10+ The three independent steps to laundering money are info

Home » money laundering idea » 10+ The three independent steps to laundering money are infoYour The three independent steps to laundering money are images are available. The three independent steps to laundering money are are a topic that is being searched for and liked by netizens today. You can Download the The three independent steps to laundering money are files here. Download all free photos.

If you’re looking for the three independent steps to laundering money are pictures information connected with to the the three independent steps to laundering money are interest, you have come to the right site. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

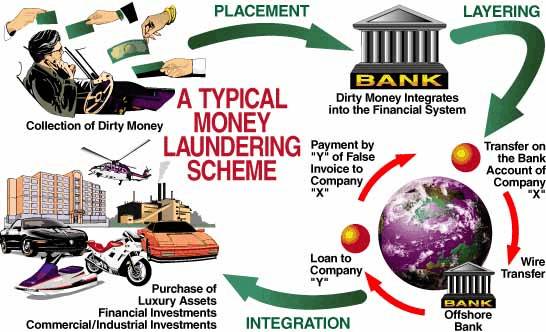

The Three Independent Steps To Laundering Money Are. However it is important to remember that money laundering is a single process. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into. Placement layering and integration stage. Tips To Streamline Anti Money Laundering Customer Due Diligence Verify identity before doing business Verifying the identity of a client before entering into a business relationship means you start off knowing that you can trust they are who they say they are.

What Is Anti Money Laundering Quora From quora.com

What Is Anti Money Laundering Quora From quora.com

This is the act of moving the ill-gotten funds into a financial institution. Money obtained from illegal activities is gradually deposited into a bank through the restaurant. The first step is called placement. Placement layering and integration. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial.

Placement- Physically placing bulk cash proceeds Layering- Separating the proceeds of the crimincal activity from their origins through layers of complex financial transactions.

Placement layering and integration. The Code of Federal Regulations 31 CFR Part 1029210 discusses Anti-Money Laundering AML program requirements for financial institutions characterized as loan or finance companies a category which now includes non-bank residential mortgage and loan. The institution may be anything from a brokerage house or bank to a casino or insurance company. In this stage the criminal relieves himself of holding and guarding large amounts of bulky cash and the money is placed into. The Placement Stage Filtering. Tips To Streamline Anti Money Laundering Customer Due Diligence Verify identity before doing business Verifying the identity of a client before entering into a business relationship means you start off knowing that you can trust they are who they say they are.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Money laundering basically involves three independent steps that can occur simultaneously. The money laundering process usually goes something like the following. Placement layering and integration. The stages of money laundering include the. 5 Steps to Conduct an Audit An article by New York Institute of Finance Anti-Money Laundering instructor Larry Schneider.

Source: slideplayer.com

Source: slideplayer.com

Tips To Streamline Anti Money Laundering Customer Due Diligence Verify identity before doing business Verifying the identity of a client before entering into a business relationship means you start off knowing that you can trust they are who they say they are. Placement layering and integration. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. Process of Money Laundering. Placement- Physically placing bulk cash proceeds Layering- Separating the proceeds of the crimincal activity from their origins through layers of complex financial transactions.

Source: tookitaki.ai

Source: tookitaki.ai

The Placement Stage Filtering. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes. Methods and Stages of Money Laundering There are three stages involved in money laundering. The money laundering process usually goes something like the following. Involves placing the crime proceeds in the inancial system egdepositing cash into a bank accountexchange currency of small denominations to currency of.

Source: calert.info

Source: calert.info

The Code of Federal Regulations 31 CFR Part 1029210 discusses Anti-Money Laundering AML program requirements for financial institutions characterized as loan or finance companies a category which now includes non-bank residential mortgage and loan. The process of money laundering has three distinct stages. The institution may be anything from a brokerage house or bank to a casino or insurance company. The Money Laundering Process. Some common methods of laundering are.

Source: ft.lk

Source: ft.lk

Placement can take place via cash deposit wire transfer check money order or other methods. While the techniques for laundering funds vary considerably and are often highly intricate there are generally three stages in the process. That the aggregate size of money laundering in the world could be somewhere between 2 and 5 percent of the worlds gross domestic product. Which option describes the placement stage. The money laundering process is divided into 3 segments.

Source: brittontime.com

Source: brittontime.com

Placement layering and integration stage. Placement- Physically placing bulk cash proceeds Layering- Separating the proceeds of the crimincal activity from their origins through layers of complex financial transactions. The institution may be anything from a brokerage house or bank to a casino or insurance company. Some common methods of laundering are. The stages of money laundering include the.

Source: drishtiias.com

Source: drishtiias.com

5 Steps to Conduct an Audit An article by New York Institute of Finance Anti-Money Laundering instructor Larry Schneider. Placement layering and integration. Process of Money Laundering. The Code of Federal Regulations 31 CFR Part 1029210 discusses Anti-Money Laundering AML program requirements for financial institutions characterized as loan or finance companies a category which now includes non-bank residential mortgage and loan. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes.

Source: gov.si

Source: gov.si

The money laundering process is divided into 3 segments. Providers are all known to have been employed in money laundering schemes. Integration- Providing an apparently legitimate explanation for the illicit proceeds. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system. The money laundering cycle can be broken down into three distinct stages.

Source: quora.com

Source: quora.com

Money laundering typically includes three stages. The stages of money laundering include the. Placement layering and integration. Providers are all known to have been employed in money laundering schemes. Placement is the first step of money laundering which is the process of moving the money into the legitimate source via financial institutions casinos financial.

Source: brittontime.com

Source: brittontime.com

The institution may be anything from a brokerage house or bank to a casino or insurance company. Proceeds of criminal activity are separated from their origin through the use of multiple levels of complex financial transactions. Money laundering is a diverse and often complex process that need not involve cash transactions. The process of money laundering has three distinct stages. The money laundering process usually goes something like the following.

Source: calert.info

Source: calert.info

Placement layering and integration. Which option describes the placement stage. Tips To Streamline Anti Money Laundering Customer Due Diligence Verify identity before doing business Verifying the identity of a client before entering into a business relationship means you start off knowing that you can trust they are who they say they are. Integration- Providing an apparently legitimate explanation for the illicit proceeds. This stage represents the initial entry of the dirty cash or proceeds of crime into the financial system.

The institution may be anything from a brokerage house or bank to a casino or insurance company. Which option describes the placement stage. The institution may be anything from a brokerage house or bank to a casino or insurance company. Some common methods of laundering are. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes.

Source: casino.org

Source: casino.org

Some common methods of laundering are. Some common methods of laundering are. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes. A criminal or criminal organization owns a legitimate restaurant business. While the techniques for laundering funds vary considerably and are often highly intricate there are generally three stages in the process.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title the three independent steps to laundering money are by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.