16++ Sra money laundering risk assessment ideas

Home » money laundering idea » 16++ Sra money laundering risk assessment ideasYour Sra money laundering risk assessment images are ready in this website. Sra money laundering risk assessment are a topic that is being searched for and liked by netizens now. You can Find and Download the Sra money laundering risk assessment files here. Download all royalty-free photos.

If you’re searching for sra money laundering risk assessment images information connected with to the sra money laundering risk assessment topic, you have come to the ideal site. Our website always gives you hints for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Sra Money Laundering Risk Assessment. The SRA asked all those firms to complete a declaration to confirm that they have a compliant anti-money laundering firm-wide risk assessment by 31 January 2020. The risk assessment must. Kegiatan National Risk Assessment on Money Laundering NRA on ML. Kajian tersebut mengidentifikasi dan menganalisis faktor-faktor ancaman kerentanan dan dampak TPPU secara nasional.

Penilaian Risiko Tindak Pidana Pencucian Uang Dan Tindak Pidana Pendanaan Terorisme Di Sektor Jasa Keuangan Sectoral Risk Assessment Sektor Jasa Keuangan Tahun 2019 From ojk.go.id

Penilaian Risiko Tindak Pidana Pencucian Uang Dan Tindak Pidana Pendanaan Terorisme Di Sektor Jasa Keuangan Sectoral Risk Assessment Sektor Jasa Keuangan Tahun 2019 From ojk.go.id

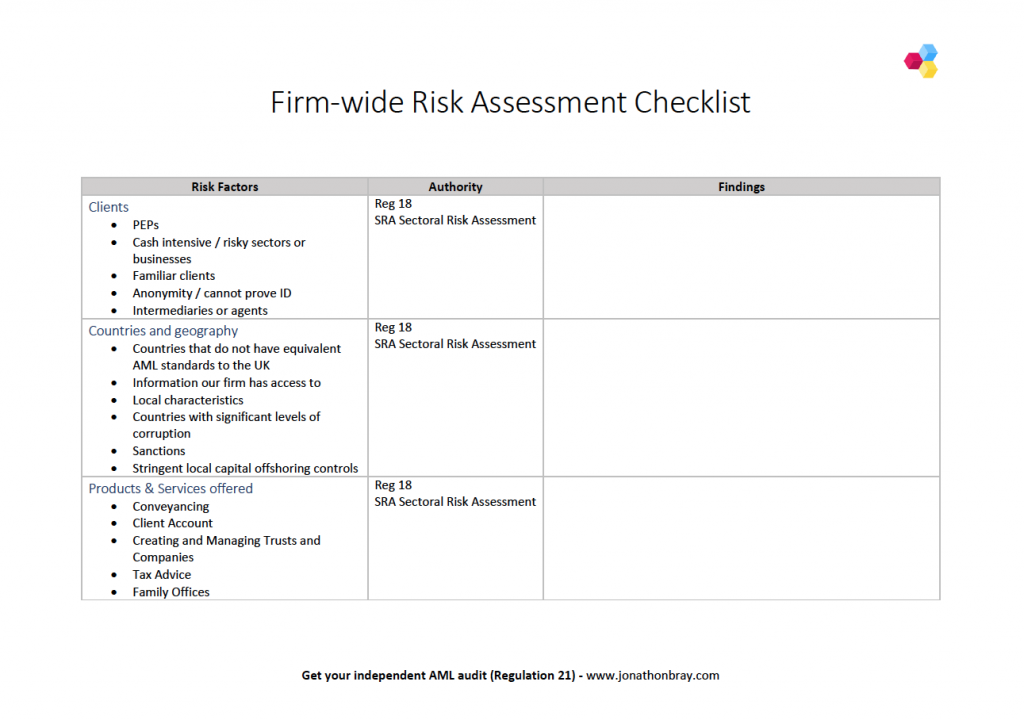

Out a risk assessment to identify and assess the businesss risks of money laundering and terrorist financing the firm-wide risk assessment. The risk assessment must. The countries or geographic areas in which you operate. Status of this document. If you have not seen it the SRA issued a warning notice in May 2019 saying Updated regulations to prevent money laundering were introduced in 2017 and we are seeing high levels of non-compliance with the regulations and that firms have not updated their policies since the new regulations came. The SRA asked all those firms to complete a declaration to confirm that they have a compliant anti-money laundering firm-wide risk assessment by.

It should be used by firms as a basis for creating and updating their own firm-wide risk assessments against which anti-money laundering policies processes and training should be implemented.

Out a risk assessment to identify and assess the businesss risks of money laundering and terrorist financing the firm-wide risk assessment. On 7 May the Solicitors Regulation Authority SRA published its latest Anti-Money Laundering Thematic Review the review focusing on firms offering trust and company services. Address the risk factors set out in the money laundering regulations namely. The SRA is compiled by the respective LPP and law enforcement apparatus Apgakum for each sector under their authority. Kajian tersebut mengidentifikasi dan menganalisis faktor-faktor ancaman kerentanan dan dampak TPPU secara nasional. It should be used by firms as a basis for creating and updating their own firm-wide risk assessments against which anti-money laundering policies processes and training should be implemented.

Source: bi.go.id

Source: bi.go.id

Kajian tersebut mengidentifikasi dan menganalisis faktor-faktor ancaman kerentanan dan dampak TPPU secara nasional. The risk assessment must identify and assesses the risk of your firm being used for money laundering or terrorist financing. The Phase 2 SRA is intended to help AMLCFT supervisors understand the money laundering and terrorism financing. One of the Action Plans contained in Stranas is a Sectoral Risk Assessment SRA in Indonesia. If firms have not fully assessed the risks present for a particular client or matter they cannot understand and manage their risk.

Source:

While many firms were fully compliant with their anti-money laundering AML obligations the SRA had substantial concerns about a significant minority and referred 26 firms into its disciplinary processes. And Eradication of Money Laundering and Terrorism Financing Stranas. Kegiatan National Risk Assessment on Money Laundering NRA on ML. This webinar explores the importance of matter risk assessments. In this 2019 the Indonesia government issued a document of The Updated 2015.

Source:

Kegiatan National Risk Assessment on Money Laundering NRA on ML. And Eradication of Money Laundering and Terrorism Financing Stranas. Out a risk assessment to identify and assess the businesss risks of money laundering and terrorist financing the firm-wide risk assessment. Keeping money launderers out of legal services is critical for the solicitors we supervise and to protect the general public. The Phase 2 Sector Risk Assessment SRA is a review of the characteristics of the new sectors covered by the AMLCFT Act - lawyers conveyancers accountants real estate agents high value dealers and the New Zealand Racing Board.

Source: slideplayer.com

Source: slideplayer.com

Solicitors Regulation Authority SRA Created Date. This webinar explores the importance of matter risk assessments. On 7 May the Solicitors Regulation Authority SRA published its latest Anti-Money Laundering Thematic Review the review focusing on firms offering trust and company services. This document should underpin your AML policies controls and procedures including your matter risk assessments. The Sector Risk Assessment is not intended to cover all money laundering and terrorist financing risks that may be specific to the circumstances of individual reporting entities.

Source:

Including through compiling a sectoral risk assessment SRA and strategic risk assessments in regard with money laundering offences especially in some sectors that are high risk of being exploited or misused for the pupose of money laundering offences. Address the risk factors set out in the money laundering regulations namely. SRA is expected to provide a. The SRA asked all those firms to complete a declaration to confirm that they have a compliant anti-money laundering firm-wide risk assessment by 31 January 2020. If you have not seen it the SRA issued a warning notice in May 2019 saying Updated regulations to prevent money laundering were introduced in 2017 and we are seeing high levels of non-compliance with the regulations and that firms have not updated their policies since the new regulations came.

Source: slideserve.com

Source: slideserve.com

Including through compiling a sectoral risk assessment SRA and strategic risk assessments in regard with money laundering offences especially in some sectors that are high risk of being exploited or misused for the pupose of money laundering offences. The risk assessment must identify and assesses the risk of your firm being used for money laundering or terrorist financing. Take into account information we publish. If firms have not fully assessed the risks present for a particular client or matter they cannot understand and manage their risk. The Phase 2 SRA is intended to help AMLCFT supervisors understand the money laundering and terrorism financing.

Source: bi.go.id

Source: bi.go.id

On 7 May the Solicitors Regulation Authority SRA published its latest Anti-Money Laundering Thematic Review the review focusing on firms offering trust and company services. Status of this document. The SRA asked all those firms to complete a declaration to confirm that they have a compliant anti-money laundering firm-wide risk assessment by 31 January 2020. Those firms must carry out a risk assessment to identify and assess the business risks of money laundering and terrorist financing the firm-wide risk assessment. In this 2019 the Indonesia government issued a document of The Updated 2015.

Source:

The Phase 2 Sector Risk Assessment SRA is a review of the characteristics of the new sectors covered by the AMLCFT Act - lawyers conveyancers accountants real estate agents high value dealers and the New Zealand Racing Board. SRA is expected to provide a. Quantitative data provided in Part 3 of the Sector Risk Assessment is sourced from Annual AMLCFT Reports provided to the Reserve Bank by the reporting entities it. BSP Completes the 3rd Money Laundering ML Terrorist Financing TF and Proliferation Financing PF Sectoral Risk Assessment March 19 2021 The Bangko Sentral ng Pilipinas BSP completed the 3rd sectoral MLTFPF risk assessment SRA of banks and other BSP-supervised financial institutions BSFIs the sector and released the report. The Phase 2 SRA is intended to help AMLCFT supervisors understand the money laundering and terrorism financing.

Source: lexology.com

Source: lexology.com

The SRA is compiled by the respective LPP and law enforcement apparatus Apgakum for each sector under their authority. The countries or geographic areas in which you operate. One of the Action Plans contained in Stranas is a Sectoral Risk Assessment SRA in Indonesia. In this 2019 the Indonesia government issued a document of The Updated 2015. And Eradication of Money Laundering and Terrorism Financing Stranas.

Source: bi.go.id

Source: bi.go.id

This webinar explores the importance of matter risk assessments. The countries or geographic areas in which you operate. Out a risk assessment to identify and assess the businesss risks of money laundering and terrorist financing the firm-wide risk assessment. If you have not seen it the SRA issued a warning notice in May 2019 saying Updated regulations to prevent money laundering were introduced in 2017 and we are seeing high levels of non-compliance with the regulations and that firms have not updated their policies since the new regulations came. It should be used by firms as a basis for creating and updating their own firm-wide risk assessments against which anti-money laundering policies processes and training should be implemented.

Source:

Setelah berbagai risiko mampu diidentifikasi dianalisis dan dievaluasi maka melalui NRA diharapkan dapat tersusun strategi yang dapat meminimalisir apabila. Kajian tersebut mengidentifikasi dan menganalisis faktor-faktor ancaman kerentanan dan dampak TPPU secara nasional. Quantitative data provided in Part 3 of the Sector Risk Assessment is sourced from Annual AMLCFT Reports provided to the Reserve Bank by the reporting entities it. One of the Action Plans contained in Stranas is a Sectoral Risk Assessment SRA in Indonesia. The SRA is compiled by the respective LPP and law enforcement apparatus Apgakum for each sector under their authority.

Source: ini.id

Source: ini.id

The risk assessment must identify and assesses the risk of your firm being used for money laundering or terrorist financing. The Sector Risk Assessment is not intended to cover all money laundering and terrorist financing risks that may be specific to the circumstances of individual reporting entities. This webinar explores the importance of matter risk assessments. Including through compiling a sectoral risk assessment SRA and strategic risk assessments in regard with money laundering offences especially in some sectors that are high risk of being exploited or misused for the pupose of money laundering offences. The sectoral risk assessment outlines the SRAs view of the issues facing legal services as they work to tackle the risk of money laundering.

Source: ojk.go.id

Source: ojk.go.id

Kajian tersebut mengidentifikasi dan menganalisis faktor-faktor ancaman kerentanan dan dampak TPPU secara nasional. In this 2019 the Indonesia government issued a document of The Updated 2015. Status of this document. The risk assessment must. This document should underpin your AML policies controls and procedures including your matter risk assessments.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sra money laundering risk assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.