12+ Terrorist financing fines uk info

Home » money laundering Info » 12+ Terrorist financing fines uk infoYour Terrorist financing fines uk images are available. Terrorist financing fines uk are a topic that is being searched for and liked by netizens today. You can Find and Download the Terrorist financing fines uk files here. Download all royalty-free vectors.

If you’re looking for terrorist financing fines uk images information linked to the terrorist financing fines uk topic, you have visit the right blog. Our site always provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

Terrorist Financing Fines Uk. The UKs anti-money laundering AML and counter-terrorist financing CTF supervisory regime is comprehensive seeking to regulate and supervise those firms most at risk from money laundering and terrorist financing. Fundraising Terrorism Act 2000 s15 Use and possession Terrorism Act 2000 s16 Funding arrangements Terrorism Act 2000 s17 Money laundering Terrorism Act 2000 s18 Triable either way Maximum. These Regulations replace the Money Laundering Regulations 2007 SI. Finance protecting our citizens and helping legitimate businesses to thrive.

Pdf Modelling Of Money Laundering And Terrorism Financing Typologies From researchgate.net

Pdf Modelling Of Money Laundering And Terrorism Financing Typologies From researchgate.net

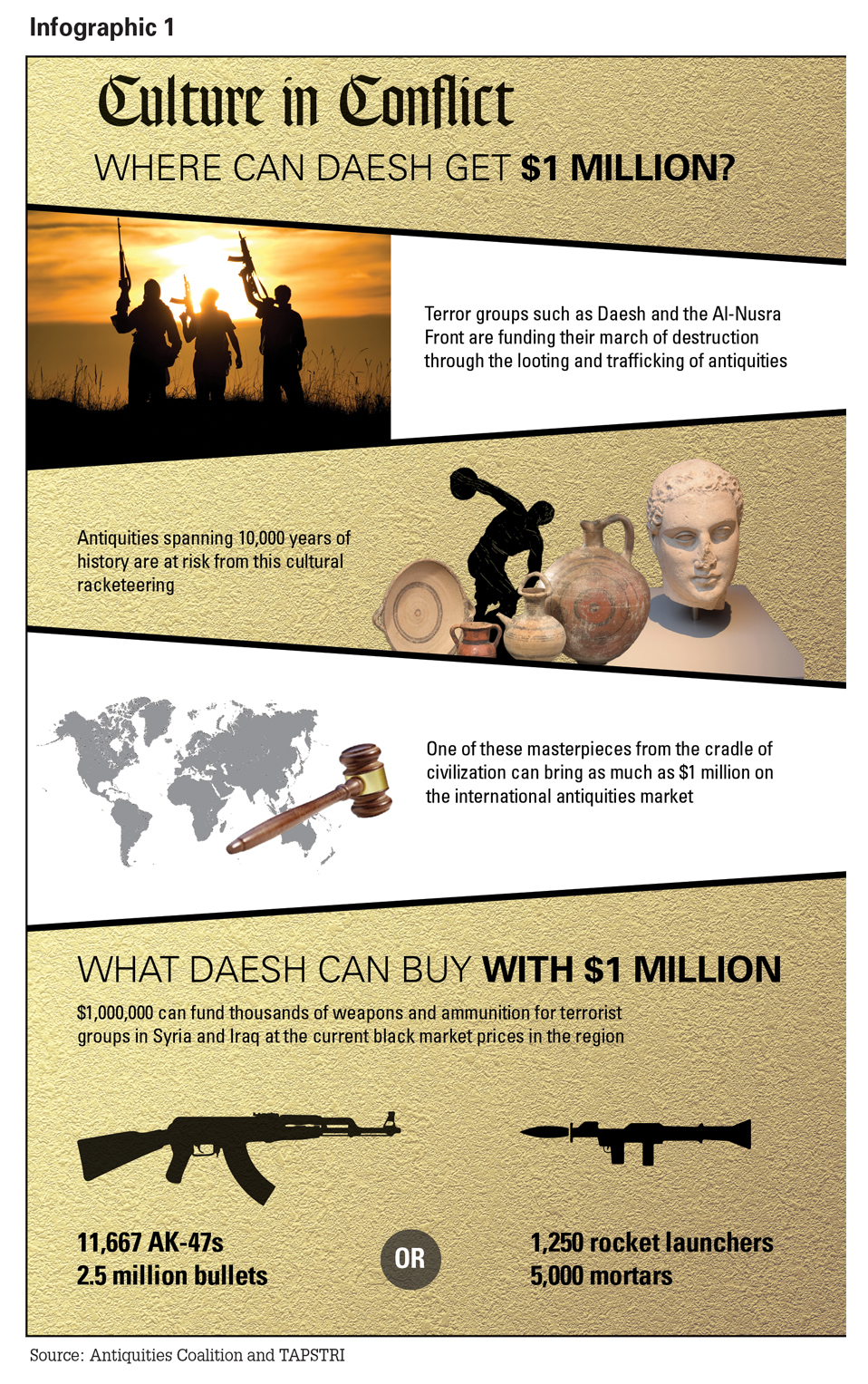

New funding techniques of terrorist organisations were recently identified by the FATF in respect of Daesh also known as the Islamic State. The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering and terrorist financing activity whilst being. However the final settlements will force the bank to take a. Carrying on business in the United Kingdom 15 10. In December 2018 the. 14 years custody Offence range.

Terrorism financing however is not only very difficult if not impossible to prevent it is also a.

Independent legal professionals and trust or. This sanctions regime aims to further the prevention of terrorism in the UK or elsewhere and protect UK national security interests. Carrying on business in the United Kingdom 15 10. High level community order 13 years custody. The UK is a member of FATF and accordingly the UK anti. These Regulations replace the Money Laundering Regulations 2007 SI.

Source: researchgate.net

Source: researchgate.net

The fines were widely expected after Standard Chartered said in February it had set aside 900m 691m to cover US and UK penalties. Given the way of its functioning Daesh recurred to new methods of funding which could be considered more inherent for a state such as levering taxes or exploiting natural resources such as in this case natural gas and oil. The offences under the Terrorism Act mirror to a large extent the money laundering offences under the Proceeds of Crime Act 2002 the 2002 Act. These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. Finance protecting our citizens and helping legitimate businesses to thrive.

Source: researchgate.net

Source: researchgate.net

Carrying on business in the United Kingdom 15 10. Penalties UK Up to two years for breach of country specific sanctions and up to seven years for breach of terrorist financing legislation. Terrorist financing provides funds for terrorist activity. It is through this regime that the UK will implement its. These have achieved some levels of success and indeed the recent Future Financial Crime Risks report from LexisNexis Risk Solutions found that 76 per cent of compliance professionals expected legislation to decrease money laundering in the UK.

Source: researchgate.net

Source: researchgate.net

UK fines money services business for AML failings. These Regulations replace the Money Laundering Regulations 2007 SI. New funding techniques of terrorist organisations were recently identified by the FATF in respect of Daesh also known as the Islamic State. UK fines money services business for AML failings. It was also fined 24m for failing to adequately guard against money laundering and terrorist financing and properly report suspicious activities.

Source: acamstoday.org

Source: acamstoday.org

It is through this regime that the UK will implement its. The offences under the Terrorism Act mirror to a large extent the money laundering offences under the Proceeds of Crime Act 2002 the 2002 Act. 20073298 with updated provisions that implement in part the Fourth Money Laundering Directive 2015849EU fourth money laundering directive of the European Parliament and of the Council of 20th May 2015 on the prevention of the use of the financial system for the purpose of money laundering or terrorist financing. Trade Embargoes prevent the trade of certain goods eg. The UK Financial Conduct Authority FCA has fined Commerzbank AGs London branch Commerzbank London 378 million for failing to institute adequate anti-money laundering AML controls from 2012 to 2017 in violation of Principle 3 of the FCAs Principles for Businesses.

Source: acamstoday.org

Source: acamstoday.org

However the final settlements will force the bank to take a. It is through this regime that the UK will implement its. Fundraising Terrorism Act 2000 s15 Use and possession Terrorism Act 2000 s16 Funding arrangements Terrorism Act 2000 s17 Money laundering Terrorism Act 2000 s18 Triable either way Maximum. The UKs anti-money laundering AML and counter-terrorist financing CTF supervisory regime is comprehensive seeking to regulate and supervise those firms most at risk from money laundering and terrorist financing. The terrorism finance offences are each punishable.

Source: researchgate.net

Source: researchgate.net

However the final settlements will force the bank to take a. It was also fined 24m for failing to adequately guard against money laundering and terrorist financing and properly report suspicious activities. UK fines money services business for AML failings. The terrorism finance offences are each punishable. The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of its business.

Source: globalriskinsights.com

Source: globalriskinsights.com

The UKs anti-money laundering AML and counter-terrorist financing CTF supervisory regime is comprehensive seeking to regulate and supervise those firms most at risk from money laundering and terrorist financing. In December 2018 the. Auditors and others 17 12. This sanctions regime aims to further the prevention of terrorism in the UK or elsewhere and protect UK national security interests. UK fines money services business for AML failings.

Source: globalriskinsights.com

Source: globalriskinsights.com

Terrorism financing however is not only very difficult if not impossible to prevent it is also a. Terrorism financing however is not only very difficult if not impossible to prevent it is also a. Money Laundering and Terrorist Financing CHAPTER 1 Application 8. The fines were widely expected after Standard Chartered said in February it had set aside 900m 691m to cover US and UK penalties. The Counter-Terrorism and Border Security Act 2019 received Royal Assent on 12 February 2019.

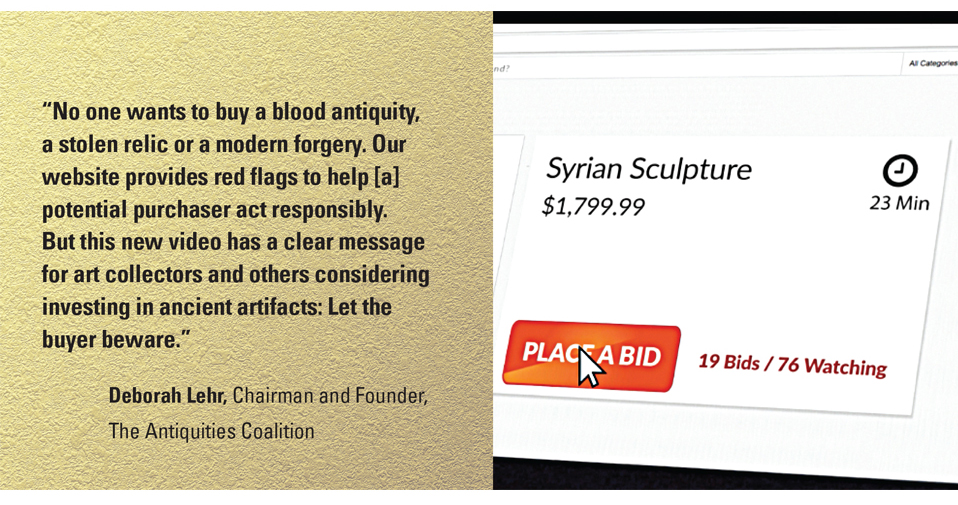

Source: acamstoday.org

Source: acamstoday.org

These regulations require you to apply risk-based customer due diligence measures and take other steps to prevent your services from being used for money laundering or terrorist financing. The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering and terrorist financing activity whilst being. These have achieved some levels of success and indeed the recent Future Financial Crime Risks report from LexisNexis Risk Solutions found that 76 per cent of compliance professionals expected legislation to decrease money laundering in the UK. However the final settlements will force the bank to take a. Terrorist financing provides funds for terrorist activity.

These have achieved some levels of success and indeed the recent Future Financial Crime Risks report from LexisNexis Risk Solutions found that 76 per cent of compliance professionals expected legislation to decrease money laundering in the UK. New funding techniques of terrorist organisations were recently identified by the FATF in respect of Daesh also known as the Islamic State. However the final settlements will force the bank to take a. The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of its business. 20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI.

However the final settlements will force the bank to take a. Terrorist financing provides funds for terrorist activity. The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering and terrorist financing activity whilst being. The Financial Conduct Authority FCA has fined Standard Chartered Bank Standard Chartered 102163200 for Anti-Money Laundering AML breaches in two higher risk areas of its business. It was also fined 24m for failing to adequately guard against money laundering and terrorist financing and properly report suspicious activities.

The fines were widely expected after Standard Chartered said in February it had set aside 900m 691m to cover US and UK penalties. These have achieved some levels of success and indeed the recent Future Financial Crime Risks report from LexisNexis Risk Solutions found that 76 per cent of compliance professionals expected legislation to decrease money laundering in the UK. The government is keen to ensure that the UKs anti-money laundering and counter terrorist financing regime effectively deters money laundering and terrorist financing activity whilst being. The UK is a member of FATF and accordingly the UK anti. Military goods with certain embargoes placing requirements on.

Source: researchgate.net

Source: researchgate.net

Finance protecting our citizens and helping legitimate businesses to thrive. The FATF plays a central role in global efforts in combatting terrorist financing through its role in setting global standards to combat terrorist financing assisting jurisdictions in implementing financial provisions of the United Nations Security Council resolutions on terrorism and evaluating countries ability to prevent detect investigate and prosecute the financing of terrorism. 20072157 and the Transfer of Funds Information on the Payer Regulations 2007 SI. Auditors and others 17 12. These have achieved some levels of success and indeed the recent Future Financial Crime Risks report from LexisNexis Risk Solutions found that 76 per cent of compliance professionals expected legislation to decrease money laundering in the UK.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title terrorist financing fines uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.