10+ Three stages of kyc ideas in 2021

Home » money laundering Info » 10+ Three stages of kyc ideas in 2021Your Three stages of kyc images are available. Three stages of kyc are a topic that is being searched for and liked by netizens today. You can Find and Download the Three stages of kyc files here. Download all royalty-free photos and vectors.

If you’re looking for three stages of kyc images information linked to the three stages of kyc keyword, you have pay a visit to the ideal site. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

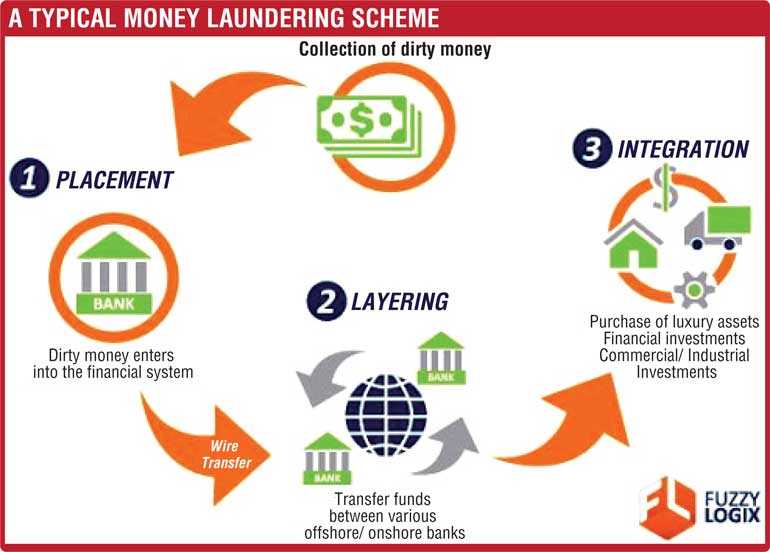

Three Stages Of Kyc. Lets discuss three steps to effective Know your customer compliance KYC Information Collection. Fundamental customer due diligence is data acquired to get confidence that there is no danger to the bank or financial institution from the client. Ascertain the identity and location of the potential customer and gain a good understanding of their business. AML KYC Process Flow.

The Three Phases Of Fintech Consumers International 2017 Download Scientific Diagram From researchgate.net

The Three Phases Of Fintech Consumers International 2017 Download Scientific Diagram From researchgate.net

How to Do KYC Online. The absolute initial phase in the KYC system is to gather the information of the customer. Assess and quantify risks more broadly. Ongoing monitoring This blog post highlights the importance of the KYC process followed by 3 steps to the KYC verification process. Its also determining clients risks being compliant with specific regulations building a seamless onboarding process storing data conducting ongoing monitoring making reports to authorities and much more. Verification Team checks the KYC document check also known as the Customer Due Diligence Check CDD process.

Organizations need to perform a detailed politically exposed person PEP and sanction check when.

What are the 3 stages. Lets discuss three steps to effective Know your customer compliance KYC Information Collection. Does this affect my organisation. Assess and quantify risks more broadly. Ascertain the identity and location of the potential customer and gain a good understanding of their business. Build a responsible organisational culture.

Source: shuftipro.com

Source: shuftipro.com

Given the need for more rigid regulations KYC and AML regulations will change in 2021. Assess and quantify risks more broadly. Does this affect my organisation. 4 quick tips for AML compliance. Its also determining clients risks being compliant with specific regulations building a seamless onboarding process storing data conducting ongoing monitoring making reports to authorities and much more.

Source: ft.lk

Source: ft.lk

Given the need for more rigid regulations KYC and AML regulations will change in 2021. Effective KYC involves knowing a customers identity their financial activities and the risk they pose. Fundamental customer due diligence is data acquired to get confidence that there is no danger to the bank or financial institution from the client. AML KYC Process Flow. After CIP the next phase in the AML KYC onboarding lifecycle process is the customer due diligence CDD phase which involves assessing the client or customer to determine whether that person or company should be given a low medium or high-risk AML rating.

Source: pinterest.com

Source: pinterest.com

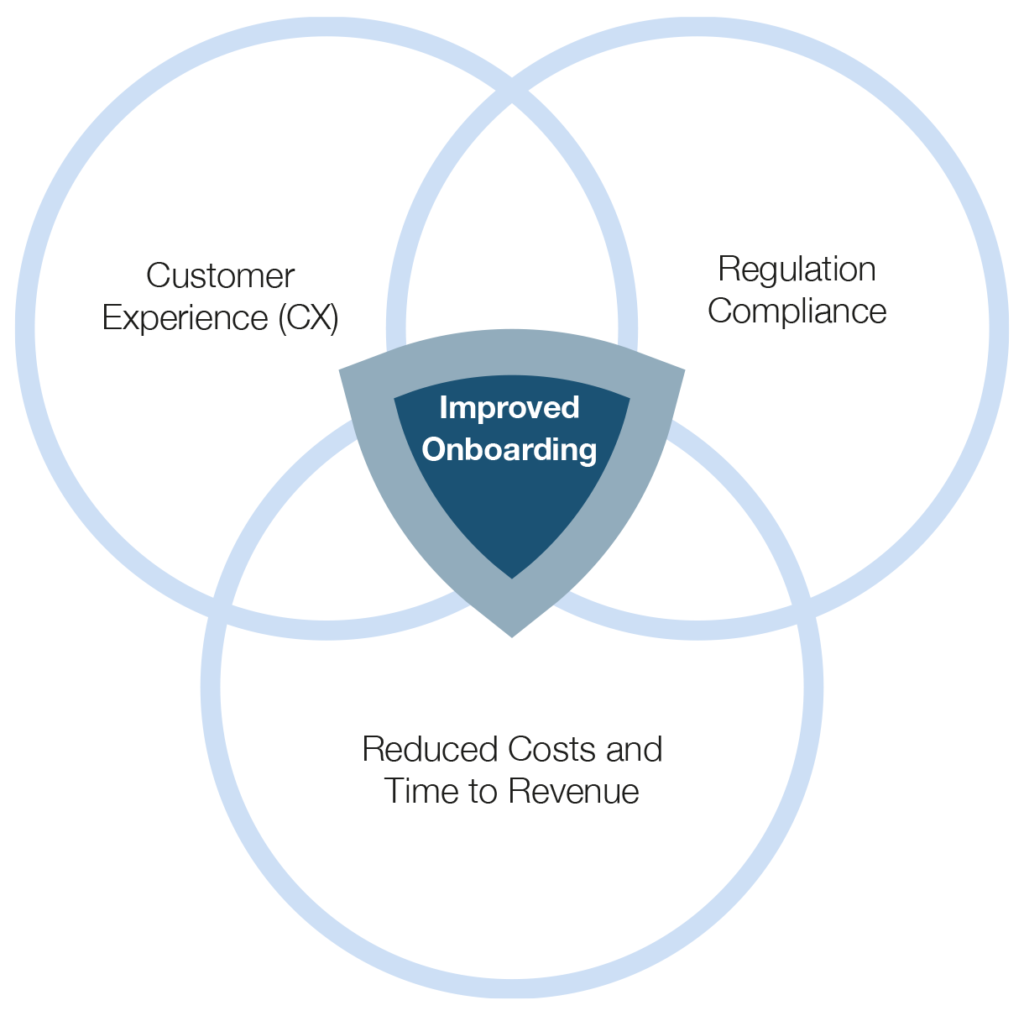

Fundamental customer due diligence is data acquired to get confidence that there is no danger to the bank or financial institution from the client. The absolute initial phase in the KYC system is to gather the information of the customer. Its also determining clients risks being compliant with specific regulations building a seamless onboarding process storing data conducting ongoing monitoring making reports to authorities and much more. The three steps of best practice have been inserted here to show that while the additional steps have added another layer of complexity by following the Assess Plan and Do stages KYC process can be simplified in a manner that will ensure successful onboarding and satisfy the regulator. Given the need for more rigid regulations KYC and AML regulations will change in 2021.

Source: shuftipro.com

Source: shuftipro.com

The absolute initial phase in the KYC system is to gather the information of the customer. To create an effective KYC process that protects your institution while minimizing friction between your bank and its customers you need three things. A critical step in the KYC process. Fundamental customer due diligence is data acquired to get confidence that there is no danger to the bank or financial institution from the client. Assess and quantify risks more broadly.

Source: arachnys.com

Source: arachnys.com

The entire identity verification procedure encompasses a lot however the most important ones are. The merchant onboarding process team stages. Assess and quantify risks more broadly. KYC can be done in three different ways-Online. How to Do KYC.

Source: slidegeeks.com

Source: slidegeeks.com

A thorough Customer Identification Program CIP Customer Due Diligence CDD and a strategy for ongoing monitoring. 5000 on or after 1st April 2018 KYC will be considered to have been done for the FY 18-19 and the DIN holder will remain KYC non-compliant for FY 17-18. How to Do KYC Online. How to Do KYC. Lets discuss three steps to effective Know your customer compliance KYC Information Collection.

Source: researchgate.net

Source: researchgate.net

Customer Due Diligence CDD Enhanced Due Diligence EDD What is AML. Keeping the tainted funds of corrupt politicians and their networks out of the legitimate financial system is a vital outcome of effective Know Your Customer KYC procedures. Know Your Customer KYC and Anti-Money Laundering AML regulations have been evolving over time. Ongoing monitoring This blog post highlights the importance of the KYC process followed by 3 steps to the KYC verification process. The entire identity verification procedure encompasses a lot however the most important ones are.

Source: pinterest.com

Source: pinterest.com

Disentangled due diligence are circumstances where the danger for tax evasion or fear-based oppressor subsidizing is low. 4 quick tips for AML compliance. How to Do KYC Online. A thorough Customer Identification Program CIP Customer Due Diligence CDD and a strategy for ongoing monitoring. Verification Team checks the KYC document check also known as the Customer Due Diligence Check CDD process.

Source: in.pinterest.com

Source: in.pinterest.com

5000 on or after 1st April 2018 KYC will be considered to have been done for the FY 18-19 and the DIN holder will remain KYC non-compliant for FY 17-18. To get through KYC you have to go through all 3 steps Liveness Identity and Proof of Residency. The merchant onboarding process team stages. Now this DIN holder need not file eForm DIR-3 KYC or access the web service DIR-3 KYC. Organizations need to perform a detailed politically exposed person PEP and sanction check when.

As the world moves forward these regulations will experience more changes. AML KYC Process Flow. Given the need for more rigid regulations KYC and AML regulations will change in 2021. Ascertain the identity and location of the potential customer and gain a good understanding of their business. Verification Team checks the KYC document check also known as the Customer Due Diligence Check CDD process.

Source: pinterest.com

Source: pinterest.com

Given the need for more rigid regulations KYC and AML regulations will change in 2021. Three diligences involved in the second step of KYC Compliance are. 4 quick tips for AML compliance. Review of KYC information recorded in Windekis under Client Profile Initiates and coordinates global searches through Client Documentation Services Regular random checks in order to review the completeness and plausibility of the client profiles recorded in the electronic system. Ascertain the identity and location of the potential customer and gain a good understanding of their business.

Source: pinterest.com

Source: pinterest.com

Know Your Customer KYC is not only a process of verifying your customers identity. Its also determining clients risks being compliant with specific regulations building a seamless onboarding process storing data conducting ongoing monitoring making reports to authorities and much more. AML KYC Process Flow. Keeping the tainted funds of corrupt politicians and their networks out of the legitimate financial system is a vital outcome of effective Know Your Customer KYC procedures. To create an effective KYC process that protects your institution while minimizing friction between your bank and its customers you need three things.

Source: pinterest.com

Source: pinterest.com

You must first click on Liveness and go through that process. Criminal activities like money. Organizations need to perform a detailed politically exposed person PEP and sanction check when. Do you know the three components of KYC. Verification Team checks the KYC document check also known as the Customer Due Diligence Check CDD process.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title three stages of kyc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.