18+ Stages of kyc process ideas

Home » money laundering idea » 18+ Stages of kyc process ideasYour Stages of kyc process images are ready in this website. Stages of kyc process are a topic that is being searched for and liked by netizens now. You can Get the Stages of kyc process files here. Find and Download all royalty-free photos.

If you’re looking for stages of kyc process pictures information related to the stages of kyc process topic, you have visit the ideal blog. Our site frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

Stages Of Kyc Process. KYC Verification Process Steps. 4 Submit the form. If details are same as earlier filed DIR-3 KYC will file web base DIR-3 KYC. Assess the risk of.

Workflow Of Client Onboarding Process Kyc Status Update Ppt Slides Presentation Graphics Presentation Powerpoint Example Slide Templates From slideteam.net

Workflow Of Client Onboarding Process Kyc Status Update Ppt Slides Presentation Graphics Presentation Powerpoint Example Slide Templates From slideteam.net

Know Your Client better known as KYC is a crucial procedure for the incorporation and registration of clients and users in organizations companies and institutions of all types and areas. 5 Crucial Steps to Effective KYC There could be many corner cases and variations of this flow but as we have said before the foundation is almost always the same. In most instances KYC will be the first phase of the Customer Due Diligence process and depending on the rating given to the customer person or entity more steps or procedures may be necessary as part of a thorough CDD particularly if the initial assessment puts them in a. This year Due date of filing of both DIR-3 KYC is 30 th September. KYC Verification Process Steps. More importantly KYC is a fundamental practice to protect your organization from fraud and losses resulting from illegal funds and transactions.

Verify the identity of the customer.

This is described as. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed. The first step in KYC verification involves the collection of personal information from an online user. Verify the identity of the customer. If details are same as earlier filed DIR-3 KYC will file web base DIR-3 KYC. Know Your Client better known as KYC is a crucial procedure for the incorporation and registration of clients and users in organizations companies and institutions of all types and areas.

Source: slideteam.net

Source: slideteam.net

Assess the risk of. Assess the risk of. If details are same as earlier filed DIR-3 KYC will file web base DIR-3 KYC. Know Your Client better known as KYC is a crucial procedure for the incorporation and registration of clients and users in organizations companies and institutions of all types and areas. 6 Your KYC verification is completed.

Source: advisoryhq.com

Source: advisoryhq.com

As mentioned earlier the KYC process. KYC refers to the steps taken by a financial institution or business to. Since the passing of the Patriot Act KYC processes have become increasingly important as they help to. KYC compliance responsibility rests with the banks. 5 Verify the status of your KYC verification this might take a few days.

Source: arachnys.com

Source: arachnys.com

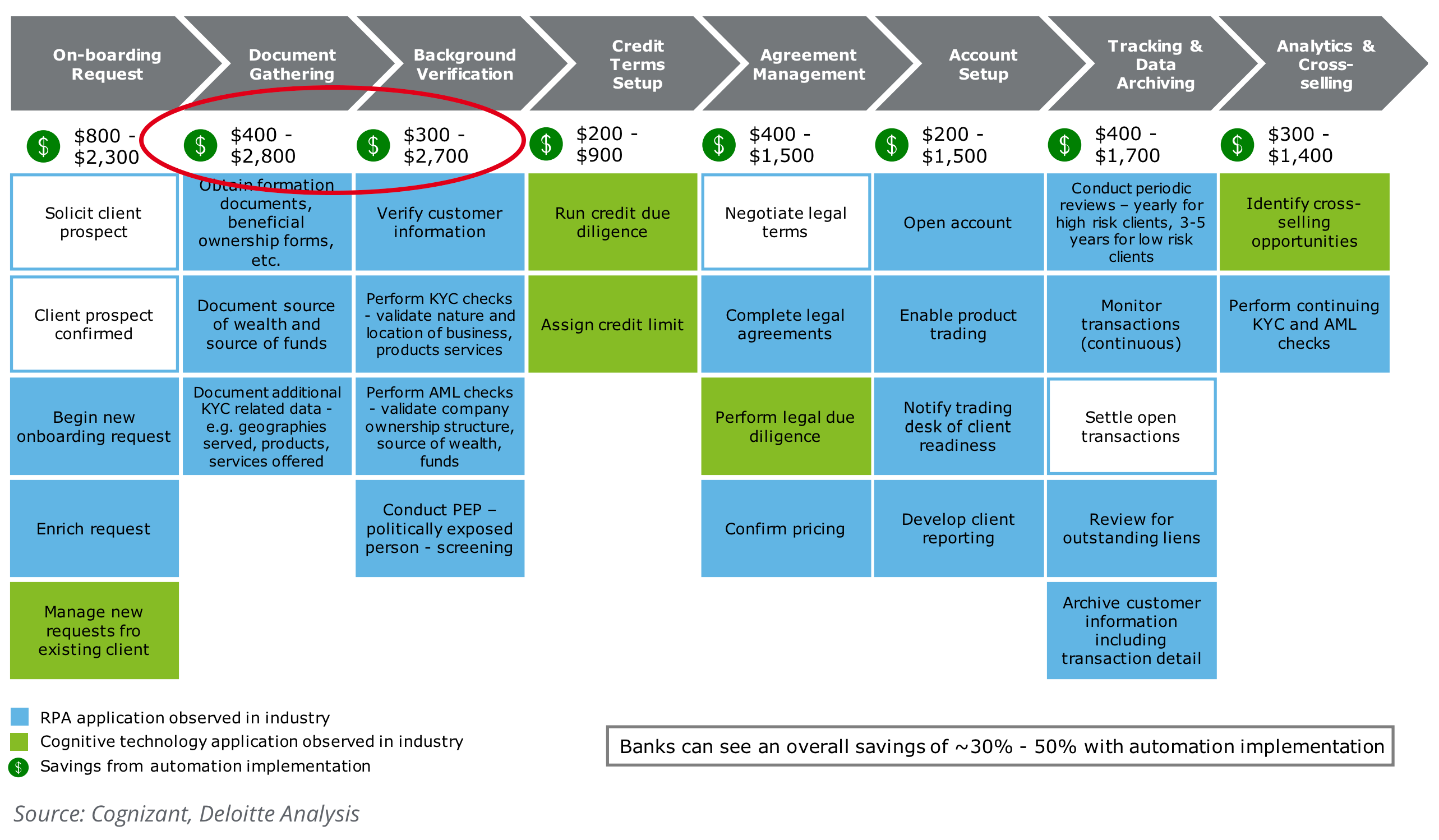

What Are the Elements of KYC. Just like the way traditional banking institutions were used to verify an identity online KYC verification is performed. Verify the identity of the customer. 5 Verify the status of your KYC verification this might take a few days. With a few exceptions the AML KYC onboarding lifecycle involves five distinct phases that are listed and explained below.

Source: shuftipro.com

Source: shuftipro.com

Offline KYC process steps generally involve manually filling up a form with details that include your Aadhaar card number name. KYC process includes ID card verification face verification document verification such as utility bills as proof of address and biometric verification. 6 Your KYC verification is completed. The KYC process is an integral part of various due diligence Due Diligence Due diligence is a process of verification investigation or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information and to verify anything else that was brought up during an MA deal or investment process. Although this procedure is applied in the onsite environment it is of decisive importance in the online environment where it is an essential requirement at a technical and regulatory level.

Source: arachnys.com

Source: arachnys.com

What Are the Elements of KYC. The first step in KYC verification involves the collection of personal information from an online user. 5 Crucial Steps to Effective KYC There could be many corner cases and variations of this flow but as we have said before the foundation is almost always the same. Know Your Client better known as KYC is a crucial procedure for the incorporation and registration of clients and users in organizations companies and institutions of all types and areas. One of those safeguards being to ensure the identity of the person completing the financial transactions.

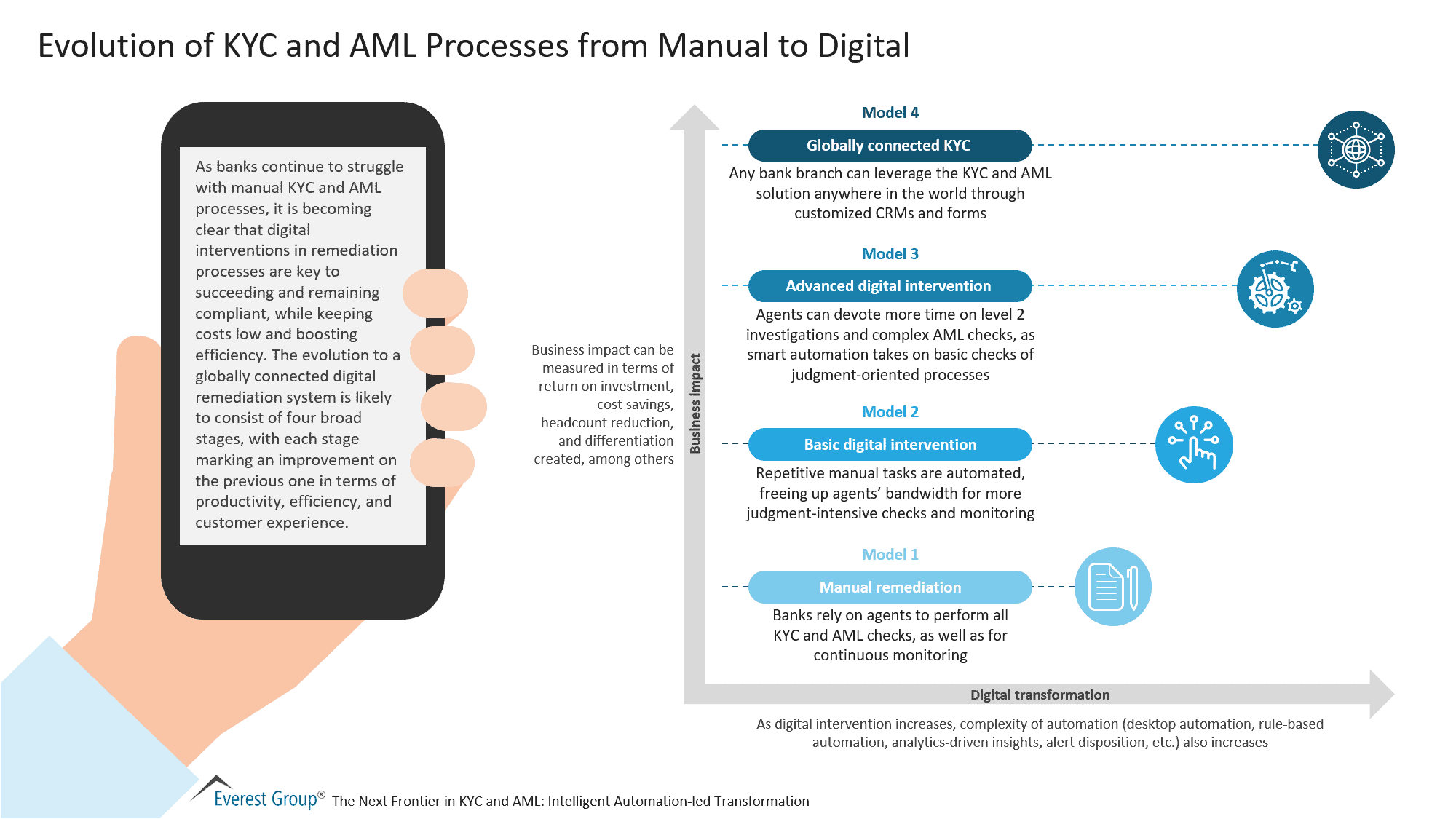

Source: everestgrp.com

Source: everestgrp.com

5 Crucial Steps to Effective KYC There could be many corner cases and variations of this flow but as we have said before the foundation is almost always the same. STEPS OF FILNG OF WEB SERVICE DIR-3 KYC. Assess the risk of. Customer Acceptance Policy CAP Customer Identification Process CIP Monitoring of Transactions. Offline KYC process steps generally involve manually filling up a form with details that include your Aadhaar card number name.

Source: basisid.com

Source: basisid.com

Check the Boxes. Therefore a completely filled out KYC profile will support the relationship manager to explain unusual transaction in the course of AML transaction monitoring. More importantly KYC is a fundamental practice to protect your organization from fraud and losses resulting from illegal funds and transactions. What Are the Elements of KYC. KYC process includes ID card verification face verification document verification such as utility bills as proof of address and biometric verification.

Source: processmaker.com

Source: processmaker.com

The KYC process is an integral part of various due diligence Due Diligence Due diligence is a process of verification investigation or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information and to verify anything else that was brought up during an MA deal or investment process. A KYC check refers to verifying that the information provided about a person is legitimate and evaluating the risks of doing business with them. KYC or Know Your Customer is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and individuals they do business with and ensures those entities are acting legallyEffective KYC protects companies from doing business with organisations or individuals involved in illegal activity such as money laundering terrorist financing. KYC Verification Process Steps. 4 Submit the form.

Source: shuftipro.com

Source: shuftipro.com

KYC Requirements for the BanksRequired Documents. Therefore a completely filled out KYC profile will support the relationship manager to explain unusual transaction in the course of AML transaction monitoring. STEPS OF FILNG OF WEB SERVICE DIR-3 KYC. Assess the risk of. 6 Your KYC verification is completed.

Source: medium.com

Source: medium.com

What Are the Elements of KYC. KYC Requirements for the BanksRequired Documents. The KYC process is an integral part of various due diligence Due Diligence Due diligence is a process of verification investigation or audit of a potential deal or investment opportunity to confirm all relevant facts and financial information and to verify anything else that was brought up during an MA deal or investment process. Therefore a completely filled out KYC profile will support the relationship manager to explain unusual transaction in the course of AML transaction monitoring. More importantly KYC is a fundamental practice to protect your organization from fraud and losses resulting from illegal funds and transactions.

Source: slideshare.net

Source: slideshare.net

As mentioned earlier the KYC process. Since the passing of the Patriot Act KYC processes have become increasingly important as they help to. KYC process includes ID card verification face verification document verification such as utility bills as proof of address and biometric verification. What Are the Elements of KYC. As mentioned earlier the KYC process.

Source: rndpoint.com

Source: rndpoint.com

A KYC check refers to verifying that the information provided about a person is legitimate and evaluating the risks of doing business with them. Therefore a completely filled out KYC profile will support the relationship manager to explain unusual transaction in the course of AML transaction monitoring. If details are same as earlier filed DIR-3 KYC will file web base DIR-3 KYC. If an individual obtained DIN after 31st March 2018 till 31st March 2019 in this case such individual shall file e-form DIR-3 KYC. KYC compliance responsibility rests with the banks.

Source: rndpoint.com

Source: rndpoint.com

Reserve Bank of India issued four key elements by which financial institutions should frame their KYC Policies. With a few exceptions the AML KYC onboarding lifecycle involves five distinct phases that are listed and explained below. Although this procedure is applied in the onsite environment it is of decisive importance in the online environment where it is an essential requirement at a technical and regulatory level. Beyond name matching a key aspect of KYC controls is to monitor transactions of a customer against their recorded profile history on the customers accounts and with peers. Know Your Client better known as KYC is a crucial procedure for the incorporation and registration of clients and users in organizations companies and institutions of all types and areas.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title stages of kyc process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.