13++ Shell companies money laundering example information

Home » money laundering idea » 13++ Shell companies money laundering example informationYour Shell companies money laundering example images are ready in this website. Shell companies money laundering example are a topic that is being searched for and liked by netizens today. You can Get the Shell companies money laundering example files here. Download all royalty-free images.

If you’re looking for shell companies money laundering example pictures information connected with to the shell companies money laundering example keyword, you have visit the right site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

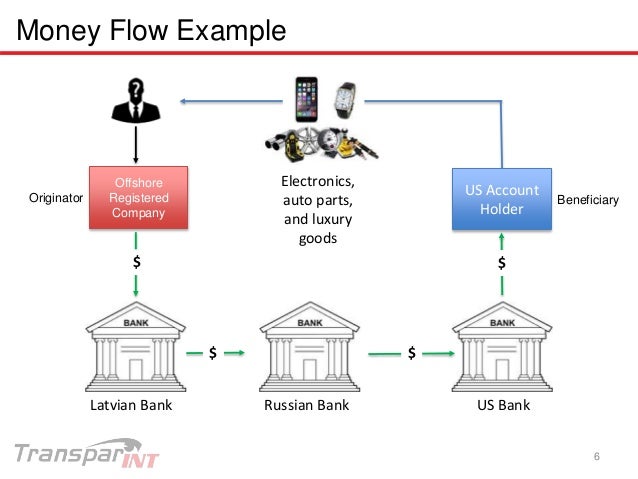

Shell Companies Money Laundering Example. Bank is involved there are also potential cash rewards pursuant to the FIRREA statute Financial Institutions Reform Recovery and Enforcement Act of 1989. The federal government may therefore pay scrutiny to the operations of a shell company for signs of illegal conduct. Those rewards cap at 16 million. For example shell companies may be legitimate but they also might be money laundering operations.

Aml Shell Companies Front Companies And The Misuse Of Real Estate From finextra.com

Aml Shell Companies Front Companies And The Misuse Of Real Estate From finextra.com

Jurisdictions such as Bermuda have faced criticism Verena MatthewDreamstime Vanessa Houlder in London November 8 2017 Hundreds of British shell companies are implicated in nearly 80bn of money. Shell companies could simply be old corporations that are now only partially in business. There were 214000 shell companies related to the Panama-based law firm Mossack Fonseca. Shell companies and money laundering. For example a shell company may be set-up in the British Virgin Islands to funnel funds to a Trust in Wyoming USA whilst a lawyer based in London could be used to manage this money potentially to be held in a bank in Malaysia. Shell companies are business entities without any actual premises employees or operational assets.

British shell companies have been linked to 52 money laundering scandals involving 80 billion pounds in the past 14 years according to researchers at campaign group Transparency International.

I just saw MK Stalin of DMK walking around with a. Effectively this means that shell companies can be established with a degree of anonymity and then used to hide illegal funds evade. Those rewards cap at 16 million. 3 Companies that hold significant assets for example subsidiary company shares but that are not engaged in active business operations would not be considered shell companies as described herein although they may in practice be referred to as shell holding companies. Shell companies are notorious for all the right reasons. In most jurisdictions shell companies can be set up by registered agents in a manner which obscures ultimate beneficial ownership UBO.

Source: ar.pinterest.com

Source: ar.pinterest.com

The extra dollars are. Money Laundering Threat Assessment December 2005 p. The federal government may therefore pay scrutiny to the operations of a shell company for signs of illegal conduct. The extra dollars are. For example all of the companies in it are limited liability partnershipsregistered to one of four UK addresses sleepy office parks and industrial estates on the outskirts of London.

Source: pinterest.com

Source: pinterest.com

Shell companies could simply be old corporations that are now only partially in business. The term SHELL company is used to describe companies that exist merely as a front for a person or organisation that wishes to hide its identity. Shell companies and money laundering. These entities often called ghost companies are frequently used by fraudsters to launder black money. They are created by registered agents to conceal ownership information from other businesses.

Source: pinterest.com

Source: pinterest.com

Those rewards cap at 16 million. British shell companies have been linked to 52 money laundering scandals involving 80 billion pounds in the past 14 years according to researchers at campaign group Transparency International. The federal government may therefore pay scrutiny to the operations of a shell company for signs of illegal conduct. I just saw MK Stalin of DMK walking around with a. Shell companies are business entities without any actual premises employees or operational assets.

Source: pinterest.com

Source: pinterest.com

These entities often called ghost companies are frequently used by fraudsters to launder black money. Dollars through a scheme such as selling a boatload of used cars worth 1 million but paid for with drug profits of 5 million. For example shell companies may be legitimate but they also might be money laundering operations. For example a shell company may be set-up in the British Virgin Islands to funnel funds to a Trust in Wyoming USA whilst a lawyer based in London could be used to manage this money potentially to be held in a bank in Malaysia. Those rewards cap at 16 million.

Source: finextra.com

Source: finextra.com

However shell companies are also frequently misused for illegal purposes and in particular as part of money laundering schemes. Those rewards cap at 16 million. 3 Companies that hold significant assets for example subsidiary company shares but that are not engaged in active business operations would not be considered shell companies as described herein although they may in practice be referred to as shell holding companies. Much of the money laundering going on today is facilitated by foreign banks. The money earned is laundered back into US.

Source: slideshare.net

Source: slideshare.net

However shell companies are also frequently misused for illegal purposes and in particular as part of money laundering schemes. In addition to launder money shell companies are also used to inflate invoices create losses to enable tax evasion inflate the share prices of parent companies By purchasing large quantities of shares and decreasing the supply later releasing them in bits and pieces also known as change in hands False transactions to provide cash for other illegal activities like kickback to clients etc. Bank is involved there are also potential cash rewards pursuant to the FIRREA statute Financial Institutions Reform Recovery and Enforcement Act of 1989. An example of a legal use of a shell corporation could be when a company interacts financially with another company. Shell companies could simply be old corporations that are now only partially in business.

Source: shuftipro.com

Source: shuftipro.com

For example a shell company may be set-up in the British Virgin Islands to funnel funds to a Trust in Wyoming USA whilst a lawyer based in London could be used to manage this money potentially to be held in a bank in Malaysia. Money Laundering Threat Assessment Working Group US. In addition to launder money shell companies are also used to inflate invoices create losses to enable tax evasion inflate the share prices of parent companies By purchasing large quantities of shares and decreasing the supply later releasing them in bits and pieces also known as change in hands False transactions to provide cash for other illegal activities like kickback to clients etc. They could also be illegal operations used to commit false accounting tax evasion money laundering asset hiding and more. Shell companies could simply be old corporations that are now only partially in business.

Source: slideshare.net

Source: slideshare.net

The extra dollars are. Those rewards cap at 16 million. The federal government may therefore pay scrutiny to the operations of a shell company for signs of illegal conduct. Shell companies could simply be old corporations that are now only partially in business. An example of a legal use of a shell corporation could be when a company interacts financially with another company.

Source: finextra.com

Source: finextra.com

British shell companies have been linked to 52 money laundering scandals involving 80 billion pounds 105 billion in the past 14 years according to researchers at. Bank is involved there are also potential cash rewards pursuant to the FIRREA statute Financial Institutions Reform Recovery and Enforcement Act of 1989. Money Laundering Threat Assessment Working Group US. The federal government may therefore pay scrutiny to the operations of a shell company for signs of illegal conduct. However shell companies are also frequently misused for illegal purposes and in particular as part of money laundering schemes.

Source: pinterest.com

Source: pinterest.com

Those rewards cap at 16 million. Dollars through a scheme such as selling a boatload of used cars worth 1 million but paid for with drug profits of 5 million. British shell companies have been linked to 52 money laundering scandals involving 80 billion pounds in the past 14 years according to researchers at. In addition to launder money shell companies are also used to inflate invoices create losses to enable tax evasion inflate the share prices of parent companies By purchasing large quantities of shares and decreasing the supply later releasing them in bits and pieces also known as change in hands False transactions to provide cash for other illegal activities like kickback to clients etc. Much of the money laundering going on today is facilitated by foreign banks.

Dollars through a scheme such as selling a boatload of used cars worth 1 million but paid for with drug profits of 5 million. Money Laundering Threat Assessment Working Group US. For example all of the companies in it are limited liability partnershipsregistered to one of four UK addresses sleepy office parks and industrial estates on the outskirts of London. In most jurisdictions shell companies can be set up by registered agents in a manner which obscures ultimate beneficial ownership UBO. Shell companies could simply be old corporations that are now only partially in business.

Source: shuftipro.com

Source: shuftipro.com

Shell companies are notorious for all the right reasons. They could also be illegal operations used to commit false accounting tax evasion money laundering asset hiding and more. However if Company A does not want to be associated with Company B as a. The extra dollars are. Effectively this means that shell companies can be established with a degree of anonymity and then used to hide illegal funds evade.

Source: researchgate.net

Source: researchgate.net

Dollars through a scheme such as selling a boatload of used cars worth 1 million but paid for with drug profits of 5 million. The extra dollars are. They could also be illegal operations used to commit false accounting tax evasion money laundering asset hiding and more. There were 214000 shell companies related to the Panama-based law firm Mossack Fonseca. They are created by registered agents to conceal ownership information from other businesses.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title shell companies money laundering example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.