14++ Structuring anti money laundering info

Home » money laundering idea » 14++ Structuring anti money laundering infoYour Structuring anti money laundering images are ready. Structuring anti money laundering are a topic that is being searched for and liked by netizens today. You can Download the Structuring anti money laundering files here. Download all royalty-free images.

If you’re looking for structuring anti money laundering pictures information linked to the structuring anti money laundering interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

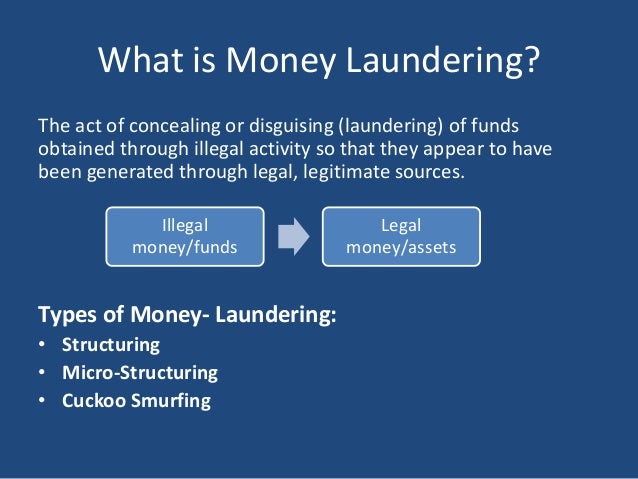

Structuring Anti Money Laundering. Tax Advice Tax advice is one of the most common services that accountants provide so they must be aware of and alert to the multiple ways in which tax services may be vulnerable to money laundering. Structuring is defined as conducting one or more transactions in currency in any amount at one or more financial institutions on one or more days in any. Structuring can take two basic forms. However it is possible to structure without the use of any smurfs at all.

Structuring Smurfing Understanding The Different Money Laundering Evasion And Fincen Violations Youtube From youtube.com

Structuring Smurfing Understanding The Different Money Laundering Evasion And Fincen Violations Youtube From youtube.com

Structuring is defined as conducting one or more transactions in currency in any amount at one or more financial institutions on one or more days in any. Tax Advice Tax advice is one of the most common services that accountants provide so they must be aware of and alert to the multiple ways in which tax services may be vulnerable to money laundering. John Smith sells a car and goes to the bank with 14000 in cash to deposit. Tax structuring could be used to hide criminal proceeds or to evade tax on legitimate income. In 1986 Congress criminalized currency structuring in the Money Laundering Control 4 Act. Structuring can take two basic forms.

The money laundering cycle can be broken down into three distinct stages.

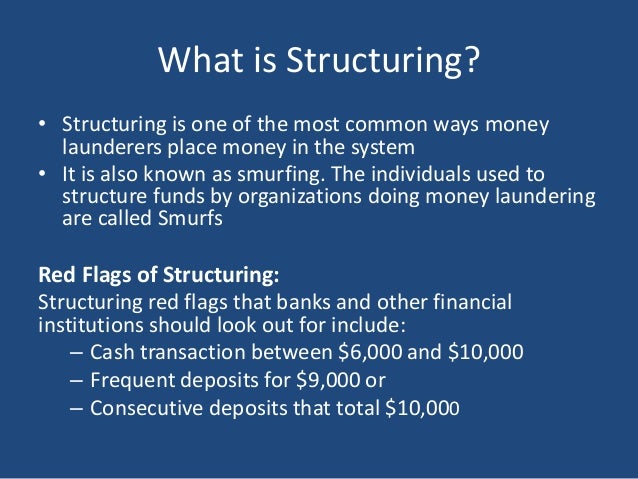

Stages of money laundering structuring. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. Businesswoman charged for Smurfing. However it is possible to structure without the use of any smurfs at all. Structuring is a well-known technique in money laundering law. Structuring is defined as conducting one or more transactions in currency in any amount at one or more financial institutions on one or more days in any.

Source: slideshare.net

Source: slideshare.net

Structuring stage of money laundering. In 1986 Congress criminalized currency structuring in the Money Laundering Control 4 Act. According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by. Stages of money laundering structuring. Structuring is defined as conducting one or more transactions in currency in any amount at one or more financial institutions on one or more days in any.

Source:

Stages of money laundering structuring. It was reported in the local media that a businesswoman was charged for structuring transactions to avoid the cash threshold reporting requirements imposed by Bank Negara Malaysia BNM on reporting institutions that are financial institutions. Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. Structuring is a well-known technique in money laundering law. 3 Stages Of Money Laundering Techniques Anti Money Laundering.

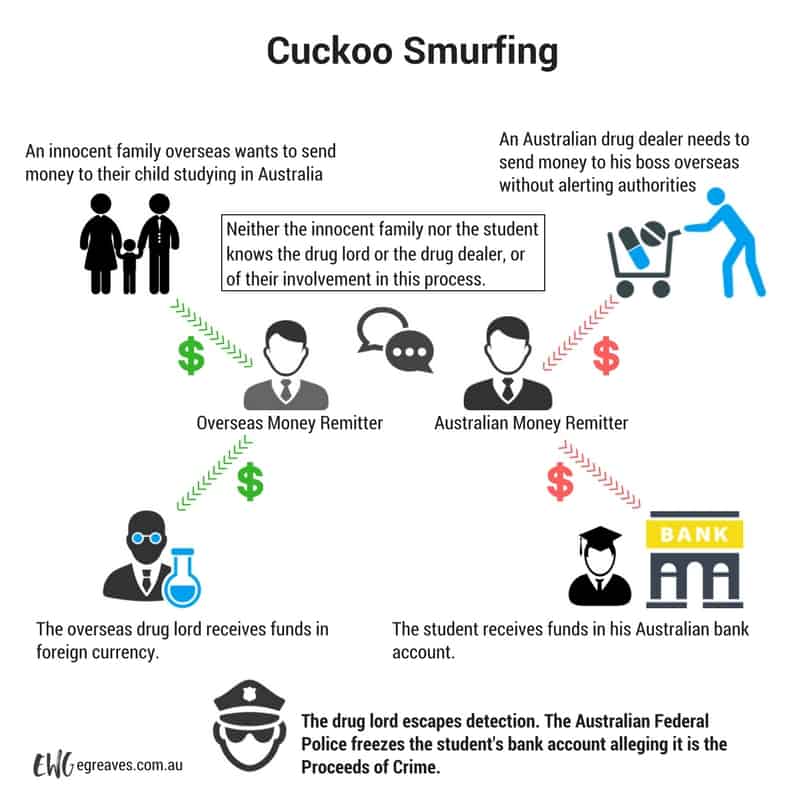

3 Stages Of Money Laundering Techniques Anti Money Laundering. Tax structuring could be used to hide criminal proceeds or to evade tax on legitimate income. According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by. Criminals may use several methodologies to place illegal money in the legitimate financial system including. So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements.

Source: planetcompliance.com

Source: planetcompliance.com

Tax structuring could be used to hide criminal proceeds or to evade tax on legitimate income. Anti-money laundering is the process of financial institutions and other business entities using in-house sometimes assisted by external parties more on this to come methods to address the risks posed by Trade-Based Money Laundering. THE BASICS Installment 5. It was reported in the local media that a businesswoman was charged for structuring transactions to avoid the cash threshold reporting requirements imposed by Bank Negara Malaysia BNM on reporting institutions that are financial institutions. However it is possible to structure without the use of any smurfs at all.

Accordingly the first stage of the money laundering process is known as placement. Anti-money laundering is the process of financial institutions and other business entities using in-house sometimes assisted by external parties more on this to come methods to address the risks posed by Trade-Based Money Laundering. It involves breaking down large sums of money to get funds placed in the legitimate financial system to avoid anti-money laundering reporting requirements usually in amounts just below 10000. Structuring is a well-known technique in money laundering law. Stages of money laundering structuring.

Source: egreaves.com.au

Source: egreaves.com.au

Tax Advice Tax advice is one of the most common services that accountants provide so they must be aware of and alert to the multiple ways in which tax services may be vulnerable to money laundering. Stages of money laundering structuring. Money laundering typically occurs in three phases. 3 Stages Of Money Laundering Techniques Anti Money Laundering. Businesswoman charged for Smurfing.

Source: calert.info

Source: calert.info

Stages of money laundering structuring. Anti-money laundering is the process of financial institutions and other business entities using in-house sometimes assisted by external parties more on this to come methods to address the risks posed by Trade-Based Money Laundering. Accordingly the first stage of the money laundering process is known as placement. Businesswoman charged for Smurfing. It involves breaking down large sums of money to get funds placed in the legitimate financial system to avoid anti-money laundering reporting requirements usually in amounts just below 10000.

Source: slideshare.net

Source: slideshare.net

Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. Structuring is defined as conducting one or more transactions in currency in any amount at one or more financial institutions on one or more days in any. Businesswoman charged for Smurfing. Structuring can take two basic forms. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short.

Source: aml-assassin.com

Source: aml-assassin.com

According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by. Funneling illegal funds through legitimate businesses that deal heavily in cash transactions. According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by. Money laundering typically occurs in three phases. Structuring stage of money laundering.

Source: slidetodoc.com

Source: slidetodoc.com

Criminals may use several methodologies to place illegal money in the legitimate financial system including. It was reported in the local media that a businesswoman was charged for structuring transactions to avoid the cash threshold reporting requirements imposed by Bank Negara Malaysia BNM on reporting institutions that are financial institutions. It involves breaking down large sums of money to get funds placed in the legitimate financial system to avoid anti-money laundering reporting requirements usually in amounts just below 10000. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short. Tax structuring could be used to hide criminal proceeds or to evade tax on legitimate income.

Source: pnghut.com

Source: pnghut.com

3 Stages Of Money Laundering Techniques Anti Money Laundering. Anti-money laundering is the process of financial institutions and other business entities using in-house sometimes assisted by external parties more on this to come methods to address the risks posed by Trade-Based Money Laundering. Stages of money laundering structuring. In 1986 Congress criminalized currency structuring in the Money Laundering Control 4 Act. Afterwards there is a stage of layering in 3 stages of money laundering.

Source: youtube.com

Source: youtube.com

So SMURFING is the act of using runners to perform multiple financial transactions to avoid the currency reporting requirements. John Smith sells a car and goes to the bank with 14000 in cash to deposit. Structuring stage of money laundering. 3 Stages Of Money Laundering Techniques Anti Money Laundering. Money laundering typically occurs in three phases.

Source: financeandriskblog.accenture.com

Source: financeandriskblog.accenture.com

According to Hughes structuring is the money laundering process by which individuals or criminal syndicates are able to bypass this recognition of money transfers by. Anti-money laundering is the process of financial institutions and other business entities using in-house sometimes assisted by external parties more on this to come methods to address the risks posed by Trade-Based Money Laundering. Accordingly the first stage of the money laundering process is known as placement. Tax structuring could be used to hide criminal proceeds or to evade tax on legitimate income. In the United States any cash deposit or withdrawal in excess of 10000 on a single business day is subject to a currency transaction report CTR for short.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title structuring anti money laundering by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.