15+ Third eu money laundering directive ideas

Home » money laundering Info » 15+ Third eu money laundering directive ideasYour Third eu money laundering directive images are available. Third eu money laundering directive are a topic that is being searched for and liked by netizens today. You can Find and Download the Third eu money laundering directive files here. Find and Download all royalty-free photos and vectors.

If you’re looking for third eu money laundering directive images information connected with to the third eu money laundering directive topic, you have come to the ideal site. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

Third Eu Money Laundering Directive. This was achieved in the UK mainly by way of the Money Laundering Regulations 2007 SI 20072157 MLRs which came into force on 15 December 2007. The 3rd EU anti-money laundering Directive 200560EC of 26102005 OJ L 309 25112005 p15 Joeb Rietrae European Commission 25 November 2005 Brussels 15122005. The European anti-money laundering directives AMLD are intended to prevent money laundering or terrorist financing and establish a consistent regulatory environment across the EU. Adoption implementing measures Ultimately 15122007.

European Union Money Laundering Directives Overview Cams Afroza From camsafroza.com

European Union Money Laundering Directives Overview Cams Afroza From camsafroza.com

The Third Directive provides a common basis for implementing the revised Financial Action Task Force FATF Recommendations which were introduced in June 2003. This note sets out a list of the countries outside the EU and the European Economic Area EEA known as third countries that were considered by EU and EEA member states to have anti-money laundering AML and counter-terrorist financing CTF regimes equivalent to the regime under the Third Money Laundering Directive 200560EC MLD3. The new Recommendations takes into account the new risks and practices that developed after the. Member states were required to implement MLD3 by 15 December 2007. Therefore the aim is to protect the integrity of the EU financial system from. The Third Money Laundering Directive 200560EC MLD3 or 3MLD came into force on 15 December 2005.

According to this Directive banks and other gatekeepers are required to apply enhanced vigilance in business relationships and transactions involving high-risk third.

As defined under the Fourth and Fifth Anti-Money Laundering Directives the EU has to establish a list of high-risk third countries to make sure the EU financial system is equipped to prevent money laundering and terrorist financing risks coming from third countries. The review of the Third Anti-Money Laundering Directive Transparency International TI is the leading organisation in the fight against corruption representing a global movement of more than 90 National Chapters committed to a world free from corruption and misappropriation. The 3rd EU anti-money laundering Directive 200560EC of 26102005 OJ L 309 25112005 p15 Joeb Rietrae European Commission 25 November 2005 Brussels 15122005. The Third Money Laundering Directive 200560EC MLD3 or 3MLD came into force on 15 December 2005. Money laundering Council Directive 91308EEC of 10 June 1991 on prevention of the use of the financial system for the purpose of money laundering 4 was adopted. Of the use of the financial system for the purpose of money laundering and terrorist financing1 This is the third European Union document that determines basic procedures and measures to guard against the use of funds derived from criminal activity 2 and it also covers.

Source: idmerit.com

Source: idmerit.com

Implementation of the 3rd. It required Member States to prohibit money laundering and to oblige the financial sector comprising credit institutions and a wide range of other financial. This chapter focuses on The Third Money Laundering Directive of the European Union EU. One of the pillars of the European Unions legislation to combat money laundering and terrorist financing is Directive EU 2015849. This note sets out a list of the countries outside the EU and the European Economic Area EEA known as third countries that were considered by EU and EEA member states to have anti-money laundering AML and counter-terrorist financing CTF regimes equivalent to the regime under the Third Money Laundering Directive 200560EC MLD3.

Source: medium.com

Source: medium.com

This chapter focuses on The Third Money Laundering Directive of the European Union EU. The 3rd EU anti-money laundering Directive 200560EC of 26102005 OJ L 309 25112005 p15 Joeb Rietrae European Commission 25 November 2005 Brussels 15122005. Adoption implementing measures Ultimately 15122007. It required Member States to prohibit money laundering and to oblige the financial sector comprising credit institutions and a wide range of other financial. Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism.

As defined under the Fourth and Fifth Anti-Money Laundering Directives the EU has to establish a list of high-risk third countries to make sure the EU financial system is equipped to prevent money laundering and terrorist financing risks coming from third countries. The review of the Third Anti-Money Laundering Directive Transparency International TI is the leading organisation in the fight against corruption representing a global movement of more than 90 National Chapters committed to a world free from corruption and misappropriation. Member states were required to implement MLD3 by 15 December 2007. The Anti-Money Laundering Directive was revised in. This chapter focuses on The Third Money Laundering Directive of the European Union EU.

Source: branddocs.com

Source: branddocs.com

It required Member States to prohibit money laundering and to oblige the financial sector comprising credit institutions and a wide range of other financial. The Third Money Laundering Directive 200560EC MLD3 or 3MLD came into force on 15 December 2005. It also explains why equivalence was. The new Recommendations takes into account the new risks and practices that developed after the. Member states were required to implement MLD3 by 15 December 2007.

Source: branddocs.com

Source: branddocs.com

The Commission is required by Directive EU 2018843 5th Anti-Money Laundering Directive to identify high-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes. The Anti-Money Laundering Directive was revised in. As defined under the Fourth and Fifth Anti-Money Laundering Directives the EU has to establish a list of high-risk third countries to make sure the EU financial system is equipped to prevent money laundering and terrorist financing risks coming from third countries. In order to protect the proper functioning of the Union financial system and of the internal market from money laundering and terrorist financing the power to adopt acts in accordance with Article 290 of the Treaty on the Functioning of the European Union TFEU should be delegated to the Commission in order to identify third-country jurisdictions which have strategic deficiencies in their national AMLCFT. Of the use of the financial system for the purpose of money laundering and terrorist financing1 This is the third European Union document that determines basic procedures and measures to guard against the use of funds derived from criminal activity 2 and it also covers.

Therefore the aim is to protect the integrity of the EU financial system from. The third directive prohibits both the laundering of money and the financing of terrorism. Adoption implementing measures Ultimately 15122007. In order to protect the proper functioning of the Union financial system and of the internal market from money laundering and terrorist financing the power to adopt acts in accordance with Article 290 of the Treaty on the Functioning of the European Union TFEU should be delegated to the Commission in order to identify third-country jurisdictions which have strategic deficiencies in their national AMLCFT. The Commission is required by Directive EU 2018843 5th Anti-Money Laundering Directive to identify high-risk third countries having strategic deficiencies in their anti-money launderingcounter-terrorism financing regimes.

Source: camsafroza.com

Source: camsafroza.com

The European anti-money laundering directives AMLD are intended to prevent money laundering or terrorist financing and establish a consistent regulatory environment across the EU. It also explains why equivalence was. The Third Money Laundering Directive 200560EC MLD3 or 3MLD came into force on 15 December 2005. The 3rd EU anti-money laundering Directive 200560EC of 26102005 OJ L 309 25112005 p15 Joeb Rietrae European Commission 25 November 2005 Brussels 15122005. The Third European Union EU Money Laundering Directive the Third EU Directive became operative on 15 th December 2007.

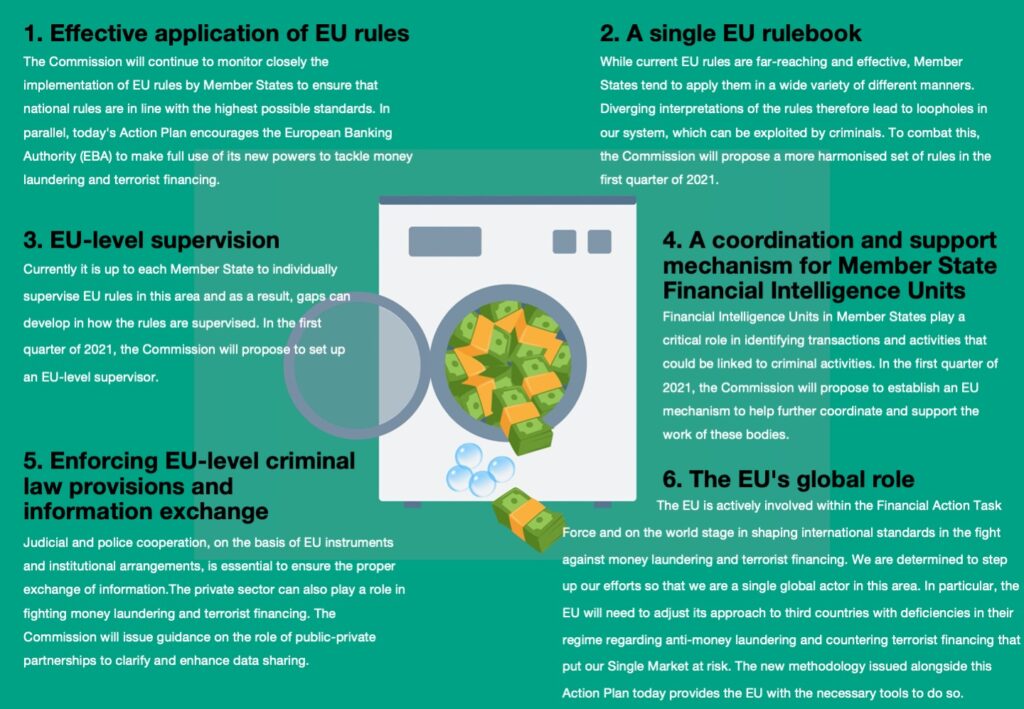

Source: ec.europa.eu

Source: ec.europa.eu

The Third Money Laundering Directive 200560EC MLD3 or 3MLD came into force on 15 December 2005. It required Member States to prohibit money laundering and to oblige the financial sector comprising credit institutions and a wide range of other financial. Of the use of the financial system for the purpose of money laundering and terrorist financing1 This is the third European Union document that determines basic procedures and measures to guard against the use of funds derived from criminal activity 2 and it also covers. As defined under the Fourth and Fifth Anti-Money Laundering Directives the EU has to establish a list of high-risk third countries to make sure the EU financial system is equipped to prevent money laundering and terrorist financing risks coming from third countries. Money laundering Council Directive 91308EEC of 10 June 1991 on prevention of the use of the financial system for the purpose of money laundering 4 was adopted.

Source: researchgate.net

Source: researchgate.net

This was achieved in the UK mainly by way of the Money Laundering Regulations 2007 SI 20072157 MLRs which came into force on 15 December 2007. Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism. Money laundering Council Directive 91308EEC of 10 June 1991 on prevention of the use of the financial system for the purpose of money laundering 4 was adopted. The 3rd EU AML Directive with new recommendations by FATF 2003 revised the terms and provided more detailed requirements in relation to customer identification and verification and situations where a higher risk of money laundering or terrorist financing may justify enhanced measures and situations of lesser risk could justify less rigorous controls. The disclosure in good faith to the authorities responsible for combating money laundering by an institution or person subject to this Directive or by an employee or director of such an institution or person of the information referred to in Articles 6 and 7 shall not constitute a breach of any restriction on disclosure of information imposed by contract or by any legislative regulatory or administrative.

Source: getid.ee

Source: getid.ee

Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive. The disclosure in good faith to the authorities responsible for combating money laundering by an institution or person subject to this Directive or by an employee or director of such an institution or person of the information referred to in Articles 6 and 7 shall not constitute a breach of any restriction on disclosure of information imposed by contract or by any legislative regulatory or administrative. The review of the Third Anti-Money Laundering Directive Transparency International TI is the leading organisation in the fight against corruption representing a global movement of more than 90 National Chapters committed to a world free from corruption and misappropriation. Therefore the aim is to protect the integrity of the EU financial system from. The 3rd EU AML Directive with new recommendations by FATF 2003 revised the terms and provided more detailed requirements in relation to customer identification and verification and situations where a higher risk of money laundering or terrorist financing may justify enhanced measures and situations of lesser risk could justify less rigorous controls.

Source: planetcompliance.com

Source: planetcompliance.com

Adoption implementing measures Ultimately 15122007. The review of the Third Anti-Money Laundering Directive Transparency International TI is the leading organisation in the fight against corruption representing a global movement of more than 90 National Chapters committed to a world free from corruption and misappropriation. Entry into force Ultimately 1562006 after public consultation. The aim is to protect the integrity of the EU financial system. Member states were required to implement MLD3 by 15 December 2007.

Source: shuftipro.com

Source: shuftipro.com

Adoption implementing measures Ultimately 15122007. The 3rd EU AML Directive with new recommendations by FATF 2003 revised the terms and provided more detailed requirements in relation to customer identification and verification and situations where a higher risk of money laundering or terrorist financing may justify enhanced measures and situations of lesser risk could justify less rigorous controls. The new Recommendations takes into account the new risks and practices that developed after the. The aim is to protect the integrity of the EU financial system. This chapter focuses on The Third Money Laundering Directive of the European Union EU.

Source: portal.ieu-monitoring.com

Source: portal.ieu-monitoring.com

Of the use of the financial system for the purpose of money laundering and terrorist financing1 This is the third European Union document that determines basic procedures and measures to guard against the use of funds derived from criminal activity 2 and it also covers. Based on Directive EU 2015849 Article 9 the Commission is mandated to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering the financing of terrorism. This note sets out a list of the countries outside the EU and the European Economic Area EEA known as third countries that were considered by EU and EEA member states to have anti-money laundering AML and counter-terrorist financing CTF regimes equivalent to the regime under the Third Money Laundering Directive 200560EC MLD3. Directive EU 2015849 of the European Parliament and of the Council of 20 May 2015 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing amending Regulation EU No 6482012 of the European Parliament and of the Council and repealing Directive 200560EC of the European Parliament and of the Council and Commission Directive. The Third Money Laundering Directive 200560EC MLD3 or 3MLD came into force on 15 December 2005.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title third eu money laundering directive by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.