20+ The risk of money laundering which involves information

Home » money laundering Info » 20+ The risk of money laundering which involves informationYour The risk of money laundering which involves images are available. The risk of money laundering which involves are a topic that is being searched for and liked by netizens now. You can Find and Download the The risk of money laundering which involves files here. Get all royalty-free photos and vectors.

If you’re looking for the risk of money laundering which involves images information connected with to the the risk of money laundering which involves interest, you have come to the ideal site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

The Risk Of Money Laundering Which Involves. This enables criminals to hide and accumulate wealth avoid prosecution evade taxes increase profits through reinvestment and fund further criminal activity including terrorism. The risk-based approach adopted by the Company and described in the Manual involves specific measures and procedures in assessing the most cost effective and appropriate way to identify and manage the Money Laundering and Terrorist Financing risks faced by the Company. The Financial Action Task Force FATF produced a report on anti-money laundering and counter-terrorist financing measures in the US. Usually the AML risk assessment results in categorization of risk.

Open Banking Lessons Challenges And Paths Forward For New Banking Services Open Banking Banking Banking Services From pinterest.com

Open Banking Lessons Challenges And Paths Forward For New Banking Services Open Banking Banking Banking Services From pinterest.com

The Financial Action Task Force FATF produced a report on anti-money laundering and counter-terrorist financing measures in the US. AML risk assessment is calculation of the possibilities of money laundering event taking place. Money laundering involves processing illicit profits in ways which mask ownership and make the funds appear to have come from legitimate sources. Trade-Based Money Laundering takes advantage of the complexity of trade systems most prominently in international contexts where the involvement of multiple parties and jurisdictions make AML checks and customer due diligence processes more difficult. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories.

Trade-Based Money Laundering takes advantage of the complexity of trade systems most prominently in international contexts where the involvement of multiple parties and jurisdictions make AML checks and customer due diligence processes more difficult.

The challenge is even greater for complex institutions that operate across several lines of business IT systems and business cultures. Money laundering involves processing illicit profits in ways which mask ownership and make the funds appear to have come from legitimate sources. The placement of the proceeds of crime can be done in a number of ways. Establish and maintain policies controls and procedures to effectively manage those risks. Carry out a risk assessment which identifies and assesses the risk of money laundering and terrorist financing to its business. Even if the banking institutions are equipped with automated risk management solutions manual human expertise is indispensable in assessing money laundering risk.

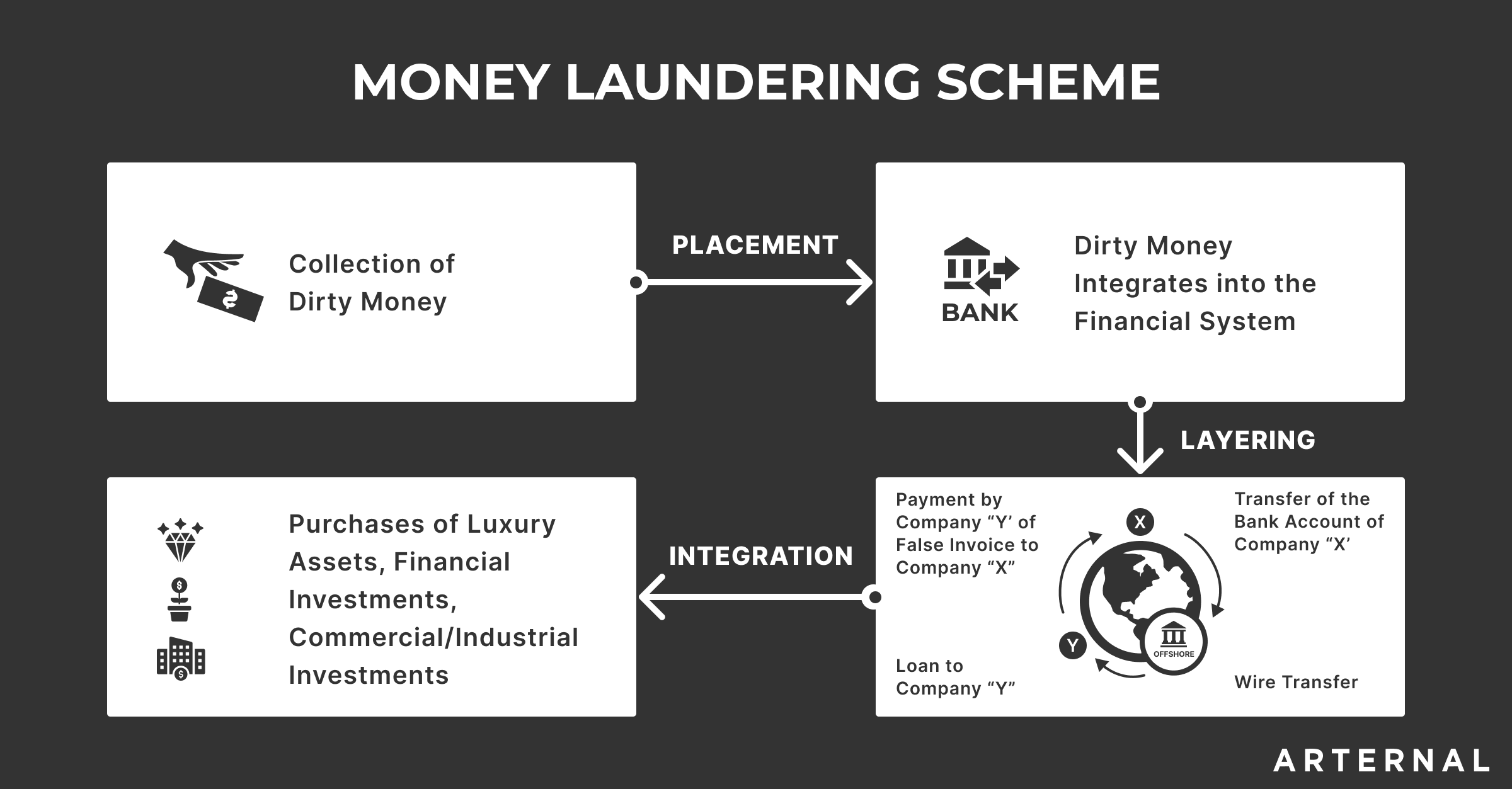

Source: arternal.com

Source: arternal.com

Trade-Based Money Laundering takes advantage of the complexity of trade systems most prominently in international contexts where the involvement of multiple parties and jurisdictions make AML checks and customer due diligence processes more difficult. The placement of the proceeds of crime can be done in a number of ways. Money laundering involves processing illicit profits in ways which mask ownership and make the funds appear to have come from legitimate sources. This enables criminals to hide and accumulate wealth avoid prosecution evade taxes increase profits through reinvestment and fund further criminal activity including terrorism. But in light of recent headlines its clear that risks of money laundering exist outside of financial services.

Source: bi.go.id

Source: bi.go.id

Even if the banking institutions are equipped with automated risk management solutions manual human expertise is indispensable in assessing money laundering risk. Support the development of a common understanding of what the risk-based approach involves. Even if the banking institutions are equipped with automated risk management solutions manual human expertise is indispensable in assessing money laundering risk. The placement of the proceeds of crime can be done in a number of ways. TBML primarily involves the import and export of goods and the exploitation of a variety of.

Source: thekeepitsimple.com

Source: thekeepitsimple.com

Support the development of a common understanding of what the risk-based approach involves. Therefore FX trading involves risks due to several difficulties in terms of tracking money. Usually the AML risk assessment results in categorization of risk. Earlier this year with over 200 pages on the scope and scale of money launderingestimated in the hundreds of billions of dollars globallyas well as its. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories.

Source: dimensiongrc.com

Source: dimensiongrc.com

And apply customer due diligence CDD measures. It involves identifying the risks associated with any business and evaluating them on the basis of their likelihood and impact. The Guidance on the Risk-Based Approach to combating Money Laundering and Terrorist Financing was developed by the FATF in close consultation with representatives of the international banking and securities sectors. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. It was published in June 2007.

Source: gov.si

Source: gov.si

Carry out a risk assessment which identifies and assesses the risk of money laundering and terrorist financing to its business. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. Earlier this year with over 200 pages on the scope and scale of money launderingestimated in the hundreds of billions of dollars globallyas well as its. Therefore FX trading involves risks due to several difficulties in terms of tracking money. And apply customer due diligence CDD measures.

Source: researchgate.net

Source: researchgate.net

And apply customer due diligence CDD measures. But in light of recent headlines its clear that risks of money laundering exist outside of financial services. Besides in 4x trading it is exposed to AML risks due to inequality between regulatory standards in different jurisdictions. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Regulated businesses are required to amongst other things.

Source: bi.go.id

Source: bi.go.id

Trade-Based Money Laundering takes advantage of the complexity of trade systems most prominently in international contexts where the involvement of multiple parties and jurisdictions make AML checks and customer due diligence processes more difficult. Regulated businesses are required to amongst other things. Establish and maintain policies controls and procedures to effectively manage those risks. Even if the banking institutions are equipped with automated risk management solutions manual human expertise is indispensable in assessing money laundering risk. Earlier this year with over 200 pages on the scope and scale of money launderingestimated in the hundreds of billions of dollars globallyas well as its.

Source: bi.go.id

Support the development of a common understanding of what the risk-based approach involves. Therefore FX trading involves risks due to several difficulties in terms of tracking money. But in light of recent headlines its clear that risks of money laundering exist outside of financial services. The Financial Action Task Force FATF produced a report on anti-money laundering and counter-terrorist financing measures in the US. The risk-based approach adopted by the Company and described in the Manual involves specific measures and procedures in assessing the most cost effective and appropriate way to identify and manage the Money Laundering and Terrorist Financing risks faced by the Company.

Source: pinterest.com

Source: pinterest.com

But in light of recent headlines its clear that risks of money laundering exist outside of financial services. The challenge is even greater for complex institutions that operate across several lines of business IT systems and business cultures. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. The Financial Action Task Force FATF produced a report on anti-money laundering and counter-terrorist financing measures in the US. AML risk assessment is calculation of the possibilities of money laundering event taking place.

Establish and maintain policies controls and procedures to effectively manage those risks. It involves identifying the risks associated with any business and evaluating them on the basis of their likelihood and impact. Trade-Based Money Laundering takes advantage of the complexity of trade systems most prominently in international contexts where the involvement of multiple parties and jurisdictions make AML checks and customer due diligence processes more difficult. It was published in June 2007. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials.

Source: amlbot.com

Source: amlbot.com

The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. Therefore FX trading involves risks due to several difficulties in terms of tracking money. Establish and maintain policies controls and procedures to effectively manage those risks. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories. Support the development of a common understanding of what the risk-based approach involves.

Source: shyamsewag.com

Source: shyamsewag.com

Carry out a risk assessment which identifies and assesses the risk of money laundering and terrorist financing to its business. It involves identifying the risks associated with any business and evaluating them on the basis of their likelihood and impact. Therefore FX trading involves risks due to several difficulties in terms of tracking money. With regulators adopting stricter norms on financial transactions and increasing their enforcement efforts institutions are facing increased complexity on customer. Carry out a risk assessment which identifies and assesses the risk of money laundering and terrorist financing to its business.

Source: coinfirm.com

Source: coinfirm.com

The Financial Action Task Force FATF produced a report on anti-money laundering and counter-terrorist financing measures in the US. With regulators adopting stricter norms on financial transactions and increasing their enforcement efforts institutions are facing increased complexity on customer. This enables criminals to hide and accumulate wealth avoid prosecution evade taxes increase profits through reinvestment and fund further criminal activity including terrorism. This is due to the fact that placing large amounts of money cash into the legitimate financial system may raise suspicions of officials. Even if the banking institutions are equipped with automated risk management solutions manual human expertise is indispensable in assessing money laundering risk.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the risk of money laundering which involves by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.