be discussed below. The Monetary Intelligence Office of the Macau government in 2020 formulated the second five-year plan to fight money laundering including terrorist financing and the setting of short-term medium and long-term targets. Stage 1 of Money Laundering. There are three stages involved in money laundering.

Source: eimf.eu

Source: eimf.eu

The sources of the money in precise are prison and the cash is invested in a manner that makes it appear to be clean money and hide the identification of the criminal a part of. What are the four key elements of a KYC policy. Placement layering and integration. Here are some of the most common ways this is achieved. And finally acquiring wealth generated from the transactions of the illicit funds integration.

Source: calert.info

Source: calert.info

Through money laundering criminals can accumulate and hide wealth and further fund illegal enterprises. To turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. What is the connection with society at large. Stage 1 of Money Laundering. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small transactions often.

Source: eimf.eu

Source: eimf.eu

Organizations dedicated to money laundering infiltrate legally constituted companies to intervene in the operation and in the financial system allocating resources for the creation of new companies. Each of these risks will be discussed below. Money laundering is the act of concealing illegal profits and making them appear to come from legitimate businesses. Money laundering typically involves three steps. There are three stages involved in money laundering.

Source: brittontime.com

Source: brittontime.com

Money laundering has one purpose. Each of these risks will be discussed below. 3 The process of laundering money typically involves three steps. There are usually two or three phases to the laundering. Fighting money laundering and terrorist financing is therefore a part of creating a business friendly environment which is a precondition for lasting economic development.

Source: bitquery.io

Source: bitquery.io

3 Types of White-Collar Crime. The idea of cash laundering is essential to be understood for those working in the monetary sector. 1956 defines three specific types of criminal money laundering according to the DOJ. Placement layering and integration. Which are types of risk associated with money laundering.

Source: study.com

Source: study.com

There are three stages involved in money laundering. Money laundering typically occurs in three phases. The possible social and political costs of money laundering if left unchecked or dealt with ineffectively are serious. 1 placement 2 layering and 3 integration. 3 Types of White-Collar Crime.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title three types of money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.