19++ The bank secrecy act requires all financial institutions to report information

Home » money laundering idea » 19++ The bank secrecy act requires all financial institutions to report informationYour The bank secrecy act requires all financial institutions to report images are available in this site. The bank secrecy act requires all financial institutions to report are a topic that is being searched for and liked by netizens now. You can Download the The bank secrecy act requires all financial institutions to report files here. Download all free photos.

If you’re searching for the bank secrecy act requires all financial institutions to report images information connected with to the the bank secrecy act requires all financial institutions to report topic, you have visit the ideal site. Our site always provides you with hints for seeing the highest quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

The Bank Secrecy Act Requires All Financial Institutions To Report. The Bank Secrecy Act BSA is US. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Bank Secrecy Act BSA requires financial institutions to assist US.

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office From blog.gao.gov

The Bank Secrecy Act requires financial institutions to report information to the federal government that law enforcement can use to investigate potential crimes like money laundering. The BSA regulations establish four regulatory requirements. The BSA compliance officer is ultimately responsible for ensuring bank policies and procedures are compliant with the BSA. Government agencies to detect and prevent money laundering. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime.

The Bank Secrecy Act BSA requires financial institutions to assist US.

Law requiring financial institutions in the United States to assist US. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. Banks and other financial institutions must ensure they meet the compliance obligations it involves. Banking Secrecy Act BSA What Is Banking Secrecy Act BSA. Law requiring financial institutions in the United States to assist US. Government agencies to detect and prevent money laundering.

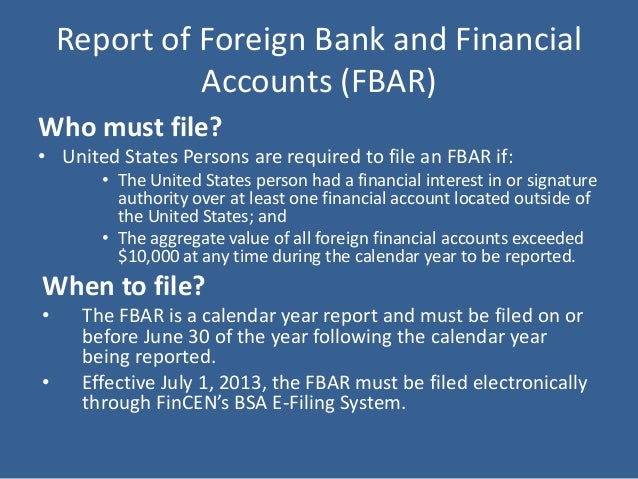

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. The BSA requires financial institutions such as credit unions banks thrifts money service businesses some insurance carriers etc to comply with certain reporting recordkeeping and identity verification requirements. The BSA regulations establish four regulatory requirements. The BSA compliance officer is ultimately responsible for ensuring bank policies and procedures are compliant with the BSA.

Passed the House on May 25 1970 302-0 Signed into law by President Richard Nixon on October 26 1970. Industry representatives told us that generating reports on suspicious activity can be labor intensive and that they would like more feedback on. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. Every customer at a car dealership travel agency casino insurance company or bank is at risk of having a SAR be secretly filed about their financial activities.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. Banking Secrecy Act BSA What Is Banking Secrecy Act BSA. The Bank Secrecy Act BSA is US. The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to. Every customer at a car dealership travel agency casino insurance company or bank is at risk of having a SAR be secretly filed about their financial activities.

Source: acamstoday.org

Source: acamstoday.org

The BSA requires financial institutions such as credit unions banks thrifts money service businesses some insurance carriers etc to comply with certain reporting recordkeeping and identity verification requirements. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report CTR which records cash transactions that exceed 10000. The law requires financial institutions to provide. Banks must retain copies of Suspicious Activity Reports SARs for ______ years from the date of filing. Law requiring financial institutions in the United States to assist US.

![]() Source: slideplayer.com

Source: slideplayer.com

Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. The Bank Secrecy Act requires financial institutions to report information to the federal government that law enforcement can use to investigate potential crimes like money laundering. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The BSA aids law enforcement and the IRS by uncovering criminal activities such as money. Passed the House on May 25 1970 302-0 Signed into law by President Richard Nixon on October 26 1970.

Source: proprofs.com

Source: proprofs.com

The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Legislation aimed toward preventing criminals from using financial institutions to hide or launder money. Industry representatives told us that generating reports on suspicious activity can be labor intensive and that they would like more feedback on.

Source: probank.com

Source: probank.com

The Bank Secrecy Act BSA requires financial institutions to assist US. Banks must retain copies of Suspicious Activity Reports SARs for ______ years from the date of filing. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report CTR which records cash transactions that exceed 10000. The Bank Secrecy Act BSA requires all financial institutions casinos and certain other businesses to.

Source: acamstoday.org

Source: acamstoday.org

The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. The Bank Secrecy Act BSA requires financial institutions to assist US. Banks and other financial institutions must ensure they meet the compliance obligations it involves. FCMs are defined as financial institutions in the BSA. Given the existence of such scrutiny all financial institutions and their customers should be cognizant of BSA and FinCEN regulations.

Source: slideplayer.com

Source: slideplayer.com

The Bank Secrecy Act requires money services businesses to establish anti-money laundering programs that include an independent audit function to test programs In implementing this requirement we determined to make clear that money services businesses are not required to hire a certified public accountant or an outside consultant to. Industry representatives told us that generating reports on suspicious activity can be labor intensive and that they would like more feedback on. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that. The BSA requires banks to help combat financial crimes. Monitor customer behavior File reports on transactions that meet certain dollar amounts Maintain records of certain transactions The Currency Transaction Report.

Source: bankerscompliance.com

Source: bankerscompliance.com

Banks must retain copies of Suspicious Activity Reports SARs for ______ years from the date of filing. Banking Secrecy Act BSA What Is Banking Secrecy Act BSA. Regulations established under BSA mandate that banks and other financial institutions establish Customer identification programs CIPs to verify the identities of their customers. Given the existence of such scrutiny all financial institutions and their customers should be cognizant of BSA and FinCEN regulations. The Bank Secrecy Act requires financial institutions to report information to the federal government that law enforcement can use to investigate potential crimes like money laundering.

Source: slideshare.net

Source: slideshare.net

Every customer at a car dealership travel agency casino insurance company or bank is at risk of having a SAR be secretly filed about their financial activities. The Bank Secrecy Act BSA is US. The banks secrecy act requires financial institutions to file reports for currency transactions greater than 10000 Which of the following terms describes the division of large cash deposits into smaller amounts to avoid reporting requirements. The Bank Secrecy Act of 1970 BSA also known as the Currency and Foreign Transactions Reporting Act is a US. The Bank Secrecy Act requires financial institutions to report information to the federal government that law enforcement can use to investigate potential crimes like money laundering.

Source: mossadams.com

Source: mossadams.com

Currency Transaction Reports CTRs and Suspicious Activity. FCMs are defined as financial institutions in the BSA. The Bank Secrecy Act BSA is the United States most important anti money laundering regulation. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime.

Source: blog.gao.gov

Source: blog.gao.gov

Passed the House on May 25 1970 302-0 Signed into law by President Richard Nixon on October 26 1970. The Bank Secrecy Act of 1970 also called the Currency and Foreign Transactions Reporting Act or just the BSA is an act that requires all financial institutions within the United States to assist all United States government agencies in detecting and preventing money laundering that. Government agencies in detecting and preventing money. Introduced in 1970 the Bank Secrecy Act requires financial institutions to work with the US government to combat financial crime. Also known as the Currency and Foreign Transactions Reporting Act the Banking Secrecy Act BSA requires banks and other financial institutions to disclose records such as currency transaction statements and financial history of accounts to regulated authorities.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the bank secrecy act requires all financial institutions to report by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.