11+ The 6th money laundering directive ideas

Home » money laundering Info » 11+ The 6th money laundering directive ideasYour The 6th money laundering directive images are available. The 6th money laundering directive are a topic that is being searched for and liked by netizens now. You can Find and Download the The 6th money laundering directive files here. Get all royalty-free photos.

If you’re looking for the 6th money laundering directive images information connected with to the the 6th money laundering directive interest, you have visit the right site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

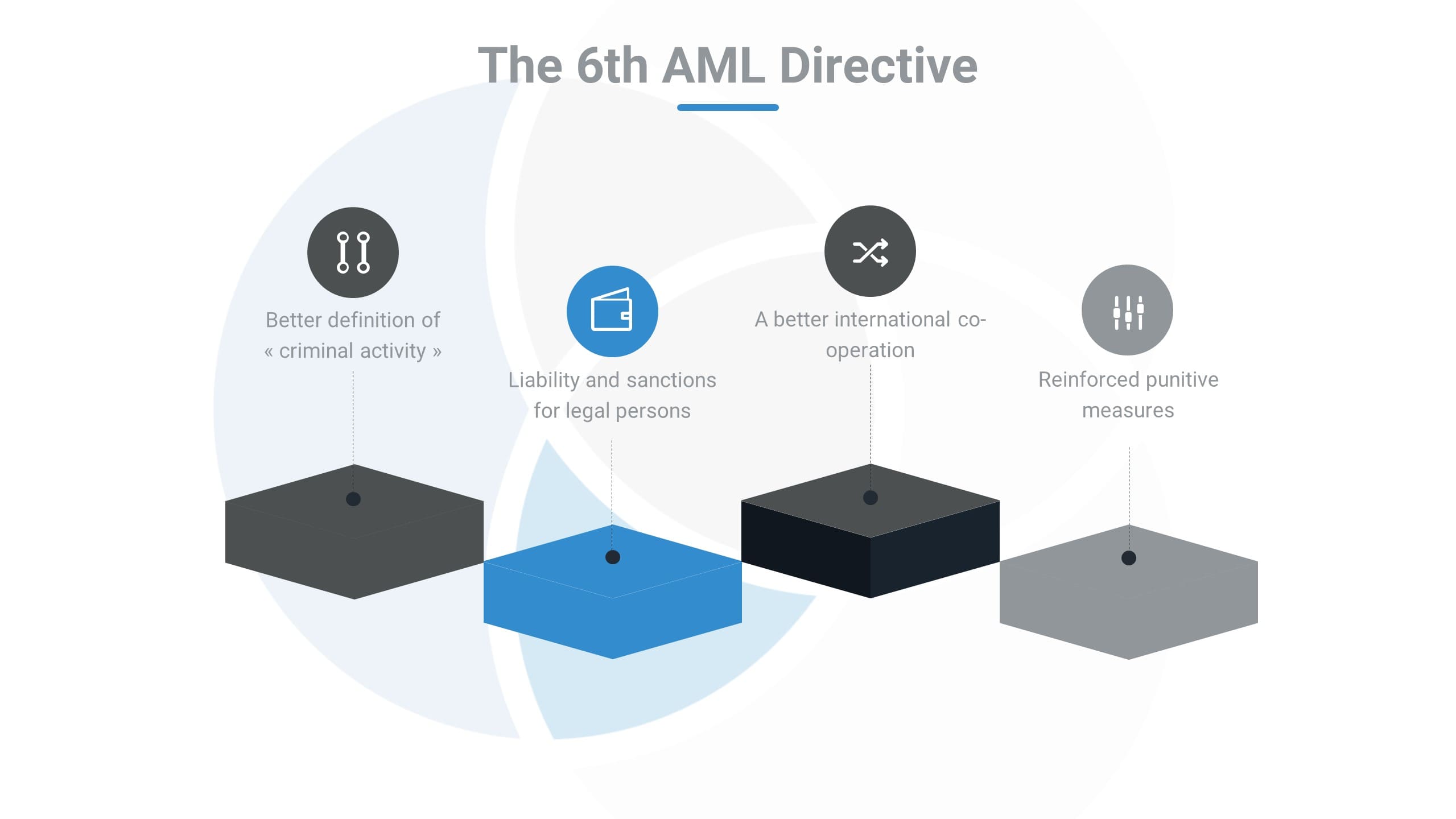

The 6th Money Laundering Directive. The 6AMLD also includes severe punishments for corporate and individual offenders ie. On 12 November 2018 the directive 20181673 on combating money laundering by criminal law the sixth anti-money laundering directive and the new regulation 20181672 on controls on cash entering or leaving the EU were published in the Official Journal of the EU. According to the new guidelines gatekeepers banks and other reporting entities must enforce anti money laundering and counter terrorist financing measures and comply with the directive by June 3rd. Sixth anti-money laundering directive.

The 6th Anti Money Laundering Directive 6amld What Is Changing From smart-oversight.com

The 6th Anti Money Laundering Directive 6amld What Is Changing From smart-oversight.com

The 6th Anti-Money Laundering Directive 6AMLD came into effect for all EU member states on 3 December 2020 and must be implemented by regulated businesses by 3 June 2021. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. The European Unions Sixth Anti-Money Laundering Directive 6AMLD came into effect for member states on 3 December 2020 and must be implemented by financial institutions by 3 June 2021. Stronger punishments the new directive changes the minimum prison sentence from one year to 4 years for money laundering offences and also fines can be given. Following 5AMLD which broadly strengthened existing AMLCFT provisions the sixth anti-money laundering directive aims to empower financial institutions and. 6thAnti-Money Laundering Directive 6AMLD.

The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount.

A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. The European Unions Sixth Anti-Money Laundering Directive 6AMLD came into effect for member states on 3 December 2020 and must be implemented by financial institutions by 3 June 2021. The 6th Anti-Money Laundering Directive 6AMLD came into effect for all EU member states on 3 December 2020 and must be implemented by regulated businesses by 3 June 2021. It follows on from the 4th and 5th MLDs and seeks to close certain loopholes in the EU Member States domestic legislation by harmonising the definition of money laundering across the bloc. A number of queries were raised during the webinar in respect of the Sixth Money Laundering Directive EU 2018 1673 6MLD which was to be transposed by 3 December 2020. The sixth anti money laundering directive 6AMLD for the European Union came into effect on December 3 2020 and organisations must comply by June 3 2021.

Source: youtube.com

Source: youtube.com

Sixth Money Laundering Directive. Shortly after issuing the 5th Anti Money Laundering Directive 5AMLD on the 23 October 2018 the EU further reinforced its mission by issuing the. Disqualification or even the closure of the establishment which was used to commit the money laundering offence. EUs 6th Anti-Money Laundering Directive January 5 2021 As of December 3rd 2020 the European Unions Sixth Anti-Money Laundering Directive. Take Action Now to Reduce your Anti-Money Laundering Regulatory Risk.

Source: northrow.com

Source: northrow.com

According to the new guidelines gatekeepers banks and other reporting entities must enforce anti money laundering and counter terrorist financing measures and comply with the directive by June 3rd. Take Action Now to Reduce your Anti-Money Laundering Regulatory Risk. The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union. This is the legislative harmonisation of 22 predicate. The European Unions Sixth Anti-Money Laundering Directive 6AMLD came into effect for member states on 3 December 2020 and must be implemented by financial institutions by 3 June 2021.

Source: vinciworks.com

Source: vinciworks.com

A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. Sixth anti-money laundering directive. The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount. It focuses on standardising the approach of EU member. The Sixth EU Anti-Money Laundering Directive 6AMLD came into force at the EU level on 2 December 2018 and EU member states are required to implement it by 3 December 2020.

Source: tookitaki.ai

Source: tookitaki.ai

With a deadline of 3 December 2020 many Member States have begun to incorporate 6AMLD into national frameworks. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018. Since the objective of this Directive namely to subject money laundering in all Member States to effective proportionate and dissuasive criminal penalties cannot be sufficiently achieved by Member States but can rather by reason of the scale and effects of this Directive be better achieved at Union level the Union may adopt measures in accordance with the principle of subsidiarity as set out in Article 5. This is the legislative harmonisation of 22 predicate. Sixth Money Laundering Directive.

Source: trustyourcompliance.com

Source: trustyourcompliance.com

The newly adopted Directive has already been dubbed as the 6AMLD due to its paramount. Take Action Now to Reduce your Anti-Money Laundering Regulatory Risk. The 6th Anti Money Laundering Directive. With a deadline of 3 December 2020 many Member States have begun to incorporate 6AMLD into national frameworks. A number of queries were raised during the webinar in respect of the Sixth Money Laundering Directive EU 2018 1673 6MLD which was to be transposed by 3 December 2020.

Source: shuftipro.com

Source: shuftipro.com

On 12 November 2018 the directive 20181673 on combating money laundering by criminal law the sixth anti-money laundering directive and the new regulation 20181672 on controls on cash entering or leaving the EU were published in the Official Journal of the EU. Following the 5AMLD coming into force in January 2020 updates have now been made for 6AMLD which is due to be transposed into national laws by December 2020. By 3rd June 2021 businesses operating in the EU must meet the new regulations set out by 6AMLD. The sixth anti money laundering directive 6AMLD for the European Union came into effect on December 3 2020 and organisations must comply by June 3 2021. A number of queries were raised during the webinar in respect of the Sixth Money Laundering Directive EU 2018 1673 6MLD which was to be transposed by 3 December 2020.

Source: salvusfunds.com

Source: salvusfunds.com

Following the 5AMLD coming into force in January 2020 updates have now been made for 6AMLD which is due to be transposed into national laws by December 2020. On 12 November 2018 the directive 20181673 on combating money laundering by criminal law the sixth anti-money laundering directive and the new regulation 20181672 on controls on cash entering or leaving the EU were published in the Official Journal of the EU. Highlights of the 6th Anti Money Laundering Directive 6AMLD The European Union has been making significant efforts to combat the laundering of money and terrorist financing within its Member States. Sixth Money Laundering Directive. Companies now face severe sanctions including confiscation of assets and seizure of business activity if they are found liable for money laundering.

Source: businessforensics.nl

Source: businessforensics.nl

The 6th Anti-Money Laundering Directive 6AMLD came into effect for all EU member states on 3 December 2020 and must be implemented by regulated businesses by 3 June 2021. Sixth Money Laundering Directive. Disqualification or even the closure of the establishment which was used to commit the money laundering offence. Stronger punishments the new directive changes the minimum prison sentence from one year to 4 years for money laundering offences and also fines can be given. The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union.

Source: pideeco.be

Source: pideeco.be

What does the 6th Anti Money Laundering Directive 6AMLD mean for businesses in the UK. A number of queries were raised during the webinar in respect of the Sixth Money Laundering Directive EU 2018 1673 6MLD which was to be transposed by 3 December 2020. One primary focus in 2021 for regulated firms is planning for compliance in line with the EUs 6th Anti-Money Laundering Directive 6AMLD which clarifies the definition of money laundering offences and establishes minimum rules on criminal liability for money laundering. Shortly after issuing the 5th Anti Money Laundering Directive 5AMLD on the 23 October 2018 the EU further reinforced its mission by issuing the. Disqualification or even the closure of the establishment which was used to commit the money laundering offence.

Source: shuftipro.com

Source: shuftipro.com

A number of queries were raised during the webinar in respect of the Sixth Money Laundering Directive EU 2018 1673 6MLD which was to be transposed by 3 December 2020. It follows on from the 4th and 5th MLDs and seeks to close certain loopholes in the EU Member States domestic legislation by harmonising the definition of money laundering across the bloc. Sixth Money Laundering Directive. Companies now face severe sanctions including confiscation of assets and seizure of business activity if they are found liable for money laundering. Following the 5AMLD coming into force in January 2020 updates have now been made for 6AMLD which is due to be transposed into national laws by December 2020.

Source: smart-oversight.com

Source: smart-oversight.com

The sixth anti money laundering directive 6AMLD for the European Union came into effect on December 3 2020 and organisations must comply by June 3 2021. One primary focus in 2021 for regulated firms is planning for compliance in line with the EUs 6th Anti-Money Laundering Directive 6AMLD which clarifies the definition of money laundering offences and establishes minimum rules on criminal liability for money laundering. Following 5AMLD which broadly strengthened existing AMLCFT provisions the sixth anti-money laundering directive aims to empower financial institutions and. The aim of standardising the definition of predicate offences is to strengthen cross-border cooperation so that it is more efficient and faster in the European Union. The Sixth EU Anti-Money Laundering Directive 6AMLD came into force at the EU level on 2 December 2018 and EU member states are required to implement it by 3 December 2020.

Source: camsafroza.com

Source: camsafroza.com

What does the 6th Anti Money Laundering Directive 6AMLD mean for businesses in the UK. Take Action Now to Reduce your Anti-Money Laundering Regulatory Risk. A STEP FORWARD TO TAX TRANSPARENCY AND ACCOUNTABILITY. Stronger punishments the new directive changes the minimum prison sentence from one year to 4 years for money laundering offences and also fines can be given. A new Directive complementing and reinforcing the Fourth and the Fifth Anti-Money Laundering Directives 4AMLD and 5AMLD was adopted on 23 October 2018.

Source: skillcast.com

Source: skillcast.com

The 6th Anti Money Laundering Directive. Disqualification or even the closure of the establishment which was used to commit the money laundering offence. It follows on from the 4th and 5th MLDs and seeks to close certain loopholes in the EU Member States domestic legislation by harmonising the definition of money laundering across the bloc. The 6th Anti Money Laundering Directive. 6thAnti-Money Laundering Directive 6AMLD.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title the 6th money laundering directive by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.