19+ Structuring deposits money laundering ideas

Home » money laundering Info » 19+ Structuring deposits money laundering ideasYour Structuring deposits money laundering images are available. Structuring deposits money laundering are a topic that is being searched for and liked by netizens today. You can Download the Structuring deposits money laundering files here. Download all royalty-free photos.

If you’re looking for structuring deposits money laundering pictures information linked to the structuring deposits money laundering topic, you have visit the right site. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that fit your interests.

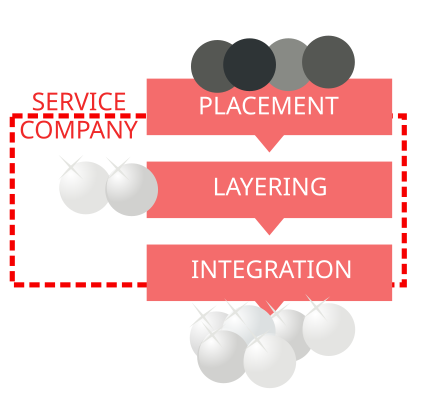

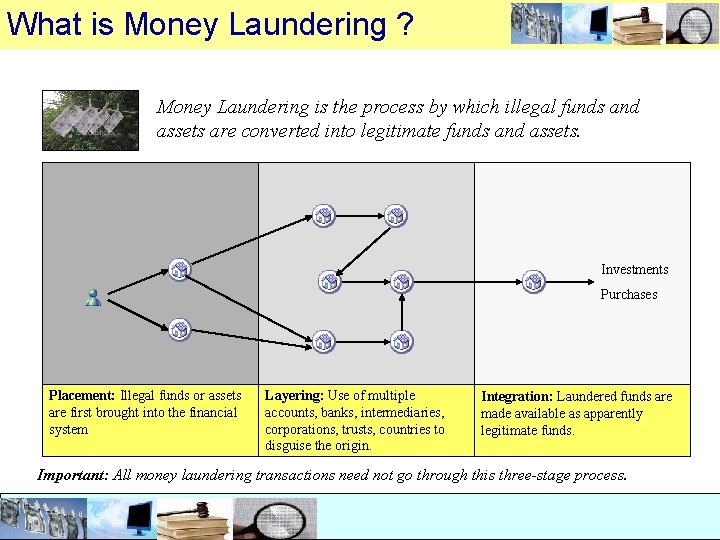

Structuring Deposits Money Laundering. An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small. Money laundering typically occurs in three phases. 3 Stages Of Money Laundering Techniques Anti Money Laundering.

Layering Aml Anti Money Laundering From amlbot.com

Layering Aml Anti Money Laundering From amlbot.com

Almost 50 of the depository institution Suspicious Activity Reports filed to date lists Bank Secrecy ActStructuringMoney Laundering as the suspected violation. 2 The extent and specific parameters under which a financial institution must monitor accounts. Structuring is a Crime. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement. Structuring is the practice of conducting financial transactions in a specific pattern calculated to avoid the creation of certain records and reports required by the Bank Secrecy Act BSA andor IRC 6050I Returns relating to cash received in trade or business etc. In most cases cash deposits or exchanges represent the Placement phase.

The Internal Revenue Service reminded businesses that they must file Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business when they engage in cash transactions in excess of 10000.

In the Anti-Money Laundering World AML structuring consists of the division breaking up of cash transactions deposits and withdrawals with the intent to avoid the Currency Transaction Reporting CTR filings. Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business. Therefore they use chips for a few hours and convert them back into cash. Structuring is the idea of structuring your deposits withdrawals etc. Structuring is done by individuals who are trying to avoid the Internal Revenue Service in some way often as part of a money laundering plan or in some form of tax evasion for money obtained in illegal transactions. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short.

Source: amlbot.com

Source: amlbot.com

Typically but not always structuring is related to money laundering. Money laundering typically occurs in three phases. Money Laundering and Structuring Under Federal Law In laymans terms money laundering is a process by which an individual or group tries to disguise the origin of dirty money such as the proceeds of fraud extortion or drug trafficking so that it appears to come from a legitimate source. An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. To avoid detection by the Bank.

An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. Why Structuring or Smurfing Is Done Money Laundering. Structuring is done by individuals who are trying to avoid the Internal Revenue Service in some way often as part of a money laundering plan or in some form of tax evasion for money obtained in illegal transactions. Money launderers appear as stakeholders to enter the business ecosystem and place money through the f.

STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement. Structuring is the idea of structuring your deposits withdrawals etc. Structuring stage of money laundering. In most cases cash deposits or exchanges represent the Placement phase. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement.

Source: pinterest.com

Source: pinterest.com

Therefore they use chips for a few hours and convert them back into cash. Why Structuring or Smurfing Is Done Money Laundering. In the Anti-Money Laundering World AML structuring consists of the division breaking up of cash transactions deposits and withdrawals with the intent to avoid the Currency Transaction Reporting CTR filings. Money launderers appear as stakeholders to enter the business ecosystem and place money through the f. STRUCTURING is the act of altering a financial transaction to avoid a reporting requirement.

Source: pinterest.com

Source: pinterest.com

Therefore they use chips for a few hours and convert them back into cash. Structuring as readers may recall is the federal criminal offense of splitting up bank deposits so as to keep them under a threshold such as 10000 above which banks have to report transactions to the governmentStructuring is unlawful whether or not it occurs in conjunction with any other legal offense as opposed to being motivated by say a desire to keep a low profile in general. Typically but not always structuring is related to money laundering. Why Structuring or Smurfing Is Done Money Laundering. Money Laundering and Structuring Under Federal Law In laymans terms money laundering is a process by which an individual or group tries to disguise the origin of dirty money such as the proceeds of fraud extortion or drug trafficking so that it appears to come from a legitimate source.

Source: slidetodoc.com

Source: slidetodoc.com

The Internal Revenue Service reminded businesses that they must file Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business when they engage in cash transactions in excess of 10000. An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. Structuring is a Crime. Structuring as readers may recall is the federal criminal offense of splitting up bank deposits so as to keep them under a threshold such as 10000 above which banks have to report transactions to the governmentStructuring is unlawful whether or not it occurs in conjunction with any other legal offense as opposed to being motivated by say a desire to keep a low profile in general. Money Laundering and Structuring Under Federal Law In laymans terms money laundering is a process by which an individual or group tries to disguise the origin of dirty money such as the proceeds of fraud extortion or drug trafficking so that it appears to come from a legitimate source.

Source: in.pinterest.com

Source: in.pinterest.com

Historically methods of money laundering have included smurfing or the structuring of the banking of large amounts of money into multiple small. Why Structuring or Smurfing Is Done Money Laundering. Structuring does not have to include illegally sourced money or money laundering it can be legal money and it can be as simple as you do not want the amount or frequencies of your deposits to be scrutinized by the bankso you structure the deposits accordingly. 3 Stages Of Money Laundering Techniques Anti Money Laundering. Money launderers appear as stakeholders to enter the business ecosystem and place money through the f.

Source: pinterest.com

Source: pinterest.com

In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. In most cases cash deposits or exchanges represent the Placement phase. Money laundering typically occurs in three phases. Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short.

Source: umrohgratis99.blogspot.com

Source: umrohgratis99.blogspot.com

But depositing 9500 with the purpose of evading the currency transaction reporting requirement is a crime called structuring. Structuring does not have to include illegally sourced money or money laundering it can be legal money and it can be as simple as you do not want the amount or frequencies of your deposits to be scrutinized by the bankso you structure the deposits accordingly. Why Structuring or Smurfing Is Done Money Laundering. To avoid detection by the Bank. A financial institutions anti-money laundering program should be designed to detect and report both categories of structuring to guard against use of the institution for money laundering and ensure the institution is compliant with the suspicious activity reporting requirements of the Bank Secrecy Act.

Source: amlbot.com

Source: amlbot.com

An example of structuring would be a business with cash of 17000 to deposit breaking it into two deposits one of 9000 and the other of 8000 with specific intent to evade the banks. Money Laundering and Structuring Under Federal Law In laymans terms money laundering is a process by which an individual or group tries to disguise the origin of dirty money such as the proceeds of fraud extortion or drug trafficking so that it appears to come from a legitimate source. Structuring as readers may recall is the federal criminal offense of splitting up bank deposits so as to keep them under a threshold such as 10000 above which banks have to report transactions to the governmentStructuring is unlawful whether or not it occurs in conjunction with any other legal offense as opposed to being motivated by say a desire to keep a low profile in general. 2 The extent and specific parameters under which a financial institution must monitor accounts. But depositing 9500 with the purpose of evading the currency transaction reporting requirement is a crime called structuring.

Source: wikiwand.com

Source: wikiwand.com

The Internal Revenue Service reminded businesses that they must file Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business when they engage in cash transactions in excess of 10000. Typically but not always structuring is related to money laundering. Has various AML Anti-Money Laundering initiatives in place but structuring is more than just money laundering. Therefore they use chips for a few hours and convert them back into cash. Structuring does not have to include illegally sourced money or money laundering it can be legal money and it can be as simple as you do not want the amount or frequencies of your deposits to be scrutinized by the bankso you structure the deposits accordingly.

Source: slidetodoc.com

Source: slidetodoc.com

The Internal Revenue Service reminded businesses that they must file Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business when they engage in cash transactions in excess of 10000. When a person structures money they are usually structuring deposits to the bank in order to avoid certain reporting requirements. Has various AML Anti-Money Laundering initiatives in place but structuring is more than just money laundering. Money launderers appear as stakeholders to enter the business ecosystem and place money through the f. Almost 50 of the depository institution Suspicious Activity Reports filed to date lists Bank Secrecy ActStructuringMoney Laundering as the suspected violation.

Source: umrohgratis99.blogspot.com

Source: umrohgratis99.blogspot.com

Structuring stage of money laundering. But depositing 9500 with the purpose of evading the currency transaction reporting requirement is a crime called structuring. The Internal Revenue Service reminded businesses that they must file Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business when they engage in cash transactions in excess of 10000. Structuring is done by individuals who are trying to avoid the Internal Revenue Service in some way often as part of a money laundering plan or in some form of tax evasion for money obtained in illegal transactions. A financial institutions anti-money laundering program should be designed to detect and report both categories of structuring to guard against use of the institution for money laundering and ensure the institution is compliant with the suspicious activity reporting requirements of the Bank Secrecy Act.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title structuring deposits money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.