15+ Terrorist financing mauritius information

Home » money laundering Info » 15+ Terrorist financing mauritius informationYour Terrorist financing mauritius images are available in this site. Terrorist financing mauritius are a topic that is being searched for and liked by netizens now. You can Get the Terrorist financing mauritius files here. Download all free photos and vectors.

If you’re looking for terrorist financing mauritius images information linked to the terrorist financing mauritius topic, you have visit the right site. Our website frequently provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

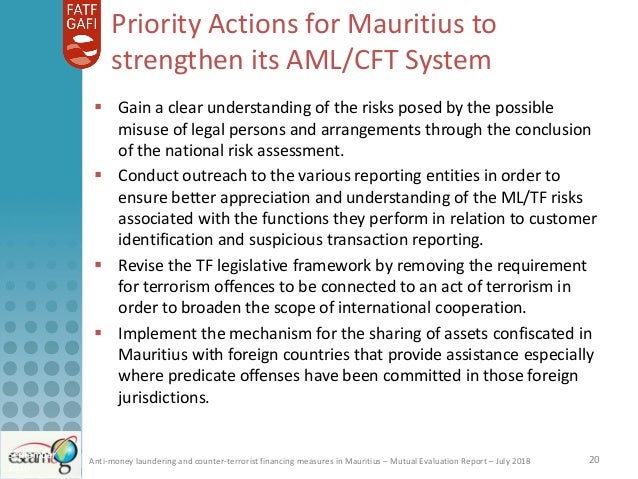

Terrorist Financing Mauritius. Earlier report on Mauritiuss efforts to combat money laundering and terrorist financing. Terrorism financing cares little about the source of the funds but it is what the funds are to be used for that defines its scope as opposed to money laundering whereby cash raised from criminal activities is made to look legitimate for re-integration into the financial system. The NRA shows that the terrorism financing threat in Mauritius is medium-low for various reasons. This risk assessment was commissioned by the Government of Mauritius as part of its commitment as a member of the Financial Action Task Forces FATF Global Network1 to combat the financing of terrorism.

Documents Financial Action Task Force Fatf From fatf-gafi.org

Documents Financial Action Task Force Fatf From fatf-gafi.org

Terrorist Financing Risk Assessment for the NPO Sector in Mauritius Executive Summary 1. Mauritius will adopt to tackle money laundering ML terrorist financing TF and proliferation financing PF threats over the next three years. Combatting the Financing of Terrorism Miscellaneous Provisions Act 2020. Identifies the nature of the terrorist financing threat to NPOs in Mauritius. The Banking Act is amended. This risk assessment was commissioned by the Government of Mauritius as part of its commitment as a member of Financial Action Task Force FATF1to combat the financing of terrorism.

To better visualize the flow of funds from point of origin to point of distribution the visualization process must be slowed down much like an inexperienced quarterback learns to slow.

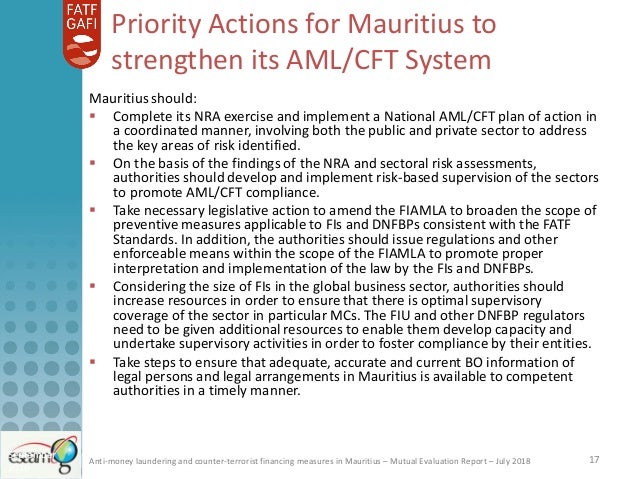

8 raised in Mauritius for use in the financing of terrorism related activities within the country. Understand and assess the money laundering and terrorist financing risks faced by Mauritius. It paves the way to the implementation of a risk-based approach to combatting money laundering and terrorism financing activities thus making relevant stakeholders more effective in their efforts. The risk extent and nature of money laundering and terrorist financing in Mauritius. Earlier report on Mauritiuss efforts to combat money laundering and terrorist financing. The Financial Action Task Force FATFa global anti-money laundering and terrorist financing inter-governmental body that sets international standards aimed to prevent these illegal activitieson 25 June 2021 released a report indicating that Mauritius has substantially completed with anti-money laundering and terrorism financing reforms.

Source: dtos-mu.com

Source: dtos-mu.com

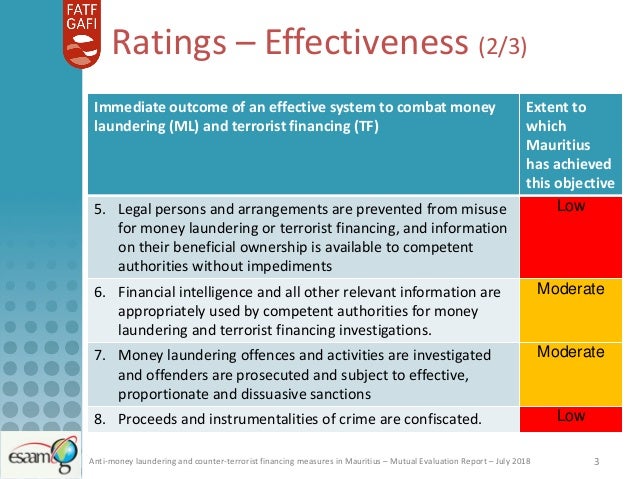

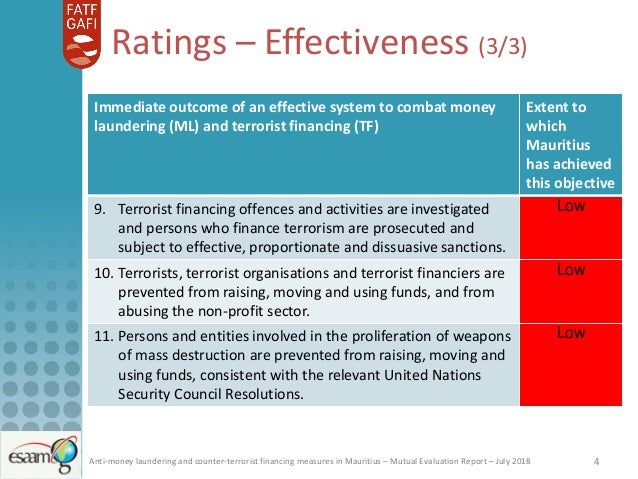

ESAAMLG Mutual Evaluation of Mauritius 2018 including executive summary and ratings tables. Money laundering is a three-step process consisting of placement layering and integration. Mauritius progress in strengthening measures to tackle money laundering and terrorist financing. FATF Methodology for assessing technical compliance with the FATF Recommendations and the Effectiveness of AMLCFT systems. Identifies the nature of the terrorist financing threat to NPOs in Mauritius.

Source: slideshare.net

Source: slideshare.net

The NRA shows that the terrorism financing threat in Mauritius is medium-low for various reasons. The Financial Action Task Force FATFa global anti-money laundering and terrorist financing inter-governmental body that sets international standards aimed to prevent these illegal activitieson 25 June 2021 released a report indicating that Mauritius has substantially completed with anti-money laundering and terrorism financing reforms. Overall Mauritius has made sufficient progress in addressing deficiencies in technical compliance identified in its MER to justify re-rating of the following recommendations. Terrorist Financing Risk Assessment for the NPO Sector in Mauritius Executive Summary 1. To better visualize the flow of funds from point of origin to point of distribution the visualization process must be slowed down much like an inexperienced quarterback learns to slow.

Source: mauritiushindinews.com

Source: mauritiushindinews.com

The Financial Action Task Force FATFa global anti-money laundering and terrorist financing inter-governmental body that sets international standards aimed to prevent these illegal activitieson 25 June 2021 released a report indicating that Mauritius has substantially completed with anti-money laundering and terrorism financing reforms. Terrorist Financing and NPOs in Mauritius NPO Terrorist Financing Risk Assessment Completed in 2020 Meets FATF requirements to. The NRA shows that the terrorism financing threat in Mauritius is medium-low for various reasons. There has been no reported terrorist attack in the country and no known cases of funds. It was completed with support from the EU-funded Global.

Source: slideshare.net

Source: slideshare.net

ESAAMLG Mutual Evaluation of Mauritius 2018 including executive summary and ratings tables. Identifies the nature of the terrorist financing threat to NPOs in Mauritius. Terrorist Financing and NPOs in Mauritius NPO Terrorist Financing Risk Assessment Completed in 2020 Meets FATF requirements to. Mauritius progress in strengthening measures to tackle money laundering and terrorist financing. Mauritiuss progress in strengthening measures to tackle money laundering and terrorist financing.

Source: elibrary.imf.org

Source: elibrary.imf.org

Secondly the Bank of Mauritius will now review periodically the assessment of money laundering or terrorism financing risk profile and risks of non-compliance of a financial institution licence holder or group upon the occurrence of major events or developments in the management and operations of the financial institution or holder of licence. This Act may be cited as the Anti-Money Laundering and. It paves the way to the implementation of a risk-based approach to combatting money laundering and terrorism financing activities thus making relevant stakeholders more effective in their efforts. Combatting the Financing of Terrorism Miscellaneous Provisions Act 2020. Financial institutions should on their part maintain updated anti-money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies.

Source: slideshare.net

Source: slideshare.net

There has been no reported terrorist attack in the country and no known cases of funds. Terrorist Financing Risk Assessment for the NPO sector in Mauritius Executive Summary 1. Terrorist Financing Risk Assessment for the NPO Sector in Mauritius Executive Summary 1. Identify NPOs which by virtue of their activity or characteristics are likely to be at risk of terrorist financing. Terrorism financing cares little about the source of the funds but it is what the funds are to be used for that defines its scope as opposed to money laundering whereby cash raised from criminal activities is made to look legitimate for re-integration into the financial system.

Source: blueazurite.com

Source: blueazurite.com

Terrorist Financing and NPOs in Mauritius NPO Terrorist Financing Risk Assessment Completed in 2020 Meets FATF requirements to. Secondly the Bank of Mauritius will now review periodically the assessment of money laundering or terrorism financing risk profile and risks of non-compliance of a financial institution licence holder or group upon the occurrence of major events or developments in the management and operations of the financial institution or holder of licence. It was completed with the support of the EU-. Terrorist Financing Risk Assessment for the NPO Sector in Mauritius Executive Summary 1. Money laundering is a three-step process consisting of placement layering and integration.

Source: globalfinance.mu

Source: globalfinance.mu

FATF Methodology for assessing technical compliance with the FATF Recommendations and the Effectiveness of AMLCFT systems. Mauritius brought numerous amendments to its Anti-Money Laundering and Combating the Financing of Terrorism AMLCFT framework and a new set of Regulations namely the Financial Intelligence and Anti Money Laundering Regulations 2018 was promulgated effective as from 01 October 2018 to address the FATF requirements regarding Customer Due. It was completed with the support of the EU-. This risk assessment was commissioned by the Government of Mauritius as part of its commitment as a member of the Financial Action Task Forces FATF Global Network1 to combat the financing of terrorism. In addition it describes the priorities and objectives in addressing financial crime and assists Mauritius in meeting international obligations set by the Financial Action Task Force.

Source: fatf-gafi.org

Source: fatf-gafi.org

Institutions should operate in order to ward off money laundering and terrorist financing risks. The main objective of the first National Money Laundering and Counter Terrorism Financing Risk Assessment NRA was to provide Mauritius with an effective pathway to implementing a risk-based AMLCFT regime through the efficient allocation of resources and the adoption of measures to prevent and mitigate money laundering and terrorism financing. Money laundering is a three-step process consisting of placement layering and integration. There has been no reported terrorist attack in the country and no known cases of funds. The author of this report is Danny Sougith Sanhye Assistant Director of the Financial Intelligence Unit and the information in this report is not intended to address the circumstances of any particular sector entity or individuals.

Source: slideshare.net

Source: slideshare.net

Money laundering is a three-step process consisting of placement layering and integration. Mauritius brought numerous amendments to its Anti-Money Laundering and Combating the Financing of Terrorism AMLCFT framework and a new set of Regulations namely the Financial Intelligence and Anti Money Laundering Regulations 2018 was promulgated effective as from 01 October 2018 to address the FATF requirements regarding Customer Due. To better visualize the flow of funds from point of origin to point of distribution the visualization process must be slowed down much like an inexperienced quarterback learns to slow. It was completed with the support of the EU-. The terrorist funding cycle is to raise move store and spend money.

Source: amarbheenick.blogspot.com

Source: amarbheenick.blogspot.com

ESAAMLG Mutual Evaluation of Mauritius 2018 including executive summary and ratings tables. The author of this report is Danny Sougith Sanhye Assistant Director of the Financial Intelligence Unit and the information in this report is not intended to address the circumstances of any particular sector entity or individuals. The risk extent and nature of money laundering and terrorist financing in Mauritius. Mauritius will adopt to tackle money laundering ML terrorist financing TF and proliferation financing PF threats over the next three years. There has been no reported terrorist attack in the country and no known cases of funds.

Source:

ESAAMLG Mutual Evaluation of Mauritius 2018 including executive summary and ratings tables. Secondly the Bank of Mauritius will now review periodically the assessment of money laundering or terrorism financing risk profile and risks of non-compliance of a financial institution licence holder or group upon the occurrence of major events or developments in the management and operations of the financial institution or holder of licence. There has been no reported terrorist attack in the country and no known cases of funds. The main objective of the first National Money Laundering and Counter Terrorism Financing Risk Assessment NRA was to provide Mauritius with an effective pathway to implementing a risk-based AMLCFT regime through the efficient allocation of resources and the adoption of measures to prevent and mitigate money laundering and terrorism financing. Understand and assess the money laundering and terrorist financing risks faced by Mauritius.

Source: slideshare.net

Source: slideshare.net

Financial institutions should on their part maintain updated anti-money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies. To better visualize the flow of funds from point of origin to point of distribution the visualization process must be slowed down much like an inexperienced quarterback learns to slow. This risk assessment was commissioned by the Government of Mauritius as part of its commitment as a member of Financial Action Task Force FATF1to combat the financing of terrorism. Financial institutions should on their part maintain updated anti-money laundering and terrorist financing deterrence policies including regular update and training of concerned staff to keep up with new emerging typologies. This Act may be cited as the Anti-Money Laundering and.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title terrorist financing mauritius by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.